2 Top Canadian Stocks to Buy During This Correction

Don’t get us wrong, we aren’t advocates of “buying the dip.” When it comes to buying stocks we are strong believers that time in the market, beats timing the market.

A person is much more likely to lose money attempting to time the dips than if they just bought strong Canadian stocks and held them for the long term.

However, we are also well aware that these dips tend to lead to some attractive prices due to overdone sell-offs. In this article, we’re going to take a look at two of these scenarios.

Shopify (TSE:SHOP)

There hadn’t been a huge success story on the technology front here in Canada for quite some time until Shopify came around. Even with this recent correction, it’s safe to say that Shopify (TSE:SHOP) will have its place in history as one of the best Canadian stocks of all time.

Prior to COVID-19, Shopify was still putting up triple digit growth on a quarterly basis. However, the pandemic put a spotlight on the company as many flocked to the company’s online shops due to extensive brick and mortar lockdowns.

Zero signs of slowing down

Many believed that Shopify would settle down once the economy re-opened under the expectation that people head back to brick and mortar methods of shopping. However, if we look to the company’s most recent quarterly report, there is zero signs of slowing down. Revenue increased 57% on a year over year basis, including 70% growth from its subscription solutions.

MRR, or monthly recurring revenue, was up just shy of 70% and gross merchandise value increased nearly 40% year over year. With MRR increasing at the rate it is, it’s clear that business owners are leaning towards Shopify being a permanent addition to their sales toolkit.

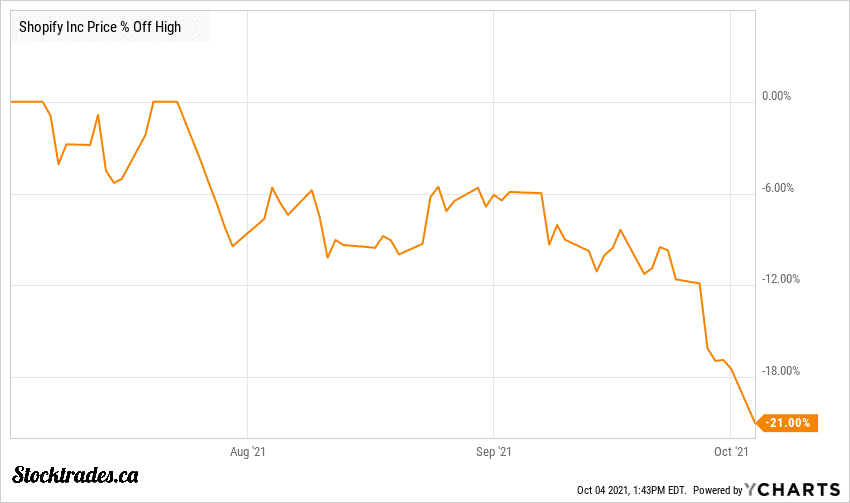

So why the sharp correction? Shopify is currently trading 21% off its late July peaks despite posting outstanding results, and investors are wondering whether or not there is an opportunity here.

Historically, Shopify has gone through plenty of 20%~ corrections. In fact, that’s often considered the best time to buy, as it typically rebounds from there. However, the environment is slightly different at the time of writing. We are in a situation where bond yields are rising and interest rates are likely to go up sooner rather than later.

When yields and interest rates rise, investors are often not willing to pay as high of a premium (valuation wise) for growth. So, Shopify could face more pressure moving forward.

Despite this, Shopify is a company that simply continues to perform, and I think it’s pretty important we put market noise aside and understand that buying Shopify at these levels has a high probability of being a successful investment half a decade from now.

Could it dip an additional 10%? Absolutely. But, we’re not worried about gains over the course of a month, 6 months, or even a year.

We want to buy strong companies, and hold them for the long term. Shopify is exactly that.

Dollarama (TSE:DOL)

For those looking for a defensive option with a little bit of growth left in the tank, the dip in Dollarama (TSE:DOL) might be attractive.

Now you might be thinking “11% is hardly a meaningful dip” but considering Dollarama has a beta of 0.80, the company isn’t as volatile as the markets overall. This is likely due to its defensive nature of the industry it operates in.

Dollarama is a dollar store retailer, one that isn’t as prone to economic swings as say a luxury clothing store. In fact, the company can be expected to perform well even during poor economic times as people look to pinch pennies.

Over the last decade, Dollarama has grown its revenue and earnings by 15% and 22.5% on an annual basis respectively. Now, growth has slowed in recent times which caused somewhat of a valuation reset, but this is an option for Canadians that is defensive in nature, that also provides some potential for outsized growth.

Largest dollar chain in the country

Dollarama is the largest dollar chain in the country, by a wide margin. In fact, with stores in excess of 1380, its next closest competitor is Dollar Tree, which has only 227 stores. This creates somewhat of an economic moat when it comes to dollar stores. The company has lofty goals of over 2,000 stores by 2031, and thus far it states that it is on track to achieve that goal.

Over the last 12 years, the company has a 11.5% compound annual growth rate on same store sales and it is consistently delivering and executing on new price points, allowing for higher margins.

From a valuation standpoint, the company is a bit expensive, trading at 21.2 times forward earnings and 4 times sales. However, it’s important to understand that this company is still able to grow at a double digit clip, and if it can keep up with mid double-digit earnings growth, 21 times earnings isn’t all that crazy. Especially considering we get the added buffer of it being somewhat of a defensive option for times of economic instability.

Could it dip more? Absolutely. COVID-19 is still having an impact on sales and one-off costs, along with the markets undergoing somewhat of a correction themselves.

But, this is one that you should be adding to your watch list today, as it is an outstanding company, one that has outperformed the TSX on a consistent basis.

Next, is Tourmaline Oil (TSX:TOU) the best energy play in Canada?