2 Top Canadian Value Stocks To Buy Today

The rotational shift to value stocks has been in full effect in 2021. Growth has taken a back seat and many former value plays are leading the way.

This has been happening for a few months now, and today it is becoming increasingly difficult to find good value plays in terms of Canadian stocks.

The good news is that there is still value to be found. Today I’ll focus on two that are being weighed down by macro factors, and that are worth investors’ attention.

Enbridge (TSX:ENB)

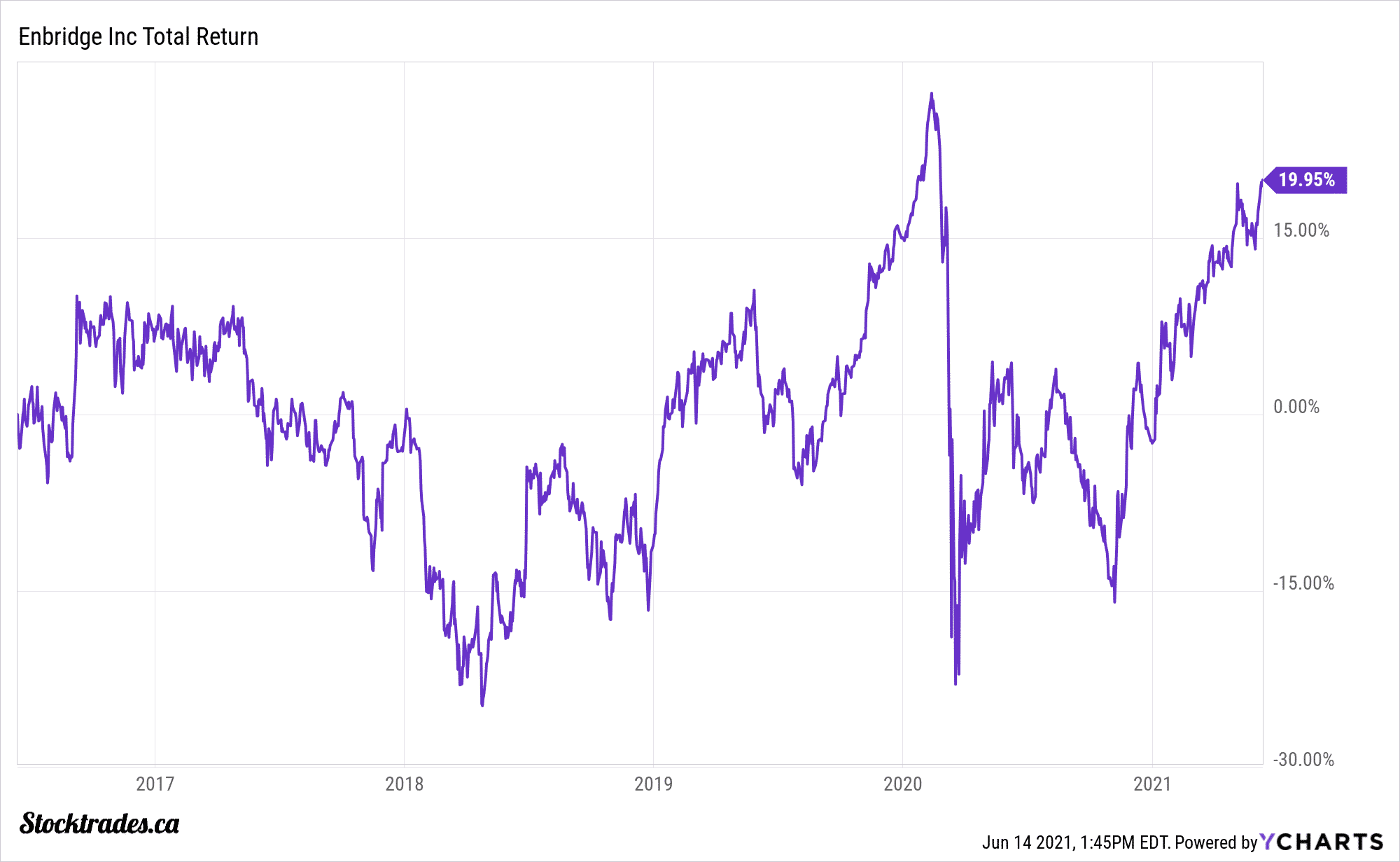

The energy sector has rebounded in a big way, but in some cases there is still plenty of room to run. Case in point, Enbridge (TSX:ENB) is up by around 18% this year but it is currently trading at a 22% discount to historical valuations.

Enbridge (TSX:ENB) 5 year total return

One of the main reasons for Enbridge’s recent struggles is the unfavorable U.S. political environment. Pipelines are being targeted by the Biden Administration and the Line Replacement 3 project is caught in the crossfire. There are numerous legal proceedings surrounding this flagship pipeline.

Today, Enbridge is awaiting a decision from the Minnesota Court of Appeals on whether Enbridge completed proper analysis on potential impacts to the Lake Superior watershed in the event of an oil spill. A decision is due on June 21 and a ruling in their favour would lead to a re-start in construction.

What happens in a ruling against? The permit is revoked and project is likely to be delayed another 6-12 months which leaves more time for opposition to build their case against it.

Enbridge has many other growth projects in the queue. Much like the negativity surrounding the Keystone XL project was baked into TC Energy’s (TSX:TRP) price, it appears the same is true of a potential negative outcome on Line 3 for Enbridge.

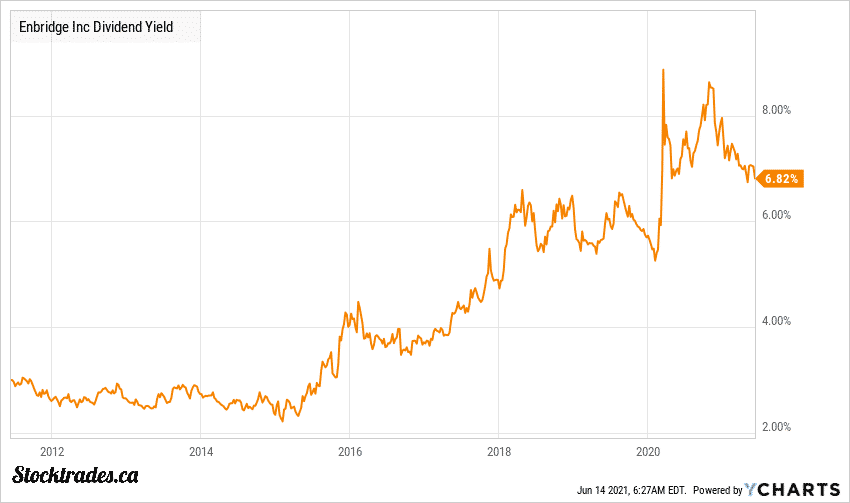

Any setback will likely only have a short-term impact on its stock price and in the meantime investors can enjoy an attractive dividend that yield’s well above historical averages (~7%).

Enbridge (TSX:ENB) dividend yield

Toronto-Dominion Bank (TSX:TD)

Canada’s banks have had a nice run in 2021 and all of the Big Six Banks are currently sitting on double-digit gains. Does that mean they have run their course? Not necessarily. As a whole, Canada’s banks still provide decent value and the potential for rising interest rates will continue to be a tailwind.

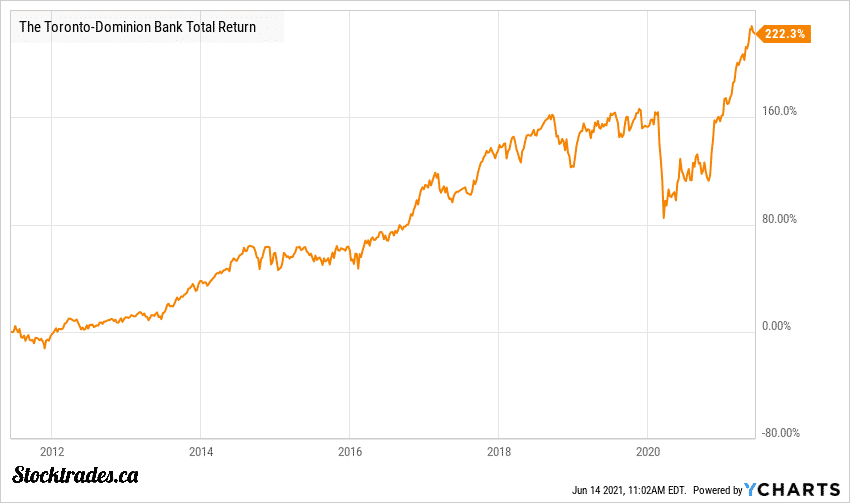

There is one bank that stands out in terms of valuation – Toronto-Dominion. TD Bank (TSX:TD) is one of only two of Canada’s Big Six Banks that is currently trading at a discount to historical averages. While the Royal Bank of Canada (TSX:RY) is currently trading at a modest 5% discount, TD Bank is trading at an 11% discount to historical multiples.

Keep in mind, while TD Bank is undervalued compared to its peers this doesn’t mean it has underperformed. In fact, the company’s 22% gains in 2021 is right in line with the average. That means, something is likely holding it back.

That something is two-fold Provision for Credit Losses (PCLs) and Bank Overdraft fees.

In the second quarter, TD Bank saw the biggest swing in PCLs, going from a $3.2 billion charge last year to a $377M recovery in Q2 of 2021. It was one of only two banks to post a recovery, and it was the largest recovery by a long-shot.

Why is this a negative? In theory it isn’t, but analysts jumped on the big discrepancy as compared to peers. It also led to a big ‘artificial’ beat on earnings. However, that is true of all Canada’s banks. Bottom line, it isn’t a negative unless the company was overly bullish and ends up having to reset next quarter.

The most recent headwind is news that Ally Bank in the U.S. has eliminated overdraft fees. It has been a hot topic of conversation among lawmakers and a question of whether all banks should follow suite. TD Bank is expected to be the most impacted. Why? It has the highest exposure to the U.S. Retail market.

In the last 12 months, TD earned $400M from overdraft fees in the U.S. and if overdraft fees were eliminated it would reduce TD’s forward EPS estimates by approximately 3%. This would have a negative short-term impact, but long-term TD Bank is well positioned to reward investors – especially as the U.S. economy is ramping up much faster than the Canadian economy.

TD Bank (TSX:TD) 10 year total return

Wondering which telecom is the best bet in Canada? We took a look at two popular options, BCE and Telus.