3 Canadian Stocks We’re Avoiding

[mv_video key=”tqfyokqwoxn4cpcqgvts” volume=”70″ aspectRatio=”true” title=”3 Top Canadian Stocks We’re Avoiding In 2020″ thumbnail=”https://mediavine-res.cloudinary.com/v1589484691/rtbp3dfkt6g5idr96fjb.jpg” jsonLd=”true” doNotOptimizePlacement=”false” doNotAutoplayNorOptimizePlacement=”false” sticky=”false”]**This article is a transcription of the video in this article. If you’d like to view our original video on Youtube instead, you can find it here —> top Canadian stocks we’re avoiding in 2020

Hey everyone, Dan again from Stocktrades.ca.

Markets are starting to become a little more shaky, we’re seeing that volatility again.

Not like we saw in March, when 4-5% swings in either direction was becoming the norm, but they are starting to get rocky as earnings come out.

The thing is, most companies are reporting earnings from January to March right now. So these don’t even have the effects of COVID-19 on the whole quarter.

We expect second quarter earnings to actually be worse, and we don’t think we’re out of the woods yet.

This video has a different take

Our most popular content here on Stocktrades is figuring out what Canadian stocks you should be buying. Today’s video and article however will provide something different.

That is, three stocks that you should be avoiding right now. So many Canadian investors are rushing into the markets right now and not learning how to buy stocks correctly.

Whether it be to get in on the upswing, or in one particular instance in this video, simply a fear of missing out.

Just a quick mention before we get started, we are having a sale on our premium end, it’s 30% off right now.

We typically run these discounts every 3-4 months and we’re down to our last set of discounts, so if you want to hop on board, simply click the link below to have a closer look.

Have a look at what Stocktrades Premium offers

Just to clarify, our service does come with a 30 day money back guarantee. So, if you’d like to join over 1000 Canadians at Stocktrades Premium, we’ve got some excellent prices.

3 Top Canadian stocks you should be avoiding right now

So before we get into the first Canadian stock, I just want to make one thing clear.

By me saying you should be avoiding these stocks right now, in no way do I mean if you’re a holder of these stocks you should be selling them.

There is a clear difference between the two, and just because a stock isn’t a clear buy for me right now, doesn’t mean you should go and dump your shares.

Air Canada (TSX:AC)

Before COVID-19, Air Canada (TSX:AC) was one of the most efficient airlines in the world. They have a significant moat here in Canada, and the only other airline that really competes is Westjet.

This is different than airlines down south, where there is a plethora of competition which often drives prices down.

They’ve made key acquisitions with Transat and Aeroplan, and they’ve been one of the best growth stocks on the TSX over the last decade prior to the crash.

A $10,000 investment in Air Canada just after the financial crisis in 2008 and a sale at its peak before the crash would have you sitting on $638,000.

And the thing is, people just thing travel is going to resume and everything will go back to normal after this.

Which it might. It is a possibility, but it’s also a possibility that COVID-19 has changed the airline landscape forever.

Business travel is critical for Air Canada

Air Canada generates a significant amount of its profits from business travel.

And if you’re someone who’s working at home right now for their company, you can see how easy it is to communicate via video platforms.

Whereas before, businesses might have flown employees to a central location to attend meetings, conferences etc.

But after the dust has settled from all of this, will companies see there is a potential to save money?

I mean look at the video at the top of the article. I’m broadcasting this to thousands of people, and all I have is a high speed internet connection and a $700 camera.

A lot of people do raise the issue of security, and although this could be an issue in the short term, this is an industry that is quickly evolving as well.

Passenger travel for Air Canada probably not an issue

There is a very small chance that passenger travel is hurt over the long term. Once we get a vaccine, people will start traveling again. So while it could effect the short to mid term growth, the thing that really concerns me is the long term business travel aspect of it.

Canadian investors are not the only ones trying to catch a falling knife right now. The American airline companies are struggling much harder than Air Canada, yet people are still buying them.

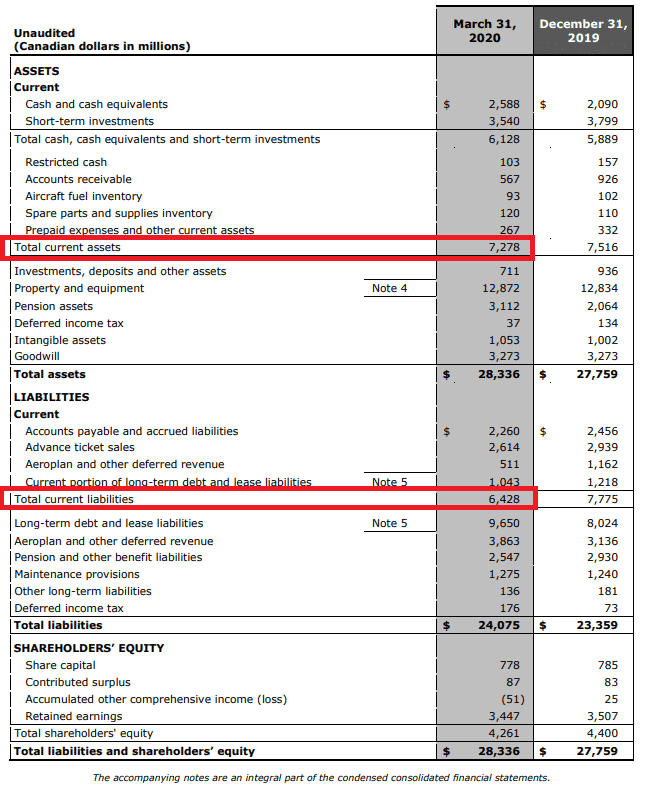

Air Canada posted an operating loss of $433 million in Q1 2020. This can be compared to operating income of $127 million in 2019. When comparing quarter to quarter number like this year over year, Air Canada had saw 27 straight quarters of revenue growth. That streak has come to an end.

Air Canada is currently in cash preservation mode

Cost reduction programs are expected to save the company a little over $1.05 billion, and they have drawn down (borrowed) just over $1 billion from its revolving credit facility.

The company has also just reached an agreement to put planes and engine parts up for collateral to secure another $600 million USD loan.

In terms of balance sheets, Air Canada’s is healthy. They have enough assets to cover short term debt obligations.

The issue is, we just don’t know when this is going to end for the company. Are they doing everything right to preserve its position right now? Abslutely.

But the fact is, an investment in Air Canada right now comes with a huge degree of speculation, and the longer this is drawn out the longer the company needs to use debt to survive.

Shopify (TSX:SHOP)

We’ve seen a lot of panic selling over the last couple months. The markets are starting to come back in April, but we’re starting to see a little more fear in the markets and selloffs are continuing.

But this stock has actually got investors panic buying. And not because the fundamentals back the stock price.

They simply have a fear of missing out.

Don’t get me wrong, I love this company, I love the way they’re growing. In fact, we recommended Shopify (TSX:SHOP) to premium members in December of 2018 at $166 and it’s now trading at over $1000.

I had an average price of Shop in the $160 range and I actually took profits around $600. And as of right now, it looks like a huge mistake.

However, there is a good chance that the rally Shopify is seeing right now is unsustainable. And investors buying in at these $1000 price points may get into trouble.

COVID-19 is helping Canadian tech stocks

Canadian tech stocks are significantly outperforming the TSX right now.

However, the one staggering thing about Shopify is how it’s outperforming its technology peers.

- Shopify: 101.69%

- Constellation Software: 14.8%

- Kinaxis: 54%

- CGI Group: -22%

- Lightspeed POS: -35.4%

Shopify’s stock price has essentially doubled in a little over a month. Compare this to another major eCommerce stock like Amazon, that has recovered just over 22% in the same time frame.

Now, the growth we’re seeing from Shopify is remarkable. The company is seeing year over year revenue growth in the 47-50% range. And the company is now the most expensive company on the TSX.

The thing about this is, they still aren’t profitable. The company earned about $1.5 billion in 2019. It currently has a market cap of around $123 billion.

To put this into perspective, lets look at the second largest company, Royal Bank. The company currently has a market cap of $119.

If you look at Royal Banks dividend, it pays around $4.32 a share on an annual basis. Over the course of the year, this equals around $6.1 billion in dividends annually.

Yes, Royal Bank pays out 4 times Shopify’s revenue just in dividends.

Yet on a market cap basis, Shopify is worth more.

Will Shopify continue this growth?

It will eventually slow down, but over the short term I would say yes.

However, investors often fall into a trap of just paying whatever they have to to get into the stock right now.

And this is clearly what’s happening with Shopify doubling in such a short amount of time. The company is seeing a huge surge in new store openings because of COVID-19.

However, after the dust has settled, how many of these merchants will become full time subscribers? Analysts see little upside at today’s price levels, and I tend to agree.

Let me reiterate though, this is an excellent company, one of the best in the country. It has simply got too much attention recently and its price has shot up to the point where I’m just not comfortable paying right now.

I’ll be looking for a dip in the future.

Suncor Energy (TSX:SU)

The third and final stock is Suncor Energy (TSX:SU). I am long Suncor Energy, and the company is one of the biggest oil and gas companies in the country. They’ve garnered a lot of attention lately based on its dip in price.

But, on a macro-economic and fundamental basis moving forward, I just don’t see them being a solid pick.

Investors buying the stock right now simply aren’t looking at the environment it is operating in. They’re simply saying the stock is 50% off highs, oil isn’t going anywhere, I’m buying.

And there’s a couple reasons Suncor may struggle moving forward.

Suncor’s dividend

The Federal Government just announced it is willing to supply aid to major companies that need it. But one of the major conditions of this aid is the fact that the company can’t supply dividends until the money is paid back. Suncor hasn’t requested this yet, but it is a possibility they may need it.

This may lead to its dividend, which was already suspended recently, being completely cut. This would hurt the stocks price even further.

In terms of other companies, Royal Dutch Shell just recently cut its dividend for the first time since the second world war, and it just shows you how bad it is in the oil and gas sector.

The fact is, you want to invest in reliable companies that can provide consistent cash flows. And in the last decade, I think they have been anything but.

This isn’t their own undoings. Companies like Suncor and Canadian Natural are very efficient companies. Which, by the way, Canadian Natural did not cut its dividend.

However its been shown that the price of oil can essentially be crippled on a whim. And this just isn’t something I’m comfortable investing in. And even though I do own Suncor and believe it is undervalued, I am looking to exit my position once I gain back some of my money.

Investing in Canadian oil companies has been a horrible investment

Over the last 15 years, Canadian oil and gas companies have been a horrible investment.

Suncor has a CAGR of 0.84% over the last 15 years. Sure, the dividends are nice, but you have severely underperformed the overall markets.

And even though that compound annual growth rate is abysmal, it hasn’t even been the worst out of the major players. Imperial Oil actually has a CAGR of -1.64% over the same timeframe.

The only major Canadian oil and gas company that stands out over that timeframe, and is one that I own as well, is Canadian Natural Resources (TSX:CNQ). The company has a CAGR of 3.47% and has actually outperformed the market. It also has one of the best dividends in the country.

Suncor is undervalued, but think long term

At today’s price levels, Suncor is undervalued. Could you make money over the short term buying it? Absolutely.

But is this a stock I want to hold in my portfolio with a 10+ year time horizon? In my opinion, no.

Like I’ve shown you, 2 of the 3 major players have been proven to be terrible investments.

And more importantly, over the last 5 years we’ve witnessed two major oil crashes caused by Saudi Arabia on a whim. This just isn’t somewhere I am comfortable parking my money for the long term.

COVID accelerated this yes, but the flooding of the oil market was going to happen anyways. And there is actually reports that companies aren’t even following OPEC cut requirements.

Once the cut deal ends in 2022, there is a strong possibility they could simply flood the market again.

Our Canadian economy relies on oil extensively. However, that doesn’t necessarily make it a good investment.

Hope you liked the article and video if you ended up watching it, and make sure to subscribe to our Youtube channel!