Your Edge in the Markets Starts With Stocktrades

From in-depth stock and ETF research to comprehensive guides and reviews, 40,000 Canadians a month use Stocktrades to improve their portfolios, invest stress-free, and retire earlier. Click below to grab 3 of Dan’s top picks for 2025.

Our Cornerstone Canadian Investing Research

You could say a lot of these pieces helped put us on the map. With hundreds of thousands of views each year, these are some of the most comprehensive research articles we’ve produced.

Meet Dan Kent

Growing up around Calgary, Alberta, Dan has been a self-directed for over 16 years, turning his passion for researching stocks into one of Canada’s largest financial websites, Stocktrades, with over 1.4 million visitors in 2024. His insights have been featured in the Globe and Mail, Forbes, Business Insider, CBC, Yahoo Finance, and more. He has also worked with some of the largest financial institutions in the country, like the Bank of Montreal and Toronto Dominion Bank.

Dan co-hosts The Canadian Investor Podcast and runs one of the largest investing communities in Canada, Stocktrades Premium.

With a strong commitment to unbiased, high-quality financial research, Dan built Stocktrades to help Canadians navigate the investing world—without the noise of high fees or click-driven advice of mainstream financial media.

Some of Our Freshest Pieces

With hundreds of pieces available on the top Canadian stocks or ETFs to buy, you’ll never run out of ideas. Have a look at some of our recently updated or newly published articles below.

See what thousands of investors are saying about Stocktrades Premium

Great

It’s like talking to a friend over a…

I am relatively new to investing, and some of the advice has already SAVED me a lot of money, especially on exit strategies and separating emotions from facts.

Why not five? ya gotta leave room to improve!

Love the fact that you post your…

Along with your service and being a TCI Patreon member, that’s a winning combination.

A great place to retrieve priceless information for any investor

I like the vast amount of information provided on the stocktrades website as well as on Discord. I love the stock analysis reports provided. This saves people like myself, new investors, a huge amount of time. Keep up the great work, helping us becoming better investors.

Stocktrades Family 🙂

Excellent way to start self investing for your future

Well worth the $!

Liking the content of Stocktrades

Regards, Justin S

Confidence in getting feet wet.

Great experience for begginers

Quality content

Great Investment Tool

Detailed responses and information

Cheapest and Top-Notch Education

Great value for the money

Good value & community

Excellent service, highly recommended.

Love the Q&A section

Great people. Great service.

They give you the tools you need and they care.

Fantastic experience

Happy New StockTrades Member!

I made a few changes to my investments as a result of Dan’s Philosophy of Dividend Investing. So far I added a couple of securities on the recommended CDN Foundation’s List. Up approximately 5% to date!😊

Keep up the Great Work! 🇨🇦

I haven’t been a member for long but…

Stocktrades is an excellent place to…

Stocktrades is an outstanding platform

5 month update

Dan & Mat not only provide guidance, but explain the reasons behind their suggestions, in language that a beginning investor can understand. This has enabled me to have a much better understanding of what to look for in order to make a good investment decision. Thank-you so much for your help, and patience.

Insightful!

Genuine, worth every single penny

Well-researched and great community!

The confidence to make my small savings grow.

StockTrades Rocks!!!

Thank you so much for your time and efforts to answer all the questions really appreciated!!

I enjoy my Sunday news letter

I have used the Foundational Stocks as my guide and am doing ok in these turbulent times.

These guys write informative articles that I actually understand.

Thanks guys.

Excellent Service

Very happy with Stocktrades

They provide exactly the service s I need. Great recommendations backed up by research and a strong thesis. They also put their own money into what they recommend but wait till we have bought ours first to make sure there is no fishy business. Its the only service I have been a part of that doesn’t drown me with 700 emails a day trying to upsell more services.

Stocktrades has been an amazing…

Incredible team to help you invest with confidence

Stocktrades is the real deal

StockTrades is best if you are a longer term investor.

Great platform. Dan & Mat are awesome, educated & well informed.

Top Research and Suggestions

I like it because the information is to…

Highly recommend them!

Impressive

A lifeline in turbulent times

Awesome value for the money

Stocktrades worth the investment

Keep up the great guidance.

Fair value for $$ spent!

A++ Service and Team

Highly recommended for any DIY investor!

Retired, conservatively invested, very pleased…

Well worth the price of admission!

Really enjoy Stocktrades

The Stocktrades premium membership…

I wish I had found this website sooner…

Been a member for 2 years…

Top Notch Investment Service

Stocktrades is legit

Very well rounded stock info site

tutorials are informative for new to stock trading people and good for investors that may not have a full grasp of picking stocks.

Well worth the fees.

Informative

Clear Analysis

I appreciate the bull lists and model portfolios that provide me paths to potential investing success.

Deserving of your time and money

Best investing decision of my life!

Amazing team

Dividend growth FTW!

I love my premium subscription

Thanks for your hard work!

Stocktrades is great

Stocktrades provides useful information

COVERSATIONS WITH LIKE-MINDED INVESTORS

Excellent analysis and excellent recommendations

great tool for me as a beginner

Second to none

Almost a year into discovering them and, well, I highly recommend you take a closer look.

Always timely information

I have have enjoyed being a member and will continue

Thanks all

Stocktrades

I have had decent success with some of there picks.

Will continue to be a member

New Subscriber

Information from Stocktrades

I have made several trades based on…

Appreciate the honesty and consistency…

Excellent service, Great information

Stocktrades are very prompt in their…

Excellent info for the price.Well…Review

Exceeds my expectations

Excellent!!

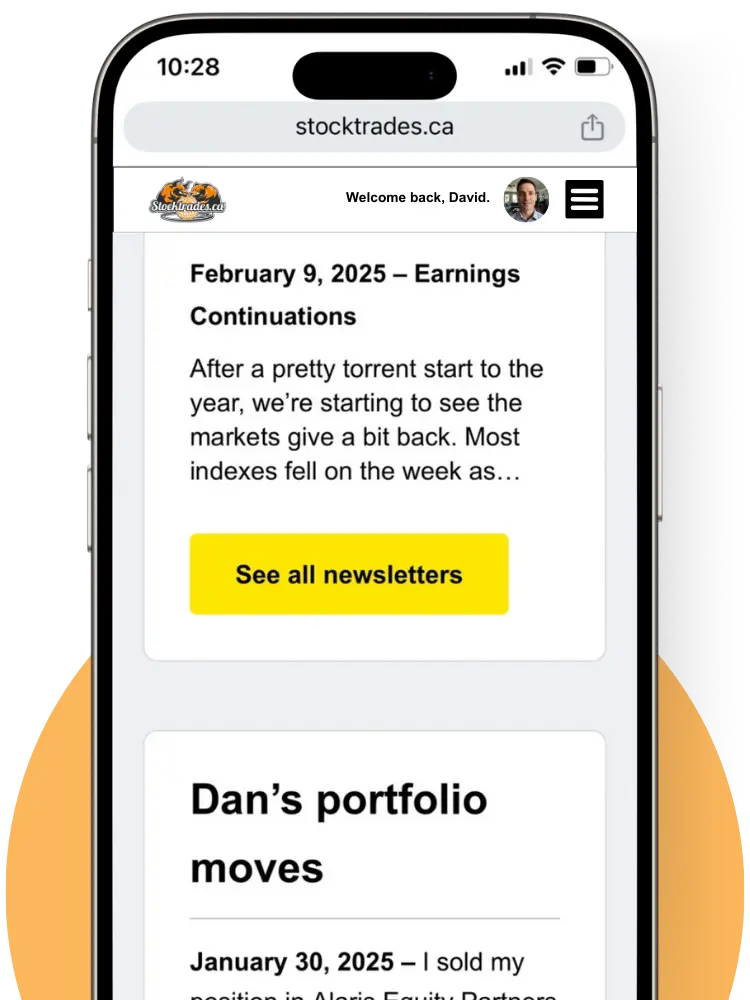

Join Over 25,000 Canadians Receiving My Insights, Commentary, and Strategies FREE

My jam-packed weekly newsletter will have you in the know about market events, strategies, top stocks, and so much more. All in just a 5 minute read.

Join Our Premium Community

Since 2018, I’ve been providing Canadians with expert research on some of the top Canadian and US opportunities on the market today. Our platform has grown to over 2000 Canadian investors, all of which use Premium to invest with more confidence, improve their returns, and ultimately retire earlier.

Stocktrades Premium

For those who want to identify better stocks

- 52+ In-Depth Market Publications

- Dividend & Growth Buy Lists

- Canadian & US Core Holding Picks

- 6 Strategic Model Portfolios

- 5400+ Stocks Graded Across 90 Core Metrics

- Get Any Question Answered Via My Q&A

- Fully Private Discord

- Full Access To My Portfolio, Transactions, and Returns

- 30-Day Subscription Back Guarantee

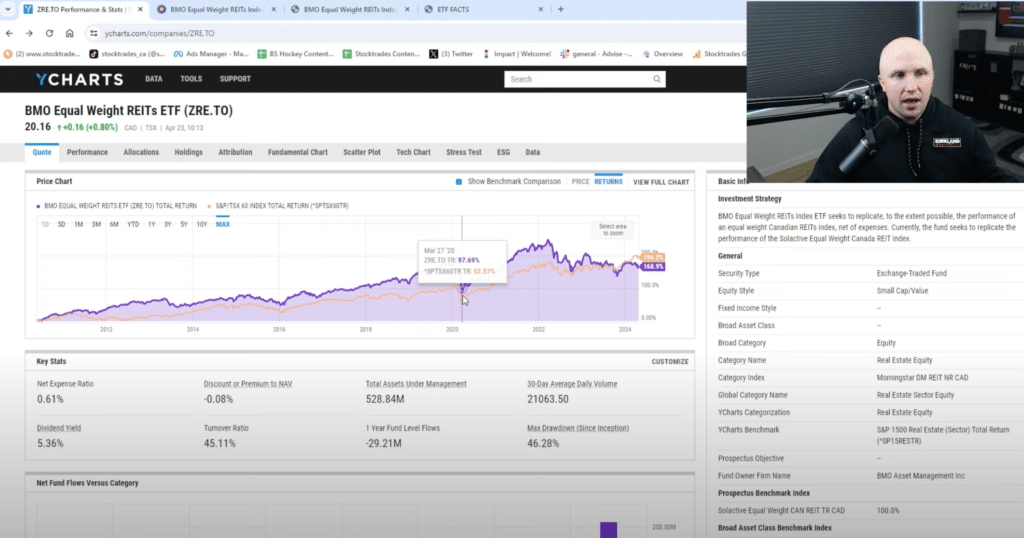

Stocktrades ETF Insights

For those who want to identify the best active and passively managed ETFs to add to their portfolios

- Monthly Newsletter Issues

- ETF Shortlists and Best Funds to Buy

- ETF Screener, containing 60+ data points across 5200+ funds

- Get Any Question Answered Via My Q&A

- Fully Private Discord

- Comprehensive case studies and market commentary

- 30-Day Subscription Back Guarantee

Frequently

asked questions

With so many investing websites out there these days, I’m sure you have questions. Lets answer some of them.

One of the main reasons we started Stocktrades was due to the low-quality content published by mainstream financial media. Most writers on these sites are paid per piece, encouraging quantity over quality. Every piece of content you see here at Stocktrades is produced in house and by a writer with extensive experience in the financial markets.

Stocktrades.ca was founded in 2016 by investors Daniel Kent and Dylan Callaghan, with the ultimate goal of providing Canadian investors with the best possible tools to increase their investment portfolios. In an industry plagued with misinformation, our main priority is to maintain complete objectivity and bring investors around the world accurate, timely and high quality investment news and information.

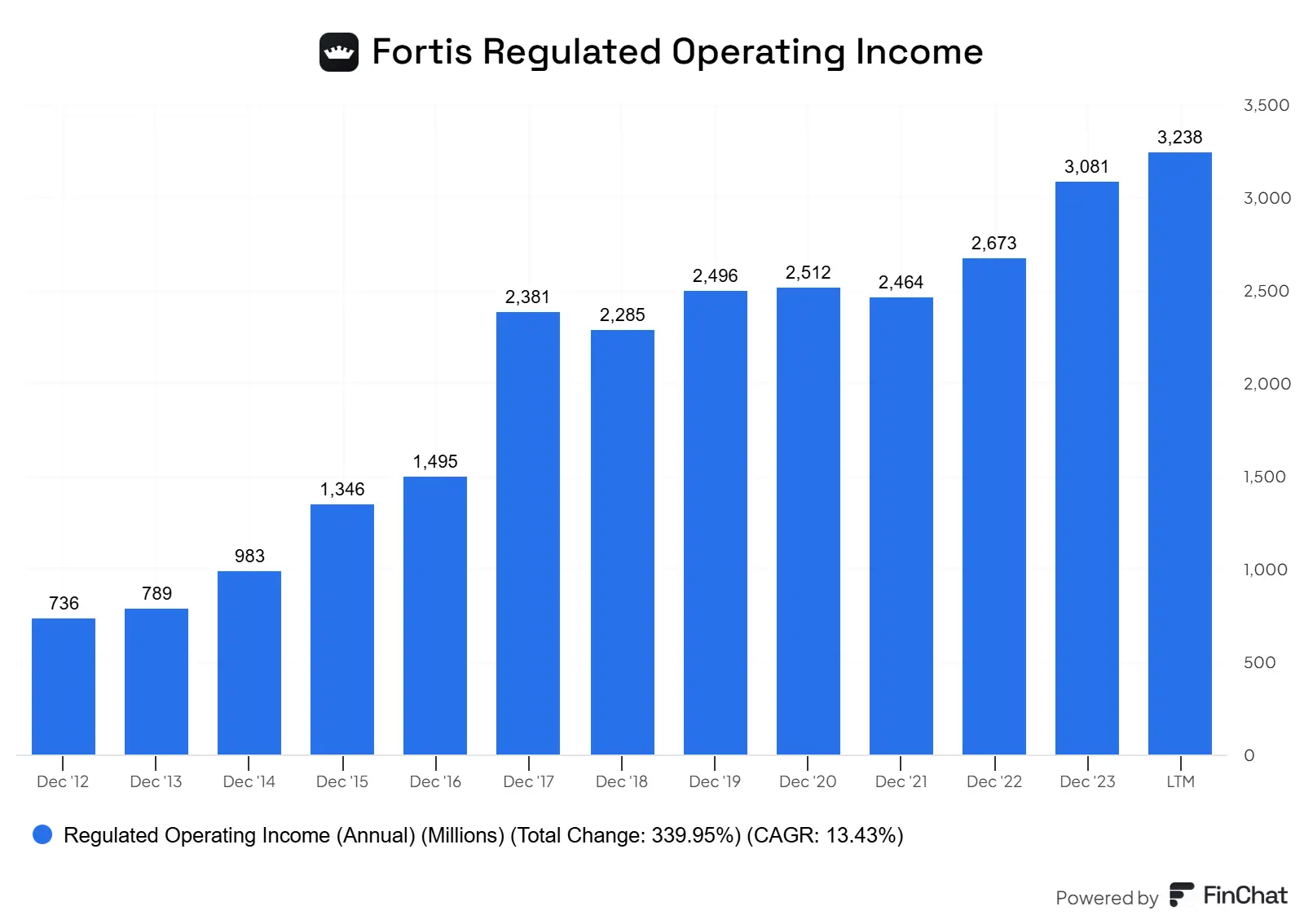

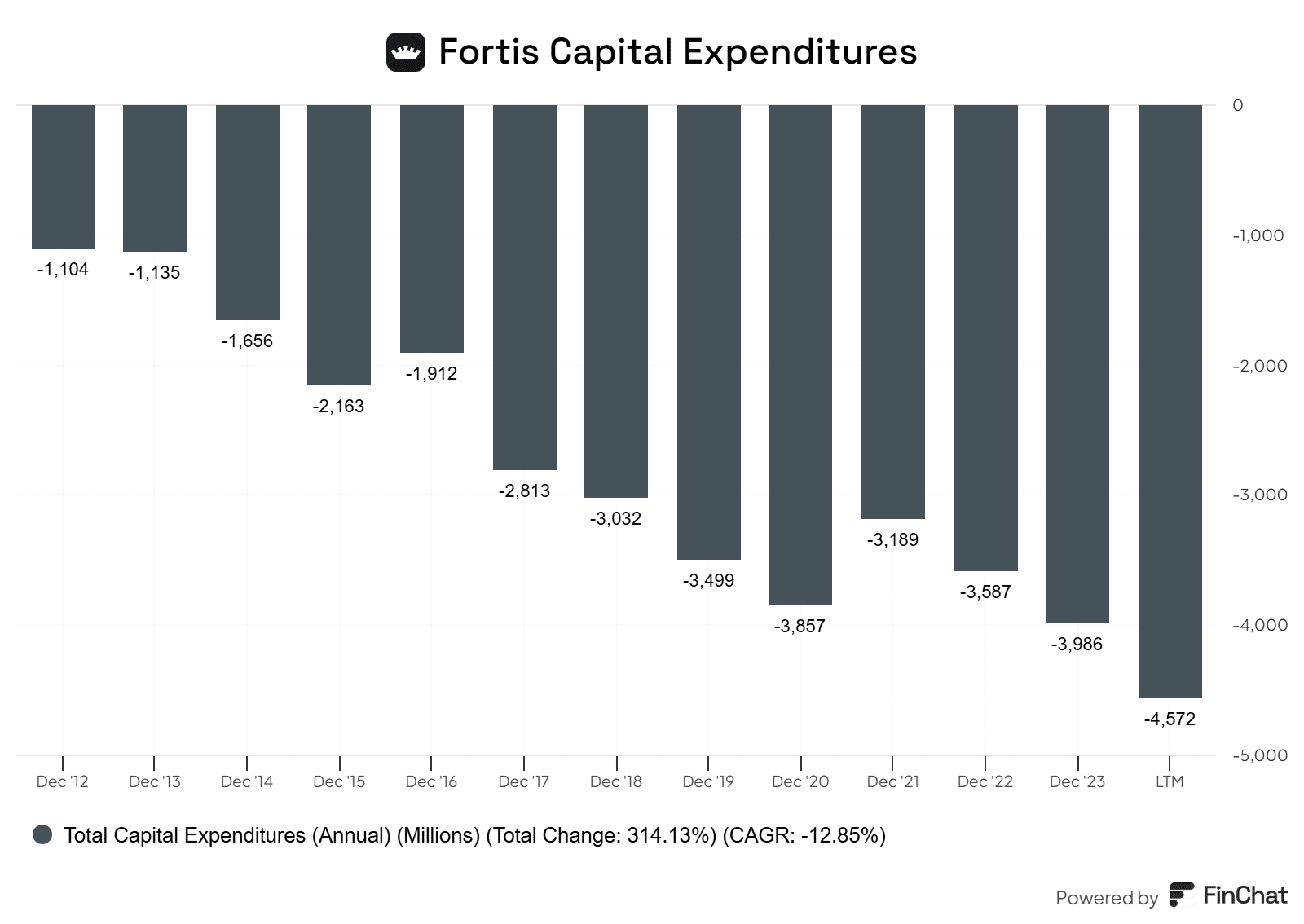

Fortis doesn’t have a lot of key performance indicators to look for. The two primary ones worth keeping an eye on are capital expenditures and regulated operating income. Ultimately more money invested back into the business to grow its asset base is crucial, and in terms of operating income, it gives a picture of the overall health of the underlying business.

Click the images to expand them if needed!

February 14, 2025 – Fortis continues to turn out strong results in a lower-rate environment. Earnings per share of $0.83 topped expectations of $0.81, and the company managed to post mid-single-digit growth in terms of annual earnings per share despite a pretty rocky environment.

Fortis rarely gives me anything to talk about. This is to be expected, as the company generates over 99% of its earnings from regulated utilities. The regulation in utilities makes earnings about as consistent as they can get, and the company rarely ever comes out with any sort of surprises.

On the year, capital expenditures came in at $5.2B. The result of capital expenditures over the last year or so allowed the company’s rate base to increase by 6% on a year-over-year basis. Effectively, the rate base of a utility is what the company utilizes to figure out the pricing it can charge clients for their services. We want to see the rate base continue to grow. With Fortis’s capital plan of $26B invested back into the business from 2025-2029, this should allow it to continue to grow its rate base at a mid-single-digit pace, which should support dividend growth in the same range.

As mentioned, this earnings write-up is relatively short because there isn’t much to talk about. The company’s capital plan should allow it to grow its rate base by 6.5%~ annually through to 2029, which will support mid-single-digit earnings growth and dividend growth. As rates continue to decline, I expect to see more popularity when it comes to Canadian utilities. As a result, we could see valuation multiples continue to expand. In this case, Fortis could put up annual returns over and above its rate base growth.