5 Reasons Why Investing is More Important Than Ever in December 2024

Many people think the path to creating wealth and retiring early is to simply save money. Unfortunately, many people with this mentality will ultimately be left working in their later years while they should have been enjoying their retirement.

How do we really create wealth?

We can invest our money.

Whether it be in the stock market, real estate, the bond market, or the plethora of other ways available to us to invest our money and help it grow, investing is the true path to financial freedom.

In this article, we’re going to go over the benefits of learning how to buy stocks, investing, the risks of not investing, along with the importance of investing when it comes to the economy. So without further ado, let’s get started.

What are the benefits of investing?

Inherently, humans think of risk first. When we try to think of the benefits of investing, we often get stuck on the idea that there is the potential for us to lose all of our money when investing.

We could have this bias towards loss because of a family friend, coworker, or relative that suffered large losses in the stock market. But the reality is, if you invest the right way, there is almost no chance of you losing all of your money. In fact, it has been, at least over the previous 100+ years, a guaranteed path to financial freedom.

Over the last fifty years, every $1 invested in the stock market has turned into $177.33. This works out to be just shy of an 11% return every year on average. Now, if we remove inflation, which will come up later on in this article, our returns shrink to $1 turning into $27.12. Which, looks relatively small especially when we compare it to the prior number of $177.33.

But the important thing to understand here is that after we have accounted for the significant increase in the cost of goods, we still have 27 times the buying power than we would have if we kept the money in a savings account.

Why is investing important in an economy?

By investing your money, you are contributing to the well-being of the country and the economy. A company primarily goes public and issues stock to fuel further growth. That further growth leads to more employees, which leads to more people having expendable capital to invest in the stock market, which results in a higher stock price and capital gains for those who are currently investing.

Overall, investing in the stock market can not only increase your financial stability, the balance of your bank account, and generate additional income, but it can also contribute to the financial well-being of many other Canadians through an increase in employment and overall a growing economy. This is ultimately a benefit regardless of whether or not you have money in the stock market.

5 reasons why investing is important, and why avoiding it could be detrimental

1. The impacts of inflation on buying power

If you’ve ever heard someone say “I remember when XX only cost XX back in my day!” you’ve witnessed someone being impacted by the number one long-term destroyer of wealth, inflation.

Although you may think your wealth is growing by hoarding money in a savings account, the reality is although the actual amount of dollars you have is increasing, the goods that saved money can buy you is decreasing.

The consumer price index is the measure of how much it would cost a Canadian for an average basket of goods and services. Imagine going to the grocery store in the year 2000 and buying $100 worth of groceries. That same basket of groceries will cost you $150 today, a 50% increase.

Lets also say in the year 2000 you had $50,000 in a savings account. Over the years, you managed to grow that account up to $75,000. Although the dollar value of your account has grown by $25,000, considering everything costs 50% more, you have in essence saved nothing.

One of the greatest investors of all time Warren Buffett called inflation a giant tapeworm, stating:

“That tapeworm preemptively consumes its requisite daily diet of investment dollars regardless of the health of the host organism”

The solution to inflation is creating an investment portfolio that grows at a faster rate of inflation. If we go back to the above situation, had you invested that $50,000 and earned 8% a year, you would have a balance of $233,047 today. Although inflation has resulted in a 50% increase to the costs of goods, your investment has increased in value by nearly 500%, outpacing inflation by a significant margin.

2. Retiring earlier

Even if you enjoy your job, it’s highly unlikely you’d be willing to give up time spent doing the things you love for it. Investing over a long period of time ultimately gets you to the goal of retirement quicker, or even semi-retirement enjoying whatever activity you chose at that time. Investing for the long term can more easily make that a reality.

If we make a relatively conservative estimate of $1.5 million needed to retire, it would be virtually impossible for someone on a modest income of $60,000 a year after tax to achieve this over a 40-year working career if they were simply saving. Even putting aside 1/3 of their income ($20,000 annually) would result in only $800,000 in savings after the 40 year mark.

However, if they had instead invested that $20,000 every year and earned 8%, their $800,000 in total contributes would result in a whopping balance of $5.6 million. That is nearly four times your retirement goal.

In fact, they would have hit their goal of $1.5 million just 25 years after they started invested.

I know these numbers likely seem high to you. The goal of this is to simply provide an idea of the impacts of compounding returns when it comes to your investments. Whether you can contribute $20,000 a year or $5000 a year, the end result is over the long term the higher returns will shave years, possibly even decades, off your working career.

3. The ability to tax shelter your money

The federal government has plenty of tools to allow Canadians to grow their wealth and retire earlier. And whether or not you think these investment vehicles are sufficient enough, they are still useful when it comes to building your net worth.

The Tax Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP) are accounts that let Canadians invest in mutual funds, ETFs, stocks, bonds, or many other forms of investments tax free.

Not only is the money earned inside of a tax free savings account not subject to capital gains when investments are sold, but the money can also be withdrawn from the account with no tax consequences. Contributing $6000 a year to your TFSA and earning 8% a year on that capital could have you sitting one $745,000 in tax-free capital after 30 years.

And in terms of the RRSP, although the money is taxed on withdrawal, higher-income earners can benefit significantly from contributions to the RRSP, as it can offset your taxable income in the years you contribute to the account.

Overall, tax-sheltered accounts are one of the main reasons to get started investing today. In fact, it can be argued the government is doing Canadians a disservice by calling it the tax-free savings account, as simply saving inside of it instead of looking for better returns in the stock market is an error that will cost you a significant amount of capital appreciation over the long term.

4. Diversification of your income

Although the main strategy when it comes to investing should be to buy it and hold it, when push comes to shove and you really need capital, you can likely turn to the dividends generated by your investment portfolio.

Whether it be avoiding the stock market or a real estate purchase, if you aren’t investing right now it is likely you are depending on one sole source of income, your job. And, as we’ve witnessed numerous times in the past, jobs are anything but secure.

Investing in the stock market allows you to have a backup source of income in such circumstances that you need it, primarily in the form of dividends. However, it could also be in the form of a more tax-efficient capital gain as well.

As you continue to make regular investments to your accounts, your dividend income will grow and your capital appreciation will increase, opening up another source of income if you choose to utilize it. If not, there’s no harm in re-investing the passive income generated from your investments and compounding it to a larger sum over the long term.

5. Achieving financial independence

Along with diversification and eventually cutting ties with your 9-5, investing can allow a person to achieve the ultimate goal of many, and that is financial independence.

Now, you may be asking yourself…

“what’s the difference between this reason, financial independence, and retiring early”

And it is important to understand that there are some key differences to being financially independent and actually retiring. By definition, financial independence is having enough income to cover all of your living expenses without having to be employed. That means if you lost your job tomorrow, you could either call it quits and retire, or seek out another job without the stress of having the money to cover all of your living expenses.

Many people who are financially independent choose to continue working. Whether it is because they are now accruing wealth for their children or simply do not want the traditional retirement lifestyle, the whole idea of it is that they now are able to choose to work, not forced to work.

This could give you the flexibility to work a job you enjoy without a minimum salary needing to be met.

Overall, you simply cannot afford to not invest

Investing often goes hand in hand with the stock market. As such, many people think investment risks are high, due to the nature of the stock market’s volatility.

However, there are plenty of investment strategies, and there is likely one that fits your risk tolerance perfectly. Whether you seek out a financial advisor or financial planner to discuss this or attempt to figure it out on your own via the self-directed investing route, the most important part is that you actually start investing.

Over a short period of time, especially during downturns, it can seem like making money in the stock market is impossible. However, the risk of loss, if invested right away and according to your risk tolerance of course over the long term is next to 0.

There have been studies performed showing that investments made, even at the absolute peak of the stock market, have outpaced the inflation rate and returned positive growth on your capital. Yes, over the course of 1, 2, or even 5 years you could be sitting on losses, but over the long term, you will be rewarded.

The general consensus is to invest money you don’t plan to touch for at minimum 5-10 years, and invest the vast majority of your portfolio in strong companies capable of weathering many different economic environments.

You also might have more flexibility than you think, if you are just starting out. Fractional shares in Canada is how some people can include stocks they otherwise wouldn’t be able to in their portfolios.

How do I find these stocks?

As mentioned, there is no problem with assessing your financial situation and figuring out you are better suited to using a financial advisor. They know the market risks, they are experts at figuring out your risk tolerance and building an appropriate portfolio for you, offering a hands off approach.

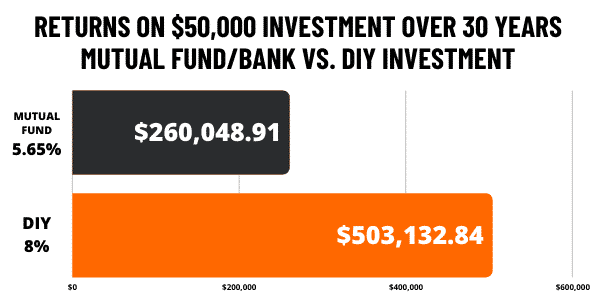

However, it is important to understand the fees you will pay for such a service. As highlighted by the chart below, a 2-3% management fee charged by a mutual fund or financial advisor can have significant impacts on your portfolio over the long term, often a 6 figure sum.

If you’re interested in heading down the path of self-directed investor, Stocktrades Premium helps over 1800 Canadians identify some of the best-performing stocks in the country on a yearly basis.

Not only do we provide the research and tools to help you succeed, but we individually guide Canadians through the complexities of the market and make them better investors in the process. If you’re interested in joining, just click here.