Air Canada Stock: Turbulent Skies Ahead for Investors

Air Canada’s stock has been a hot topic lately. Slowing sales, pilot strikes, and weak results have put a lot of eyes on Canada’s largest airline.

The industry is known for its ups and downs, and Air Canada is no exception.

Air Canada’s stock price sits well below its pre-pandemic highs. It might seem like a bargain, but there is much more to this when you dig beyond the surface. The company faces several challenges.

I’m not convinced Air Canada stock is a great buy right now. Lets dig into why.

Key Takeaways

- Air Canada’s stock price is lower than pre-pandemic levels, but that doesn’t necessarily make it a good deal

- The airline faces ongoing challenges like labour disputes and changes in travel patterns

- Airline stocks are risky investments due to the industry’s slim profits and sensitivity to outside factors

Q2 Results – Air travel starting to slow

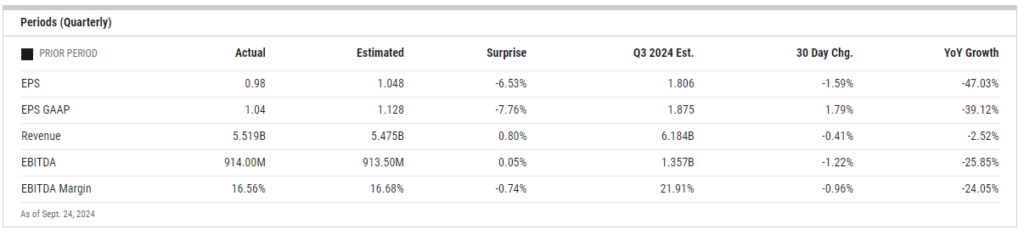

Air Canada’s Q2 results are a bit of a mixed bag. While they’re still pulling in decent numbers, there are some worrying signs that air travel might be cooling off.

Let’s look at the good stuff first. Operating revenues hit $5.5 billion, which is a 2% bump from last year. Not too shabby considering how many Canadians are pinching pennies right now.

They also managed to fly 6.5% more capacity, so they’re definitely putting more planes in the air.

But here’s where things get a bit dicey:

- Operating income dropped by $336 million to $466 million

- Adjusted EBITDA fell by $306 million to $914 million

- Net income took a nosedive from $838 million to $410 million

These numbers tell me that while Air Canada’s bringing in more cash, they’re spending a lot more to do it. That’s not a great trend.

On the bright side, their leverage ratio improved slightly from 1.1 at the end of 2023 to 1.0 in June 2024. That’s a small win for their balance sheet.

Earnings per share dropped from $1.85 to $0.98. It’s clear that rising costs are eating into their profits.

Looking ahead, Air Canada plans to increase capacity by 4-4.5% in Q3 compared to last year. They’re also forecasting a 5.5-6.5% increase for the full year. That’s ambitious, but I’m not sure if demand will keep pace.

Business travel slowdown – A gigantic problem for Air Canada

Air Canada is facing a significant issue with business travel taking a nosedive. It’s no secret that corporate flyers are the bread and butter for airlines, and Air Canada’s no exception.

The pandemic’s thrown a wrench in this. Because of the popularity of video calls and online conferences, business travel has slowed. While travel’s picking up, it’s not the same it was before COVID hit.

Here’s the main issues:

- Business flyers often spend much more than normal consumers

- Companies tightening their belts on travel budgets

- Video calls replacing face-to-face meetings

I’ve noticed a shift in how businesses approach travel. They’re sending fewer folks on trips, but those who do fly are going further. It’s quality over quantity now.

Pilot strike – Likely not the last

I believe Air Canada’s recent last-minute deal with its pilots is just the beginning of labour unrest in the airline industry. While they’ve dodged a bullet for now, I reckon we’ll see more turbulence ahead.

The new agreement offers pilots a hefty pay bump and improved benefits. But here’s the catch – it’s only a 3-year deal. In my view, that’s a short runway given the current economic climate.

I predict we’ll see more labour action in the coming years, not just from pilots but from various worker groups. The cost of living isn’t slowing down, and employees are feeling the squeeze.

Air Canada may have avoided a shutdown this time, but I wouldn’t be surprised if we’re back at the negotiating table sooner rather than later. The airline industry is particularly vulnerable to these pressures.

Not only does this impact operations, but expenses as well. Pilots are the lifeblood of these businesses.

Air Canada valuation – Not really as good as it seems

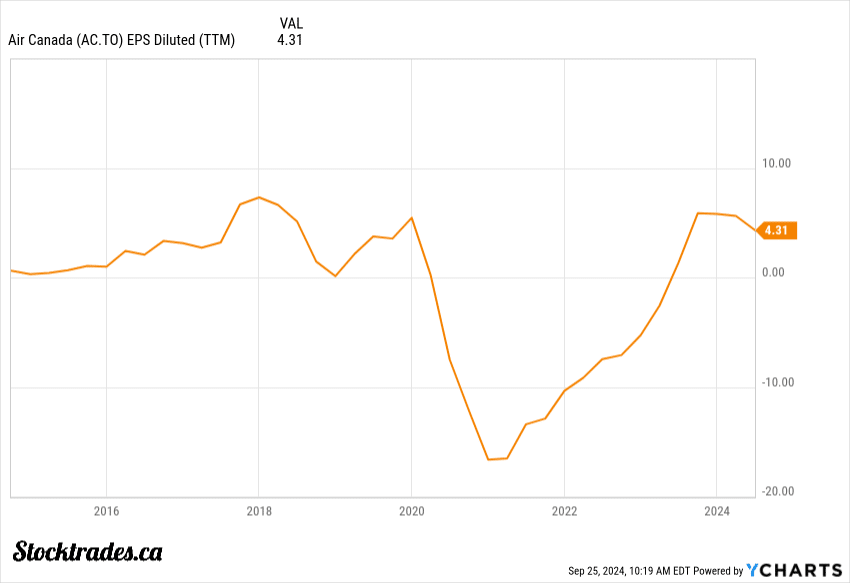

At first glance, Air Canada’s stock might look like a bargain. The trailing P/E ratio is just 3.67, which seems incredibly cheap for a major airline.

But I’m not convinced this is a great value play.

Falling earnings: While past performance looks good, future earnings are expected to drop. This means the forward P/E is higher at 5.83.

Debt concerns: Air Canada’s debt levels are worrying. The debt-to-equity ratio is over 1,000%, which is sky-high. This massive debt load puts a big strain on the company’s finances.

Negative industry trends: Airlines face ongoing challenges like fuel price volatility and economic uncertainty. These factors could hurt Air Canada’s bottom line.

Poor stock performance: Despite the seemingly low valuation, Air Canada’s stock has fallen nearly 13% in the past year. Meanwhile, the S&P 500 has gained over 34%.

I think the market is pricing in these risks. While the stock might look cheap based on past earnings, I believe the future outlook is much less rosy.

Air Canada’s enterprise value to EBITDA ratio is only 2.35. This low number typically signals a bargain, but I’m sceptical given the company’s challenges.

Are airlines ever viable businesses to own?

In my opinion, airlines are rarely good businesses to own. I’ve always been wary of investing in them, and for good reason.

Airlines face huge costs to operate. They need to buy or lease expensive planes, pay for fuel, and cover high maintenance costs. It’s a constant struggle to stay profitable.

The industry is also very cyclical. When the economy is good, people travel more. But when times are tough, travel is one of the first things folks cut back on. This makes airline profits swing wildly up and down.

Airlines typically have very low profit margins too. They’re always competing on price, which squeezes their profits even further. It’s hard to build a great business when your margins are so thin.

I’m also concerned about future travel demand. After the post-pandemic travel boom, I expect things to slow down in the coming years. This could hurt airline profits even more.

Air Canada’s stock has had its ups and downs. While it can sometimes look tempting, I think there are usually better places to invest my money.