Is Algonquin Power Stock a Gigantic Value Trap?

Algonquin Power once held promise as a growing player in the North American utility sector, as both a regulated utility and a renewable option. However, the company’s stock has struggled since late 2022, with its share price declining sharply due to various financial and operational issues.

Algonquin Power’s woes stem from its heavy exposure to floating rate debt and the need to sell off key assets. The company’s decision to divest its renewable energy business, which was its fastest-growing segment, has left many investors questioning its future prospects.

Is Algonquin Power stock still a worthwhile investment despite these setbacks, or a value trap?

Key takeaways

- Algonquin Power’s stock has declined due to financial challenges and asset sales

- The company’s focus has shifted away from its formerly fast-growing renewables segment

- Investors should carefully weigh Algonquin’s current position against other utility stocks

The company’s exposure to floating-rate debt was a gigantic misstep

Algonquin Power made a critical mistake by taking on excessive floating rate debt. This left the company vulnerable to rising interest rates, which have dramatically increased its borrowing costs.

As a company that grew extensively in a low rate environment, it put up outstanding returns in a post-financial crisis.

As rates accelerate post-pandemic, however, so did the interest expenses on this debt. This put significant pressure on the company’s margins and cash flows.

So much so that the company had to slash the dividend in an effort to shore up operations. Since that cut, it has been an ugly few years for Algonquin.

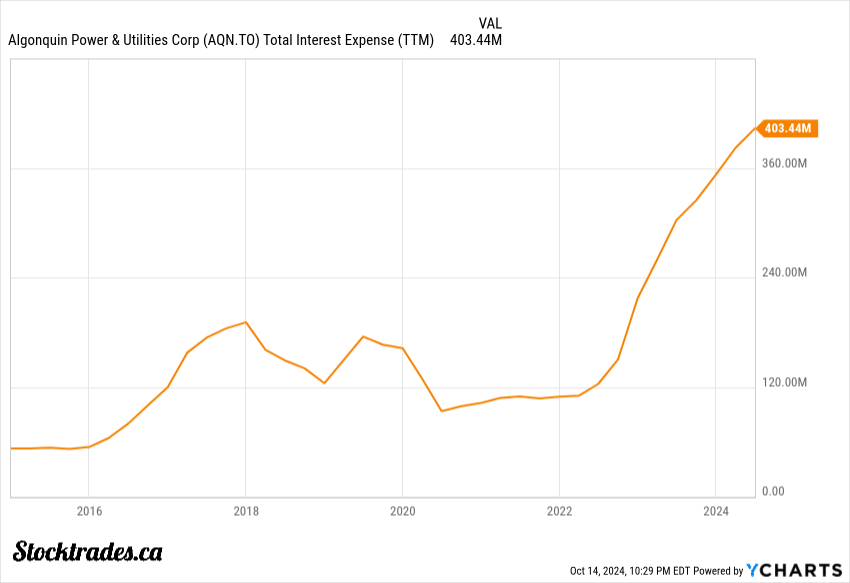

Compared to peers like Fortis and Emera, Algonquin’s debt structure looks riskier. To give you an idea on the debt structure, Fortis had less than 4% of its debt on floating rates in 2022. Algonquin was north of 22%. Look no further than the chart below, which shows the company’s interest expenses, to give you an idea on how much it was impacted.

In my view, management dropped the ball on managing leverage. They should have refinanced more debt at fixed rates when rates were low. Now they’re scrambling to deal with higher costs. And that scrambling led to another dividend cut later on.

Algonquin’s balance sheet still looks stretched, and I think these financial missteps contributed to Algonquin’s poor stock performance. The market is rightly worried about the company’s ability to manage its debt burden in a falling, yet still higher rate environment.

The company has been forced to sell off its fastest growing asset, its renewables

Algonquin Power & Utilities Corp. made a pivotal decision to sell its renewable energy business for up to $2.5 billion. This move is a game-changer for the company’s future, but not in a good way.

The sale of renewables is a double-edged sword. On one hand, it helps Algonquin pay down debt and become a pure-play regulated utility. On the other, it means parting with what was likely its most promising growth engine.

I believe this decision will significantly alter Algonquins growth trajectory. Renewable energy has been a hot sector, attracting high valuations and investor interest. By exiting this space, it is essentially trading growth potential for stability.

The shift to a pure-play regulated utility model has its pros and cons:

Pros:

- More predictable earnings

- Reduced debt load from the sale

- Potentially improved credit rating

Cons:

- Lower growth prospects

- Reduced exposure to the booming clean energy sector

- Possible loss of investor interest in the stock

Algonquin’s future now hinges on its regulated utility operations. These businesses typically offer steady but slower growth compared to renewables. However, the issue here is that investors are highly likely going to just view higher quality regulated utilities like Fortis as the better option.

The company’s management seems to believe this move will create long-term value. But I’m not entirely convinced. While it addresses short-term balance sheet concerns, it may limit the company’s ability to capitalize on the global shift towards clean energy.

They had to sell off a prime asset to shore up a balance sheet due to significant missteps.

It now looks to simply be an inferior regulated utility to its peers

Algonquin Power has fallen behind Fortis as a stronger regulated utility peer.

Firstly, Algonquin’s smaller scale leads to operational inefficiencies. The company struggles to match the cost-effectiveness of larger rivals like Fortis.

Geographic concentration is another concern. While Fortis boasts a broad portfolio across North America, Algonquin’s assets are more limited in scope. This lack of diversification increases risk.

Fortis shines when it comes to dividends. Its track record of consistent increases spans 5 decades. Algonquin’s dividend history has been nothing short of a mess the last couple years.

I’m just not really sure where the stock ever becomes attractive when looking at other regulated peers, unless it can put up some strong results over the next year or two to gain the trust of investors again.

Although the dividend is well covered now, I wouldn’t buy the stock

Algonquin Power’s current dividend yield of 5% might seem tempting at first glance. The payout appears well-covered for now, following the company’s recent 40% dividend cut and asset sale.

But I’m not convinced this makes Algonquin a buy. The firm’s growth prospects have weakened considerably. Its recent renewable energy business sale raises questions about future earnings potential.

I worry about the possibility of future dividend cuts or simply a no-growth dividend if earnings stagnate. The company has already slashed its payout twice in recent memory. This pattern doesn’t inspire confidence in dividend stability.

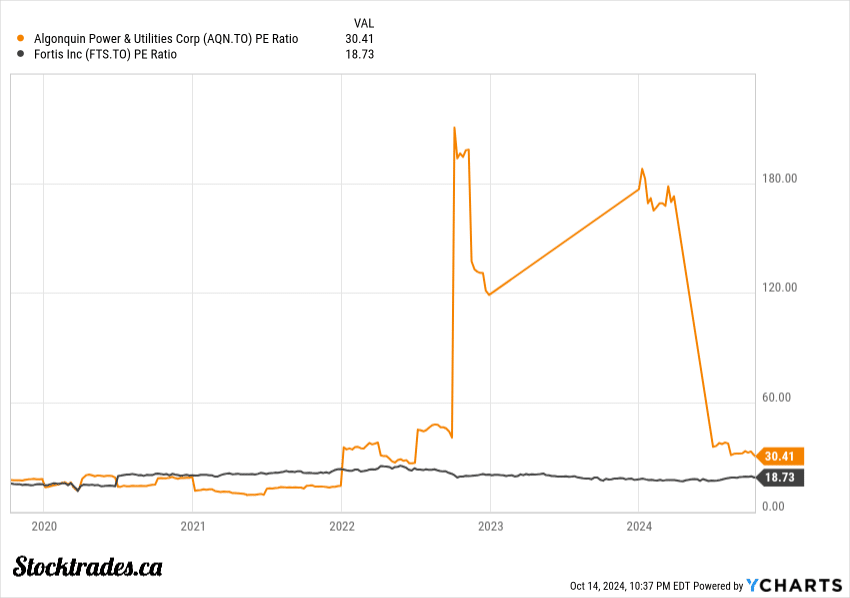

When I compare Algonquin to stronger peers like Fortis, the contrast is stark. Fortis offers a lower yield but with much greater reliability and growth prospects. In addition to this, despite Algonquin taking a beating, it’s still much more expensive than Fortis from a price to earnings standpoint.

In my view, the short-term income from Algonquin’s dividend doesn’t justify the long-term risks.

The company’s strategic decisions and financial health give me pause. I’d rather invest in utilities with more stable outlooks and proven track records of dividend growth.