Altagas (TSE:ALA) Dividend & Stock Analysis

The oil and gas sector has taken a beating for as long as I can remember. Even when I was first learning how to buy stocks here in Canada more than a decade ago, they just weren’t popular options.

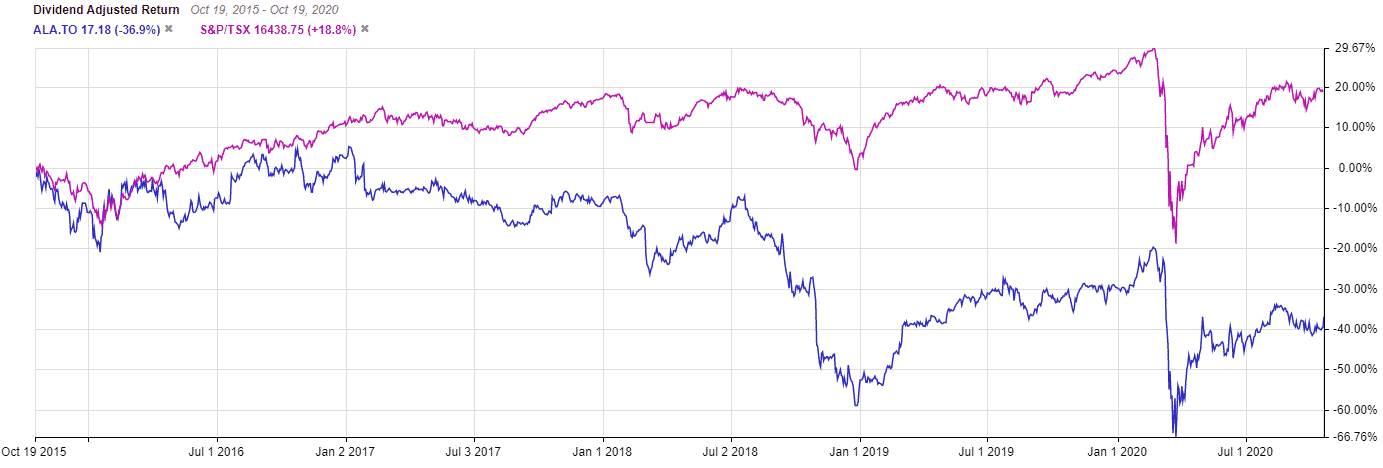

Over that same time period, I’ve witnessed Altagas (TSE:ALA), a popular Canadian dividend stock, mistaken for a pure-play energy company by many investors.

Yes, Altagas does have a prominent midstream department that accounts for around 30% of revenue. But its bread and butter is utilities, a sector with much more stability right now.

So the real question moving forward, especially with investors sour after a huge dividend cut in 2018, is if this company still relevant in 2020, and is there any upside in Altagas stock right now?

Lets find out.

Altagas (TSE:ALA) dividend and stock analysis

Altagas is a diversified energy infrastructure business, with operations in four primary segments. These include Midstream, power, utilities and corporate operations.

Its utility business owns and operates natural gas distributions across North America while its midstream segment extracts, transports and stores natural gas liquids.

Finally, it’s power segment includes generating assets such as hydro, wind, biomass and natural gas-fired.

In its most recently quarterly filing, the company reported that 68% of revenue came from its utility segment, 28.1% from its midstream segment and the remaining 4%~ from its corporate and power segments.

The company is Canadian, but the bulk of its revenue comes from the United States. As of writing, the company serves approximately 1.7 million customers with utility services in the United States.

In light of COVID-19, the company has reiterated that 2020 outlook remains the same. So, is Altagas’s current dividend safe?

Lets have a look at Altagas’s dividend

For many Canadian investors, especially ones that had a large position in the company, the wound from Altagas’s massive dividend cut in 2018 is still fresh. I managed to spot the impending doom prior to the cut and exited my position just in time, but many didn’t.

We often lose trust and become a lot more skeptical when it comes to companies who’ve slashed their dividends. So, is Altagas’s safe now, or will we see another cut?

In my opinion, a firm yes and no respectively to those questions. Here’s why.

Prior to the dividend cut that saw the company go from a $0.183 monthly dividend to $0.08, the company was paying out $2.196 in annual dividends all while generating less than $1.00 in annual earnings per share.

The impending dividend cut was blatantly obvious. In fact, the company’s stock price actually increased by 16% when the cut was announced. That’s how much this dividend cut was priced into the stock even prior to it being made.

Now the company sits with a healthy $0.08 monthly dividend, totaling $0.96 while trailing twelve month earnings sit at $1.44. This works out to be a payout ratio in the range of 66% of earnings, a payout ratio I’m comfortable with.

At the time of writing, the company yields around 5.85% and much like a similar regulated utility company Fortis (TSE:FTS), the company should be able to generate consistent cash flows with 68% of its revenue coming from rate-regulated utilities.

The fact that most of its revenue is exposed to a higher USD is also another positive.

With the recent dividend cut, I don’t expect Altagas to make big moves when it comes to dividend growth.

In fact, I expect them to be even more prudent and cautious. Mismanagement and letting the dividend get out of control did lead to a dividend cut that caused its stock price to crater from the $28 range to $15, something that has left a sour taste in a lot of investors mouths.

However, considering the company yields nearly 6%, we don’t need a lot of dividend growth to make this income play worth it, especially at current valuations, which is what we’ll get to next.

Does Altagas stock have a lot of upside?

I’m not one to put too much weight on analyst estimates, but I know people like to see them nonetheless. As of right now, analysts figure there could be as much as 34% upside in Altagas stock today, with a price target of $22.

Considering the company is expected to see shrinking revenue in both 2020 and 2021, I think that price target is a little rich. However, I still feel there is some potential for outsized gains, along with collecting a near 6% yield with Altagas.

Historically the company has traded at 1.7 and 24.4 times sales and forward earnings respectively over the last 5 years. Right now, the company is trading at 0.86 times sales and 15.81 times earnings.

Now, dividend stocks typically do trade at a higher premium, and ones that cut the dividend tend to take a long-term haircut in terms of price. So I think we’ll see those 5 year averages tune down a bit. But, Altagas is still cheap, and with the company growing its midstream business at a pretty rapid clip, there’s more room for growth with Altagas than say an industry leader like Enbridge.

Just recently the company paid $715 million to double its stake in a midstream firm called Petrogas, and it now owns 74% of the company. Petrogas has averaged adjusted earnings of $186 million over the last 3 years, so it seems like Altagas paid a very fair price to increase its stake.

Then there’s Ridley Island Propane Export Terminal, the first propane export facility in the country. Atlagas expects the terminal to drive export volumes upwards of 40,000 bbls/d, and can store 1.2 million tonnes of propane.

In fact, in the company’s most recent quarterly filing, they reported that the RIPET facility reported record volumes. In terms of growth, this facility is definitely the company’s main driver.

Overall, I think this is a strong play if you’re looking for a triple-play stock here in Canada. The company provides value in a severely discounted share price, income in a near 6% dividend yield, and growth in its current infrastructure expansion.

However, don’t expect that growth to come immediately. Patients is key. Much like other areas such as financials, and insurance companies like Manulife Financial (TSE:MFC), for their own reasons, investors will have to be patient with Altagas as well. The oil and gas bear market will more than likely keep this stock at bay, even though in reality, it shouldn’t.