Apple Stock: Overvaluation? Navigating the Risks Ahead

Apple has helped shape how we interact with technology over the decades. But recent challenges have put pressure on the tech behemoth.

A person could probably safely suggest that the rate of ground-breaking technology from Apple in recent years has dampened significantly compared to when cell phones and touchscreen tech was more swiftly evolving.

Apple has a strong year-over-year balance sheet. The company is strong no doubt. But some investors question the future growth potential of Apple in the face of economic uncertainty and increased competition within pretty much all of the company’s product offerings.

Am I buying Apple stock today? Let’s take a closer look at some pros and cons and see.

Key Takeaways

- Apple faces challenges with iPhone sales and market competition

- The company continues to innovate and expand its product ecosystem

- Investors should weigh Apple’s long-term potential against current market pressures

Strong earnings despite a relatively weak economy

Apple posted Q3 revenue of $85.8 billion, up 5% year-over-year, surpassing analyst expectations. The standout performer was the company’s Services segment.

It reached a new all-time high, growing 14% to $24.21 billion. This growth is impressive and suggests Apple’s strategy to diversify beyond hardware is paying off.

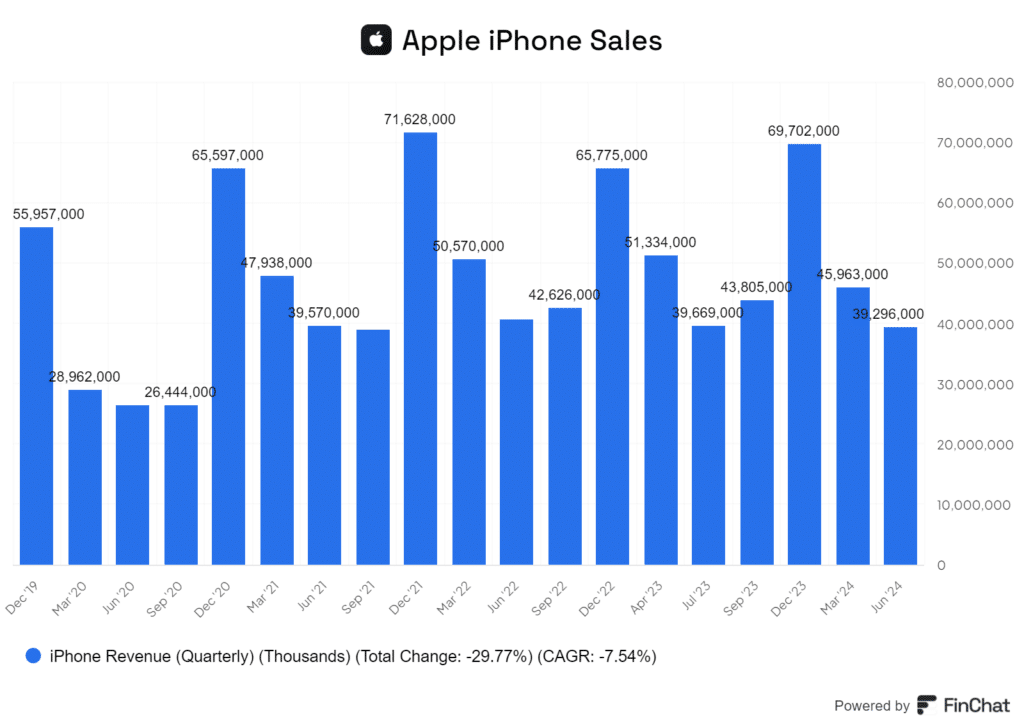

iPhone sales dipped slightly to $39.30 billion, down from $39.67 billion last year. While any decline in their flagship product can raise eyebrows, it still beat estimates.

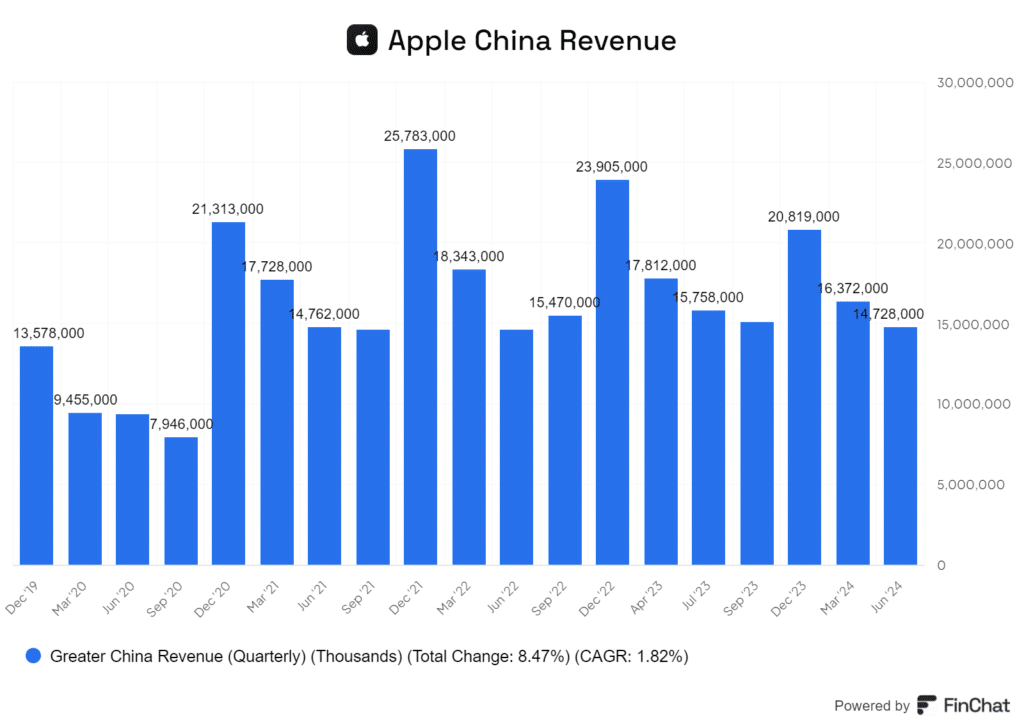

One area of concern is China, where sales fell 6.5%. The increased competition from local brands like Huawei is clearly taking its toll.

Earnings per share came in at $1.40, an 11% increase year-over-year. This strong bottom-line growth, despite modest revenue gains, speaks to Apple’s ability to manage costs effectively and improve margins.

The announcement of Apple Intelligence, their new AI initiative, is intriguing. It will be interesting to see how this technology evolves and how Apple intends to work it into their products.

iPhone 16 sales, China risks, and innovation hurdles

The iPhone 16 isn’t selling as well as it was hoped, which is a big problem for a company that relies so heavily on its smartphone lineup.

China’s market is another worry. It’s a crucial area for Apple, but competition from local brands like Huawei is intensifying. Additionally, there are strict AI regulations that could limit Apple’s ability to innovate there.

Here’s a quick rundown of the main challenges:

- Disappointing iPhone 16 sales

- Increased competition in China

- Strict AI regulations in key markets

- Lack of groundbreaking updates

- Delayed AI features

I would be concerned that these issues could really impact Apple’s bottom line if they’re not addressed soon. The company needs to find new ways to innovate and excite customers, or it might start losing its shine.

Long-term opportunities for growth

Apple’s stock has been on a tear lately, hitting record highs due to excitement around AI developments. While this enthusiasm is understandable, I’m not entirely convinced that it’s justified.

The company’s push into AI with iOS 18 is promising, but Apple faces stiff competition in this space. It’s unclear if they can truly differentiate themselves here.

Apple’s Services division continues to grow, which is a positive sign. However, I worry about the sustainability of this growth and whether it can truly offset potential declines in iPhone sales. After all, lower sales of phones will ultimately lead to lower service revenue, eventually.

The edge AI market presents an opportunity for Apple, with predictions of 25.9% annual growth. But it’s a crowded field, and success is far from guaranteed.

Rising R&D costs as Apple explores new product categories like AR/VR could be a concern. These investments might not pay off, putting pressure on margins as the company burns capital.

In my view, Apple’s long-term growth prospects are mixed. They have opportunities in AI and Services, but face significant challenges in maintaining their dominant market position.

Is Apple fairly priced?

Apple’s price-to-earnings ratio of 35.99 is quite high for a mature tech company. This P/E ratio suggests investors expect significant growth, which may be unrealistic given Apple’s size and market saturation.

The PEG ratio of 3.46 is another red flag. A PEG above 1 often indicates overvaluation, and Apple’s is well above this threshold.

Apple’s reliance on the iPhone is a risk factor for the company for sure. The smartphone market is mature, and finding new growth avenues could be challenging.

If we have a look at Apples P/E to other tech players:

• Apple P/E: 35.99

• Microsoft P/E: 35.46

• Google P/E: 23.54

It is a tad concerning, as both Microsoft and Google are growing at a faster pace.

The company’s EV/EBITDA ratio of 27.63 is also high, suggesting the stock may be pricey relative to its earnings power.

While Apple’s brand strength is a powerhouse and the company’s cash flow is impressive, the current valuation doesn’t leave much room for error.

The company needs to deliver significant innovation to justify these multiples.

Is now the time to buy Apple?

Personally I buy an iPhone because I have always bought an iPhone. I have not upgraded my phone in a while, I prefer the smaller frame phones despite the not so great cameras.

In terms of Apple’s stock I don’t know if I would be too worried about missing out on the shares. The company is a total powerhouse and has been for decades. But right now the company is pretty expensive, so, definitely no value prospect here unless they deliver exceptional results. I have some doubts about any major growth from Apple given the competition their products are facing. Parking cash in Apple doesn’t really cut it as a stellar dividend angle either.

For me, Apple is not something I am going to be super into right now. Obviously the company’s track record is impressive, but the high valuation leaves little room for error and these are interesting times.

I’m concerned about Apple’s ability to maintain its premium pricing in a potentially weakening global economy. Consumer spending on high-end devices could falter, further impacting things like iPhone sales.

The company’s heavy reliance on China for manufacturing poses risks, given ongoing geopolitical tensions.

Given these factors, I believe one could wait for a more attractive entry point. A correction could provide a better opportunity to invest in Apple at a more reasonable valuation.

For now I’ll keep Apple on my watchlist but I wait to see what the company does next.