Is Aritzia Stock the Next Lululemon, or a Fashion Dud?

Aritzia has made waves in the fashion retail world. The company’s focus on high-quality, trendy women’s clothing has propelled it from a single boutique to a major player in North America.

Despite recent challenges, Aritzia’s ambitious U.S. expansion plans and growing online sales suggest potential for long-term growth.

The Canadian retailer has faced its share of hurdles, from navigating the complexities of cross-border expansion to adapting to rapidly changing consumer preferences. Yet, Aritzia’s strong brand identity and loyal customer base have helped it weather these storms.

As the company continues to push into the U.S. market, investors are keeping a keen eye on its performance.

The company’s ability to manage inventory levels, improve profit margins, and capitalize on its e-commerce growth will be crucial factors in determining its future success.

Lets dig into why I like the company.

Key takeaways

- Aritzia’s U.S. expansion and online sales growth show promise for future success

- Recent inventory and profit margin challenges are normalizing

- Upcoming earnings report will provide insight into the company’s ability to navigate the current retail landscape

Aritzia Q1 fiscal 2025 earnings recap and what to expect for earnings coming up

Aritzia’s Q1 fiscal 2025 results were impressive, with net revenue increasing 7.8% to $498.6 million. This growth is particularly noteworthy given the company is a mid-tier fashion retailer and money is certainly tight for many consumers.

The company’s performance in the United States was a standout, with revenue jumping 13% to $284.7 million. This growth was driven by Aritzia’s expansion strategy and increasing brand awareness south of the border.

I’m particularly encouraged by the 2% comparable sales growth across all channels and regions. Aritzia isn’t exactly cheap, and many consumers can likely think of much better ways to spend their money at this point. Yet, the company continues to drive growth.

Gross profit margins saw a significant improvement, increasing 510 basis points to 44%.

Looking ahead to future earnings reports, I expect Aritzia’s growth trajectory to continue. The company’s planned 50% square footage expansion in the U.S. this year could be a major catalyst for revenue growth.

E-commerce sales, which grew 4.2% in Q1, may see further acceleration as Aritzia optimizes its product mix and invests in digital initiatives.

Margin recovery is another area to watch. If Aritzia can maintain its improved gross profit margins while managing expenses, we could see stronger earnings growth in upcoming quarters.

Updates on U.S. expansion and online sales growth

Aritzia’s U.S. expansion strategy is kicking into high gear. The company plans to open 8-10 new boutiques annually, focusing on prime locations in major cities like New York, Los Angeles, and Miami.

This aggressive approach aims to boost brand awareness and capture market share in a market that is 10x the size of Canada.

Aritzia’s ambitious goal is to more than double its U.S. revenue. The retailer is smartly capitalizing on its growing popularity south of the border. By increasing its physical presence, Aritzia can better showcase its “Everyday Luxury” aesthetic to American shoppers.

The online front is equally exciting. Aritzia’s e-commerce segment has seen explosive growth, with plans to reach $1.5-1.7 billion in sales by fiscal 2027. This would account for about 45% of total revenue – a significant jump from current levels.

To support this digital push, Aritzia is investing in:

- A revamped website (eCommerce 2.0)

- Improved product discovery tools

- A dedicated mobile app

The company’s omnichannel approach is spot-on in my view. By blending physical store expansion with digital innovation, Aritzia is positioning itself for long-term success in the evolving retail landscape.

Updates on profit margin pressure and inventory glut

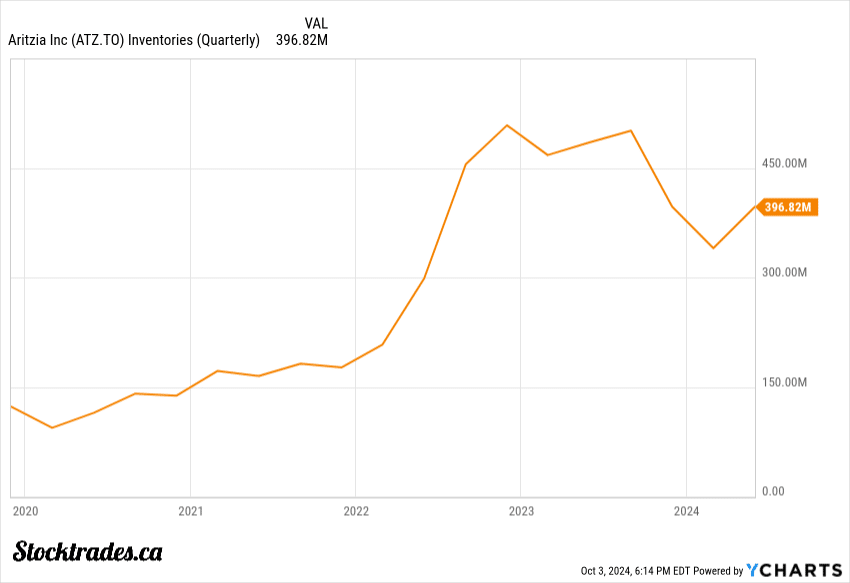

Profit margins have been under pressure, and there’s been an inventory glut to contend with.

The good news is that Aritzia seems to be turning things around. They’ve normalized inventory levels, ending the year with a 27% reduction compared to the previous fiscal year. This should help ease some of the margin pressure moving forward.

Discounting and promotional activity have taken a toll on margins, but I expect this to improve as inventory levels stabilize. The company has also been working on supply chain improvements, which should lead to better cost management.

Aritzia has implemented cost-cutting initiatives, including a smart spending program that’s expected to save over $60 million annually.

As inflation-related pressures ease and demand stabilizes, I anticipate we’ll see margin improvement in the coming quarters. The company’s focus on inventory management and supply chain optimization should start paying off soon.

Local and global economic uncertainties

The fashion retail sector faces challenging times amidst economic uncertainties. Inflation and shifting consumer spending patterns pose risks to many retailers.

Yet, Aritzia’s position in the market may offer some protection.

Aritzia’s premium demographic tends to be less affected by economic downturns. These customers often have more disposable income, allowing them to continue spending on fashion even in tough times.

I believe Aritzia’s brand strength gives it an edge. The company’s ability to maintain pricing power could help offset potential cost increases due to inflation.

U.S. expansion plans are a key part of Aritzia’s growth strategy. While this carries risks, it also diversifies the company’s market exposure.

The U.S. Federal Reserve’s policies will impact consumer spending. Higher interest rates might cool demand, but Aritzia’s target market may be less sensitive to these changes.

In my view, Aritzia’s business model shows signs of resilience. Its focus on quality and style at accessible price points could help it weather economic storms better than some competitors.

Am I buying Aritzia today?

I’m confident that Aritzia stock is a buy today. The company’s growth story is compelling. It has significant room for expansion in the U.S. market.

Aritzia’s strong brand identity and loyal customer base provide a solid foundation for future success. Their e-commerce platform continues to thrive, offering another avenue for growth.

While there are risks to consider, such as inflation and inventory challenges, I believe Aritzia is well-positioned to navigate these hurdles. The company’s management has demonstrated adaptability in the face of changing consumer trends.

I’m particularly encouraged by Aritzia’s potential for margin recovery and earnings growth. As the company optimizes its operations and scales up, profitability should improve.

Given these factors, I’m bullish on Aritzia’s prospects. The combination of a proven business model, expansion opportunities, and improving financials make it an attractive investment option.

In my view, Aritzia is poised to deliver long-term value to shareholders. Despite short-term market fluctuations, I believe now is an opportune time to add Aritzia stock to a well-diversified portfolio.