Artis REIT (TSE:AX.UN) – A Cheap REIT and an Activist Catalyst

Investing in Canadian REITs has become a popular strategy for Canadians. If you’re new and just learning how to buy stocks, in short REITs can give you single click exposure to a variety of real estate sectors. without having to purchase properties themselves, maintain them, collect the rent, and deal with tenants.

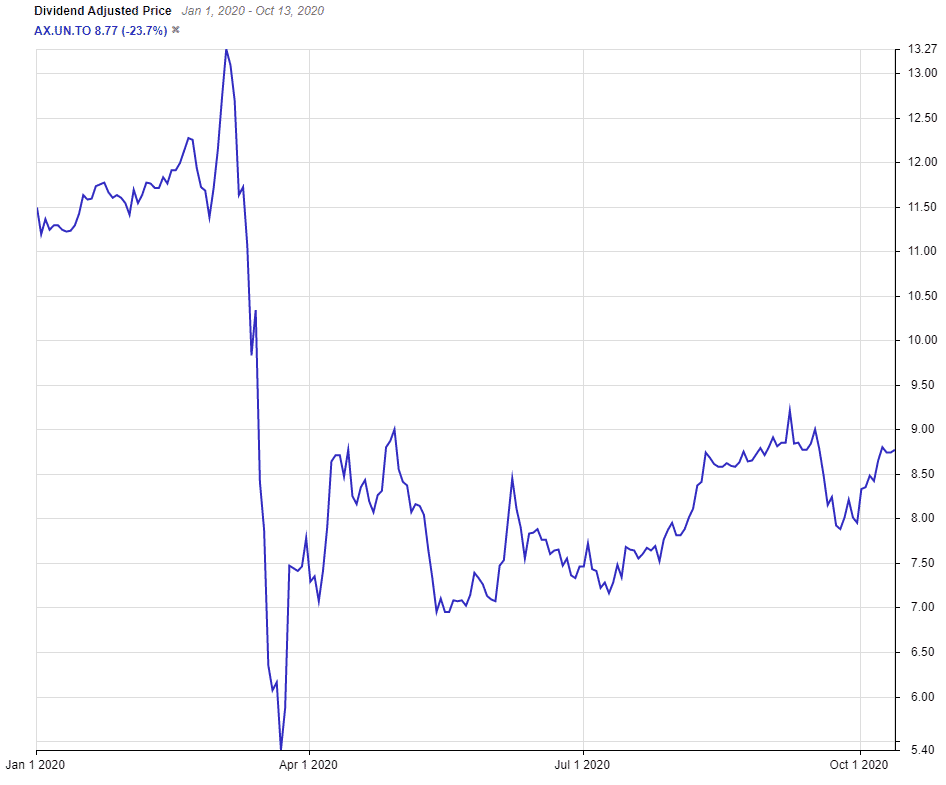

To add to this, a lot of Canadian REITs are trading at significant discounts to 52 week highs and NAV because of the COVID-19 pandemic.

One of those real estate investment trusts is Artis REIT (TSE:AX-UN).

What does Artis REIT (TSE:AX.UN) do?

Artis Real Estate Investment Trust is an unincorporated close-ended REIT. The company’s portfolio primarily consists of properties located in Central and Western Canada, particularly Saskatchewan (7%), Manitoba (12%), and Alberta (16%).

The trust also has properties in select markets in the United States, with the bulk of them being in Arizona (11%), Minnesota (23%), and Wisconsin (11%).

The largest portion of the company’s portfolio is office properties at 48%, followed by industrial at 35%, and finally retail at 17%.

In total, Artis has over 24 million square feet of office, retail, and industrial leasable areas, and over 216 properties.

Why Artis REIT may be a bargain at these price levels

Artis REIT has been one of Canada’s cheapest REITs for a while. The market punishes it because it has retail exposure, and worse, Alberta retail exposure. It is exposed to the slumping Calgary office market.

Artis owns 40 retail properties (excluding two it is in the process of selling), with most of that space in Alberta.

With the rise of e-commerce and the state of the Alberta’s economy since the oil collapse in 2015, Alberta retail is a market investors want to avoid.

The market is overestimating the retail exposure however. Retail makes up less than 20% of Artis’s FFO and if the retail FFO vanished, Artis would still be considered cheap in my eyes.

Artis’s exposure to Calgary’s office market – where vacancies are almost 30% and landlords are giving away years of free rent just to get tenants – is also overestimated.

REIT investors, rightfully are concerned by this, but Calgary office space provides just 2.1% of Artis’s NOI.

In my opinion, the market is wrong to value Artis cheaply based on this, but we have to play the cards the market gives us.

And that’s where the catalyst comes in.

Spinoff and Sandpiper

Artis announced in early September that it plans to spinoff its retail properties into a new REIT, Artis Retail REIT.

This would immediately get rid of the retail properties the market didn’t like and it would reduce Artis’s diversification (pure play REITs tend to trade at higher multiples).

The end result of this? Management hopes the market will reward Artis with a higher valuation because of it.

Sandpiper Group, an activist investment firm which has taken on several other REITs in Canada, objects to the plan.

It claims that Artis Retail REIT will not trade at fair value on its own given its retail portfolio and small size, so unitholders of Artis will not get fair value from either holding on to their spun off units or selling them cheaply.

Partly because of the spinoff, Sandpiper, which owns roughly 5% of Artis, is moving to replace the board of Artis. Sandpiper wants to sell off the retail properties slowly, which is more likely to result in getting fair value for them.

It also wants to end the business relationship with The Marwest Group of Companies which Artis uses to do its developments. It is a company owned and controlled by the family of Artis CEO Armin Martens.

Sandpiper suggests not using Marwest will reduce costs and means Artis can immediately raise its distribution.

Whether Sandpiper is successful replacing the Artis REIT board or not, the attention from the fight will mean Artis needs to be run less like a family company, a good thing for unitholders.

And either way the retail properties are on their way out, so Artis REIT is bound to see its valuation go up.

Artis REIT Valuation

Artis REIT trades at just 8.6x 2020’s AFFO, using the AFFO from the first half of 2020 and annualizing it.

As I said at the start, Artis has been too cheap for a while, but it’s 5 year average multiple is still 10.7x.

Just going back to its average multiple would get Artis REIT to $10.90, roughly 25% upside from today’s price.

Artis has upgraded its portfolio by getting rid of its Calgary office exposure, and as it gets rid of the retail properties the market should give Artis an even higher multiple.

Not only does Artis present the potential for capital gains, but the yield is over 6% right now with an AFFO payout of roughly 50% during the worst environment imaginable when many tenants were shut down due to COVID-19.

Artis, under either current management or Sandpiper, plans to use the excess AFFO to reduce debt and invest in industrial real estate developments.

Industrial REITs are trading at over 15x AFFO, so as Artis grows its industrial portfolio Artis’s multiple should grow as well while reducing debt to lower risk.

Conclusion

Artis is undervalued because investors are overestimating its exposure to retail real estate and Calgary’s office market.

The activist campaign by Sandpiper is going to shine a light on Artis’s high quality portfolio and should serve as a catalyst for the unit price. This could result in quick upside.

Artis’s 5 year average AFFO multiple would mean 25% upside. If Artis trades up to the target price of analysts ($12), Artis’s NAV ($15.40), or Sandpiper’s estimate of fair value ($16.57), the upside is even higher.