Is Barrick Gold Stock Still the Gold Play in 2025?

As one of the world’s largest gold producers, the company has weathered market volatility exceptionally well.

Despite numerous setbacks over the years, Barrick has shown resilience. The company’s stock has delivered total returns of over 40% in the past 5 years. Although this has underperformed the index, it has outperformed many peers in the gold mining sector.

The gold market remains dynamic, influenced by factors like inflation fears and central bank policies. Can Barrick maintain its momentum?

Let’s take a deeper look at what’s in store for this mining giant.

Key Takeaways

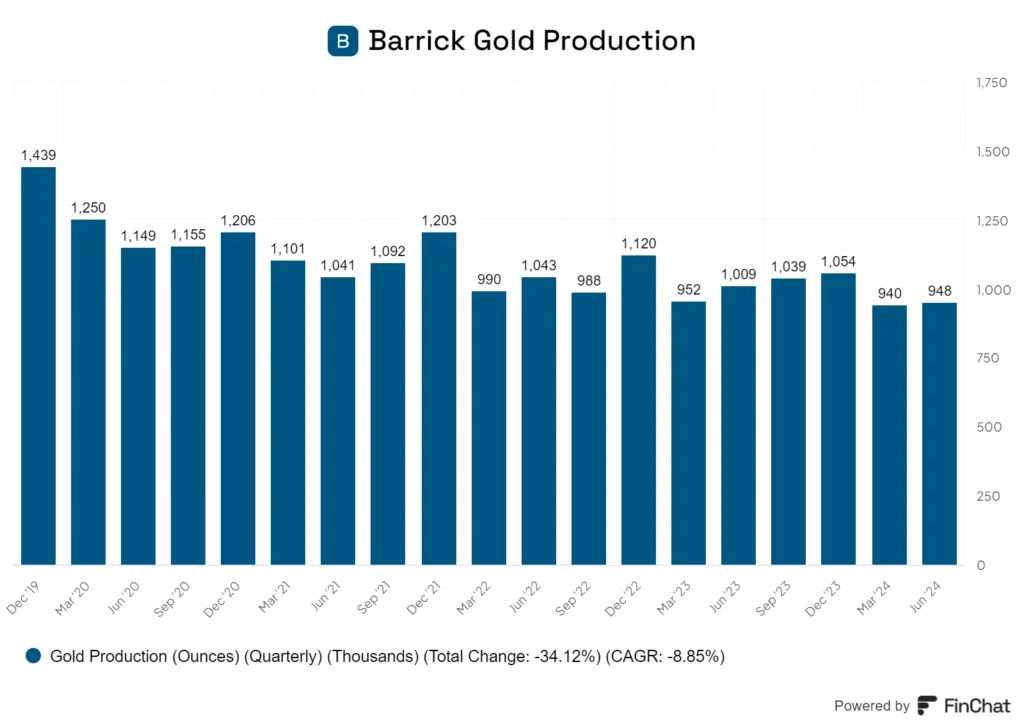

- Barrick’s recent production decline may impact short-term stock performance

- The company’s growth strategy and cost management will be crucial for future success

- Gold price trends and market conditions will continue to influence Barrick’s outlook

Barrick Gold’s Q3 production misses targets

The company’s gold production fell short of expectations, coming in at 948,000 ounces compared to the anticipated 975,000 ounces.

What’s causing this dip? It appears the main culprits are the Carlin and Cortez mines in Nevada. These key operations have been struggling with lower output, which has had a significant impact on overall production figures.

Lower ore grades seem to be a factor here. When mines produce lower-grade ore, it takes more effort and resources to extract the same amount of gold. This can lead to increased costs and reduced efficiency.

Speaking of costs, I’m concerned about the projected rise in all-in-sustaining costs (AISC). An increase of at least 2% over the previous quarter’s $1,498 per ounce could put pressure on Barrick’s profit margins.

On a more positive note, Barrick is planning an operational expansion at the Carlin mine. This could potentially boost throughput and recoveries in Q4, helping to offset some of the Q3 losses.

I’ll be watching closely to see if Barrick can still meet its full-year production targets. The company will need a strong Q4 performance to make up for this shortfall.

Despite Q3 setback, Barrick Gold delivers strong double-digit growth in 2024

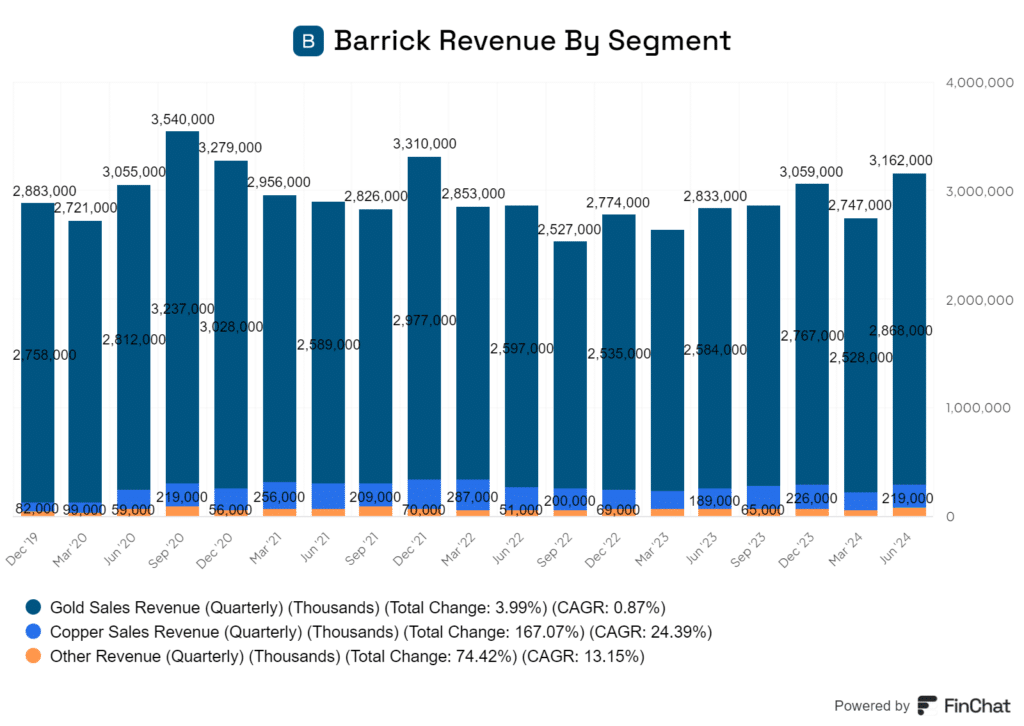

Barrick Gold’s performance in 2024 has been impressive, even with the Q3 production hiccup one can’t deny it’s had a solid year. The company has achieved double-digit growth in numerous key areas.

Gold prices have been a major tailwind. The precious metal reached record highs in 2024, boosting Barrick’s revenue significantly. Heading into the company’s next earnings release, I believe this price surge has more than offset the production challenges faced this quarter.

Barrick’s cost management strategies have paid off. The company has implemented efficiency improvements across its operations, leading to higher profit margins.

Shareholders have reaped the benefits of this strong performance. Barrick has increased dividends and share buybacks, outpacing many peers in the sector. While the market has responded positively to Barrick’s results this past year, it still trails the performance of the S&P/TSX Composite Gold Index.

As one of the largest companies in the industry, this isn’t all that surprising. That said, it could also be a sign that Barrick has a longer positive runway than some of its peers.

Key drivers shaping the gold market for 2024 and beyond

Gold prices have been on a wild ride lately, and I expect this trend to continue. The precious metal hit all-time highs in 2024, driven by a mix of factors.

One key driver is the Federal Reserve’s interest rate policy. I believe the Fed will continue cutting rates moving forward, which could weaken the U.S. dollar and boost gold prices.

Global inflation is another crucial factor. While inflation has cooled in many countries, it’s still a concern as energy prices are leading much of the decline. Gold often shines as an inflation hedge.

Geopolitical tensions are rising, increasing safe-haven demand for gold. I think this trend will persist, supporting higher prices.

Central bank gold buying has been strong. I expect this to continue, particularly from emerging markets looking to diversify their reserves.

For Barrick Gold, these trends are mostly positive. Higher gold prices typically boost the company’s profits. But it’s not all rosy – a strong U.S. dollar could partly offset gains.

Most gold bulls have price targets of $2,600 to $2,800 per ounce in the coming years. This would be great news for Barrick’s bottom line.

In my view, the outlook for gold remains bright. But it’s a complex market with many moving parts. Investors should keep a close eye on economic indicators and global events.

What investors should watch for next quarter

As we approach Barrick Gold’s Q3 earnings release, I’m keeping a close eye on several factors.

As per its production announcement, gold prices in Q3 averaged $2,474 per ounce, which might help offset some production challenges. This is up materially from the average realized gold price of $1,928 it achieved in Q3 of Fiscal 2023. This price strength could boost revenue despite lower output, and I’m going to be really curious to see what numbers it posts.

For Barrick Gold’s Q3 earnings, analysts expect an average EPS of $0.46, 37% higher than the previous year.

Revenue is forecast at $4.59 billion, representing a 15.95% growth year-over-year (YoY). For the full year 2024, revenue is expected to grow by 18.71%, while EPS growth is projected at 56%.

Given the miss on production, I’d expect these numbers to come down over the next couple of weeks.

The company’s preliminary Q3 production results showed gold output in line with Q2. While not ideal, it will benefit from higher realized prices. The company is also expecting a strong Q4 to make up for the shortfall in Q3.

Guidance updates will be critical. I’m curious to see if Barrick maintains its full-year outlook or adjusts expectations based on Q3 performance and Q4 outlook.

The Pueblo Viejo mine’s 23% production improvement is a bright spot. I’ll be watching for details on how this might impact future quarters.

Overall, while the production miss is disappointing, there are still plenty of tailwinds for the company ahead.