BCE Stock – Cheap, but Better Opportunities Elsewhere

As a Canadian investor, I’ve been keeping a close eye on BCE stock lately.

BCE Inc, one of Canada’s largest telecommunications companies, has been making waves in the market, for all the wrong reasons in my opinion.

The company’s debt situation in a rapidly increasing rate environment has caused it to be in a bit of a bind, and is now being forced to sell off assets to shore up its balance sheet along with cutting capital expenditures just to find the capital to cover the dividend.

The company’s recent moves really caught my attention, however.

BCE’s decision to sell its minority stake in Maple Leaf Sports and Entertainment to Rogers Communications for $4.7 billion was a necessary evil, but will hurt the company long-term. I’ll speak more on that later, however.

Q2 2024 Results and Analysis

BCE’s second quarter 2024 financial results paint an interesting picture, and one that isn’t particularly attractive.

Revenue took a slight dip, down 1.3% year-over-year. The main culprit? A $66 million decrease in product revenue, which accounted for 93% of the total decline.

Why the drop in product revenue? A few factors come into play:

- 70% of new mobile activations were BYOD (Bring Your Own Device)

- Revenue elimination from The Source

- Decreased business wireline data product sales

The company reported a 1.3% decline in adjusted earnings per share and a 9.6% reduction in operating cash flow.

Free cash flow increased to $1.09B on the quarter, but when we look to the first 6 months of the year, the company has paid out $800M~ more towards the dividend than it has generated in free cash flow.

The company continues to guide to potential double digit decreases in free cash flow in 2024 and mid to high single digit earnings decreases.

The sale of MLSE and why I don’t believe it is optimal

I’m not convinced that BCE’s decision to sell its stake in Maple Leaf Sports & Entertainment (MLSE) is the best move. MLSE was a crown jewel in BCE’s portfolio, owning iconic teams like the Toronto Maple Leafs and Toronto Raptors.

Sports franchises have been skyrocketing in value, and I don’t see that trend reversing anytime soon. The C$4.7 billion price tag for BCE’s 37.5% stake puts MLSE’s total value at a whopping C$12.53 billion. That’s a massive sum, but I do believe it will be a bargain in the future.

Why would BCE part with such a valuable asset? I suspect they felt forced into it due to financial pressures. The company has been struggling with debt and needs to focus on its core telecom business.

Plus, there’s the competitive angle. Rogers Communications is buying out BCE’s stake, giving them majority control of MLSE. That’s a big win for Rogers and a strategic loss for BCE.

Now, just because I believe the sale is suboptimal doesn’t mean I don’t believe it had to happen. The company is in rough shape financially, and realistically had to do this. However, mismanaging your balance sheet and forcing yourself to sell off a prime asset isn’t exactly good management.

Concerning debt levels and quality of balance sheet

As of June 2024, BCE’s debt stood at CA$39.5 billion, which is a notable increase from CA$34.4 billion a year earlier.

When the company couldn’t hit its debt targets at the start of 2024, it simply raised its debt targets to a more reachable level. This should be a gigantic warning sign to investors. Guidance that has been in place for years that is raised to make the target easier to hit for a company that is currently swimming in debt and interest rate expenses.

The sale of MLSE should allow it to pay down some debt, but the reality is it won’t even cover the amount of debt the company has issued in the last 9 months.

Getting its balance sheet in order has been a main focal point of management for more than a year now. There has been very little done, in my opinion, and although rates will continue to decline in the future, the company is realistically not going to be bailed out by falling interest rates, and needs to get those debt levels down.

Dividend coverage is lacking, and needs to improve in 2025

I’m concerned about BCE’s dividend coverage ratio. The company’s payout ratio has been creeping up, reaching worrying levels over the last few years. This trend suggests BCE may be stretching to maintain its generous dividend.

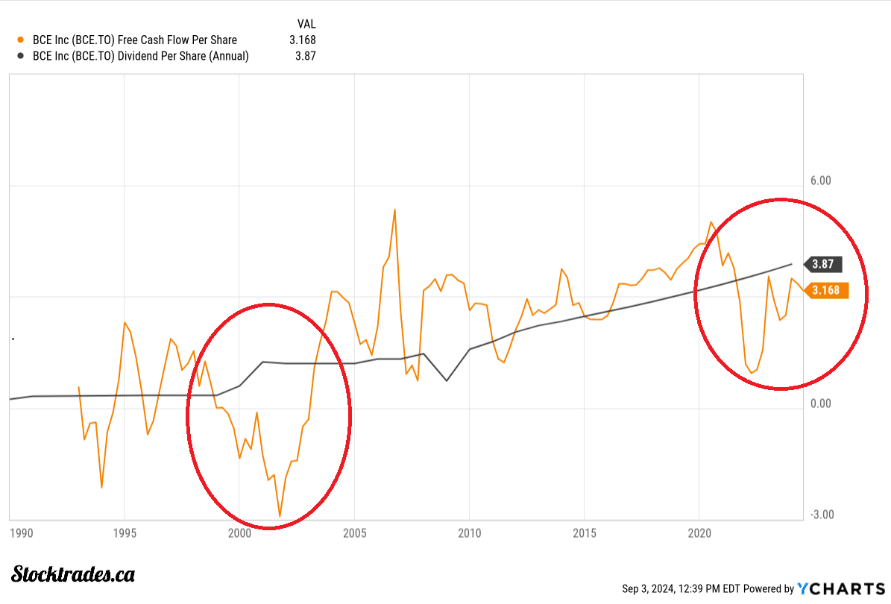

There is a common misconception by many Canadians that telecom companies will go through long periods of a lack of dividend coverage due to high capital expenditures. The chart below debunks this myth.

BCE has not went through more than 2 years of dividends making up more than 100% of free cash flow since the dot com bubble in 2000. This is an event that hasn’t happened in nearly 2 and a half decades, and needs to be taken into consideration.

BCE has a proud history of dividend growth, increasing payouts for 15 consecutive years. However, I believe this streak may be at risk. The company’s recent 3.1% dividend hike to $3.99 per share seems modest compared to past increases, and one could argue it shouldn’t have even been done at all.

Without meaningful improvement, I fear a dividend cut may be on the horizon. While BCE’s management likely wants to avoid this scenario at nearly all costs, they may have no choice if financial performance doesn’t strengthen.

I do see multiple expansion, but I see that for every telecom play

With all this said, I do think BCE’s current stock price might offer some value for investors. The company’s long history and dominant position in the Canadian telecom market are certainly appealing factors.

However, I’m not convinced BCE is a standout among its peers. I do expect companies like Rogers, Telus, and Quebecor to outperform.

When I look at the broader telecom sector, I see potential value across the board. Many players in this space are facing similar challenges and opportunities, and many are in much better shape financially.

From my perspective, BCE may actually underperform compared to other telecom stocks in the coming years. The company has virtually no growth, and is in a position now where it is having to dump assets (even high quality ones like MLSE) to shore up its balance sheet.

While BCE boasts an attractive dividend yield above 8%, I’m concerned about the sustainability of these payouts. As an investor, you should be too.

All eyes will be on Fiscal 2025 guidance. If the company predicts another shortfall in terms of free cash flow generation, the dividend should be cut.