Comparing High Yielding ETFs in Canada for Passive Income

Many Canadian investors are looking to increase their passive income stream. Some may do this by buying individual dividend stocks, some may purchase fixed income, and some may look to what we are going to speak about in this article. That is high-yielding Canadian ETFs.

Picking individual equities is extremely difficult. Not only do you need to navigate through quarterly reports multiple times a year, but you also have to deal with gut-wrenching drawdowns that can make you second guess your decision to buy.

Exchange Traded Funds, or ETF for short, are more broad-based and for the most part take away the concentration risk that is present with individual stocks. ETFs now stretch across a multitude of different industries and sub sectors such as banking and finance, cryptocurrency ETFs, real estate, agriculture, and many more.

If an exchange-traded fund contains 100 holdings, disappointing earnings from a single company are unlikely to impact its price by much.

And, if we’re looking to generate more passive income, we want it to be passive right? We don’t want to be constantly checking our holdings and verifying if a stock is still worth holding. There are some Canadian ETFs that can possibly assist in that endeavor.

In this article, we’ll go over some of the best Canadian dividend ETFs with high-yields

Overall, our mentality here at Stocktrades is to not chase dividend yields. Some high-dividend options are what we like to call “yield traps”, duping investors into purchasing products that are financially engineered to provide high income, but sub-par overall returns.

In this article, you’ll find simplified products. Ones that use basic strategies understandable to most investors to generate strong passive income for investors.

Beware of large management fees (MER) with high yielding ETFs

Most high-yielding ETFs, at least the ones that utilize covered call or leveraged strategies will have higher expenses. This is because the fund is actively managed, and requires more of a conscience effort from fund managers to drive performance.

It is also worth noting that in situations where the management team uses things like leverage and covered calls you read the overall strategy of the fund before purchasing.

Many Canadians may blindly purchase high-yielding exchange-traded funds without truly knowing what they are buying, which can lead to devastating consequences, especially in the case of leverage.

High yielding ETFs can sometimes sacrifice overall returns

If long-term capital appreciation is the goal of your portfolio, you must understand that some high-yielding options in terms of ETFs will sacrifice this element to ensure a strong passive income for its unitholders.

Learning how to buy stocks or seasoned investor alike, it is crucial you figure out your own investment strategy, risk tolerance and financial goals before buying.

With that said though, there are a plethora of strong options here in Canada, a few that we will go over in this article of high yielding Canadian ETFs.

What are the best high-yielding Canadian ETFs to buy today?

- Hamilton Enhanced Multi-Sector Covered Call ETF (TSE:HDIV)

- BMO High Dividend Covered Call ETF (TSE:ZWC)

- iShares Canadian Dividend Aristocrat ETF (TSE:CDZ)

- BMO Covered Call Utilities ETF (TSE:ZWU)

- CI Financial Energy Giants Covered Call ETF (TSE:NXF)

- Vanguard Canadian High Dividend Yield Index ETF (TSE:VDY)

Hamilton Enhanced Multi-Sector Covered Call ETF (TSE:HDIV)

If you are a fan of covered call ETFs here in Canada, you’re going to be a huge fan of the Hamilton Enhanced Covered Call ETF (TSE:HDIV).

Why?

The fund takes some of the most popular covered call options here in Canada and combines them into a single ETF, providing a strong monthly dividend income yielding north of 8.5% at the time of writing.

The ETF’s top holdings include the BMO Covered Call Utilities and Bank ETF, Harvest Healthcare Leaders ETF, and even the Horizons Enhanced Income Gold Producers ETF.

If you were to own all the constituents of this ETF individually, your average dividend yield would only be about 0.10% higher than this fund. Which, makes it worthy of inclusion simply based off convenience. However, one thing we do need to understand about this ETF is its “enhanced” nature. The fund uses 25% leverage to squeeze out extra income for its investors. This puts the fund in a higher risk category than a normal ETF.

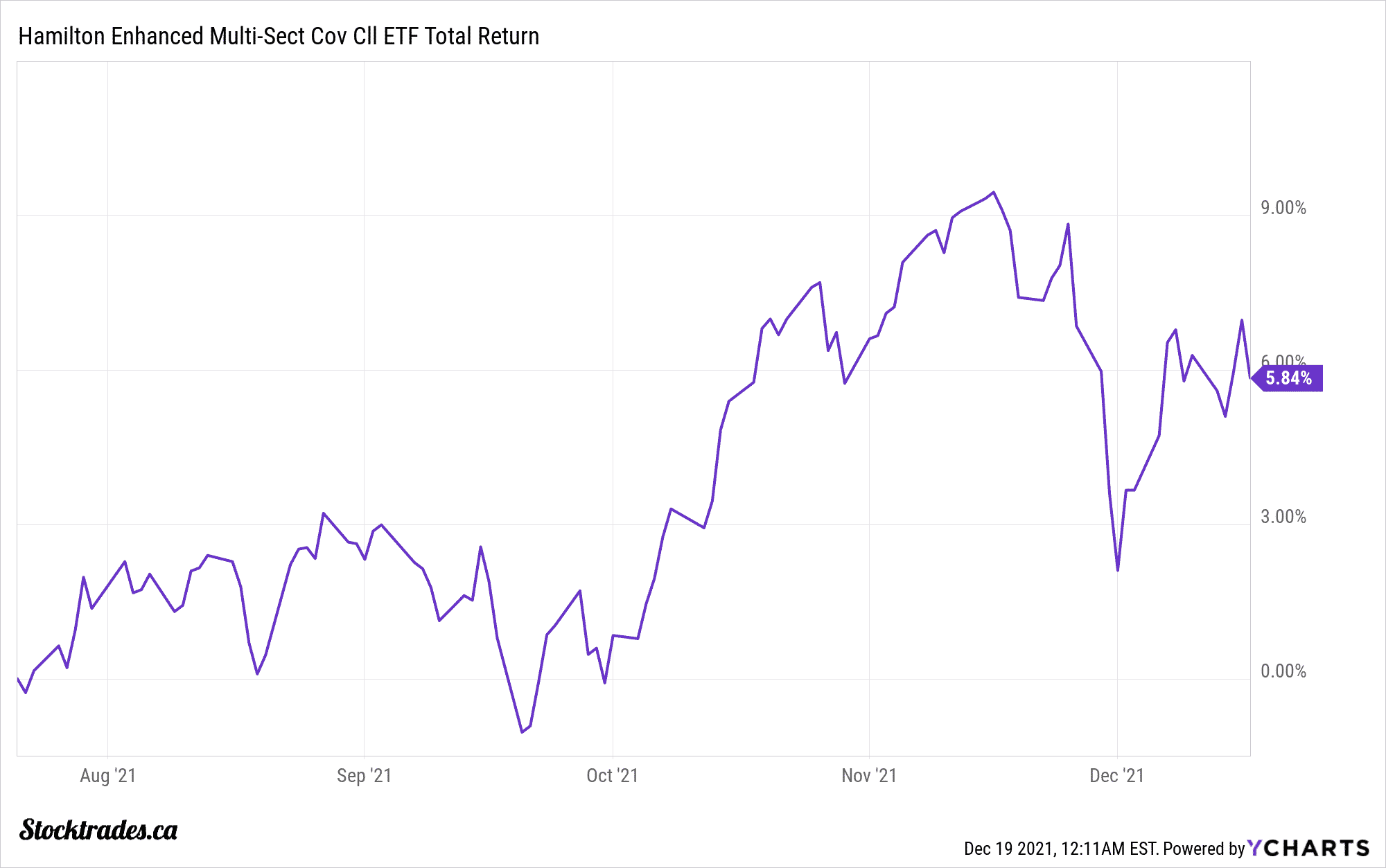

In terms of performance, the fund is virtually brand new, debuting in mid-2021 likely due to the massive surge in investors seeking passive income options. Management expense ratios sit at 0.65%, meaning you’ll pay $6.50 per $1000 invested in this ETF and assets under management at the time of writing of around $82M.

BMO High Dividend Covered Call ETF (TSE:ZWC)

BMO has done exceptionally well when it comes to introducing well-run, niche ETFs for Canadians. The High Dividend Covered Call ETF (TS:ZWC) is no different.

The ETFs main goal is to provide large passive income to its unitholders via a yield-weighted portfolio of Canadian companies and selling covered call options on them.

The fund yields just shy of 7% at the time of writing and pays its distribution on a monthly basis, usually around the end of the month. It is a popular ETF here in Canada, with assets under management of over $1.3B and daily volume of over 151,000 units a day, making it an especially liquid ETF.

Unlike HDIV, this ETF owns underlying stocks, not ETFs. Its largest holdings contain the likes of Canadian Imperial Bank of Commerce, Enbridge, TD Bank, Royal Bank, BCE, Manulife Financial, TC Energy, and many more.

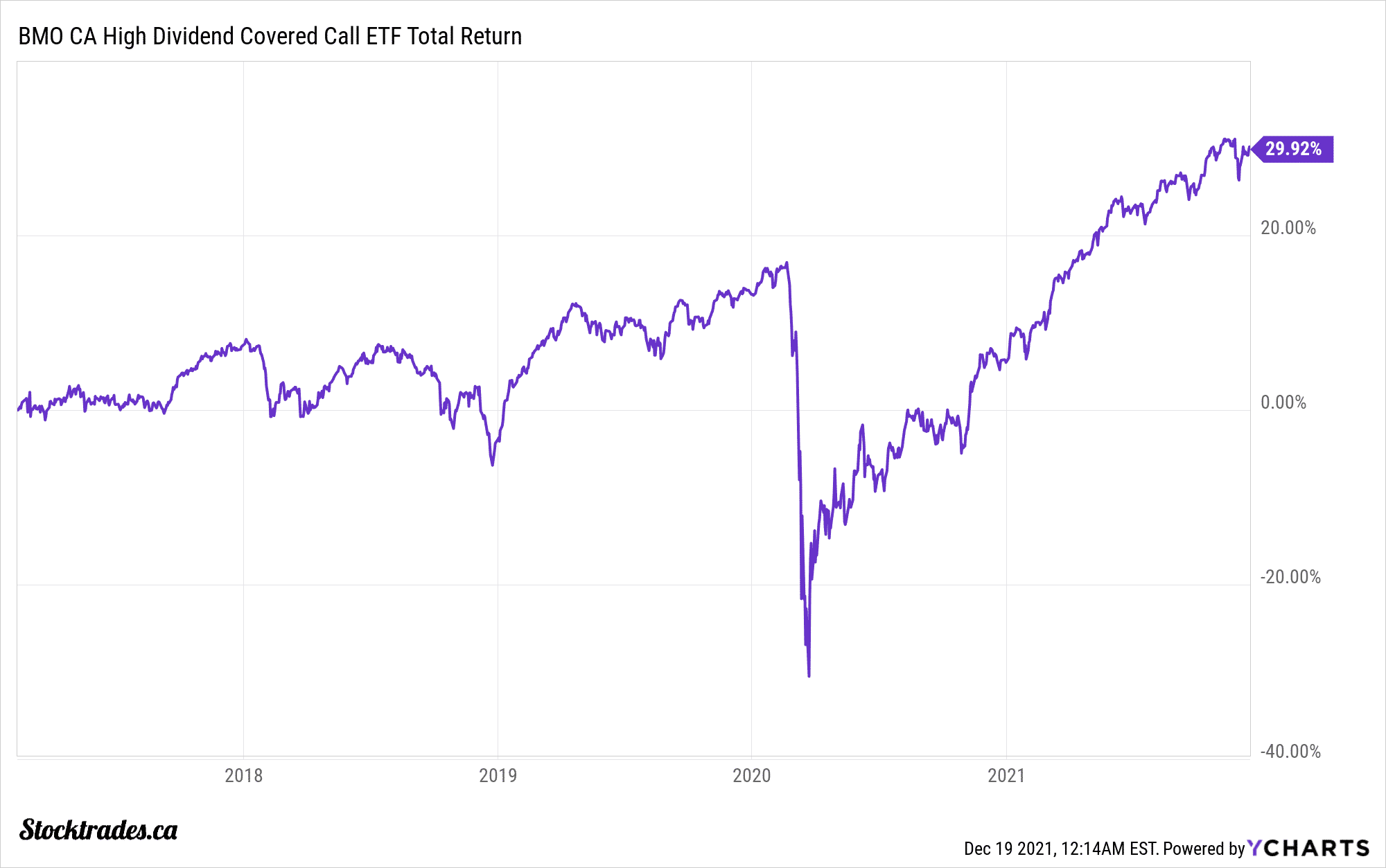

Management fees come in at 0.72%, meaning you’ll pay $7.20 per $1000 invested, a fair price for those looking for a large yield. In terms of performance, if you had taken the distributions and re-invested them, you’d be sitting on returns of just shy of 30% since the funds inception in 2017.

This is a significant underperformance of the TSX Index, but this isn’t really all that surprising. Covered call strategies will typically struggle during bull markets, in which we have been in one for the better part of a decade.

If the market goes sour over the next few years, this might be an ETF that Canadians would want to have a look at.

iShares Canadian Dividend Aristocrat ETF (TSE:CDZ)

Yes I know, the iShares Canadian Dividend Aristocrat ETF (TSE:CDZ) isn’t exactly what I would call “high yielding”, but hear me out. If you’re looking for a middling yield with a strong history of dividend growth, then there might not be a better option in the country than CDZ.

CDZ’s primary objective is to give Canadians exposure to all of the Canadian Dividend Aristocrats. If you’re unaware of what an Aristocrat is, it is a company that has raised the dividend in 5 consecutive years. At the time of writing, there are over 80 companies who fit this description, and CDZ owns them.

Some of the key holdings inside of this ETF are those with multi-decade dividend growth streaks like Enbridge, Canadian Natural Resources, TC Energy, and Imperial Oil. The fund yields in the low 3% range and has assets under management of $993M at the time of writing.

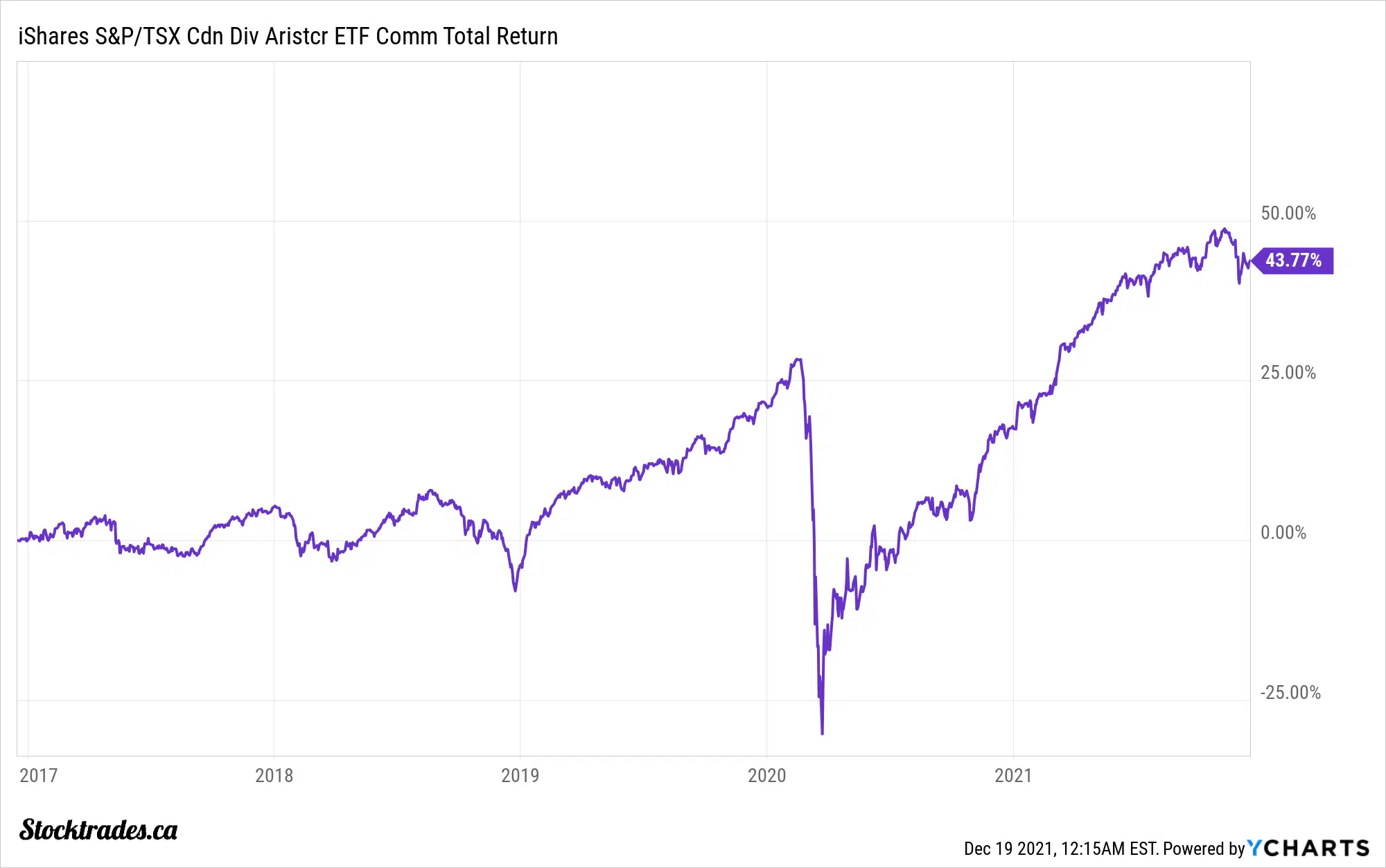

The fund also has one of the lower expense ratios on this list, coming in at $6 per $1000 invested. This is likely due to the fact it is more of an index fund than an active management fund, aiming to replicate the performance of the S&P/TSX Canadian Dividend Aristocrats Index.

In terms of performance, the fund has actually underperformed the TSX Index as of late. This is likely due to the fact that oil and gas has struggled mightily over the last decade. However, there is a chance that the industry could rebound over the next few years, and if it does, CDZ’s holdings contain a significant amount of major players in the industry and it could end up in some nice distribution hikes.

BMO Covered Call Utilities ETF (TSE:ZWU)

Utility stocks are well known for providing strong dividends to its investors. This is due to the fact most of them are in established, slow-growing industries and the best way to distribute profits to shareholders is in the form of a dividend instead of investing the money internally.

The BMO Covered Call Utility ETF takes these high-income paying companies and turbocharges the distribution with covered call option writing. As a result, you have an ETF that yields north of 7.5%. ZWU is certainly one of the highest-yielding ETFs on this list.

In terms of holdings, its largest holding will be ZUT, which is the BMO Equal Weight Utility ETF. It has a mid-single-digit allocation to this ETF and the remainder of the fund is in popular Canadian utilities like TC Energy, BCE Inc, Telus, Fortis, Pembina Pipeline, Emera and Hydro One.

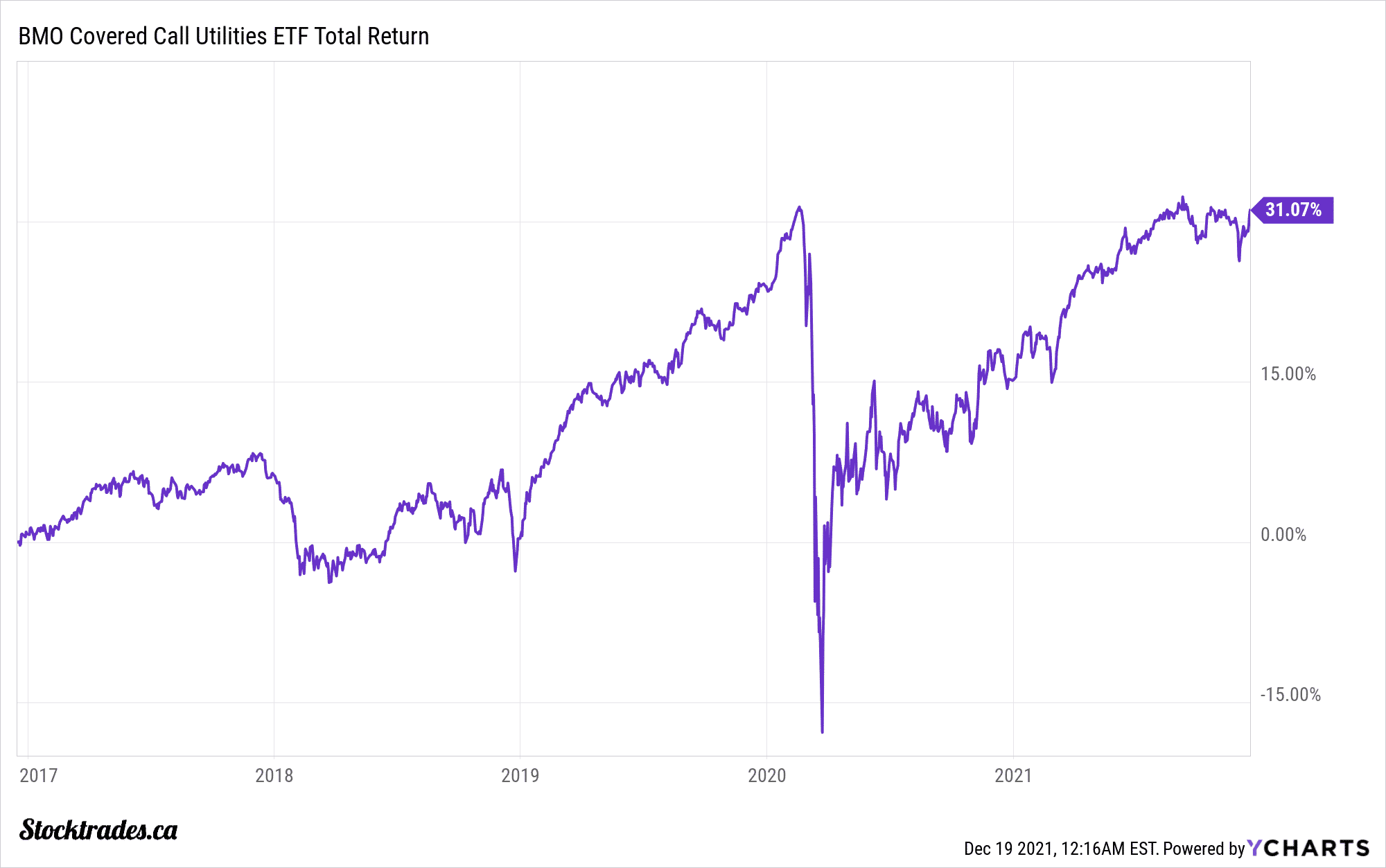

The fund has management fees of around $7.10 per $1000 invested and assets under management that exceed $1.5B, making it one of the bigger ETFs on this list as well. In terms of diversification, as you can tell it does not invest in just traditional “utilities”, in the sense that many Canadians think of a utility only to be a power company. It contains exposure to many midstream pipelines and telecommunication companies as well.

Reinvested dividends with this ETF, and you’d be sitting on a total return of 62.67% since 2012. However, it’s important to note that over the same timeframe the NAV of this fund has shrunk by 16%. Make no mistake about it, if you are buying ZWU, you are not doing so for long-term capital growth. It is strictly for the regular dividend income.

CI Financial Energy Giants Covered Call ETF (TSE:NXF)

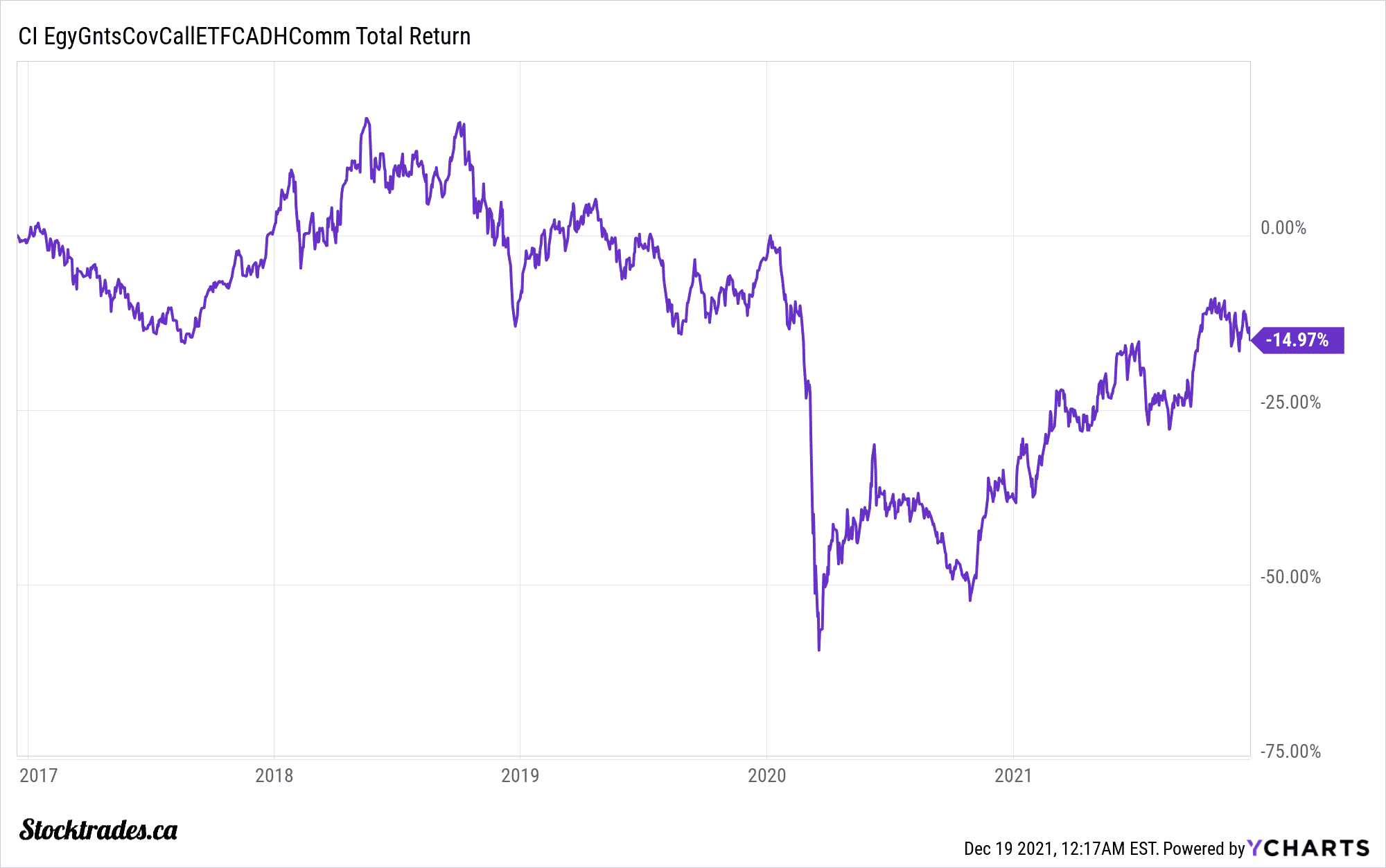

One important thing to note on the CI Energy Giants Covered Call ETF is the fact that this is very much a short-term play on the bullish cycle we are expected to go through with crude oil. Over the course of the long term, this fund has struggled, losing 50% of its value since mid-2015.

However, this is primarily due to the fact that oil and gas collapsed during that timeframe. And, if you believe the industry is set to turn things around, it might not be a bad option. And overall, sentiment seems to be pointed this way, as the fund gained nearly 30% in 2021.

The objective of this fund is fairly simple. It holds some of the largest North American energy companies and sells covered calls on them. Top holdings include the likes of Suncor Energy, Canadian Natural Resources, Exxon Mobil, Chevron, Royal Dutch Shell, and Hess.

The fund yields a whopping 8.1% at the time of writing and pays out a quarterly distribution. This is key to note, as most of the funds on this list will pay monthly, especially the other fund selling covered calls.

With assets under management of $395M, it’s relatively small compared to the others. But, this is to be expected as the industry has been crushed over the last half decade. If we look to the last year, it has had $116M of inflows, showing that investors are starting to take a peek at the oil and gas sector again.

If you’re looking for heightened income from the oil and gas sector, this is an interesting option. Just know that the sale of covered calls on these energy giants may not allow you to benefit from capital appreciation, if there is to be any.

Vanguard Canadian High Dividend Yield Index ETF (TSE:VDY)

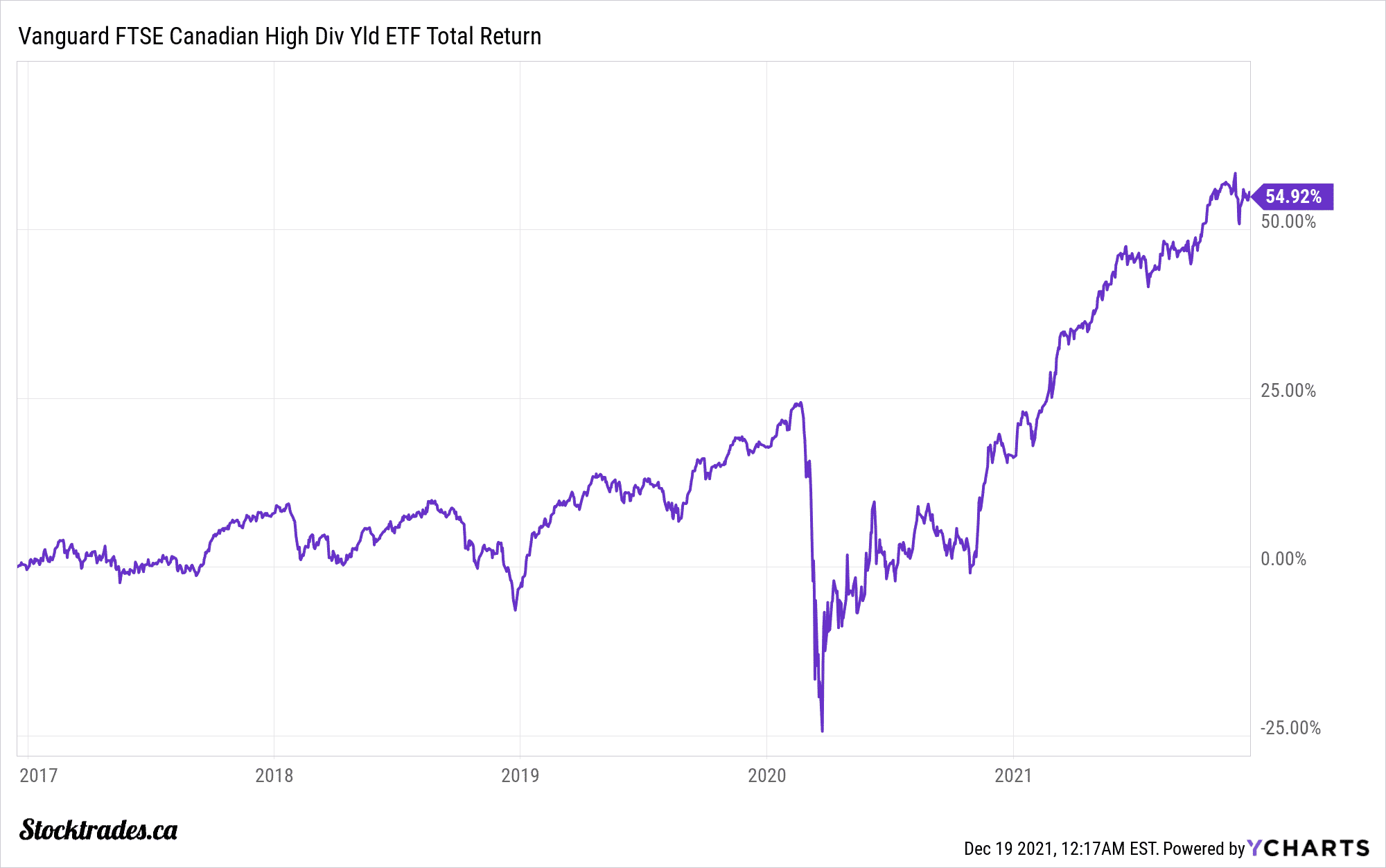

For the most part, this list is made up of ETFs that require a little bit of financial engineering to increase the distribution. But for the first Vanguard ETF on this list, it is strictly a fund that aims to replicate the Canadian High Dividend Yield Index.

The fund is dominated, at least at the top end of it, by Canadian financial institutions. Some of its top holdings contain Toronto-Dominion Bank, Royal Bank of Canada, Bank of Nova Scotia, and National Bank of Canada. However, it still does contain plenty of high-yielding energy and utility plays like Fortis and Enbridge as well.

The ETF only yields 3.65%, maybe not enough to entice those who are seeking super high yield. But, it’s also important to understand that it has the lowest expense ratio on this list by a wide margin, costing you only $2 per $1000 invested. This difference in fees ultimately ends up in your pocket at the end of the year.

The fund is also the best performing on this list, with total returns of over 140% since its late 2013 inception. Although you aren’t necessarily getting super high income, it doesn’t hurt to maybe sell off a few units of a better-performing fund and pay yourself a “self-made” dividend.

Overall, are these high-yielding ETFs worth it?

When we look at taxable situations, many high-yielding ETFs are not the most efficient. For one, capital gains are some of the most tax-efficient returns you can generate. You’d be better off selling off units of a fund that might yield less, but achieve higher total returns.

Obviously, this is individual-specific, but there is rarely a time where this is not a net positive situation, at least in the case of taxes paid.

Many people get tunnel vision when it comes to dividend yield, and it is important to understand your overall situation and what you would like to achieve from your portfolio.

These high-yielding ETFs might give a Canadian retiree a nice passive income stream in retirement to pay their bills, but does a 25-year-old with a 30+ year time horizon really need to sacrifice compounding returns to achieve a higher yield?

It’s something you might regret down the line, which is why it is imperative to figure out what you want from your portfolio and align your assets to achieve that goal.