Is There a Bottom in Sight for Blackberry Stock?

Key takeaways

- BlackBerry’s recent earnings show some encouraging signs, but they’re a long ways from “back”

- BlackBerry has been working hard on restructuring and cost management efforts

- A possible acquisition? Unlikely, but possible

Once known for its smartphones, Blackberry now focuses on software and cybersecurity. This shift hasn’t been easy, and BlackBerry is continuing to get hammered over the years, down 83% from pandemic highs and down 99% from its highs witnessed during the financial crisis.

This is no doubt making investors wonder about its future. Despite these troubles, BlackBerry keeps working on new products and trying to grow its business.

Looking at BlackBerry’s history, we can see a company that’s always trying to adapt. From ruling the smartphone world to now battling in the competitive software market, it’s been quite a ride.

But adaptability doesn’t really get you anywhere in the public markets. Ultimately, you need results. Does Blackberry have a hope of turning it around? Lets dive in.

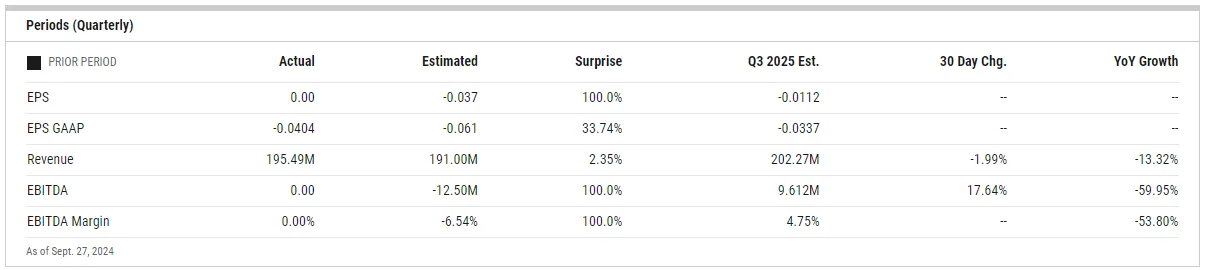

BlackBerry’s Q2 earnings

BlackBerry’s Q2 2025 results paint an encouraging picture for investors. The company has made significant strides towards profitability, achieving breakeven adjusted EBITDA and non-GAAP earnings per share.

I’m particularly impressed by the double-digit revenue growth in both IoT and Cybersecurity divisions. After all, these are the main drivers for the business moving forward.

IoT revenue grew 12% year-over-year to $55 million, while Cybersecurity revenue increased 10% to $87 million, exceeding guidance.

The improved gross margins are another bright spot. IoT gross margin increased to 82%, while Cybersecurity gross margin rose to 55%.

Cash flow trends are also positive. Operating cash usage beat expectations, improving by $43 million year-over-year to $13 million.

The company’s cost-cutting efforts are paying off. Operating expenses were 24% lower than the baseline for the prior year.

BlackBerry’s QNX software continues to be a strong performer, delivering solid royalty revenue. The launch of QNX Containers for OS virtualization could further boost this segment’s growth.

In the Cybersecurity division, the introduction of CylanceMDR Pro and recognition for CylanceENDPOINT show BlackBerry’s commitment to innovation and product excellence.

Looking ahead, BlackBerry has raised the bottom end of its full-year guidance range for IoT. A bump in guidance is certainly a bright spot.

Restructuring and cost management efforts

BlackBerry has been working hard to turn things around. The company’s recent restructuring efforts are looking like they’re starting to pay off.

I’ve noticed they’re making some smart moves to cut costs and streamline operations. They’ve trimmed down the workforce and are now laser-focused on growth areas like IoT and cybersecurity.

CEO John Chen seems to be leading the charge on this front. His leadership in restructuring has been key.

Here’s what I think they’re doing right:

- Cutting unnecessary expenses

- Streamlining the workforce

- Focusing resources on high-potential areas

- Improving operational efficiency

These changes are starting to pay off. They’re not spreading themselves too thin anymore. Instead, they’re putting their energy into areas where they can really shine.

The road ahead isn’t easy, and they have a very long way to go. But I think these restructuring efforts are a step in the right direction.

Facing market challenges

Blackberry faces stiff competition in the cybersecurity realm, where giants like Microsoft and Cisco dominate. It’s not an easy fight, but I believe BlackBerry’s focus on enterprise-grade security gives it a fighting chance.

The global IoT market presents both opportunities and hurdles. While demand is growing, BlackBerry must prove its solutions are top-notch. The delays in electric vehicle development have thrown a wrench in the works for the IoT segment, impacting near-term revenue projections.

The moat is thin and the competition is stiff from some major tech giants with a plethora of cash on hand.

Despite these challenges, I see potential long-term growth catalysts:

- Rising cybersecurity needs

- Increasing IoT adoption in various industries

- BlackBerry’s strong presence in automotive software

The company’s restructuring efforts are a step in the right direction. Cost-cutting measures have improved profitability visibility, which I think could lead to better valuations down the road.

Even with the setbacks from delays in EV development, BlackBerry still has a healthy backlog in its IoT division.

This represents potential future earnings and signals strong market interest in their IoT offerings, particularly within the automotive space. As EV development picks up pace and normalizes, BlackBerry has a great opportunity to turn this backlog into real revenue, which could significantly boost growth in their IoT sector.

BlackBerry’s transformation isn’t anywhere close to complete, but I believe its strategic focus on high-growth areas could position it well for the future.

Potential M&A activity on the horizon

While there’s been chatter about private equity interest in BlackBerry, nothing’s confirmed yet.

BlackBerry has put considerable effort into dividing its operations into two separate units: Cybersecurity and the Internet of Things, the latter heavily focused on its QNX operating system.

It’s hard to imagine the company would undergo such a transformation without a clear financial incentive, with an M&A deal appearing to be the most likely reason.

This speculation is further backed by CEO John Giamatteo’s remarks in August. He suggested that selling certain assets could now be on the table, noting it was previously more challenging when their portfolio was more complex.

My perspective on BlackBerry stock

I believe BlackBerry stock presents a compelling risk/reward opportunity. The company’s strategic pivot to cybersecurity and IoT has positioned it well in high-growth sectors.

The IoT market is an area where I see strong growth potential for BlackBerry. Their QNX platform is already a leader in the automotive sector, and I expect this dominance to expand.

The current stock price, in my view, doesn’t reflect BlackBerry’s true value. After a 30% year-to-date drop, I think now could be a reasonable time to add it to your watchlist.

Key reasons for my optimism:

• Strong positioning in cybersecurity and IoT

• Successful restructuring initiatives

• Potential for strategic mergers and acquisitions

While short-term challenges exist, particularly in the cybersecurity division, I’m confident in BlackBerry’s long-term prospects.

The company’s ongoing transformation make it an attractive investment for those willing to be patient.