Bank of Montreal – Should You Buy The Stock on Weakness?

As one of Canada’s biggest banks, BMO garners a lot of attention when it reports earnings. Over the last year or so, the company has not put up good results, there is no need to sugar coat it.

However, BMO’s stock currently offers a high dividend yield and discounted valuation, making it a seemingly attractive option for long-term investors looking for steady income.

The bank’s solid track record and wide-ranging services in personal banking, wealth management, and capital markets contribute to its appeal.

But at this point, it’s not all smooth sailing.

The bank’s provisions for credit losses and its exposure to the US commercial real estate market have sparked debates among investors as to whether this company is a buy.

Lets dive into my thoughts.

Key Takeaways

- BMO stock offers a high dividend yield, appealing to income-focused investors

- Recent quarterly results have caused some concern among investors, myself included

- The current dip in stock price will likely continue until provisions normalize

BMO Q3 Earnings – A borderline ugly quarter

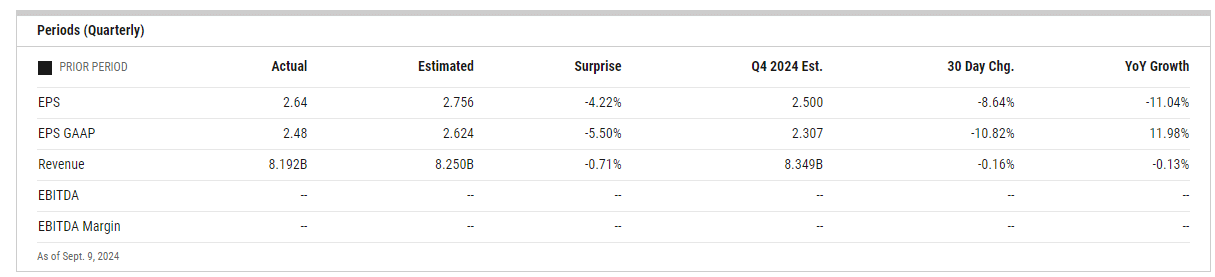

Bank of Montreal’s third quarter results for 2024 were disappointing, to say the least. The bank’s performance fell short of expectations on practically all fronts, and there were plenty of surprises.

The most concerning aspect was the sharp rise in provisions for credit losses (PCL). PCLs jumped to $906 million, nearly doubling from $492 million in the same quarter last year.

This suggests BMO is bracing for an increase in potential loan defaults, which could spell trouble ahead. The most surprising thing is how much this company blew past estimates for $740M~ in provisions.

Because of these provisions, adjusted earnings per share fell to $2.64 from $2.94 year-over-year..

The Canadian banking segment showed some resilience with a 4% increase in net income. However, the U.S. division struggled, with net income dropping 6% compared to last year.

BMO’s stock price tanked 6.2% following the earnings release. The market’s reaction suggests widespread concern about the bank’s near-term prospects.

While BMO’s capital position remains strong with a CET1 ratio of 13.0%, the overall picture from this quarter is cause for caution.

The combination of weak revenue growth, surging credit provisions, and compressed margins paint a worrying picture for the bank’s immediate future.

Provisions for credit losses – Continual surprises are spooking investors

I’m concerned about BMO’s recent spike in provisions for credit losses. The bank’s C$906 million set aside in Q3 2024 far exceeded expectations and signals growing credit quality issues.

This trend is alarming. BMO has now missed earnings estimates for three straight quarters, largely due to these ballooning provisions.

I believe investors are right to be spooked by the bank’s inability to accurately forecast credit losses.

A few key worries stand out:

• U.S. real estate exposure

• Rising commercial loan defaults

• Potential for further “surprises”

BMO’s higher commercial lending concentration makes it especially vulnerable to economic weakness. If provisions keep climbing, it could seriously dent long-term profitability.

The bank claims these issues are “contained,” but I’m skeptical.

BMO expects provisions to stay high near-term before normalizing in 2025. I think that timeline may be optimistic given current economic uncertainty.

US commercial real estate portfolio and US segment an issue

I believe BMO’s exposure to the US commercial real estate sector is a major concern for investors. The bank’s US business segment performance has been hit hard by challenges in this market.

High vacancy rates in office buildings are a big problem. Many companies have shifted to remote work, leaving office spaces empty. This trend is putting pressure on commercial landlords and their lenders.

Interest rates have also played a role.

BMO’s recent results reflect these issues. A huge chunk of the banks impaired loans are coming from US CRE.

The bank’s larger exposure to commercial loans compared to some peers is troubling. As credit conditions worsen, this could continue to drag down BMO’s earnings.

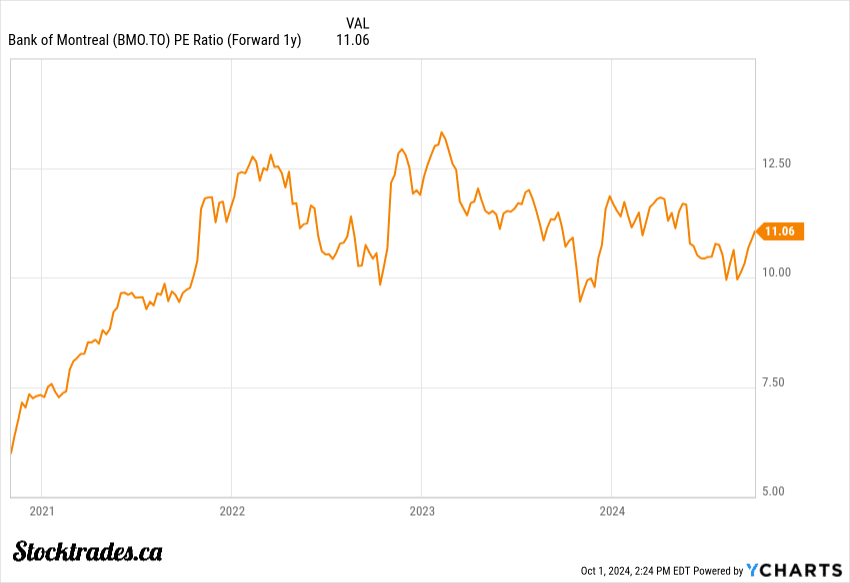

Valuations are discounted, but future is unknown

Bank of Montreal’s stock appears undervalued at first glance. Its forward P/E ratio of 11.07 suggests a discount compared to historical averages.

The price-to-book ratio of 1.11 also indicates potential value. When we look to a stock like Royal Bank, it is trading at nearly double the book multiple.

These metrics might tempt investors looking for bargains in the financial sector.

But I’m cautious about declaring BMO a clear buying opportunity.

Provisions are a key concern. As economic uncertainties persist, BMO may need to set aside more funds to cover potential loan defaults. This could impact future earnings, which would turn than 11X P/E into a higher one.

On the positive side, BMO’s dividend yield of 5.08% is attractive for income-focused investors. The payout ratio of 69.51% is high, suggesting that the bank may not be able to grow the dividend much in the near future, but isn’t at any risk of being cut.

Is the bank a buy the dip opportunity?

BMO’s provisions for credit losses and exposure to U.S. commercial real estate are concerning. The current economic environment adds another layer of uncertainty.

On the flip side, BMO’s long-term market position is solid. It’s a well-established bank with a strong presence in Canada and growing operations in the U.S.

The bank’s strong dividend yield is certainly attractive. BMO has a history of consistent dividend growth, and although I do believe it will continue to grow the dividend in the future, I don’t expect large increases.

In my opinion, BMO could be a buy-the-dip opportunity for patient investors. However, I’d much rather just buy stronger institutions like Royal or National. I may be wrong if BMO rebounds in the future. However, if the bank continues to struggle, it will lag most all other financial institutions.