BNS Stock – Has Bank of Nova Scotia Finally Turned a Corner?

Bank of Nova Scotia (TSE:BNS), commonly known as Scotiabank, is one of Canada’s Big Five banks and a significant player in the global financial sector.

As a multinational banking and financial services company, it has placed an emphasis on expanding internationally versus south of the border. This strategy thus far has come back to haunt it.

While its international operations have shown some improvements, they still lag behind expectations. In a notable move, Scotiabank has shifted its strategy with the Keybank acquisition, potentially reshaping its future trajectory.

For income-focused investors, Scotiabank’s dividend has long been a draw. However, concerns have arisen about the company’s ability to maintain its status as a Dividend Aristocrat.

The bank’s recent performance has been a mixed bag, with earnings results that have neither impressed nor disappointed.

Despite recent challenges, Scotiabank’s stock remains a topic of interest for those seeking potential value in the Canadian banking sector.

Lets go over my thoughts on the bank.

Key Takeaways

- Scotiabank’s stock performance reflects a mix of challenges and potential opportunities, primarily focused towards challenges

- The bank’s international operations and recent acquisitions look to indicate a potential turnaround

- Dividend sustainability remains a key consideration for potential investors

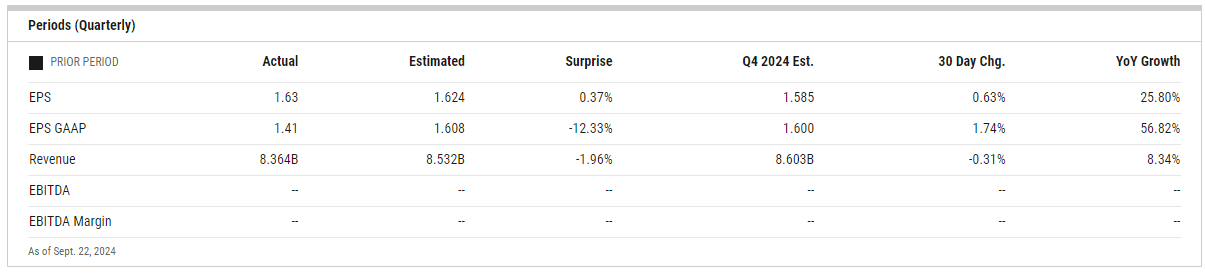

Recent earnings – Not good, but not bad

Bank of Nova Scotia’s latest financial results paint a mixed picture. Q3 earnings per share came in at $1.63, right inline with analyst estimates. Revenue, however, slightly missed targets at $8.36B.

Revenue growth remained relatively flat, suggesting challenges in expanding the bank’s core business lines. However, this performance should be viewed in the context of a challenging economic environment.

Overall, I’ve been so used to seeing Scotia report poor earnings, that this “so-so” quarter seems like a win in my eyes. If the bank can string a couple of these together, it is likely it garners more interest from the market, especially when other banks like Toronto Dominion and Bank of Montreal are struggling.

The banks provisions for credit losses seem to be normalizing, and normalizing is certainly something that can be seen as a positive. We’re far away from recoveries when it comes to provisions right now, and the market tends to take note and react positively when we see stability.

The bank’s international operations, particularly in Latin America, continue to be a source of both opportunity and risk. These markets offer growth potential but can also introduce volatility to earnings.

Overall, Bank of Nova Scotia’s recent earnings reflect a bank navigating challenging waters. While not stellar, the results demonstrate resilience in one of the more complex environments we’ve been in for quite some time.

International operations – Improvements, but still lacking

Bank of Nova Scotia’s international operations have shown promising signs recently. The bank beat analyst expectations in its latest quarter on its international end, with revenue gains helping to offset higher provisions for credit losses.

The international division delivered stronger performance, contributing to the bank’s overall positive results. Revenue from international units increased, demonstrating some traction in key markets.

However, challenges remain. The bank has noted that returns from international operations haven’t matched the risks associated with them. In my opinion, there is still a ton of work to be done to optimize the bank’s global strategy.

The bank’s international exposure sets it apart from other Canadian banks, but it’s a double-edged sword. It offers growth potential, but that potential just hasn’t worked out whatsoever.

KeyBank Acquisition – A shift in company strategy

Scotiabank’s recent agreement to acquire a 14.9% stake in KeyCorp signals a notable shift in the company’s expansion strategy. This move marks a departure from Scotiabank’s typical focus on growth outside North America.

Historically, Scotiabank has targeted international markets, particularly in Latin America and the Caribbean. However, the KeyBank acquisition suggests a newfound interest in the United States banking sector.

This strategic pivot could be seen as a response to changing global economic conditions. By investing in KeyCorp, Scotiabank diversifies its portfolio a bit, becoming less reliant on international markets.

The US$2.8 billion investment in KeyCorp may offer Scotiabank several advantages:

- Access to KeyBank’s established US customer base

- Exposure to the US retail and commercial banking sectors

- Potential for knowledge sharing and technological synergies

It’s worth noting that this acquisition comes at a time when US regional banks have faced challenges. Scotiabank’s decision to invest in KeyCorp could be seen as a vote of confidence in the American banking system.

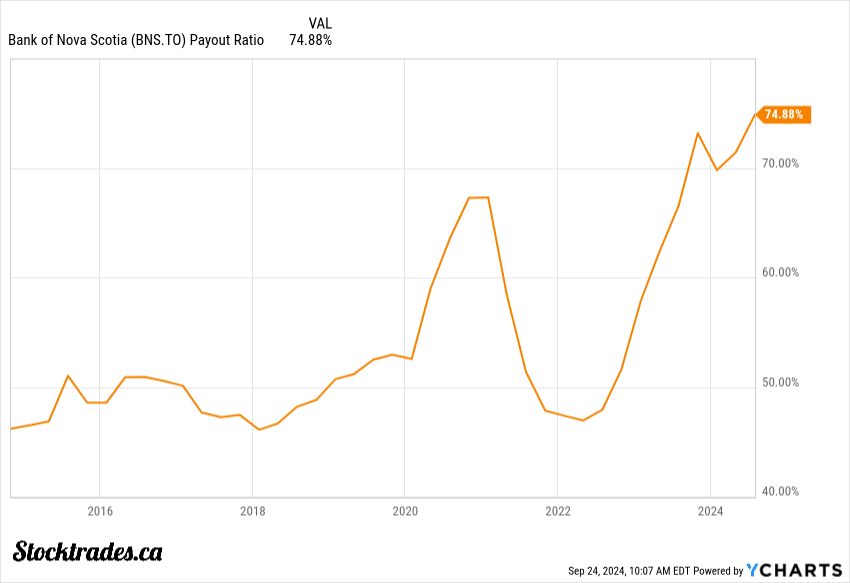

The dividend – Company at risk of losing Aristocrat status

Bank of Nova Scotia’s dividend status is on shaky ground. The company hasn’t raised its dividends since early 2023, putting its prestigious Aristocrat status at risk.

If Scotiabank doesn’t increase its dividend in 2024, it could lose this coveted title. This situation is concerning for income-focused investors who rely on consistent dividend growth.

The bank’s current payout ratio sits at a hefty 75%. For financial institutions, this high percentage isn’t ideal. It leaves little room for reinvestment in the business or to cushion against economic downturns.

Given the lacklustre earnings projections for Scotiabank, the bank might need to prioritize financial stability over dividend growth in the near term. The last thing you want to do is raise the dividend at a 75%~ payout ratio and report flat earnings for a year or two. It leaves little room for error.

Investors should be prepared for the possibility that Scotiabank may hold off on dividend increases. I would be surprised if they raised the dividend in Q4, but they possibly could by a very small amount to maintain their Aristocrat status.

The current dividend yield of 6%~ is certainly attractive. However, without consistent growth, it may not be enough to offset the risks associated with the high payout ratio and uncertain economic conditions.

Still not enough to convince me there has been a turnaround

The Bank of Nova Scotia’s recent performance hasn’t quite turned the corner yet. While the stock has shown some resilience, I wouldn’t be rushing out to buy it.

That said, it’s certainly performed much better than its competitors Toronto Dominion and Bank of Montreal over the last year.

I prefer Canadian banks like Royal Bank and National Bank. To me, they offer a more compelling investment opportuny.

These institutions have demonstrated stronger domestic operations and more consistent growth strategies.

BNS’s international expansion, particularly in Latin America, hasn’t yielded the expected returns. This has put pressure on the bank’s overall growth and profitability compared to its peers, and it is not a hole they can dig out of very fast.

Investors might find better value and growth prospects with other Canadian banking stocks at this time. However, all that said, I am keeping an eye on the company’s quarterly earnings over the next bit here, as there are signs it is starting somewhat of a turnaround. Just not enough to convince me to buy yet.