Can Shopify (TSE:SHOP) Keep up It’s Torrent Growth Rate?

There is no questioning Shopify (TSE:SHOP) has been one of the most notable Canadian stocks of recent memory.

In fact, this is a popular Canadian growth stock that will likely go down in history as one of the most successful Canadian stocks in history.

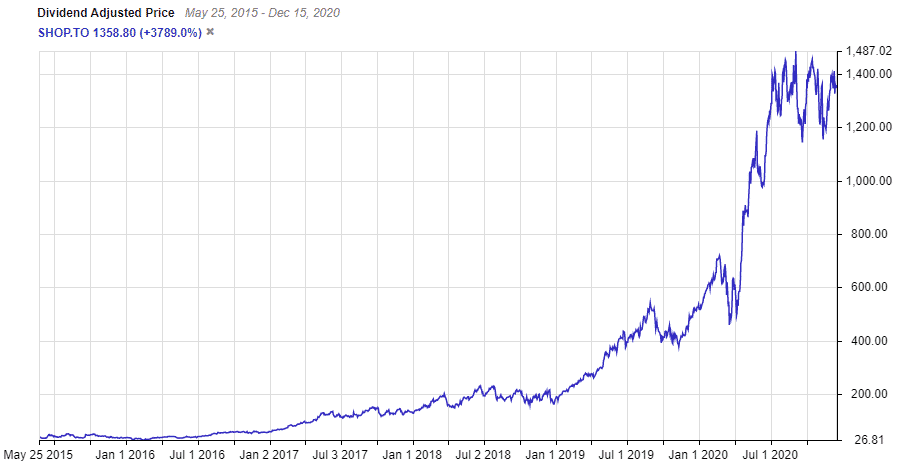

Those who bought the stock, $10,000 worth of this popular e-commerce giant when it IPOed in 2015 have saw that investment grow to $379,000 in just over 5 years.

Shopify’s meteoric rise hasn’t been based on hype or outlandish predictions. The company’s share price has increased because it’s also one of the fastest growing companies in the country, routinely crushing analyst expectations and posting 45%+ annual revenue growth.

So, the real question is, does this company still have room to run? How much more can Shopify really grow? Lets have a look.

So what exactly does Shopify (TSE:SHOP) do?

Shopify, especially in its younger years, was often dubbed “The Next Amazon”. The companies are similar, but not exact.

Shopify’s slogan on its website is “making commerce better for everyone.” And, it’s certainly doing so thus far.

Shopify has helped over 1,000,000 businesses start selling online, powered through its Shopify platform, which helps retailers set up an online store in minutes.

In fact, in 2019 the company contributed over $319 billion in economic activity worldwide, highlighting the shear size of the company’s overall platform.

So now that we know that Shopify helps small, medium and even large scale businesses develop e-commerce stores and drive more revenue, lets have a look at why this company has been able to grow so fast.

Shopify appeals to all business owners, and is quickly gaining market share

With products ranging from just $29 a month to over $2,000 a month, Shopify truly does appeal to merchants of all sizes.

And, this proved to be huge during the COVID-19 pandemic as the company helped countless small and medium size businesses keep their heads above water as lockdowns took their toll.

Because of the pandemic, brick and mortar businesses flocked to companies like Shopify and set up online stores. Shopify in turn extended their free trial from 14 days to 90 days, which let struggling brick and mortar businesses sell online while their stores were shut down, absolutely free.

As a result, Shopify saw the fastest year of growth in terms of Gross Merchant Volume, which is the total dollar value of orders facilitated on the Shopify platform, since it’s IPO back in 2015. Gross merchant volume in the latter half of 2020 more than doubled the same time period in 2019.

Even prior to the COVID-19 pandemic, the company boasted the second highest market share out of all U.S. retail e-commerce sales in 2019, capturing 5.89%.

Although this is miniscule when looking at Amazon’s lofty 36.99%, if we look to the competition it is outpacing, we see giants like eBay, Wal Mart, Apple, Wayfair, Best Buy, and Costco.

Bears point to Shopify’s inability to keep these customers

The primary knock that bears have on Shopify is the fact that the COVID-19 pandemic has temporarily shifted retailer activity, and that brick and mortar businesses who weren’t online prior to the pandemic will simply cancel their Shopify platforms and head back to selling the old fashioned way.

However, not only have first time Shopify customers stuck around even after the height of the lockdowns in early 2020, the company’s decision to extend its 90 day free trial in the third quarter of 2020 has accelerated customer growth even more.

In the third quarter of 2020, Shopify posted a record number of new merchants on the platform despite most pandemic style restrictions being eased, highlighting the fact that this isn’t a buoy for dying businesses, this is a rock solid platform where customers are realizing they can generate more revenue paired with their physical businesses.

Will Shopify be able to maintain its current level of growth?

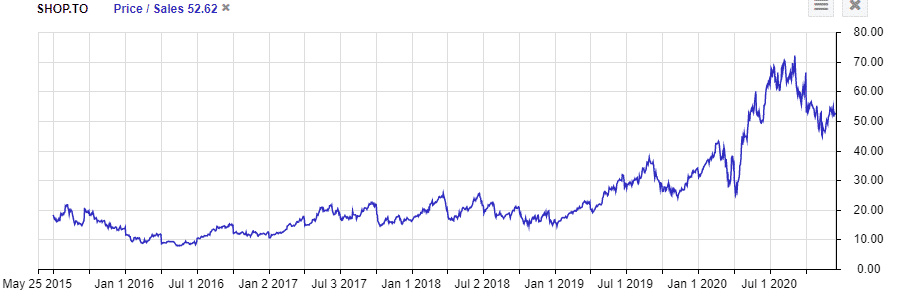

There’s no questioning the fact that Shopify is currently expensive. After all, the company is currently trading at 52 times sales. And if we look to the chart, at its peak the company was trading as high as 71 times sales.

However, considering the company’s rapid pace of revenue growth over the last half decade, paying 50 times sales for a company of this nature isn’t really a high price to ask.

Since its IPO in 2015, Shopify has a compound annual growth rate on revenue of 50.45%, and posted nearly 50% of its total 2019 revenue in the third quarter of 2020 alone.

Yes, the COVID-19 pandemic did accelerate this, but when you couple revenue growth with a 47% compound annual growth rate over the same time period in monthly recurring revenue, a 54.4% CAGR in gross merchandise volume, and a 50.56% CAGR on gross profit, this is a company that is growing nearly every aspect of its business at a near 50% clip annually, not just its top line.

No, the company isn’t profitable. However, investors should be more than comfortable sacrificing profitability to allow this company to continue growing at the pace it has been, especially considering managements track record of execution. One company that we covered that impresses when it comes to management’s ability to meet expectations is Kinross Gold (TSE:K).

Overall, you likely won’t be upset owning Shopify years from now

When looking at the stock price, Shopify seems expensive. Investors often look at the returns it has achieved over the last 5 years and think the stock has simply run it’s course and is destined to fade into mediocrity now.

However, they’re ignoring the true pace that this company is growing at. Is Shopify expensive when compared to a mature Canadian company, or even most growth companies here in Canada? Absolutely.

But valuation ratios tend to be used as absolutes, which is one of the biggest mistakes I see investors make all the time. A company can have a price to earnings of 50 and be more attractive than one that has a single digit P/E.

The company’s premium in terms of stock price is a premium paid because of rapid growth. Rapid growth I think many Canadians would enjoy half a decade from now, even if they purchased at these price levels.

It is a company however to keep an eye on in terms of growth. No matter how fast Shopify has grown revenue in the past, there is no guarantee it will continue to do so in the future.