What Happened to Xebec-Adsorption (Tse:Xbc) and Can It Recover?

Trust. No matter the situation, developing trust is key to success. This applies to personal or professional life and is also applicable to investing.

How does one build trust?

Turning to a recent blog post by Coinbase CEO, Brian Armstrong, he talks about developing trust:

“Companies are often reticent to share negative facts, in their inherent desire to look good, and therefore also have a conflict. To become a source of truth, companies will increasingly need to be comfortable sharing facts which paint them in a negative light as well. There is nothing like sharing mistakes, to build trust.”

This quote can be applied to all facets of life, however it rings especially true for publicly listed companies including Canadian stocks which have that ‘inherent desire to look good’ in the eyes of shareholders.

Companies and management need to develop trust with the markets, and if that trust is broken it can have devastating effects. A recent example of this is Xebec Adsorption (TSX:XBC).

Without going into too many details, the company’s share price cratered on news it was going to miss full-year 2020 guidance in a material way as a result of changes in revenue recognition and contract cancellations.

Misleading investors a huge issue for Xebec Adsorption (TSE:XBC)

In short, the company overstated revenue in previous quarters and it saw a few customer orders go by the wayside. Was this a trend? Were there issues with other contracts? Others in the industry did not record such big cancellations, so was Xebec dealing with inferior clients? It led to more questions than answers.

Translation – trust broken.

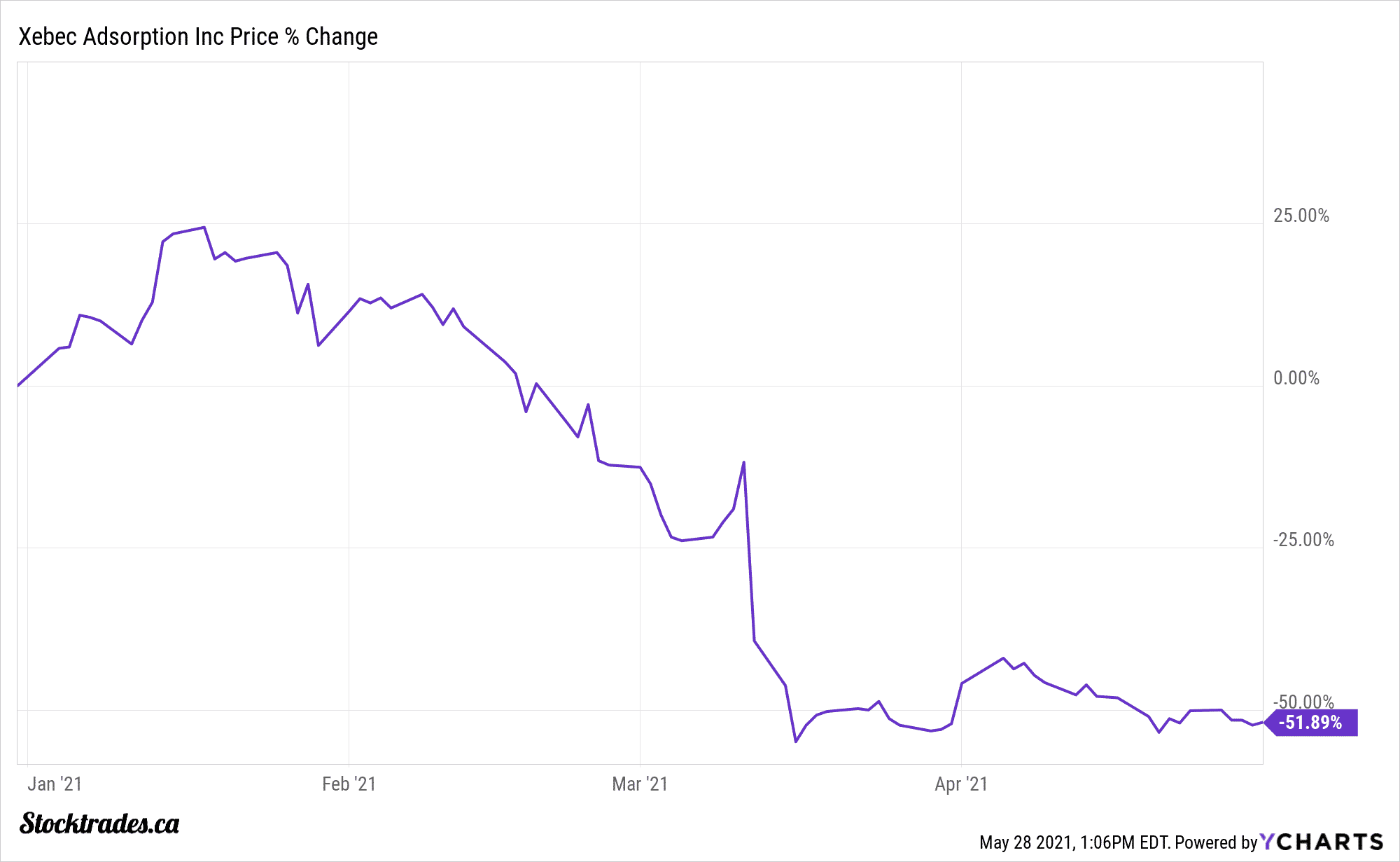

The company had been on a steady downtrend since early February, and the news that came in March caused it to lose ~50% of its value over the days that followed.

Criticism towards the company in its handling of the issue is deserved. In early February, Xebec announced “Changes in Leadership” in which “Dr. Prabhu Rao (was) leaving Xebec in his capacity as Chief Operating Officer effective immediately.”

This follows the departure of the Xebec’s Chief Financial Officer in December.

Looking back, one could see something was brewing with Xebec

did someone know something was up?

In November, the company revised FY 2020 guidance downwards along with quarterly results. The second time it had to revise downwards in 2020, but with COVID-19 impacting operations the markets largely shrugged off the news as one-time events. New guidance still represented strong YoY growth and Xebec continued its march towards all-time highs.

On the same day, it announced a new CFO “effectively immediately” with the former CFO staying on as an advisor role until December. Then came the news that it was acquiring well-respected hydrogen company HyGear.

In my opinion, it was around this time that the company knew there were issues. The new CFO (Mr. Stéphane Archambault), an experienced financial executive with decades of experience working with publicly listed companies such as CAE (TSX:CAE), brought some much needed legitimacy to the role.

On the same day it announce the departure of Dr. Rao in February, Xebec announced that former HyGear CEO (Mr. Marinus Van Driel) was going to “lead Xebec’s global hydrogen operations as the new President for the Global Hydrogen Group, in addition to his role as President for Xebec Europe”.

While it did announce it would add a COO in due course, the appointment of Mr. Van Driel to those roles lessened the need to hasten the search for Dr. Rao’s replacement.

Xebec Adsorption (TSE:XBC) early 2021 price movement

Then the bomb dropped in March and the stock price collapsed. These are events investors cannot plan for, but hindsight being 20/20 the share price really began its material decline after the February executive changes. As is often speculated when these things happen, did someone know something was up?

It is clear that Xebec’s rise to a highly touted publicly traded company was too much for many of the former executives to handle. This is normal but it is the sequence of events and the way in which management changes unfolded that was troubling.

Trust was broken, and the company has a long way to repair its relationship with the market

Xebec is now a “show-me” stock and while it posted strong growth and re-iterated guidance in its first quarter post-issues, it still missed analysts’ estimates. Estimates which are calling for 107% revenue growth in Fiscal 2021.

What is an investor to do? Take it quarter by quarter.

Xebec will have to execute to perfection. The good news, it now has a more seasoned executive team leading the charge, and the issues were unrelated to its products and services – which are still expected to see strong demand.

This is why personally, I have held on to my position. While I am sitting on losses and will be ready to dispose of my position at any moment, I’m willing to be patient with the company as I believe it is still well positioned to benefit from a growing shift to renewables, hydrogen in particular.

This being said, patience will be key as the stock is likely to be highly volatile from here on out. While recent price action has been positive, it remains a speculative play and one that is only for those with a higher risk tolerance.

Don’t miss a Canadian stock to avoid and another to buy this summer.