Canadian Bank Stock Earnings Overview – Are They Buys?

Canada’s bank earnings season is usually highly anticipated by investors. Why? They are considered a bellwether of the Canadian economy. Some are among the most popular Canadian dividend stocks, and as they are some of the most widely held stocks in the county, their quarterly results are highly scrutinized.

Now that second quarterly results have been announced, let’s look back and see which of Canada’s Big Six banks was this quarter’s winner, and which lagged its peers.

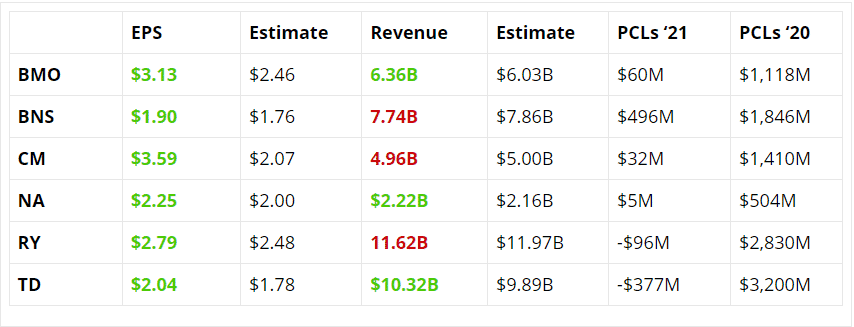

First, let’s start with a quick overview of their performance against estimates and provision for credit losses (PCLs) which have been a big topic of discussion over the past year.

When it comes to PCLs, one thing was clear – the banks have a much higher confidence in Canada’s economic outlook moving forward.

Across the board, banks crushed earnings as PCL’s were revised downward in a big way.

What Canada’s bank stocks did hasn’t happened in quite some time

It’s been a while since all six of Canada’s Big Banks beat on the bottom line. In terms of revenue, only three banks topped estimates; the Bank of Montreal (TSE:BMO), National Bank (TSE:NA), and TD Bank (TSE:TD).

It is worth noting that despite topping estimates, TD Bank’s revenue fell by 2.9% YoY – one of only two to see declining revenue YoY. The other was the Bank of Nova Scotia (TSE:BNS) which saw revenue drop by 3.3% over Q2 of last year.

Notably, both BMO and NA saw double digit growth on the top line. The Bank of Montreal grew revenue by 16% while National Bank grew revenue from $2.03 to $2.2B (10%).

When it comes to PCLs, one thing was clear – the banks have a much higher confidence in Canada’s economic outlook moving forward. For those that are unaware, PCLs are a forward looking metric and “is an estimation of potential losses that a company might experience due to credit risk.” (Investopedia)

At the beginning of the pandemic, the Bank of Nova Scotia stood out as it booked lower PCLs in terms of % change when all the other banks were far more conservative and booked higher PCLs. BNS ended up making up the difference in the following quarter as it was clear they had underestimated the impacts.

This time, the opposite happened. BNS looked to be the most conservative bank, only dropping PCLs by 73% YoY. Criticism was instead pointed at TD Bank, one of only two to book a recovery in PCLs. TD Bank went from booking $3.2B in PCLs last year, to a $377M recovery – by far the biggest swing among all Canada’s banks.

So which Canadian banks stood out?

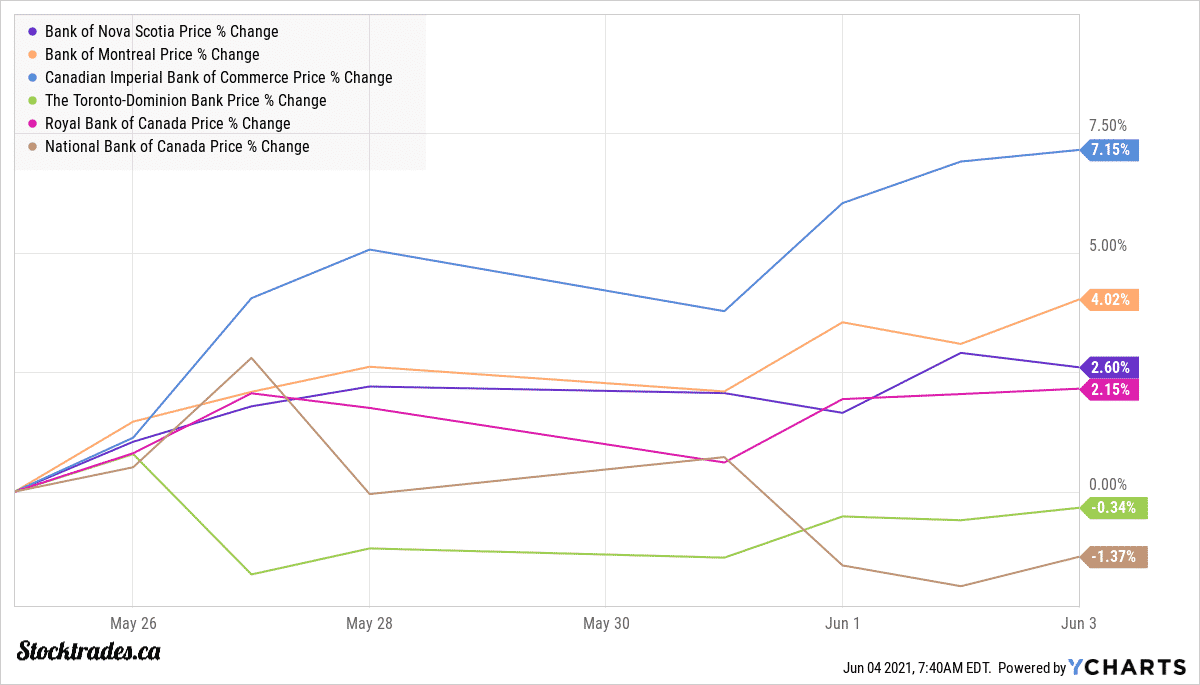

Since banks reported, most are in positive territory but BMO and CIBC (TSE:CM) stand out with gains of 4.02% and 5.96% respectively. On the flip side, TD Bank and National Bank are the only two to be sitting on losses of 1.1% and 4.05% respectively. Of note, the chart below is only reflective of results since the first bank reported (which was BMO).

In my opinion the Bank of Montreal delivered the best results. Strong growth across the board and it also posted strong ROE of 16.7%. As management put it, the company enters the “second half of the year with strong momentum”.

On the flip side, despite gaining just shy of 1% since reporting, the Bank of Nova Scotia continues to trail its peers. Not necessarily because of poor results, but because the international banking (IB) segment weighed on results due to a slower recovery. On the flip side, it could be one to watch as it may result in outperformance moving forward as it benefits from more upside in the second half if the IB segment fully recovers.

Next, have a look at our piece covering the latest for Canadian Dividend All-Stars for the week of June 14.