Canadian Dividend All-Stars – Week of 06 14

Lets have a look at recent happenings for some Canadian dividend stocks. It has been a few weeks since our last update as we entered another seasonal lull for dividend growth announcements.

June is usually not a big dividend growth month, and with the cap on dividend raises imposed on the banks, the past few weeks have come and gone with little to discuss.

While dividend growth isn’t expected to ramp up until later this year, there are a few to watch in the coming weeks.

Before we jump into that, there is plenty to review from our last update. Of note, all figures are in Canadian dollars unless otherwise noted.

Recent dividend updates

In our last update, both Finning International (TSX:FTT) and ONEX Corp (TSX:ONEX) were identified as two All Stars at risk of losing their dividend growth status.

Both companies had kept their dividend steady for 8 consecutive quarters with their last raises coming in Q1 of Fiscal 2019. Unfortunately, both companies stayed the course in Q1 of Fiscal 2021, and it now marks nine consecutive quarters since they last raised dividends.

They are now on the clock and have until the end of the year to raise dividends before losing their growth streaks. The biggest surprise of the two is Finning International which owns an impressive 19-year streak.

Much like competitor Toromont (TSX:TIH) which extended the company’s streak after a prolonged period of dividend stagnation, I am confident that they will come through and keep that streak alive.

I am less confident in ONEX and its 8-year streak.

Upcoming dividend raises, cuts or suspensions

Andrew Peller Ltd (TSX:ADW.A)

Current Streak: 15 years

Current Yield: 2.06%

Earnings: Wednesday, June 16

What can investors expect:

Will they or won’t they? It is a theme that has been prevalent in recent months and one that applies to Andrew Peller (TSX:ADW.A). Much like Finning and ONEX, Andrew Peller is riding a streak of dividend stagnation.

The company has not raised dividends in eight consecutive quarters, the last raise coming along with second quarter results in June of 2019. Prior to that, the company had a pretty steady dividend growth pattern and had consistently raised the dividend along with Q2 results.

Will the company extend its streak to 16 years? I don’t see why not.

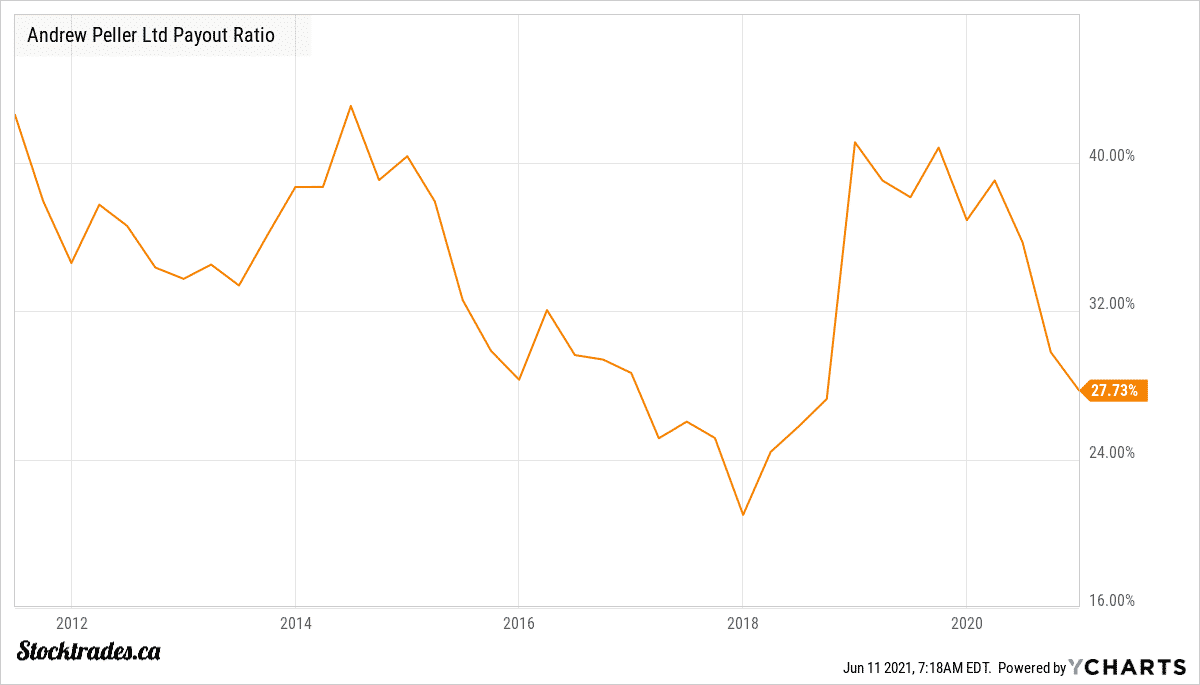

The company has managed to increase revenue and earnings consistently throughout the pandemic. As a result, its payout ratio has decreased from about 40% (which was quite respectable to begin with) down to 27% currently. The company’s cash payout ratio also sits at only 34% of free cash flow.

Prior to the pandemic, Andrew Peller’s annual dividend growth rate typically hovered in the high, single digits. However, the last raise which came in at 13.32% was the highest in the company’s history.

Given the lack of dividend growth last year and improving payout ratios, I see no reason that the company can’t deliver another double digit raise in 2021.

|

EST DGR |

EST Increase |

New Div |

|---|---|---|

|

~15% |

$0.0085 |

$0.065 |

While we are on the topic of dividends, this top Canadian stock could hike its dividend by 30%.