Canadian National Railway (TSX:CNR) Maintains Strong Moat Despite Recent Challenges

Usually, when we talk blue chip Canadian stocks – there is little due diligence required. These are best-of-the-best, market-leading companies with significant moats. However, there are times when even the most stable of stocks enter periods of uncertainty.

Case in point, Canadian National Railway (TSE:CNR) has been in the news pretty much all year. First, the company was battling Canadian Pacific Rail (TSE:CP) in an effort to acquire Kansas City Southern. It was a back-and-forth affair until the feds south of the border cast some doubt on CN Rail’s takeover attempts.

While it was ultimately unsuccessful, CN Rail did benefit from a one-time merger termination fee of $705M ($606M after-taxes).

TCI Fund Management claims Canadian National Railway (TSX:CNR) is off the rails

The company has been under a public attack by its second largest shareholder, TCI Fund Management who believes that management should go. TCI also released a four-point plan in which it details how the company can get itself back on track.

This isn’t the first time TCI has attacked high-profile management teams and it won’t be the last. It is also worth noting that TCI has done so with little success thus far.

Not surprisingly, TCI’s plan came the day before earnings – a strategic move to keep the pressure on CN Rail management.

On October 19, the company reported strong Q3 results and also announced that CEO Jean-Jacques Ruest was retiring. The subject of many TCI attacks, JJ Ruest will be stepping down at the end of January, 2022.

Not to be outdone – TCI released a statement shortly after claiming that Ruest’s departure was “a clear admission by the Board that change is needed” and that their preferred CEO candidate Jim Vena was available and waiting.

That is certainly plenty of action for a boring, stable company.

Canadian National Railway (TSX:CNR) maintains strong moat

The good news? This will all be forgotten over the long-term. None of this changes CN Rail’s moat, and while it may lead to choppy action in the short-term, this is still one of the best defensive stocks to own in the country.

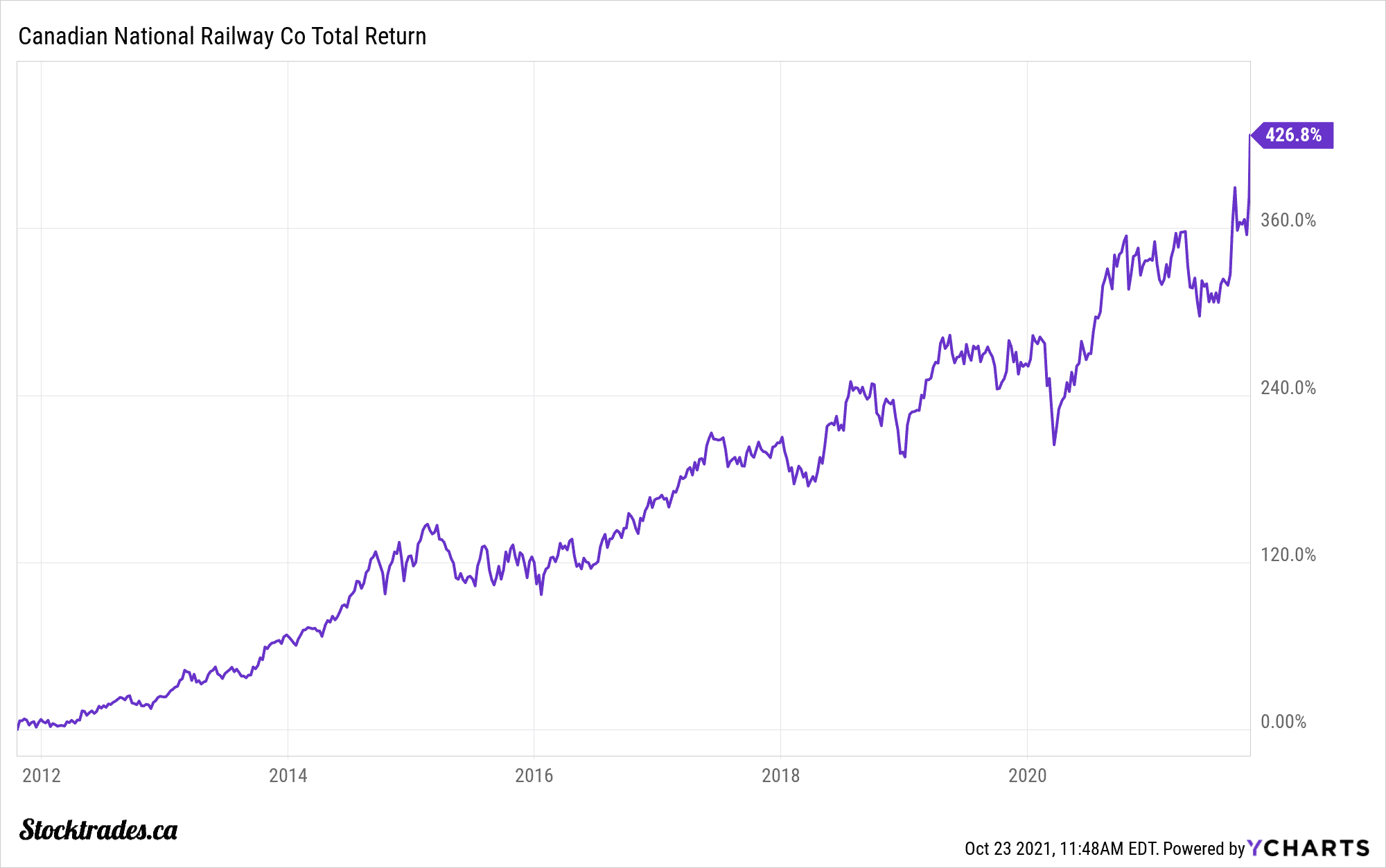

Canadian National Railway (TSX:CNR) 10 year total return

Not to mention, CN Rail posted strong Q3 results in which it beat on the top and bottom lines. Adjusted earnings per share of $1.52 beat by $0.10 and revenue of $3.6 billion beat by $770M. EPS and revenue increased by 10% and 5.3% respectively year over year.

The company’s operating ratio also saw meaningful improvement as it came in at 59%, a 90 basis point improvement. The company’s struggles in this area was a concern for TCI, so improvement in this area is sure to be welcomed.

Looking forward, management re-iterated Fiscal 2021 outlook. They expect to deliver EPS growth of 10% over Fiscal 2021 and revenue ton per mile to increase in the mid, single-digit range. Finally, it is targeting free cash flow of $3.0-$3.3B which is inline with Fiscal 2020.

All in all, the company seems to be in the midst of change. What hasn’t changed? The company continues to deliver and despite all the negative publicity caused by TCI, CN Rail is on the verge of hitting all-time highs. It remains one of the safest stocks to own in the country.

Moving on, in the face of rising interest rates, here are two top Canadian stocks to have a look at.