Canadian Natural Resources Mega Acquisition & Dividend Bump

Key takeaways

- Canadian Natural Resources buys Chevron’s Oilsands Assets

- The company also made a 7% increase to the dividend

- Investor interest remains high due to the stocks cash flow return policy

Canadian Natural Resources stock offers investors exposure to one of North America’s largest independent crude oil and natural gas producers.

The company’s story is one of steady expansion and smart acquisitions. It has grown from a small oil and gas firm to a powerhouse in the Canadian energy landscape.

Canadian Natural Resources has shown a knack for buying assets at opportune times and improving their efficiency. As of Monday, this doesn’t look to be slowing down at any point.

The company announced the acquisition of Chevron’s Oilsands Assets for $6.5 billion.

Is the acquisition beneficial for the company and the stock? Lets dig into it.

Canadian Natural Resources acquires Chevron’s oilsands assets for $6.5 billion

Canadian Natural Resources has made a strategic move by acquiring Chevron’s oilsands assets for $6.5 billion. This deal significantly boosts CNQ’s presence in Alberta’s energy sector.

The acquisition includes:

- 20% stake in Athabasca Oil Sands Project

- 70% interest in Duvernay shale

In my view, this purchase aligns perfectly with CNQ’s long-term growth strategy. It expands their oilsands production capacity and strengthens their position in North America’s energy market.

I expect this deal to create operational synergies for CNQ. By integrating these assets, they can likely reduce costs and optimize production across their expanded portfolio.

The scale of this acquisition could lead to improved margins for CNQ. Larger operations often benefit from economies of scale, potentially lowering per-barrel production costs.

I think this move shows CNQ’s commitment to sustainable energy development in Canada. By taking over these assets, they can apply their expertise to operate them efficiently and responsibly.

This acquisition positions CNQ as an even stronger player in the Canadian oilsands. It demonstrates their confidence in the long-term value of these assets despite current market challenges.

Dividend boost: Quarterly dividend increased by 7.1% amid acquisition

Canadian Natural Resources also announced a 7.1% dividend hike. This boost, raising the quarterly payout to CAD 0.5625 per share, coincides with CNQ’s acquisition of Chevron Canada’s Alberta assets.

This move shows CNQ’s confidence in its cash flow generation.

CNQ’s forward dividend yield now sits at 4.30%. This puts it ahead of many competitors in the energy sector. I find this yield quite attractive for income-focused investors, and its cash flow return policy is really coming to light today.

The company’s free cash flow appears strong enough to support this higher payout plus the acquisition. CNQ expects the newly acquired assets to contribute additional cash flow, further securing the dividend.

The payout ratio remains at around 50% of earnings, which is a comfortable number for me even in a volatile oil and gas sector.

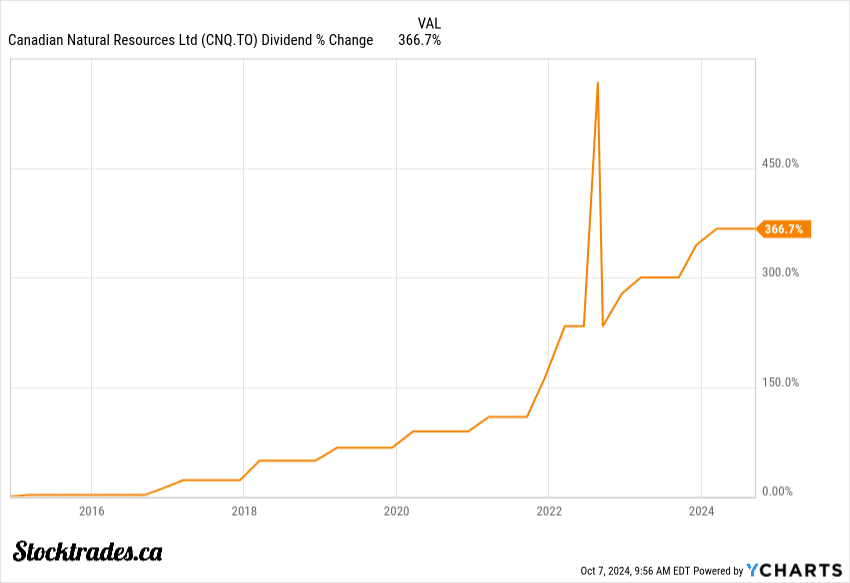

In my view, CNQ’s dividend policy sets it apart from peers. While some companies struggle to maintain payouts during acquisitions, CNQ has raised the bar with 25 consecutive years of growth now.

Strong free cash flow and shareholder returns

Canadian Natural Resources stands out as a top-notch dividend stock in my view. The company’s ability to generate strong free cash flow, which is the lifeblood of shareholder returns, has been known for decades now.

CNQ’s focus on low-cost oil sands production is a key driver of its cash flow strength. These assets have long reserve lives and low decline rates, meaning less ongoing investment is needed to maintain production levels.

The company’s operational efficiency is noteworthy, arguably the most noteworthy in the industry. CNQ has managed to increase production while keeping costs in check. This combination is a recipe for strong free cash flow generation.

Here’s what makes CNQ’s dividend appeal to me:

- 4.3% current yield

- 25 consecutive years of dividend growth

- Around 50% payout ratio

Beyond dividends, CNQ’s shareholder return program includes significant share buybacks. The company aims to return 100% of free cash flow to shareholders when net debt is below $10 billion, which it is now.

It balances reinvestment in core assets, debt reduction, and shareholder returns. This approach should support long-term dividend growth and share price appreciation.

While oil price volatility is always a risk, CNQ’s low-cost structure provides a buffer. The company can generate free cash flow even in challenging market conditions. Case in point, look at the COVID-19 pandemic.

Is Canadian Natural Resources stock a buy?

The company’s recent performance, strategic acquisitions, and dividend growth make a strong case for adding it to one’s portfolio.

CNQ’s growing production forecast of 4-5% for 2025 demonstrates its commitment to expansion despite rocky oil prices. This growth, paired with efficient operations, positions the company to capitalize on favourable market conditions.

CNQ’s low breakeven costs and high reserves are key strengths. These factors contribute to it being the most reliable company in the oil and gas sector.

While oil price volatility remains a concern, CNQ’s diverse asset base and efficient operations help mitigate this risk. The company’s strong balance sheet provides further stability.

Given its growth prospects, solid financials, commitment to shareholder returns, and the likely synergies from the Chevron acquisition, I believe Canadian Natural Resources stock is a buy.