Is Canadian Pacific Kansas City Canada’s Premier Railway Stock?

Canadian Pacific Kansas City has been making waves in the railway industry since its merger earlier this year.

The Canadian Pacific and Kansas City Southern merger created a lucrative railway network spanning Canada, the United States, and Mexico.

This reach offers promising opportunities for cross-border trade and increased efficiency. The merger also brings challenges, such as integrating two large companies and navigating complex regulatory environments across three countries.

Is this railway giant well-positioned to capitalize on its new strengths and be one of the best Canadian stocks to buy moving forward, or are there headwinds that could derail its progress?

Let’s look deeper at what’s driving Canadian Pacific Kansas City’s performance and whether it might be a worthwhile addition.

Key takeaways

- The recent merger has created a unique North American railway network

- Economic factors and integration challenges could impact future performance

- Long-term industry stability could support the company’s growth prospects

Canadian Pacific’s earnings were impressive, despite a rough economy

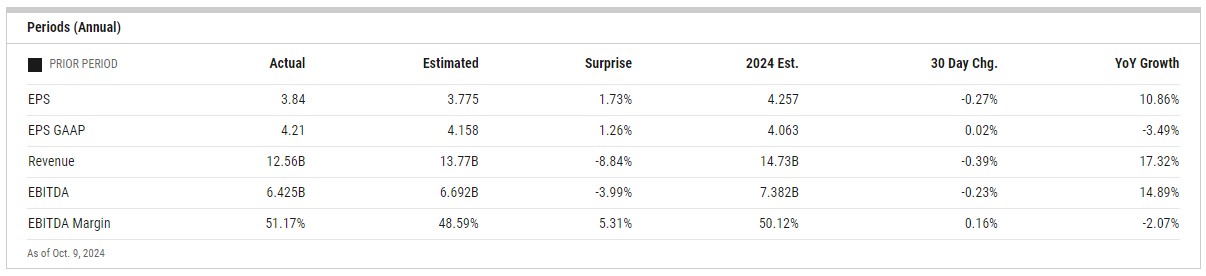

I’m impressed by CPKC’s second-quarter results for 2024. As you can tell by the image, it topped earnings expectations while revenue came in shy. However, I’d view earnings as the more important metric at this point in time.

A key highlight is the improvement in the railways operating ratio. The core adjusted combined OR decreased by 280 basis points to 61.8%. This suggests better operational efficiency, as the lower the ratio, the better.

Looking to earnings per share growth, core adjusted diluted EPS increased by 27% to $1.05. A large chunk of the positive earnings growth will likely be a result of the acquisition.

CPKC’s freight performance appears strong. Volume growth, measured in Revenue Ton-Miles, increased by 6%. This growth likely stems from improved performance in key sectors like grain, energy, and automobiles.

Safety metrics have also improved. The decrease in FRA-reportable train accidents and personal injuries is a positive sign.

Moving forward, I think CPKC will be well-positioned for continued success. Management seems confident in their strategy and ability to meet full-year guidance. The integration of CP and KCS appears to be progressing well, with synergies starting to materialize.

Growth in intermodal shipping a tailwind

I believe Canadian Pacific Kansas City (CPKC) is well-positioned to capitalize on the growing intermodal shipping market.

While many North American railroads have seen increases in intermodal traffic, CPKC’s recent merger presents unique opportunities.

The combination with Kansas City Southern has created the first single-line rail network linking Canada, the U.S., and Mexico. I expect this to drive significant cross-border shipping synergies.

Key benefits:

• Faster transport times

• Reduced border delays

• Simplified logistics

These advantages should make rail more competitive with trucking for many shippers.

Analysts project substantial cost savings from the merger. While estimates vary, many expect annual synergies of $1 billion or more within 3 years. I think these projections are reasonable given the potential for operational efficiencies.

The North-South trade corridor is a major growth opportunity. As near-shoring trends continue, I anticipate increased freight flows between the three countries. CPKC’s expanded network is ideally suited to serve this demand.

Intermodal shipping offers environmental benefits compared to trucking. With growing focus on sustainability, I believe this gives rail an edge for many customers.

While CPKC’s intermodal volumes dipped in early 2024, I view this as temporary. The company’s long-term growth prospects in this segment look promising to me.

Labour costs, fuel costs, and increased competition

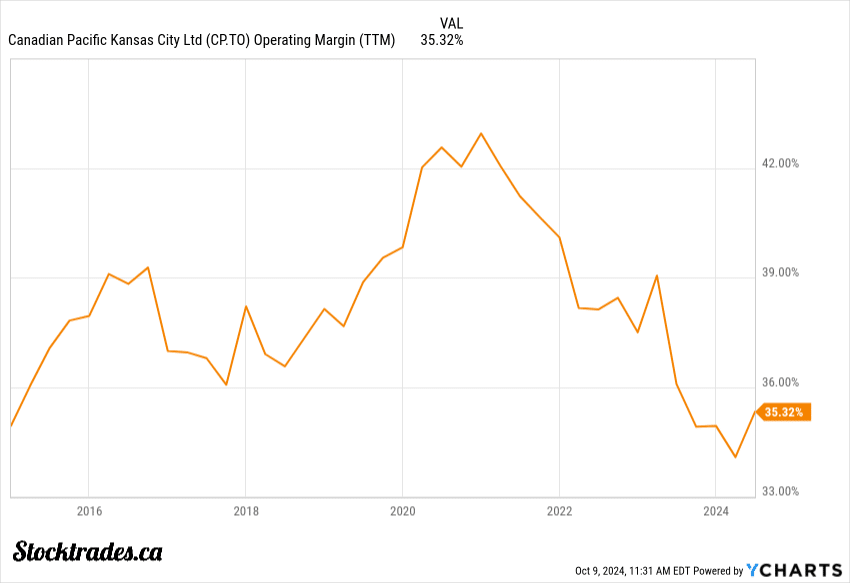

Canadian Pacific Kansas City (CPKC) faces several challenges. Margins have been under scrutiny, and as you can tell, operating margins are nowhere near pandemic levels.

Labour costs are a key concern, with wage inflation pressuring profit margins. I believe CPKC will need to navigate delicate negotiations with unions to balance fair compensation. However, strikes are certainly an element we need to consider as investors.

Fuel costs are another significant factor. With diesel prices fluctuating, CPKC must carefully manage its fuel surcharges to protect profitability. I expect the company to invest in fuel-efficient locomotives and optimize train operations to mitigate this risk.

Competition from trucking companies and other Class I railroads remains fierce. CPKC’s market share in the railroads industry stood at 16.87% in Q2 2024, trailing behind Union Pacific and CSX.

To stay competitive, I think CPKC needs to leverage its unique transnational network and focus on service reliability.

In my opinion, while CPKC faces headwinds, its strategic positioning and cost management efforts make it well-equipped to navigate these industry pressures. The company’s ability to adapt and innovate will be crucial in maintaining its competitive edge in the North American freight market.

CPKC should benefit from decreasing interest rates from debt relief and economic activity

I believe CPKC is poised to gain from the potential decrease in interest rates. As a capital-intensive business, the railway giant’s financial health is closely tied to policy rates.

CPKC’s long-term debt could become less burdensome if rates fall. This might open doors for refinancing, potentially leading to significant savings on interest payments.

The Federal Reserve and Bank of Canada are expected to cut rates even further moving forward. This could be a game-changer for CPKC’s future.

An improved economic environment, spurred by lower rates, could boost freight volumes. More goods moving across North America would likely translate to higher revenues for CPKC.

Here’s how I see CPKC benefiting from lower rates:

- Reduced interest expenses

- Increased ability to invest in infrastructure

- Potential for higher freight volumes

- Improved profitability

Why CPKC won’t be impacted much by trucking

When it comes to freight transportation, safety is a top priority. I believe rail has a clear edge over trucking in this area. The statistics speak for themselves: rail accidents occur far less frequently than truck crashes on our highways.

Rail shines in long-haul freight and hazardous materials transport. The tracks provide a dedicated pathway, reducing the risk of collisions. This is especially crucial for cross-border shipments, where consistency in safety standards is vital.

CPKC has made impressive strides in safety technology. Their investment in Positive Train Control is a game-changer, preventing train-to-train collisions and derailments caused by speed.

The durability of rail infrastructure is another key factor. Tracks and bridges are built to last, with regular maintenance ensuring their longevity. This contrasts sharply with the constant wear and tear on our roads from heavy trucks.

Overall, railway shipping is going to be relevant for a very long time in my opinion, and there is no fear of better technology coming in and taking over the industry.

Am I buying Canadian Pacific Kansas City today?

The rail industry’s future looks bright, especially when we consider its environmental edge. Trains are far more efficient than trucks for moving freight, producing fewer emissions per tonne.

This advantage will likely grow as governments tighten environmental regulations.

CPKC is positioning itself well in this green future. They’ve set ambitious carbon reduction targets and are investing in innovative technologies like hydrogen-powered locomotives. These efforts show a commitment to sustainability that could pay off in the long run.

But is CPKC a buy right now? I’d say yes.

The company’s recent merger creates North America’s first single-line transnational railway. This gives them a unique competitive advantage. Still, there are short-term hurdles. Integrating two large companies takes time and can be costly.

Economic uncertainties could also impact freight volumes in the near term.

If you have a long investment horizon and can stomach some potential short-term volatility, CPKC could be a solid addition to a diversified portfolio. Just be prepared to hold on through any bumps along the tracks.