Canadian Renewable Energy ETFs – Which Are Leading The Pack?

One of the most attractive aspects of investing in exchange traded funds (ETFs) is the ability to get wide-spread exposure to various industries. It enables investors to own a basket of Canadian stocks, which may be quite enticing, especially if it is not clear which companies are the industry leaders.

Investing in industry-focused ETFs is even more attractive when said industry is in its infancy. With companies like Lion Electric (TSE:LEV) hitting the market many investors are beginning to recognize that there is a clear shift towards renewable energy.

However, since we are in the early stages of this shift, it can be difficult to figure out which companies will lead the pack, and more importantly which will be around in 10 years’ time.

Research has shown that there are two predominant factors that help keep funds afloat. The first being the fund manager, and the second being assets under management (AUM).

The larger the fund manager, such as a major financial institution, the more likely the fund is to continue operating. Similarly, the higher the AUM, the better. For the purposes of this piece we ensured the ETFs had minimum assets under management of $50M.

To our surprise, there were only two renewable energy ETFs listed on the TSX

Interestingly enough, both of these ETFs launched in early 2021. The good news is that both have AUM above $50M and are supported by two of the largest fund providers in the country – Harvest and BMO.

The last option for investors looking to get exposure to the renewable energy industry is to invest in a traditional utility ETF. Some of these ETFs have high exposure to renewable energy companies.

This is not all that surprising when one considers the fact that renewable energy companies are continuously taking market share from traditional energy sources. As such, it is becoming increasingly difficult to separate traditional utilities which are investing heavily in renewables from pure play renewable companies.

So what are the best Canadian renewable energy ETFs to buy right now?

- Harvest Clean Energy ETF (TSX:HCLN)

- BMO Clean Energy Index ETF (TSX:ZCLN)

- BMO Equal Weight Utilities ETF (TSX:ZUT)

- iShares S&P/TSX Capped Utilities Index ETF (TSX:XUT)

Harvest Clean Energy ETF (TSX:HCLN)

One of the newest ETFs to launch, the Harvest Clean Energy ETF (TSE:HCLN) invests in a portfolio of the 40 largest Clean Energy Issuers selected from the Clean Energy Investable Universe.

The fund is unique in the sense that it is equally weighted across all 40 positions. That means each position will account for approximately 2.5% of the portfolio. The fund is re-balanced semi-annually which means the 2.5% weighting won’t be perfect as much can happen within a six month timeframe.

This is a low fee fund, with management fees of 0.40%. As of June 30, 2021, HCLN had $66.1M in assets under management.

Today, the top 10 include familiar TSX-listed renewable energy companies such as TransAlta Renewables (TSX:RNW), and Northland Power (TSX:NPI). One surprise addition is Suncor (TSX:SU), one of the biggest oil producers in the country.

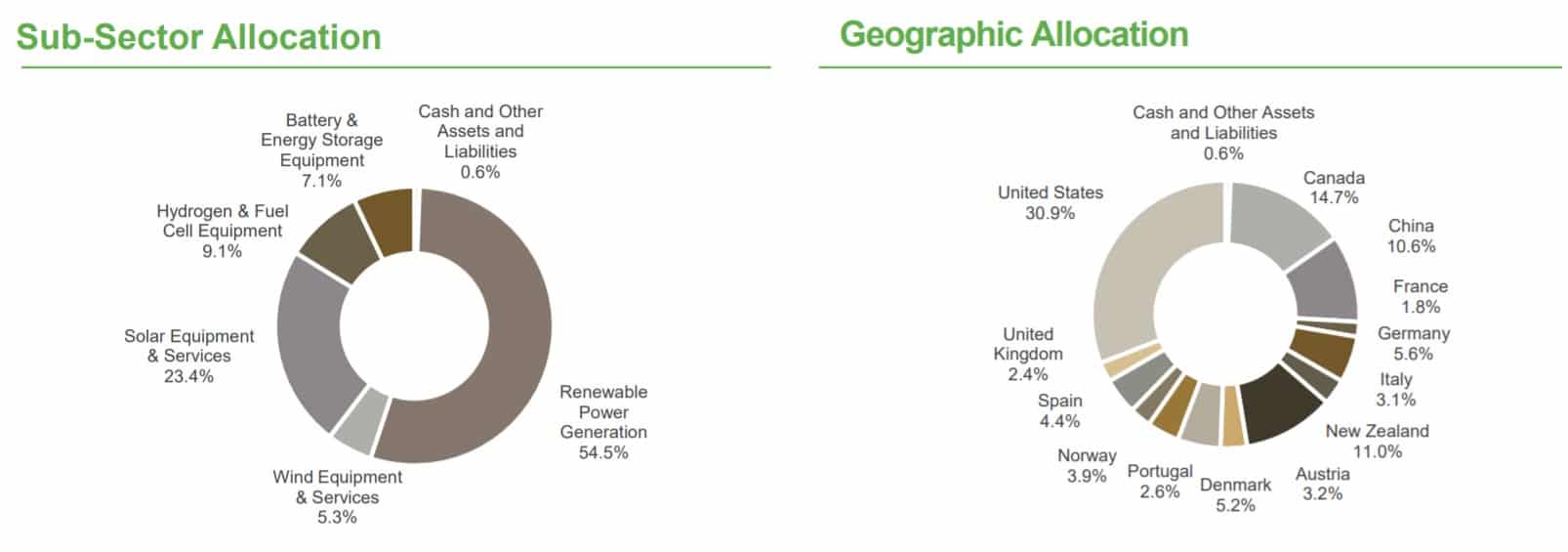

It is a highly diversified portfolio with 14.7% and 30.9% of assets originating from Canada and the U.S., while the rest are spread out worldwide. The fund is also focused on end-to-end renewable energy solutions. This is evident by the fact the ETF also owns assets in the battery & equipment storage, and hydrogen & fuel cell equipment segments.

BMO Clean Energy Index ETF (TSX:ZCLN)

Another new fund, the BMO Clean Energy Index ETF (TSE:ZCLN) was launched on January 20, 2021. The Fund aims to replicate the S&P Global Clean Energy Index. The Index has approximately 100 constituents and is “designed to measure the performance of companies in global clean energy-related businesses from both developed and emerging markets.”

The nice part about index funds is that the fees are typically quite reasonable. The BMO Clean Energy Index is no different, with low MER fees of 0.40%. The fund has $61.42M in AUM and had a net asset value (NAV) of $21.32 per share as of July 22, 2021.

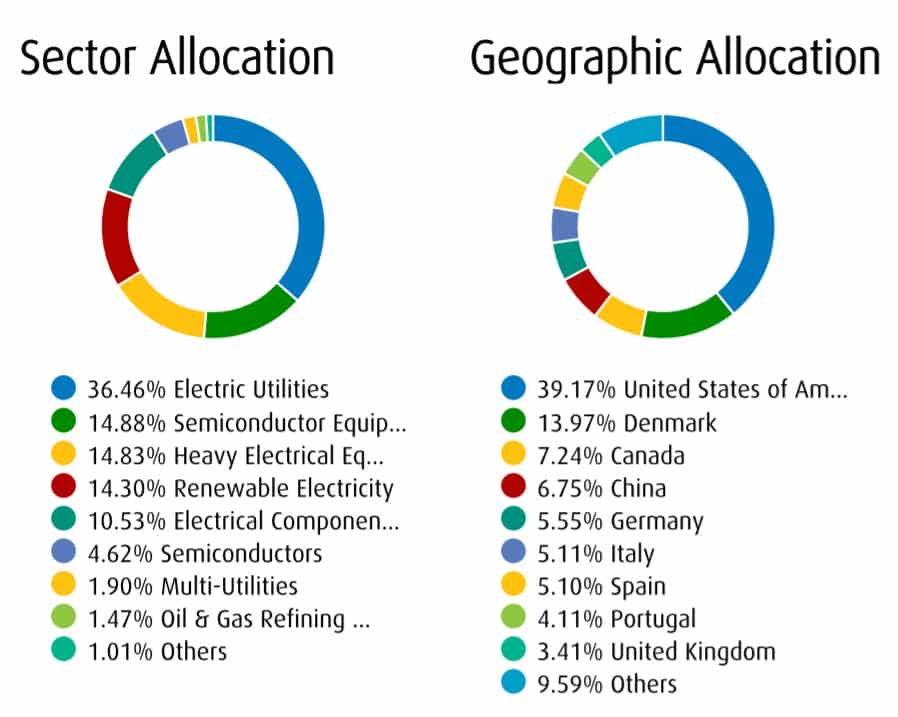

Given the Index has approximately 100 constituents, it is not all that surprising that ZCLN has a highly diversified asset base.

The Top 10 holdings account for approximately 49% of the portfolio. Of note, investors won’t find any TSX-listed companies among the Top 10. The most notable names to North American investors include Plug Power (NASDAQ:PLUG) and Xcel Energy (TSE:XEL).

Representing ~ 8% of holdings, Vestas Wind Systems is the top ZCLN holding. Vestas is a Danish manufacturer, seller, installer, and servicer of wind turbines with manufacturing plants worldwide. The stock is listed on the the Nasdaq Copenhagen, an international marketplace for Danish securities.

This is an excellent fund for those seeking international exposure to renewable energy solutions.

BMO Equal Weight Utilities ETF (TSX:ZUT)

As mentioned, there aren’t too many options for investors looking for a Canadian-listed renewable energy pure-play ETF. That being said, there are some traditional utility ETFs that have high exposure to renewables.

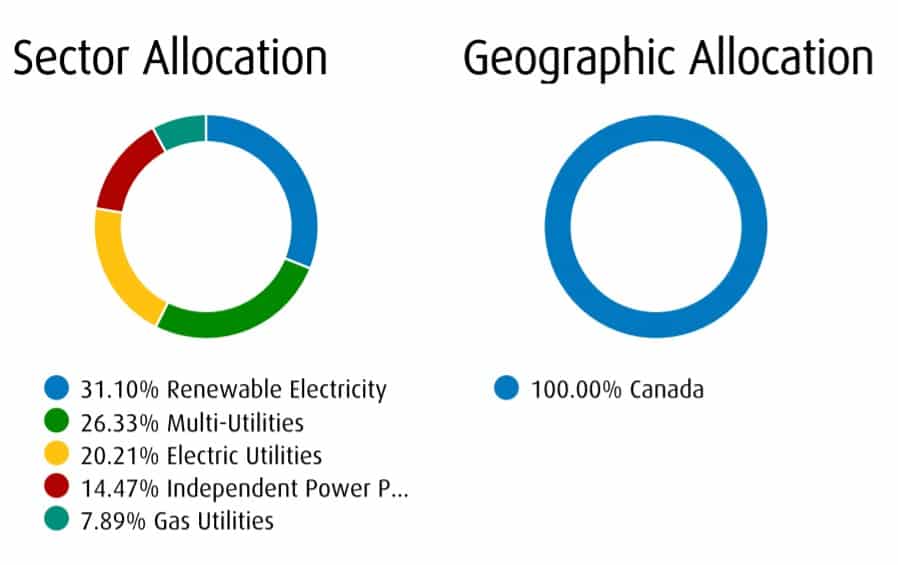

The BMO Equal Weight Utilities ETF (TSE:ZUT) aims to track the Solactive Equal Weight Canada Utilities Index and is also re-balanced semi-annually. Unlike the previous two, this ETF is 100% concentrated in Canada. This does not mean that all the underlying assets are in Canada, but it does mean that all companies held are headquartered in Canada.

Case in point, Brookfield Infrastructure Partners (TSE:BIP.UN, BIPC) is included but is very much an international company. Despite this, there is still a level of geographical and diversification risk.

In total, it has ~31% of assets in the renewable electricity industry.

Notable renewable stocks in the Top 10 include Capital Power (TSE:CPX) and Transalta Renewables (TSE:RNW). More traditional utilities and midstream companies like AltaGas (TSE:ALA), Fortis (TSE:FTS), and Canadian Utilities (TSE:CU) are also featured prominently in the Top 10 which accounts for ~70% of total holdings.

The fund has a MER of 0.61%, AUM of $451M, and a net asset value of $25.56 per share as of July 22, 2021.

iShares S&P/TSX Capped Utilities Index ETF (TSX:XUT)

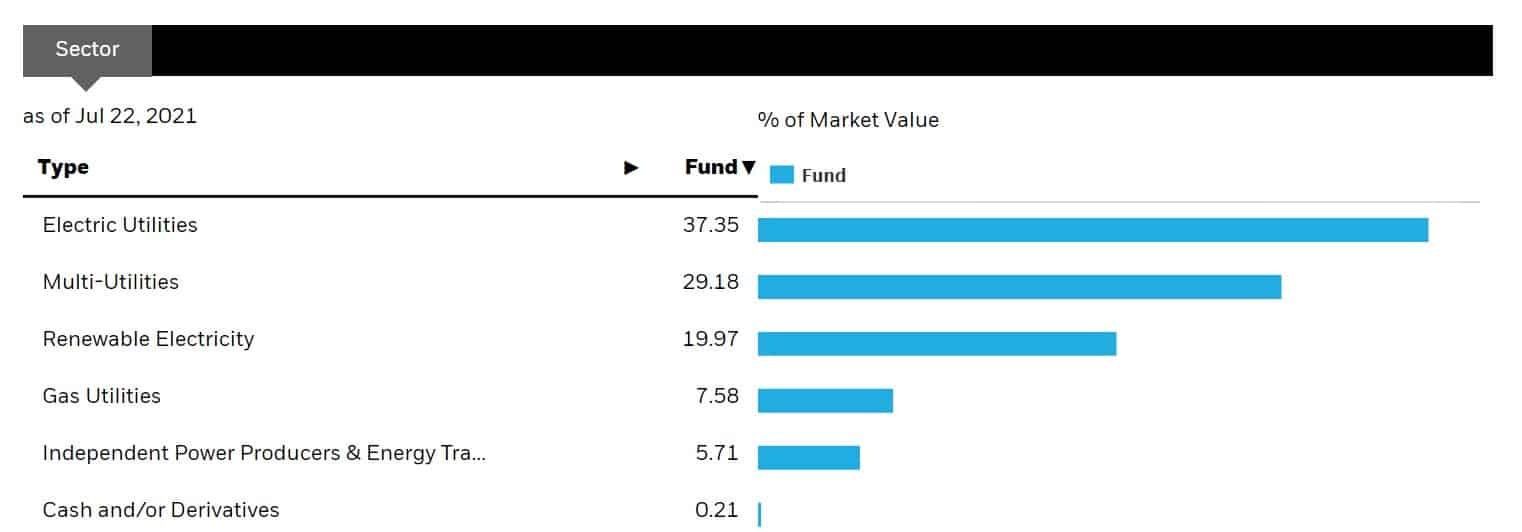

In Canada, an ETF list can’t be fully complete without the inclusion of at least one iShares product. The iShares S&P/TSX Capped Utilities Index ETF (TSE:XUT) seeks to replicate the S&P/TSX Capped Utilities Index.

The fund is rebalanced quarterly, has MER fees of 0.61% and $263M in AUM. Approximately 20% of holdings consist of renewable energy stocks. Since the fund aims to track the S&P/TSX Capped Utility Index, holdings are also entirely concentrated in Canada.

Worth noting, the fund is highly concentrated in its Top 10 holdings which account for approximately 87% of assets. Within the Top 10, you’ll find Brookfield Renewable Partners (TSE:BEPC, BEP.UN), Northland Power (TSE:NPI), CapitalPower (TSX:CPX), and Algonquin Power (TSE:AQN). While BEP and NPI are the only renewable pure plays, AQN and CPX have been investing heavily in renewables.

Fortis (TSX:FTS) is the top holding, which accounts for ~20% of assets. In fact, the Top 3 which also include Brookfield Infrastructure (TSX:BIP, BIP.UN) and Emera (TSE:EMA) account for 45% of assets.

Overall, this is a fund that is highly concentrated. While it may not have significant renewable exposure, one can expect that as renewable energy stocks continue to grow, they will make up a greater percentage of the TSX Utility Index.