Carbon Capture Stocks – Getting Exposure to Carbon Pricing

Carbon Credits. Net Zero. ESG. GHG Emissions. It feels like a new dictionary has made its way into the boardrooms, and more than ever, companies have to go beyond commitments and into action. As the world of carbon has become “financialized,” it now resembles a traditional commodity – albeit one in its infancy. This has the potential to be a lucrative investment in your portfolio over the next few years and one that you can get exposure to in different ways.

In this article, we will talk about the following:

- What are carbon credits, and why do companies care about them

- The supply and demand economics of carbon

- How to get exposure to the price of carbon

“No matter the scenario, corporations and other entities looking to buy carbon credits shouldn’t expect them to be a get-out-of-jail-free card for much longer. As the market matures – which it will – and processes are put in place to make credits resemble a traditional commodity, prices will inevitably rise. Companies will need to prioritize their gross emissions more than ever.”

Kyle Harrison, head of sustainability research at BloombergNEF – source

What are carbon credits, and why do companies care about them

A carbon offset is a transferable instrument certified by governments or independent certification bodies to represent an emission reduction of one metric tonne of CO2 or an equivalent amount of other Green House Gasses (GHGs). They are typically made up of carbon capture projects or avoidance technologies. The purchaser of an offset can “retire” it to claim the underlying reduction towards their own GHG reduction goals.

Companies have started to report and track the amount of carbon they emit yearly. Some of this is because of regulatory reasons, and the other side is that investors and consumers expect it. When they measure their carbon footprint, it typically falls under:

- Scope 1 Emissions are the direct greenhouse gas emissions from company operations.

- Scope 2 Emissions are the indirect greenhouse gas emissions from energy purchased by the company.

- Scope 3 emissions include the indirect emissions (not included in Scope 2) that occur in the company’s value chain (this includes both downstream and upstream emissions).

Scope 1 and Scope 2 emissions are within a company’s direct control. The criteria for identifying and reporting them is well established, transparent, and consistent across industries. Scope 3 is somewhat under-reported at the moment.

When a company reports these emissions, it doesn’t stop there. They usually try to reach a reduction goal, or even “Net-Zero” (0 carbon emissions). There are 2 ways to do this:

- Improve operations (e.g. use cleaner fuels, EV cars, take fewer flights, etc.)

- Purchase carbon credits

Since corporations cannot always hope to reduce their emissions through better operations, they will buy carbon credits to compensate for this shortfall.

The supply and demand economics of carbon credits

Currently, out of 5,230 companies with $1 billion+ valuations publicly listed in North America and Europe – only 457 (8.7%) companies have publicly announced some plan to reduce GHG emissions as of May 25, 2021.

This does not mean that the companies have achieved any reductions, only that they are discussing trying to implement strategies (many of which they have yet to start).

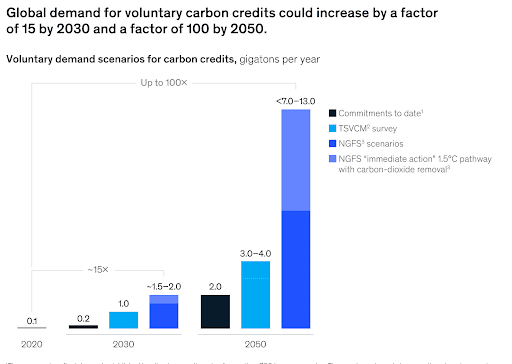

The chart below from Mckinsey shows how this demand will need to scale.

How to hold carbon in your portfolio?

In an ideal world, we could all buy carbon credits, hold them in our portfolio, and resell them when they went up in price. Due to the complexities of the different carbon registries, retirement, and other factors – this is not always possible. Here are some alternative ways.

KraneShares Global Carbon Strategy ETF (NYSE: KRBN)

the KraneShares Global Carbon Strategy ETF (KRBN) is bench-marked to IHS Markit’s Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts.

Horizons Carbon Credits ETF (TSE:CARB)

CARB is Canada’s first exchange-traded fund to provide exposure solely to carbon credits through the ownership of carbon credit futures. CARB’s investment objective is to replicate, to the extent possible and net of expenses, the performance of an index that seeks to provide exposure to investments in cap-and-trade carbon allowance.