Cheap Canadian Dividend Stocks Under $10

Although we’re advocates for avoiding tunnel vision when it comes to share price, there is no doubt an allure for Canadian investors when it comes to buying stocks that are cheap in price.

Now, regardless of whether or not you own a $1 stock or a $100 stock, if they go up 1%, you’ve made 1%, assuming your investment in both stocks is the same.

But, there is a very small case to be made about looking for cheap Canadian dividend stocks, and that is in order to write covered calls and generate even more income over and above the dividend yield, you’ll need to own at minimum 100 shares.

With that being said, I thought I’d speak on a few Canadian dividend stocks that are currently trading at less than a $10 price tag.

There’s no shortage of stocks that pay a dividend under $10 in Canada, but you really have to pay attention to quality. Because as we’ve all witnessed with the COVID-19 pandemic, a dividend cut has drastic consequences.

3 Canadian dividend stocks under $10 to scoop up today

B2Gold – TSX:BTO

B2Gold is a mid size gold producer that has operations in 5 primary jurisdictions. Mali, the Philippines, Nicaragua, Burkina Faso and Namibia.

Now, those aren’t exactly “safe” jurisdictions, and most Canadian investors who are looking for mining plays try to zone in on North American producers.

However, you’d be making a mistake overlooking this company.

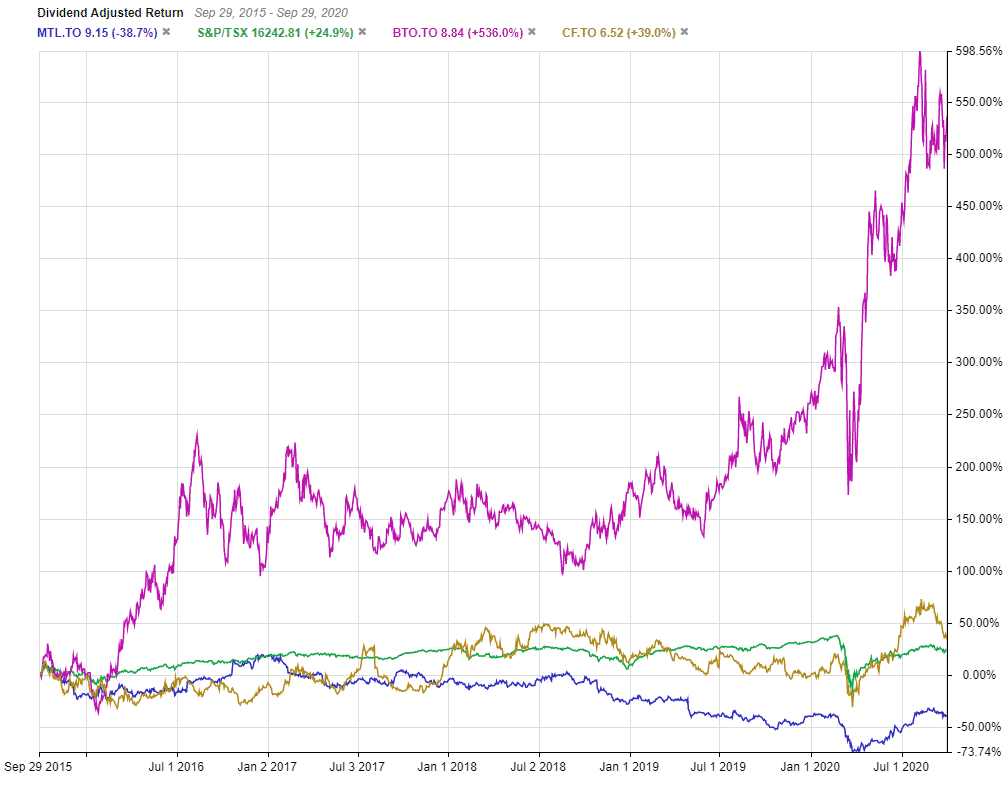

B2Gold has proven to be quite the company over the last half decade, posting dividend adjusted returns of 536%, far outweighing the TSX Index’s returns of just 24.9% over the same timeframe.

And the most important thing about this cheap dividend stock? Not only is its share price cheap, but its trading well below industry averages. With a forward price to earnings of only 16 and a price to free cash flow of 14.9, it’s well below the gold sector averages of 30.4 and 32.2 respectively.

And, not only is this Canadian dividend stock trading under $10, but its also increasing its dividend at a rapid pace. B2Gold has raised dividends twice already in 2020, and the company expects cash flows to be plentiful as commodity prices continue to rise. Speaking of which, how does a sub 10% dividend payout ratio sound?

Trading in the mid $8 range, it would only cost an investor $850 to buy a round lot of this cheap dividend stock.

Mullen Group – TSX:MTL

Stocktrades Premium investors made out quite well when we highlighted TFI International (TSX:TFII), another trucking and logistics company during the height of the pandemic.

At the time of writing, shares have since doubled in a short amount of time and investors who spotted these stocks made out like bandits, primarily because the selloffs were way overdone.

Mullen is a trucking and logistics company that services the oil and gas sectors in both Canada and the United States. The company offers a wide variety of products, including truckload and less-than-truckload freight. What most people don’t know is the company also provides things like drilling and well-servicing.

Now, is Mullen another TFII? Probably not.

In my opinion, the company has too much exposure to the oil and gas sector, and as such has underperformed the index significantly over the past half decade.

But, if you’re old enough to remember Mullen in the oil boom, it skyrocketed during high commodity prices. At one point it was nearly tripling the overall returns of the index.

At the time of writing the stock is down 0.3% year to date, and I see a potential double digit margin of safety with the stocks current price of $9.

The company did suspend its dividend for 3 months due to the COVID-19 pandemic, but in late July they started paying again at a $0.02 a month rate. This equates to a $0.24 annual dividend, or a 2.65% yield.

This is a cut from the company’s prior dividend, however I think it’s important we understand that economic conditions are unlike anything we’ve ever seen in 2020. I’m willing to give the company a pass, and actually applaud this cheap dividend stock for reinstating, especially considering its position in the oil and gas sector.

Canaccord Genuity Group – TSX:CF

A cheap dividend stock list wouldn’t be the same without a cheap financial stock. And, the only thing the COVID-19 pandemic has done has made financial stocks even cheaper.

Canaccord is a full-service financial service firm which focuses on both wealth management and the capital markets. The company provides services to individual, commercial and even institutional clients.

The company has also had an impressive growth record, growing revenue by 8.5% annually over the last 5 years and earnings in the mid 40% range. There’s not too many companies in the financial sector that can keep up with those rates.

Which leads me to my next point, which is how surprised I am with how cheap the stock is. With a forward price to earnings of 9.5, price to sales of 0.7 and price to book of 0.9, Cannacord is valued well below the financial sector averages of 13.1, 2.1 and 1.2 respectively.

Over the last 5 years, Canaccord has outperformed the TSX Index by nearly 13% and at the time of writing the stock is actually in deep oversold territory.

The company has paid out $0.12 in dividends this year, which is a far cry from the $0.22 paid out in 2019. However, $0.12 of that $0.22 came via a special dividend. So, it will be interesting to see if the company can issue one of these in a global pandemic to match its prior year payout.

Overall, cheap dividend stocks exist, but don’t chase them

While its true that share price is not representative of the company behind the stock, stocks that pay reliable and safe dividends are typically over and above the $10 range.

Case in point? Only two dividend stocks under $10 are Canadian Dividend Aristocrats. Magellan Aerospace (TSX:MAL) and Stingray Group (TSX:RAY.A).

When looking for quality dividend paying companies, it’s best to ignore share price, and also be cautious of incredibly high yield dividend stocks.

One $100 stock or ten $10 stocks yielding 5% equals a $5 annual dividend, no matter how you slice it.