CIBC Investors Edge Fees and Review

CIBC Investors Edge Review

CIBC Investors Edge is a leading Canadian brokerage, one that offers low commissions to go with the top notch security of a major Canadian Bank.

The company has a bit to go in terms of extra features and its overall platform on both desktop and mobile, but this is an excellent platform suited for those with a long term investing mentality.

Overall Rating: 3.5/5 stars

Accounts

commissions

customer service

security

platform

extras

If you’re wondering how to buy stocks, or looking to get started buying stocks, you’ll first need to open up a brokerage account.

I’m willing to bet that’s exactly why you have come to this CIBC Investors Edge review. Either that, or you’re with another discount brokerage and looking to make a swap.

In Canada, there are a plethora of online brokerages with different commission structures, various platforms, and specific types of accounts you can open.

In my opinion, the number one mistake investors make when choosing an online brokerage is getting tunnel vision when it comes to a particular factor, and that is commissions.

In this CIBC Investors Edge review, I’m not only going to sum up what the commissions and fees are, but we will go much more in depth in terms of account types, customer service, security, platform interface, and more.

So, lets get started with a little introduction on what CIBC Investors Edge actually is.

What is CIBC Investors Edge?

If you’re wondering why all the major banks tend to have separate brokerage names, that is because they are required by law to do so.

If you’re with Royal Bank, you must sign up for RBC Direct Investing. If you’re with TD Bank, TD Direct Investing. If you’re with Scotiabank, Scotia Itrade.

This is exactly why CIBC Investors Edge is part of a subsidiary owned by the Canadian Imperial Bank of Commerce, and it is where Canadians can buy and sell stocks, mutual funds, bonds, exchange traded funds, and more.

Canadian Imperial Bank of Commerce is Canada’s 5th largest bank by market cap, and the company is the end result of a large merger that occurred in 1961 between the Imperial Bank and the Canadian Commerce Bank.

CIBC Investors Edge account types

As per the company’s website, you can open practically any major account at CIBC Investors Edge, including the following registered accounts:

- TFSA

- RRSP

- RESP

The following locked-in accounts:

- Registered Retirement Income Fund (RRIF)

- Locked-In RSP (LRSP)

- Prescribed Retirement Income Fund (PRIF)

- Locked-In Retirement Account (LIRA)

- Locked-In Retirement Income Fund (LRIF)

The following non-registered accounts:

- Individual, Joint, or Corporate Cash Account

- Margin Account

And the following Non-personal accounts:

- Corporate or Partnership

- Investment Club

- Formal Trust

- Estate

There likely isn’t going to be an account that you want to open that won’t be found at CIBC Directors Edge.

Overall though, this isn’t something that sets CIBC Directors Edge apart from the rest. In fact, many other brokerages like RBC Direct Investing, Qtrade, Questrade among others offer these exact account options.

CIBC Investors Edge commissions

Remember when I said that most investors when choosing a brokerage get tunnel vision when it comes to commissions and trading fees? Well, it is a crucial factor so we’re going to go over it.

Fortunately, CIBC Investors Edge has some of the best commissions and trading fees on the Canadian markets when it comes to not only the major Canadian banks, but discount brokerages as well. They’ve got some of the best commissions in the business, hands down.

CIBC Investors Edge Commissions

| Equity and ETFs | $6.95 per trade |

| Student Pricing | $5.95 per trade |

| Active Trader Pricing | $4.95 per trade (enrolled clients only) |

| Options Trades | $6.95 + $1.25 per contract |

| Options Student Pricing | $5.95 + $1.25 per contract |

| Options Active Trader Pricing | $4.95 + $1.25 per contract |

| Mutual Funds | $0 |

| Fixed Income & Money Markets | Included in the price/yield |

CIBC Investors Edge account fees & margin rates

Annual account fees can eat away at investment returns and make a low commission platform actually cost you more. So, lets have a look at CIBC Investors Edge annual fees.

CIBC Investors Edge Annual Account Fees

| TFSA | $0 |

| RESP | $0 |

| RRSP,RRIF,LIRA,LIF | |

| Account balance of > $25,000 | $0 |

| Account balance of < $25,000 | $100 |

| Student Pricing (All Accounts) | $0 |

| Non Registered Accounts | |

| Account balance of > $10,000 | $0 |

| Account balance of < $10,000 | $100 |

And finally, we end with margin rates, in which CIBC Investors Edge charges 4% for CAD and 5% for USD.

CIBC Investors Edge security

Lots of investors these days trust the security of a big bank over a discount brokerage. And, that’s completely fair.

With CIBC being one of the largest banks in the country, the company’s security when it comes to your capital is of utmost importance.

The company has two factor authentication, which is something I view to be an absolute necessity in todays environment, and it is also part of the CIPF or Canadian Investor Protection Fund.

What this means is that in the event of insolvency, CIPF will cover your investments up to $1 million.

CIBC Investors Edge Customer Service

As new investors flood the markets recently, online brokerage customer service continues to struggle.

CIBC Investors Edge is no different. The company leaves you with a plethora of online questions via their FAQ, but it states that response times can be as long as 10 business days.

This means you could be waiting upwards of two weeks for a response to an inquiry via e-mail.

The company does have a live chat feature to logged in users, but as with most major brokerages, queues are extensive, and wait times are long.

I expect the customer service aspect of CIBC Investors Edge to improve as we move through the years post pandemic, as it will be able to add more personnel to accompany for the large surge in retail investor interest.

So for this one, I’d just stress patience.

CIBC Investors Edge trading platform and useful tools

CIBC’s platforms and tools are relatively straight forward and useful for the self-directed investor, but likely won’t appeal to an active trader.

To me, this isn’t a huge ordeal as I do believe the path to long standing wealth is through investing, not trading, but I am aware that many investors like to dabble in swing trading, or day trading.

For this, I truly do believe that Questrade’s IQ Edge is the best platform on the market today. Speaking of which, if you use the code Stocktrades50 or click here, you’ll be given $50 free when signing up with Questrade.

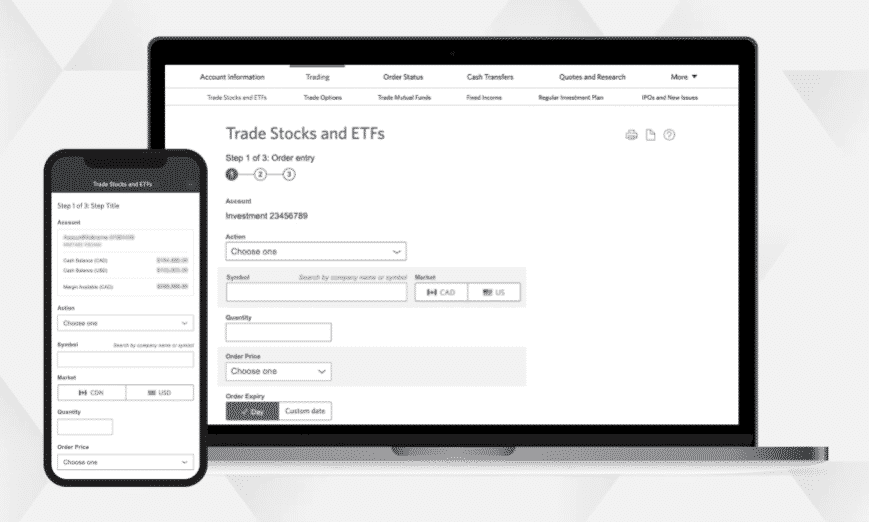

Back to CIBC. Both the desktop and mobile platforms have had a recent overhaul, and I actually like what they’ve done.

Everything is navigated easily with some user-friendly interface via their menu options, and stocks are easily quoted and charted with a few clicks of a button.

They have a mutual fund, ETF, and stock center that allow you to narrow down your focus and make better selections.

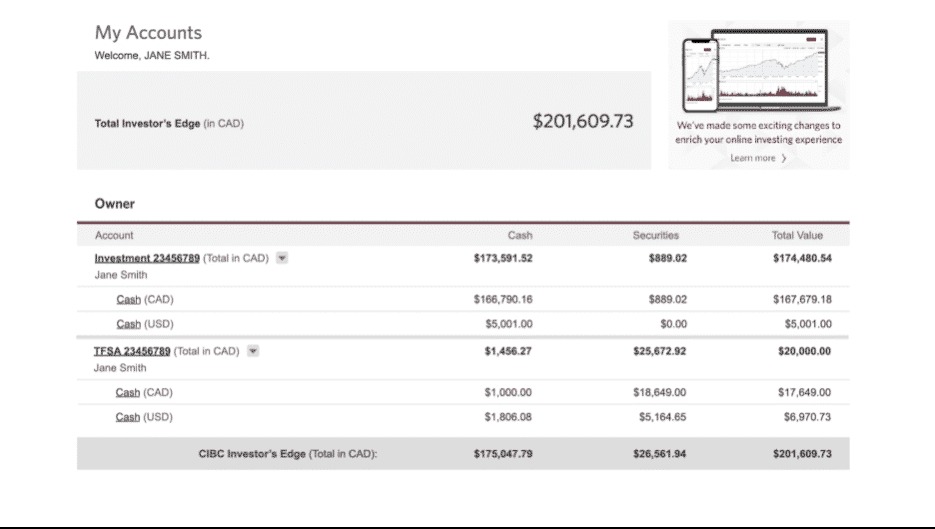

The ability to navigate current holdings, account balances, and tax slips is seamless.

However, be aware that CIBC Investors Edge does not currently offer a desktop platform, like Questrade does. This may be a deal breaker for some, as lots of investors like the ability to have an app, and not have to navigate somewhat clunky browser interfaces.

Nonetheless, if you’re not looking to become an active trader and make quick moves off charting patterns and technicals and instead just want to buy and hold stocks, the platform is perfect.