Has CIBC Turned a Corner, Or Is Its Performance Temporary?

CIBC is one of Canada’s largest banks, and has also been a bank stock I’ve watched struggle for quite some time.

That all changed in 2024, however, as the company has witnessed a significant turnaround in its operations.

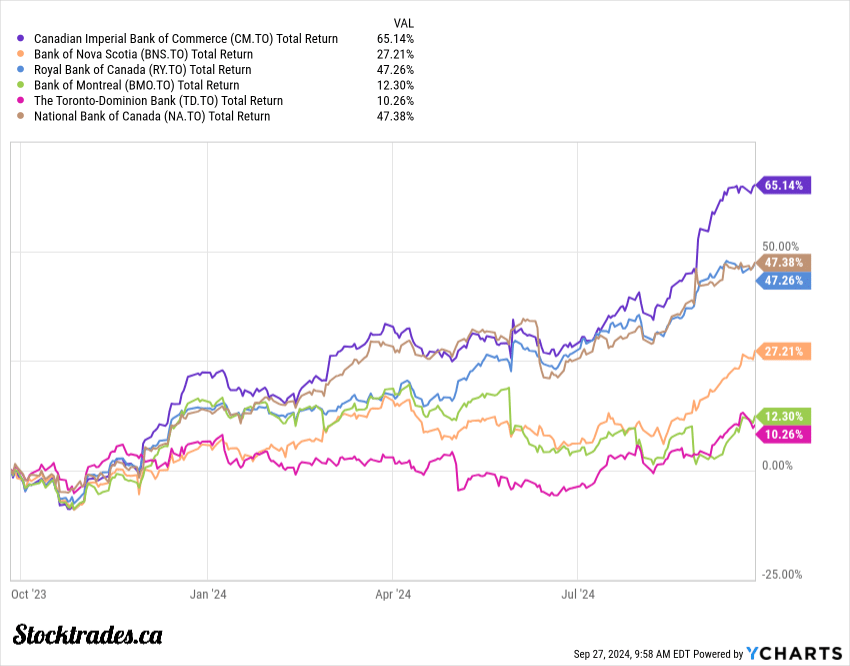

CIBC’s stock price has seen some impressive gains recently, making it one of the best-performing banks in the country.

This surge is largely due to lower provisions for credit losses, which has boosted the bank’s bottom line. In addition to this CIBC, along with other banks heavily exposed to the Canadian market, are thriving in the current economic climate.

On the contrary, many banks with heavy US exposure are struggling, like Toronto Dominion and Bank of Montreal.

But the big question on my mind is: can this momentum last? The resilience of Canadian consumers has been a key factor in CIBC’s success, but economic conditions can change quickly.

Lets dig into my thoughts.

Key Takeaways

- CIBC’s stock has outperformed many of its peers recently

- Lower provisions for credit losses and a strong Canadian market have driven CIBC’s strong financial results

- The bank’s future performance hinges on continued Canadian consumer strength

Q3 Results – One of the best performing banks in the country

I will admit, I’m thoroughly impressed with CIBC’s third quarter results. The bank has shown remarkable growth, particularly after a tough 2023.

Here’s a quick breakdown of some key metrics:

• Revenue of $6.6B (up 13%)

• Adjusted Diluted EPS: $1.93 (up 27%)

• CET1 Ratio: 13.3% (up from 13.1% last quarter)

What really caught my eye is the bank’s net income. CIBC reported a 25% year-over-year increase, reaching $1.79B. This sharp increase is, as mentioned, from a steep decline in year over year provisions.

The Canadian Personal and Business Banking segment was a standout performer. Its net income jumped by 26% compared to last year. Many investors, including myself, are a bit thrown back by how strong Canadian lending has been.

These numbers paint a picture of a bank that’s firing on all cylinders. However, we aren’t out of the woods yet here in Canada. rising unemployment, a slowing economy, and an increase in lending could be signs of overall weakness. And with its heavy Canadian exposure, it is likely to be impacted the most if the economy turns sour quickly.

CIBC’s performance is primarily fueled by lower provisions

The bank’s profits are soaring, and it’s mainly because they don’t need to set aside as much money for potential loan losses.

CIBC was the only major bank to report a decline in year over year provisions for credit losses. What this is looking like is the bank went a bit overboard in 2023, and has now realized this in 2024 and has the ability to scale them back, which is ultimately boosting earnings.

The bank is also benefiting from a more stable economic outlook, which means they don’t need to stash away as much cash for potential bad loans.

I think this trend could continue if the economy doesn’t get any weaker. It was pretty clear CIBC was betting on it being worse.

However, it’s worth noting that this boost might not last forever. Once provisions stabilize, CIBC will need to find other ways to grow its profits.

In my opinion, while CIBC’s stock looks attractive now, investors should be cautious. The current performance is partly due to temporary factors, and future growth might be harder to achieve. This has been a bank that has perennially underperformed.

Banks with heavy Canadian exposure thriving

I’ve noticed a trend in the Canadian banking sector lately. Banks with more exposure to the Canadian market are doing better than their peers with international ventures.

Royal Bank, National Bank, and CIBC are leading the pack. These banks are heavily focused on their home turf, and it’s paying off big time.

Why are they doing so well? I think it’s because the Bank of Canada cut interest rates before the US Federal Reserve. This move has boosted borrowing in Canada, giving these banks a leg up.

It’s not all smooth sailing, though. The housing market could be a double-edged sword. If it stays strong, these banks will keep thriving. But if it stumbles, they might face some challenges.

I’m keeping a close eye on mortgage renewals too. As pandemic-era mortgages come up for renewal at higher rates, these banks could face additional pressures. CIBC is more exposed to this than any other bank, with over 50%+ of their loan portfolio in mortgages.

In my view, the Canadian-focused strategy is working wonders right now. But will it last? Only time will tell.

Will the resilience of the Canadian consumer continue?

Canadian consumers have shown remarkable strength in the face of economic challenges. Yet, I can’t help but feel we’re not out of the woods yet.

One major concern is the looming mortgage renewals. Many homeowners will face higher rates, potentially straining their budgets. This could lead to a significant shift in consumer behavior.

Yes, the Bank of Canada is dropping rates. But they’re still nowhere near pandemic level rates where many consumers locked in fixed rate mortgages that are now coming due.

I’ve also noticed that lending is on the rise. While this might seem positive, it could be a red flag. It might indicate that more businesses and consumers are under financial stress.

In my view, the next few quarters will be crucial in determining if Canadian consumers can maintain their resilience.

With CIBC’s runup, would I be buying?

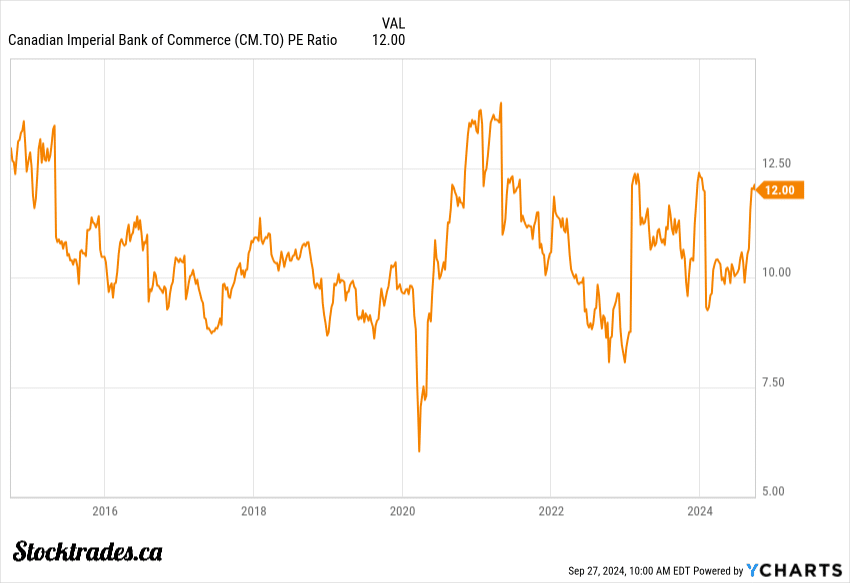

I’ve never been a big fan of CIBC, to be honest. While I can’t deny the bank has had an outstanding year, I’m still hesitant to jump on board. Valuations are now quite high for an institution with a heavy focus on the Canadian economy and a history of lagging earnings growth.

The bank boasts a tempting 6% dividend yield, which might catch the eye of income-focused investors. However, it has been a bank that has underperformed for a very long time, and I’m not convinced its turned the corner after a single year, a year that has largely been driven by provisions.

I prefer to invest in what I consider higher-quality Canadian institutions. Royal Bank and National Bank, for instance, have always seemed more solid to me, and they are the two banks I own.

CIBC’s heavy focus on the domestic market makes me a bit nervous, even though it’s working out for them now. The looming mortgage resets in 2025 could put pressure on consumers and, by extension, the bank.

So, would I buy CIBC stock right now? Probably not.