CIBC (TSE:CM) Dividend and Stock Analysis

One of the primary questions investors, particularly those looking for Canadian dividend stocks, are asking right now is if Canadian banks are still worth the investment.

After all, we’re going through one of the quickest, and harshest hits to the economy we’ve ever witnessed. It makes sense for Canadian investors to be taking a cautious approach when it comes to financials.

However, as we’ve seen from Canada’s Big 5 and insurance companies, except for The Bank of Nova Scotia, results have been way better than expected. And if you’re looking to buy stocks in Canada, the banking sector might be a golden opportunity.

As a result, there’s potential for a steady, reliable dividend paying stock like Canadian Imperial Bank of Commerce (TSE:CM) to be bought on the cheap.

So, how safe is CIBC’s dividend, and what can we expect moving forward from the financial giant? Lets take a look.

CIBC dividend and stock analysis

The Canadian Imperial Bank of Commerce is Canada’s 5th largest bank by market cap. However, make no mistake about it, this is still a very large company. With a market cap of just over $44 billion, it’s still one of the largest publicly traded companies on the Toronto Stock Exchange.

CIBC operates in three primary business segments, retail and business banking, wealth management and capital markets. The vast majority of its 11 million personal and business customers reside right here in Canada, and as a result CIBC has some of the highest exposure to the Canadian economy out of the Big 5 banks.

The company’s history spans more than 150 years and ultimately stemmed from the merger of two major financial institutions in the early 1960’s, Imperial Bank of Canada and Canadian Bank of Commerce.

CIBC dividend summary

The vast majority of investors buy CIBC for its dividend. And, for the longest time it was the highest yielding major bank stock in the country.

However, due to the Bank of Nova Scotia’s hardships recently and subsequent price drop, CIBC has lost this title.

That doesn’t mean CIBC has a poor dividend however. The company still yields 5.8% at the time of writing and a single CIBC stock pays an annual dividend of $5.80 per share.

The company does hold a 10 year dividend growth streak, effectively starting its dividend streak over again after the 2008 financial crisis.

The key thing to take from this however, is that the company did maintain its dividend throughout this crisis, as did the other major Canadian financial institutions.

Unfortunately, we can expect this dividend growth streak to come to an end in 2020, as the Government of Canada has essentially taken away the ability for Canada’s major financial institutions to raise dividends during the COVID-19 pandemic.

Most investors will view this as a negative event, however it’s imperative we understand this was done in the best interests of both current CIBC shareholders, and CIBC customers.

Stalled dividend growth will allow CIBC to preserve liquidity and survive this crisis with a maintained and high yielding dividend.

CIBC dividend growth rates and payout ratios

When it comes to dividend growth, CIBC has actually been the laggard out of the six major banks here in Canada (the Big 5 and National Bank.)

The company has a 5 year annual dividend growth rate of 7.20%, but its most recent increase of 5.60% in 2019 falls well below its 5 year averages.

Shrinking dividend growth is never something we want to see with a top dividend stock, and this is actually the second consecutive year the company has failed to hit 7% or more in annual dividend growth.

It’s fairly safe to say that 2020 will be the third consecutive year.

Now, there’s no doubt a bank stock like Toronto-Dominion Bank (TSX:TD) provides a stronger option in terms of dividend growth stocks. But what we give up in dividend growth with CIBC stock, we gain in dividend yield.

Sure, CIBC’s dividend is growing at a lesser clip, but it provides a significantly higher yield.

In terms of payout ratios, the company is currently paying out just over 67% of earnings towards the dividend. This is actually the highest payout ratio when it comes to Canada’s 6 biggest banks. However, it’s still well within what I’d deem a healthy range.

Typically when I analyze a dividend stock, I always tend to pay attention to the free and operating cash flow payout ratios.

These are simply the company’s dividend as a percentage of free/operating cash flows. However with banks, considering they run on negative operating cash flows due to a ton of cash-outflows (think of money loans), these ratios aren’t really relevant.

Overall, although anything is possible, I don’t really see a dividend cut coming from CIBC in the near future. Just don’t expect strong dividend growth either due to the headwinds presented by COVID-19.

CIBC stock valuation

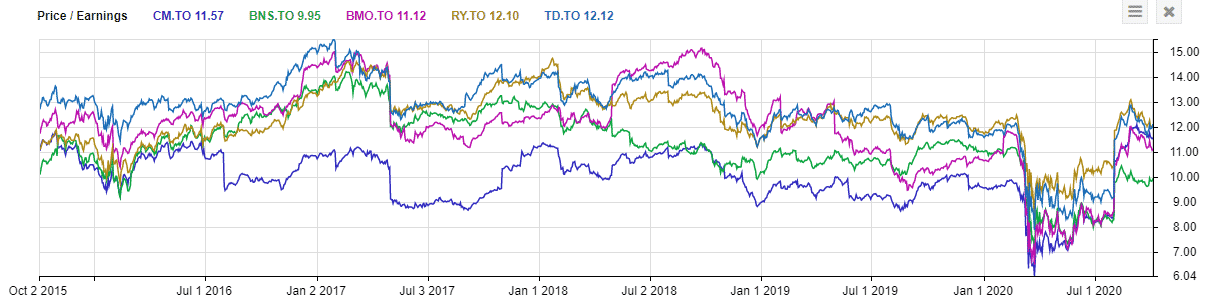

From a valuation standpoint Canadian Imperial Bank of Commerce is actually still one of the cheapest banks out of the Big 5.

Considering the bank has performed admiringly well, much better than the likes of The Bank of Nova Scotia and Bank of Montreal, this is a good sign.

CIBC is trading at a forward price to earnings of 11.57, a price to sales of 2.4 and a price to book of 1.2. The only major bank cheaper than this currently is the Bank of Nova Scotia. When comparing CIBC to BMO, I’d call valuations a complete wash they’re so close.

In terms of historical averages, CIBC is trading right in line with them. So, this is a Canadian bank that isn’t exactly presenting itself as a bargain, at least by historical standards.

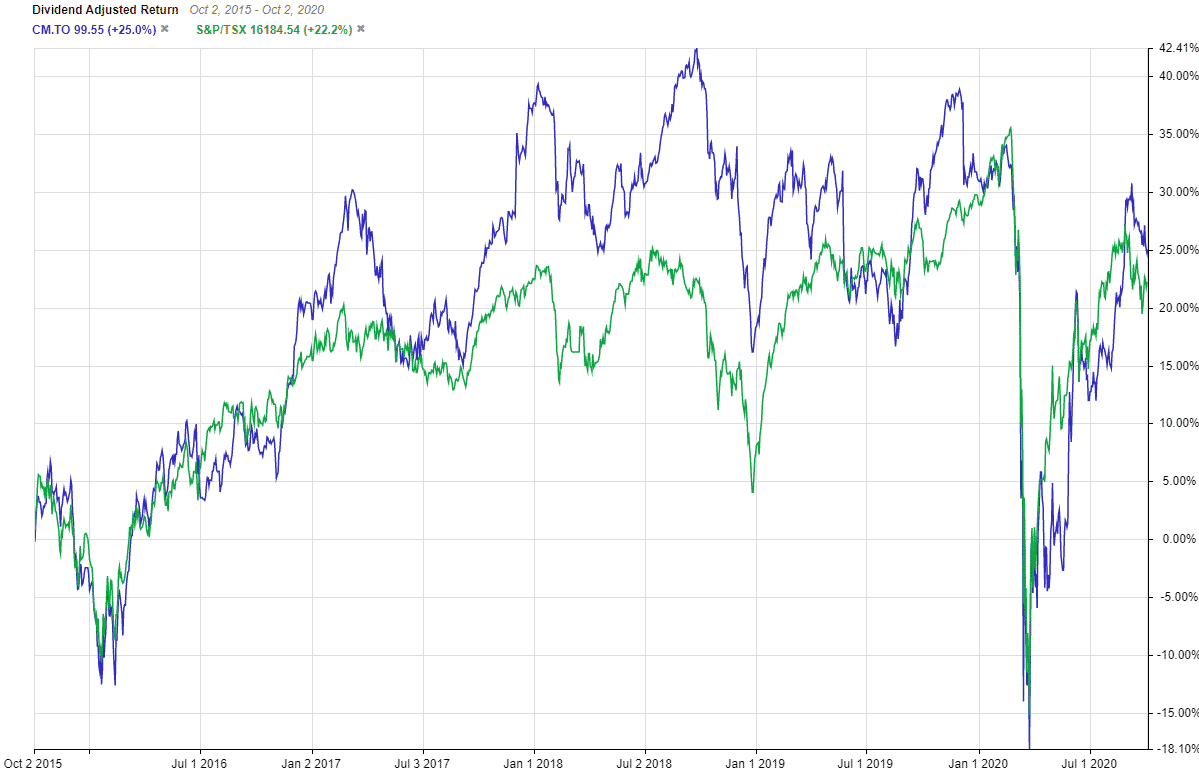

But considering the company beat analyst estimates by 26% when it filed earnings in late August, investors had to have known this stock wouldn’t remain cheap forever. In fact, it’s only down around 8% year to date, keeping pace with the TSX Index’s overall returns.

Overall, CIBC stock is an excellent option for income investors

Would CIBC be the first bank stock I’d look to add to my portfolio? No.

That title would go to none other than the Royal Bank of Canada (TSX:RY), which is what I feel is the best financial stock to own in the country right now.

But, that doesn’t necessarily mean CIBC is a poor option. In fact, it would probably be my second option right now. The other remaining banks have too much exposure to sectors/countries that I feel will underperform (oil and gas for Bank of Montreal, the U.S. economy for TD Bank.)

CIBC’s dividend is safe and will more than likely get right back to consistent dividend increases once the Government of Canada gives the go ahead for banks to raise again.

In my opinion, grab this high yielding dividend stock right now and collect the near 6% yield while the economy recovers from COVID-19.