Cineplex Stock Soars on Blockbuster Summer – Is it a Buy?

Cineplex has faced its share of challenges in recent years. The movie theatre industry has undergone significant shifts, with streaming services and at-home entertainment options becoming increasingly popular.

Despite these hurdles, Cineplex has managed to survive, and it is still one of the more popular Canadian stocks around due to many investors having some faith that movie goers will return when rates start falling.

The company has worked to diversify its offerings beyond traditional cinema experiences. They’ve expanded into areas like gaming, food service, and digital media.

Cineplex’s August box office revenues surpassed pre-pandemic levels, signaling positive momentum for the company. This uptick suggests that moviegoers are returning to theatres in strong numbers.

Is this momentum permanent? It’s difficult to say. All I will say is that this company will need an outstanding management team to survive moving forward, as adapting will be key.

Key takeaways

- Cineplex has diversified its business model beyond traditional cinema, but I’m not sure it’s good enough

- Recent box office revenues show promising signs of recovery

- The company’s adaptability will be essential if it’s going to survive.

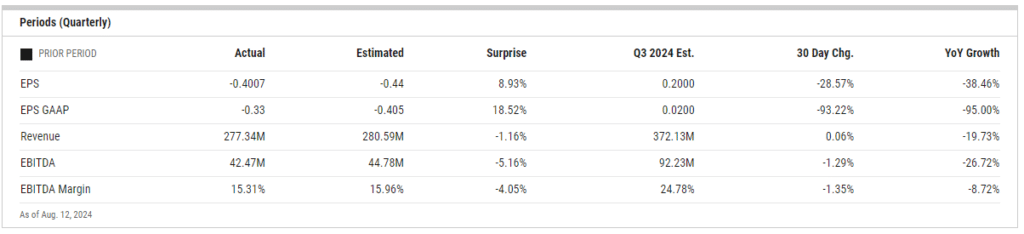

Quarterly earnings summary

Cineplex’s Q2 2024 results were not pretty. The company reported total revenues of $277.3 million, a significant drop from the previous year.

Theatre attendance took a major hit, falling to 8.7 million moviegoers. This 31.8% decrease from the same quarter last year is a red flag. It suggests the pandemic recovery isn’t progressing as hoped.

Despite the challenges, there were some bright spots:

- Record-high BPP (Box Office Revenue Per Patron) of $13.11

- All-time quarterly record CPP (Concession Revenue Per Patron) of $9.56

- 28.1% increase in Digital Place-Based Media revenue

However, these gains weren’t enough to offset the overall revenue decline.

Weak box office performances seem to be a key factor in these disappointing results. Major movie releases underperformed, and streaming competition continues to pose a threat to traditional cinema.

I’ve been a regular movie goer in the past. Nothing has really attracted me to the theatre for a while now.

Cineplex’s plan to acquire up to 6,318,346 common shares over the next year is interesting. They clearly feel the stock is discounted. But, is it actually good value to be buying shares with cash flow right now?

Cineplex’s earnings impacted by online misdirection

Cineplex’s recent attempts to boost revenue through online fees have backfired spectacularly, to say the least. The company’s decision to tack on a $1.50 online booking fee has led to a hefty $38.9 million fine from the Competition Tribunal.

This misstep has not only hit Cineplex’s wallet but also its reputation. I’ve seen countless negative reviews and complaints about these surprise charges.

Cineplex’s CineClub membership, meant to offset these fees, hasn’t gained the traction they hoped for. Many moviegoers find the additional subscription cost unappealing, especially when coupled with rising ticket prices.

The fallout from this fee fiasco has been significant:

- Decreased foot traffic in theatres

- Poor customer feedback

- Growing preference for streaming services

I believe Cineplex underestimated the public’s reaction to these fees. In an age where transparency is key, this approach feels outdated and has pushed many loyal customers to seek alternatives.

Not only are they facing a massive fine, but they’re also dealing with reduced ticket sales and concession purchases.

It’s a double whammy that could have long-lasting effects on Cineplex’s bottom line.

Fewer and fewer people are heading to the movie theatre, which is a bad thing for Cineplex

I’ve noticed a worrying trend for Cineplex: movie theatre attendance is on a steady decline. This spells trouble for the company’s bottom line and future prospects.

The rise of streaming platforms like Netflix and Disney+ has dramatically changed how we consume entertainment. Many of us now prefer the comfort of our living rooms to the big screen experience. As I mentioned, it would take a big movie release to get me out of my seat and paying $50+ at a theatre.

Inflation is also taking its toll. With the cost of living soaring, I’ve seen people becoming more selective about their discretionary spending. A night out at the movies, with tickets and snacks, can be a pricey affair.

Post-pandemic habits have further accelerated this shift. Many moviegoers have grown accustomed to watching new releases at home, making it harder to lure them back to theatres.

The decline in foot traffic is particularly concerning for Cineplex. Fewer patrons mean:

- Less ticket revenue

- Reduced concession sales

- Decreased advertising opportunities

While some argue that theatres offer a unique experience, I fear that for many, the convenience and cost-effectiveness of at-home entertainment are proving too attractive to resist.

How is the company looking from a valuation perspective?

The company’s trailing P/E ratio of 6.35 may seem attractive at first glance, but it doesn’t tell the full story.

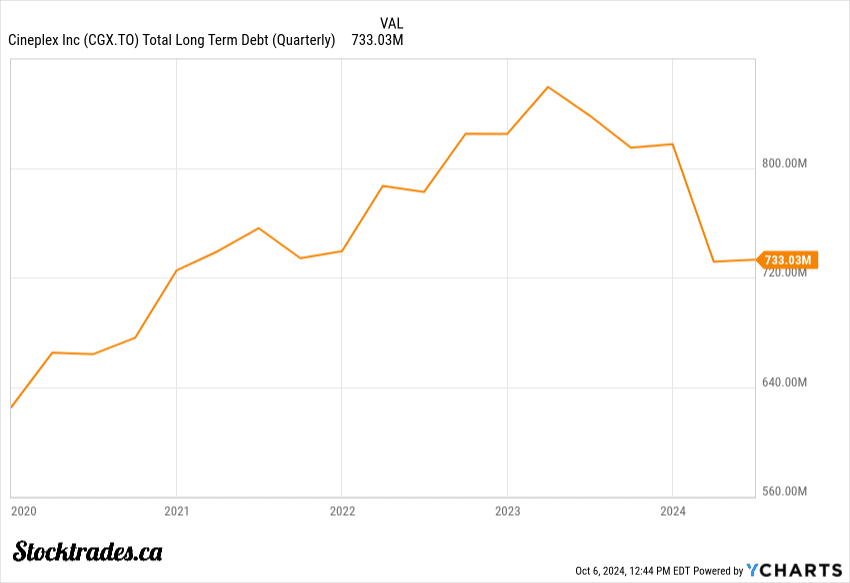

Cineplex’s debt levels are worrying. With total debt of $733 million and a market cap of only $670.60 million, the company’s leverage is quite high. Sure, it’s been actively paying it down, but it’s got a long ways to go.

The current ratio of 0.36 indicates potential liquidity issues on the balance sheet as well. Cineplex may struggle to meet short-term obligations, which is a red flag for its financial health. This may lead to new debt issuances or share issuances, both of which are not optimal for investors.

While the stock price has risen 12.98% over the past year, it has significantly underperformed the S&P 500’s 33.89% gain.

The fact that Cineplex currently has negative operating margins is also a pretty big issue for me. It points to fundamental weaknesses in the business model.

Given these factors, I don’t even believe the company is a bargain at 6.3X trailing earnings. It sounds ridiculous to say, but I can’t see much growth in the future for the company.

Would I buy the stock today?

I wouldn’t buy Cineplex stock today. The company faces several challenges that make it a risky investment.

The entertainment landscape is changing rapidly, and Cineplex hasn’t adapted quickly enough. Its moat is not wide enough for me to ever consider an investment in the company.

One major issue is the threat from streaming services. More people are choosing to watch movies at home, which cuts into Cineplex’s core business. This trend isn’t likely to reverse anytime soon.

They can introduce all of the arcades and loyalty cards they want. Movies are expensive and in-home entertainment systems are getting cheaper and cheaper.

The company relies heavily on box office sales and concessions. It hasn’t found strong alternative income streams to offset declining theatre attendance.

While some might see the current stock price as a bargain, I’m not convinced. The company’s fundamentals don’t support any sort of bullish outlook. Unless Cineplex can find new ways to attract audiences and diversify its revenue, I believe the stock will continue to underperform.