Cineplex Stock (TSE:CGX) – Don’t Attempt to Catch This Knife

Taking flyers on beaten down Canadian stocks seemed to be the thing to do during the pandemic. Especially if you’re just learning how to buy stocks in Canada, the mentality that is taught early is “buy low sell high.”

And, for the most part, it seemed to work out. There were some stocks that were providing crazy value, and investors could scoop up some solid companies trading at significant discounts.

However, as we move farther into the global recovery when it comes to COVID-19 and the economy, many investors are asking if beaten down stocks like Cineplex (TSE:CGX) are still strong opportunities moving forward.

In this article, I’m going to go over why I think Canadian investors should be avoiding Cineplex at all costs.

What is Cineplex (TSE:CGX)?

Cineplex is one of the largest theaters in Canada. Prior to the pandemic, the chain of cinemas entertained over 70 million guests per year and employed over 13,000 people.

The company is involved in esports with its WorldGaming network, as well as entertainment centers like Playdium and most recently The Rec Room.

As you would imagine the pandemic situation has hit Cineplex on the top and bottom lines significantly, but many investors are flocking to the stock because of its iconic brand recognition and what is seemingly a monopoly here in Canada, with other theatres paling in comparison to Cineplex’s footprint.

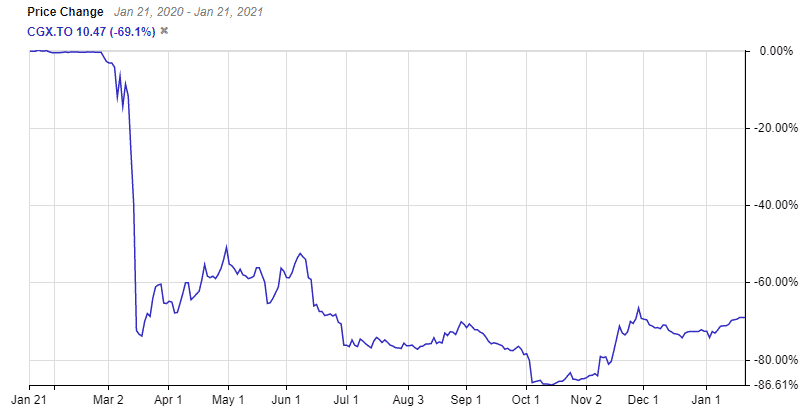

1 year price change Cineplex (CGX.TO)

Market Cap: $662.47 million

Forward P/E: 0.00

Stocktrades Growth Score: Premium Members Only

The warning signs are there for Cineplex

Even prior to the pandemic, there was a strong realization that people were transitioning away from a cinema based experience due to a multitude of factors.

- It’s expensive.

- Streaming services are becoming increasingly popular, and in some situations even taking direct business away from Cineplex, which I’ll get to later.

And finally, rapidly evolving home theatre products are making it extremely convenient for viewers to simply watch at home, with a theatre-like experience.

70 inch televisions are becoming common place in homes, primarily because discount brands are pushing out higher quality products due to innovative technology.

Although we’ll likely never achieve true theatre quality sound inside of our homes, the fact that a sound bar can now give you exceptional audio for a small price is a testament to how far it’s come.

In fact, back in 2017 there was a report put out that domestic movie theatre attendance had hit a 25 year low.

To follow that up, U.S movie tickets sales fell a further 5% last year.

Although Cineplex’s stock price looks like a value play, it’s business has been materially impacted

Prior to the pandemic, Cineplex had experienced somewhat flat box office revenue for the better part of 5 years.

This was a warning sign in and of itself, however many investors ignored this and were then hit by a failed acquisition attempt by Cineworld which collapsed the company’s share price.

Fast forward to 2020, and we have the pandemic, which has destroyed the company’s balance sheet and financial position.

As of the company’s most recent filing, Cineplex sits with a current ratio of 0.238, indicating that it has more than four times liabilities due in a year than it has liquid assets.

To think of this in easier terms, if you had rent of $1600 and only $400 at the start of the month to pay, you’d be in an equal financial position.

Now, most of its current liabilities come from what we call deferred revenue, which is essentially goods and services that Cineplex has been paid for, but hasn’t delivered. This means that in the future, the company will be providing services for capital that is already accounted for.

The company’s revenue has absolutely collapsed, falling from $1.22 billion through the first 9 months of 2020 to $365 million through the same time period this year.

And keep in mind, these financial statements ended on September 30th. What this means, is that the most recent lockdowns due to the pandemic have not been accounted for. The company will report those next quarter, which we can likely expect to be bleak.

This is a company that posted diluted earnings per share of $0.40 in 9 months of 2019 to a loss of $6.30 a share in 2020.

It’s going to take Cineplex a long time to fully recover, if it ever does

The pandemic has put Cineplex in arguably as poor of a situation as the airline companies. For the better part of 2020, operations were shut down and the company was running on fumes.

In fact, it practically still is. The financial damage that has been done to Cineplex because of the pandemic is significant.

Then, we have to factor in that there is undoubtedly a decrease in the popularity of Cineplex’s products, at least when it comes to cinema. There is no denying this.

In fact, the company was trying to adapt quickly with entertainment options like The Rec Room to decrease the impact that cinema revenue has on the company. And, if they had been given a few more years of development before this pandemic hit, they may have succeeded.

Now operations like HBO Max are showing movies on television at the same time they’re available in theatres in the United States, I fully expect this to come to Canada as well in the future.

This is no doubt going to effect ticket and concession revenue for the company moving forward.

Overall, I see too many investment thesis’s around Cineplex that state “movies will be back”.

For one, there is no guarantee that when movies come back that Cineplex will be the one to offer them. This is something you really need to understand. This is a company that’s assets can be scooped up for pennies on the dollar right now.

And secondly, movies may be “back”, but the true question is are they ever going to return to levels prior to 2017, or are we going to continue to see a decline? I’m guessing the latter. Some industries will probably have an easier time recovering from the pandemic. We looked over MTY Food Group (TSE:MTY).