Cineplex (TSE:CGX) Has Some of the Highest Short Interest in Canada

Prior to the Gamestop and AMC fiasco in early 2021, many retail investors didn’t pay an ounce of attention to stocks with heavy short interest.

However, it seems to be a pinpointed target of many investors now as they look to target and punish firms with large short positions in struggling companies.

One of those companies we’re going to talk about today is Cineplex (TSE:CGX) and whether or not the company will be able to emerge from the COVID-19 pandemic and ultimately get back on track.

As of right now, with this stock being one of the most heavily shorted Canadian stocks on the market, many investors seem to be betting on its failure.

What does Cineplex (TSE:CGX) do?

Cineplex is the largest cinema company in the country, and it operates in 3 key business segments being Entertainment, Media, and Amusement & Leisure.

The company had tens of millions of Canadians walking through its doors prior to the COVID-19 pandemic and was without a doubt the strongest brand in the industry north of the border.

Why Cineplex is one of the heaviest shortest stocks on the TSX today

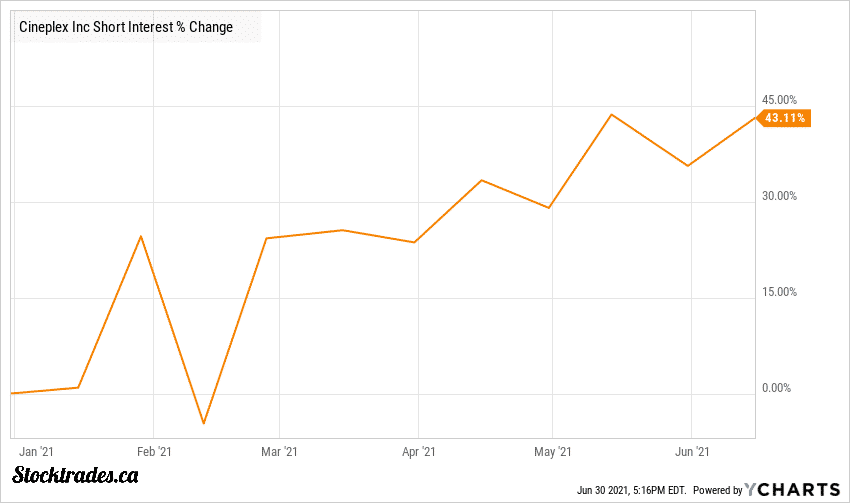

As we can see by the chart above, Cineplex’s short interest has risen by over 43% in 2021, primarily due to a surge in price from the company in anticipation of an economic reopening.

Despite business operations looking like they’ll be returning to normal, investors are still betting on the cinema company to fail as short interest is approaching 7%.

We believe there is 3 key catalysts for the increased short interest when it comes to Cineplex.

Rapid debt levels will likely harm the company for years to come

In order for the company to survive, Cineplex went through a period of significant cash burn. As a result, its balance sheet has deteriorated.

Cineplex has over $740M in debt on the balance sheet, and shareholders equity has virtually collapsed over the course of the pandemic. However, shrinking shareholder equity was a concern prior to COVID, the pandemic simply seemed to accelerate it.

The company issued a bond offering in early 2021, and the headline’s read that it was a blowout deal. Considering the company had to issue debt at a rate of 7.5% in one of the lowest interest rate environments we’ve ever been in, this really shouldn’t be viewed as a positive, and it seems many investors feel this way.

Overextended valuations are triggering bear shorts

There is no doubt that Cineplex will eventually return to normal and people will start going to movies again. However, this is a multi-year turnaround that likely has a lot of the “turnaround” already priced in.

If we look to forward estimates, Cineplex is expected to lose yet another $3.23 a share in 2021. This is to be expected, as we’re approaching the latter half of 2021 and the world still has not returned to normal.

But, if we look out to 2022 and 2023 earnings of $0.224 and $0.60 respectively, this places Cineplex’s forward price to earnings ratios at 66X and 25X in those respective years.

These are typical valuations of high profile growth stocks. Ones that investors clearly believe Cineplex won’t hold up to.

Shrinking demand for the cinema industry

There is no question that going to the cinema is not as popular as it once was. In fact, ticket sales have been shrinking for quite some time now, and in 2017 they hit a multi-decade low.

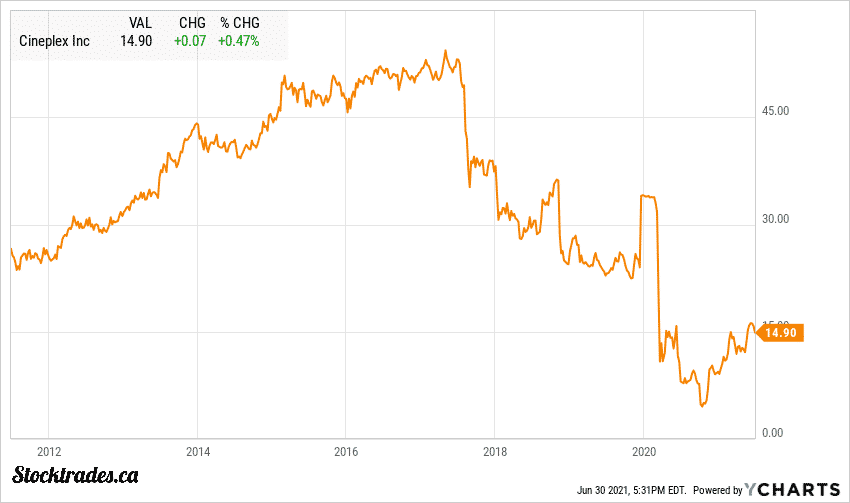

This is exactly why in the chart below, you’ll see Cineplex wasn’t only impacted by the pandemic, it was impacted by the inevitable decline of the industry back in 2017.

Cineplex bears are betting on home streaming services continuing to reduce demand in the sector. Cineplex had been working hard to diversify away from being a pure cinema company. And as of right now, they still are in terms of their Rec Rooms.

But, the pandemic hit them in a transitionary stage, and it has likely delayed much needed progress.

Is there still promise in buying Cineplex stock today?

As most long term readers know, my position on Cineplex has been quite clear over the last half decade, and isn’t solely based off COVID-19 hardships. It’s an industry I don’t see growing over the long term, and as such I wouldn’t touch it.

Could this be a typical buy the rumor, sell the news type event? Absolutely. Cineplex has gone on a strong run since the announcements of vaccines back in November of 2020, and there might be more short-term potential upside for those who want to take on a little bit of risk.

But for somebody who’s looking for a long term investment, I just don’t see what the company offers. And keep in mind, this is from someone who loves to go to the theatre, and frequents them quite often.

I know I’m the exception, not the rule, and more and more people due to convenience and simply overall costs are choosing to stay at home and watch it on the couch.

Check out the two top Canadian hydrogen stocks.