Commodity Supercycle? Have a Look at Nutrien (TSE:NTR)

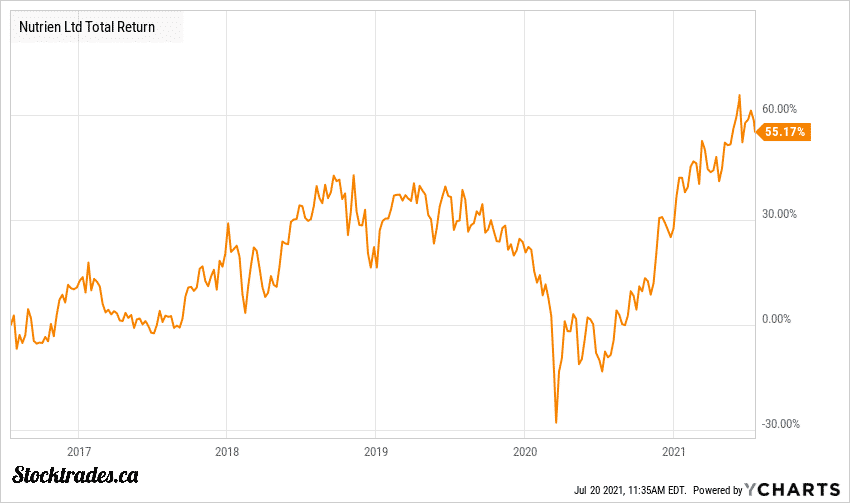

Investing in cyclical stocks can be a frustrating experience. They tend to spin their tires, outperforming in a rising commodity market only to fall back to where you originally purchased them when commodity prices fall.

And while this pattern will likely never change, there is a particular blue-chip among Canadian stocks that is not only set to benefit from an upcoming rise in commodity prices, but also an increasing global population. That stock is Nutrien (TSE:NTR). Lets have a look at why.

What exactly does Nutrien (TSE:NTR) do?

Nutrien is the result of a significant 2018 merger between PotashCorp and Agrium, making it the largest fertilizer company on the planet in terms of capacity.

The company provides 3 main crop nutrients, nitrogen, potash, and phosphate. The company’s key focus however is potash, with roughly a 20% market share.

The company is one of the largest retailers in the United States in terms of agriculture, supplying not only fertilizer but crop chemicals, seeds, and services directly to farmers.

So how will Nutrien benefit from a potential commodity supercycle?

As I mentioned above, Nutrien is heavily dependent on 3 key products, all of which are commodities. In an inflationary environment, commodities tend to perform quite well, and as a result there is some bullish sentiment towards potash, nitrogen, and phosphate.

Even as we head into late July, potash prices continue to rise. In fact, they’re up over 30% on the year. When we look to nitrogen, prices are up nearly 45% year to date.

Much like a company that relies on oil or gold production to grow its revenue and earnings, we can expect Nutrien to benefit from these rising prices.

Analysts seem to be thinking the same thing, expecting a 15% jump in revenue and a near 300% increase in earnings per share in 2021. Now, it’s important to keep in mind that we are comparing this year over year growth to 2020, which saw the world in the midst of a global pandemic. But, it is still strong growth from a company of this size nonetheless.

When we look forward to 2022 and 2023, both earnings and revenue are expected to grow in the mid single digits. Which bodes well for the company’s divided, which we’ll go over next before looking at valuation.

Despite poor payout ratios, Nutrien’s dividend is well covered

With earnings per share of only $1.38 in Fiscal 2020, you’d think the company’s $2.32 annual dividend is on the verge of being cut. However, this isn’t the case.

For starters, the company still generated over $2.35B in free cash flow last year, which was far more than the $1.38B it paid out in dividends, highlighting the fact that you need to be looking at dividend payout ratios from more than one angle.

If we look to forward earnings estimates of $4.81 in 2022, we can see that the dividend now makes up less than 50% of expected earnings, much better than the 159% payout ratio it has based on trailing earnings.

With the company being so young as a result of the merger, it doesn’t have a strong history of dividend growth. In fact, it hasn’t grown its dividend at all. This is primarily because it was sorting out some issues and synergies from the merger.

Now that things are finally coming together, I expect the company to grow the dividend moving forward, as it has plenty of room to do so, and the current economic environment should bode well for Nutrien.

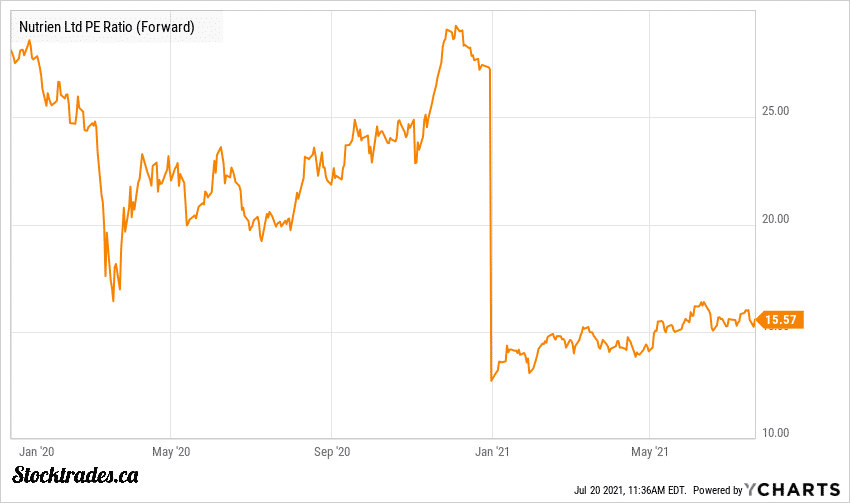

Nutrien isn’t dirt cheap, but it’s far from expensive

When we look to Nutrien on a forward basis, it is trading at approximately 15.8X earnings and 1.4X forward sales, both of which are well below its recent averages as you can see by the chart above.

I wouldn’t consider the stock a slam dunk bargain, but in markets that are touching all time highs, it’s rare to find a stock that is even reasonably valued, and Nutrien is very much that.

Most analyst estimates are in the $85-88 range, which marks around 20% upside at the time of writing. Considering this is a blue-chip giant and a global market leader when it comes to the products it provides, this is a strong rate of return.

Add to this the fact that Nutrien pays a yield north of 3%, and conservative investors will likely be happy with the returns they get out of Nutrien over the next half decade.

Overall, catalysts are there, and valuations are offering a reasonable price for exposure

If you are an investor who thinks we’ll be heading into a commodity super cycle, Nutrien is likely the best option you have in terms of gaining exposure to agricultural based commodities like fertilizers.

The company’s dividend is well covered and in a position to grow, and valuations are reasonable especially considering it has received some notable price upgrades to, as I’ve mentioned, the $88 range as of late.

Don’t expect massive growth out of Nutrien. Again, this is a blue-chip company with a market cap in excess of $43B. Mid to high single digit annual growth should be expected, with the company potentially being able to churn out double digit annualized returns in light of rising commodity prices.

The stock is going to provide reliability and low volatility inside of a portfolio. Something that investors are learning to appreciate as the markets rock back and forth in 2021.

Have you been keeping an eye on the unfolding EV market? Check out a few of the top Canadian EV stocks.