Why Constellation Software Stock Continues to Excel

Constellation Software has been an outstanding performer in the Canadian tech sector for years. The company’s acquisition approach has led to impressive returns for shareholders.

Since going public in 2006, Constellation Software’s stock price has soared by over 30,000%. This makes it one of the best-performing stocks on the Toronto Stock Exchange.

Despite its success, Constellation Software remains a bit of a mystery to many investors. The company’s low-key approach and complex structure can make it challenging to understand.

Let’s take a deeper look at this Canadian software giant to see if I can simplify the business model for you.

Key takeaways

- Constellation Software’s business model focuses on acquiring and improving vertical market software companies

- The company’s stock has delivered exceptional returns despite modest organic growth rates

- Current valuation metrics suggest the stock is expensive, but still provides strong value considering its growth

- Grab more advanced research on Constellation Software

What Constellation Software does and why few investors understand the company

Constellation Software buys small software companies that serve very specific industries, typically ones that are subscription based.

The logic with buying these vertical market software companies is that the switching costs are very high, if there is even an alternative product at all. This creates a situation where churn rate is very low, and pricing power is maintained.

Constellation lets these acquired companies run mostly on their own. This decentralized model is different from how big tech firms usually work.

Constellation isn’t after flashy growth. Instead, they focus on steady profits from niche markets. It’s like they’re building a collection of mini-monopolies.

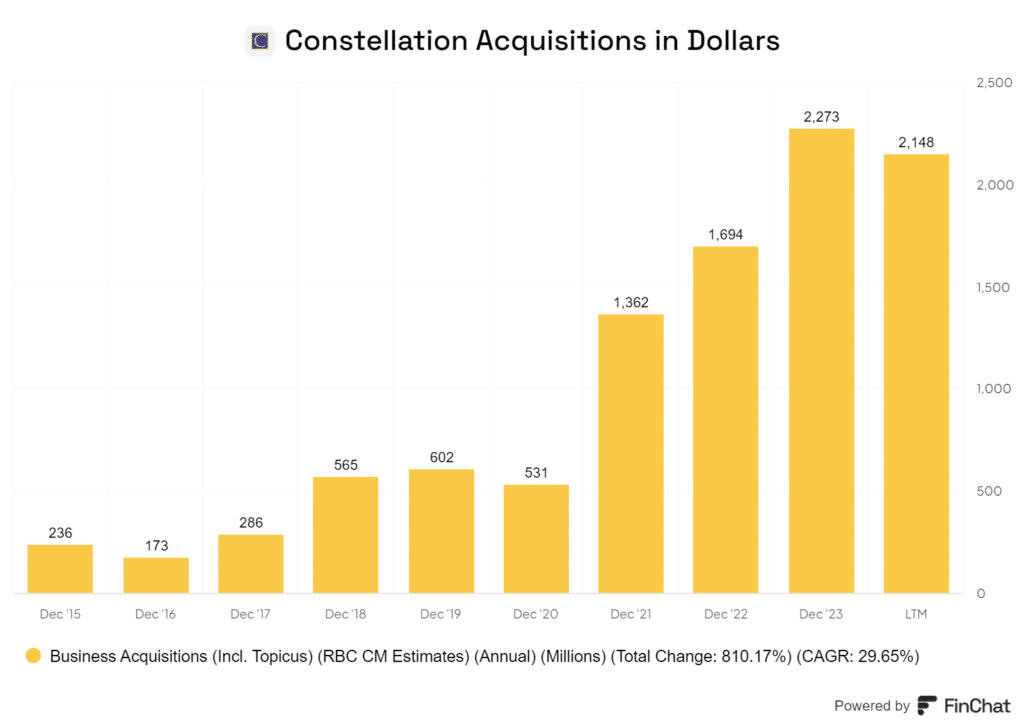

I believe this quiet approach is part of why Constellation flies under the radar. They don’t make splashy headlines like other tech giants. In fact, you hardly ever hear of their acquisitions. But they’re making a boatload of them. Look no further than the chart below.

What really impresses me is how they’ve turned acquisitions into an art form. They’re constantly buying small companies, often ones that investors have never heard of. Over time, this adds up to significant growth.

The magic is in the compounding. Each new acquisition adds to their earnings power. It’s a snowball effect that I think many investors struggle to fully appreciate.

Why the company’s organic growth rates are so low yet valuations are so high

Constellation Software’s organic growth rates might seem low at first glance, but this isn’t a cause for concern. The company’s 3% organic growth is just one piece of the puzzle.

What really drives Constellation’s value is its acquisition strategy. They excel at finding and buying undervalued software businesses at attractive prices. Then, they optimize these companies for profit, even in mature markets.

I think the market recognizes this skill. That’s why Constellation commands such a high valuation. Investors are betting on the company’s proven track record of creating long-term value through acquisitions.

They have, what I believe, to be the strongest management team on the planet.

It’s important to note that Constellation isn’t chasing rapid growth like many tech firms. Instead, they focus on disciplined capital allocation. This approach has led to impressive returns on invested capital (ROIC) over time.

The company operates in fragmented markets. This gives them plenty of opportunities to keep growing through acquisitions. I believe this strategy is more sustainable than relying solely on organic growth.

The stock is above historical averages, but the company is getting better at acquiring companies

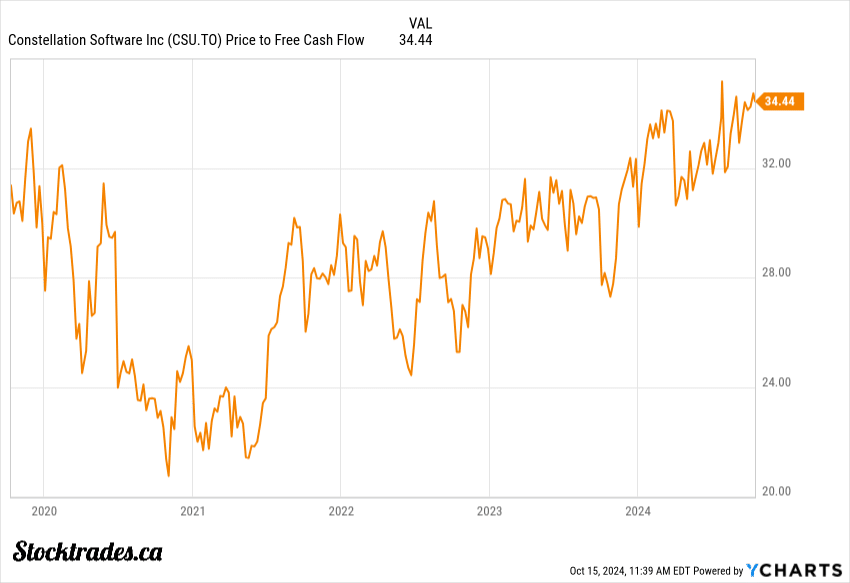

When I look at Constellation Software’s current valuation, it’s clear the stock isn’t cheap by traditional metrics. The company’s price to free cash flow, the most accurate measure of valuation for Constellation, is sitting at 5 year highs.

But I don’t think that tells the whole story.

Constellation has been honing its acquisition strategy over the years, becoming more adept at identifying, purchasing, and integrating new companies. This improved capability is crucial. It means Constellation can deploy capital more effectively, potentially justifying a higher valuation multiple.

If you look to the acquisition chart in dollars higher up in this article, you can see capital deployment has increased significantly.

In my view, these elements combine to make Constellation more valuable than its past self. The company’s ability to create long-term value through acquisitions has grown significantly.

I believe the market is pricing in this change. While the stock may look expensive compared to its own history, I’d argue it’s reasonably valued when considering its improved growth prospects.

That said, investors should be cautious. High valuations leave little room for error. Any missteps in Constellation’s acquisition strategy could lead to a sharp correction in the stock price.

However, with the history of this management team, I believe odds are in investors favor.

Why I feel the stock is still a buy today

Despite trading near all-time highs, I believe Constellation Software (CSU) remains an excellent investment.

The company’s track record speaks volumes. It has consistently delivered high returns on acquisitions, a key driver of its success.

The addressable market for vertical market software (VMS) acquisitions continues to grow. This presents ample opportunities for CSU to maintain its growth trajectory.

Mark Leonard’s leadership is a significant asset. His vision and strategic approach have been instrumental in CSU’s success. Under his guidance, the company has expanded into new verticals and international markets, and has also initiated numerous successful spinoffs, which has proven difficult in the Canadian market.

CSU’s low-risk profile is another factor that makes it attractive. The company benefits from:

- Recurring revenue streams

- Defensive market positioning

These elements provide stability and predictability to CSU’s business model.

While some may balk at the premium valuation, I believe the long-term growth prospects justify the current price.