It’s Been Quite a Run for Costco Stock – Is It Still a Buy?

Costco stock has been a top performer in recent years.

The retail giant’s unique flywheel business model and loyal customer base have helped it weather pretty much any economic situation it’s been faced with.

The wholesaler’s ability to offer quality products at rock-bottom prices has attracted millions of members worldwide at astonishingly high renewal rates. This membership model provides a steady revenue stream and fosters customer loyalty.

Let’s dive deeper into Costco’s business model, recent performance, and future prospects to see if it’s a smart investment right now.

Key Takeaways

- Costco’s membership model and bulk pricing strategy drive its success

- The company’s sales growth remains strong post-pandemic as customers have permanently changed shopping habits

- Costco stock trades at a premium, but the business model justifies it

Post-pandemic shopping habits are fueling Costco

I’ve noticed a big shift in how people shop since the pandemic. At first it was on an anecdotal basis. I stopped shopping at expensive grocery stores and found myself hitting up discount stores and Costco a lot more.

It’s not just me, though. It’s North America as a whole, and Costco has benefitted significantly. Sky-high inflation has made many of us tighten our wallets.

We’re all looking for ways to save money on groceries and household items. That’s where Costco shines.

The warehouse giant offers bulk buying options that can save shoppers a lot of cash. This trend isn’t going away anytime soon. Don’t believe me? Just walk into a store on a weekend!

Even though inflation has slowed down, prices aren’t dropping. In my opinion, we’ll keep seeing grocery costs climb, just on a normalized level. This means people will keep hunting for deals.

Costco’s membership model is brilliant. It keeps customers coming back. I think their loyal customer base will only grow.

Here’s why I believe Costco will keep thriving:

- Bulk buying saves money

- Quality products at lower prices

- Loyal members keep coming back

Costco has the best business flywheel on the planet

I’m convinced Costco’s business model is unbeatable. Their flywheel is a thing of beauty.

It all starts with membership fees. These recurring payments, which make up the bulk of Costco’s profit, allows the company to operate at lower margins and keep costs low.

This low-cost strategy attracts more shoppers. As more people flock to Costco, their buying power grows when it comes to suppliers.

With bigger orders, Costco can negotiate even better deals from suppliers. This means – you guessed it – even lower prices for us shoppers.

The cycle keeps going:

- Lower prices

- More members

- Bigger orders

- Even lower prices

And with a 93%+ renewal rate on their memberships, it is a train that doesn’t seem to want to stop.

In my opinion, this flywheel makes Costco a retail powerhouse that’s hard to match. It’s a well-oiled machine that just keeps getting stronger.

August sales results show no signs of slowing

Costco is a retailer that posts regular updates on its store sales outside of earnings. The company’s August net sales reached $19.83 billion, marking a solid 7.1% increase from last year.

This growth isn’t a one-off event either. It’s part of a consistent trend I’ve noticed:

- June: 7.4% increase

- July: 7.1% increase

- August: 7.1% increase

In my view, these results paint a picture of a company that’s not just growing, but thriving. Sure, 7%+ same store sales growth isn’t at the levels of growth of a jaw-dropping technology stock, but we’re talking about a defensive retailer here.

Costco seems to have found a winning formula that keeps customers coming back, regardless of economic conditions.

Costco’s stock is far from cheap

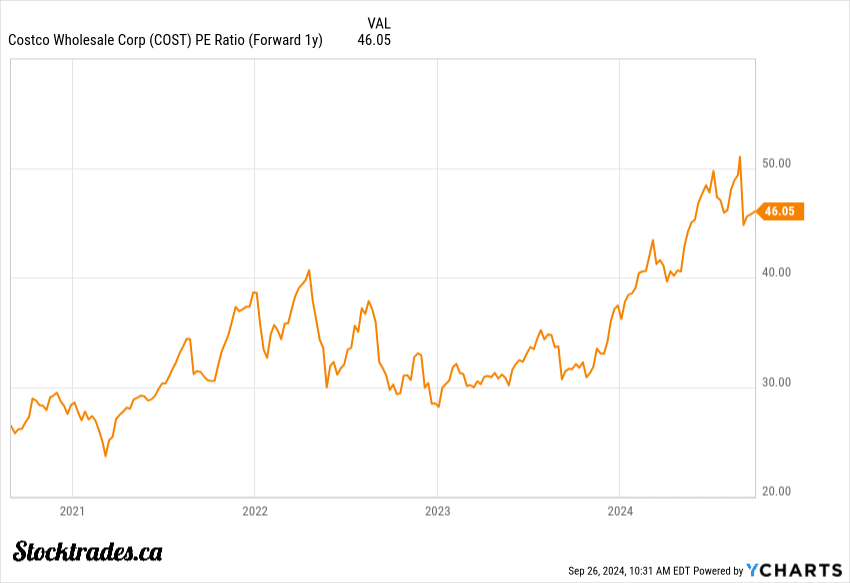

Costco’s stock is quite pricey these days. The company’s price-to-earnings ratio is over 50, which is steep by any measure. When we look on a forward basis, it gets a bit better, but still pretty expensive at 46.

Its enterprise value to EBITDA ratio is about 33, which is sky-high as well.

But here’s the thing: Costco’s business model is brilliant. They’ve got a loyal customer base and a rock-solid reputation. Their membership model brings in steady cash flow.

There should be very little surprises here. And the markets love stocks that bring little surprises.

Still, I’m a bit wary of the current valuation.

Here’s what gives me pause:

- Forward P/E ratio of 46

- PEG ratio of 4.4

- Price to free cash flow of 54

These numbers suggest the stock is priced for perfection. I spoke on the fact that NVIDIA is priced to perfection in a previous article.

However, the situations are different. I do believe Costco has a better chance of maintaining results.

Is it a buy at today’s price levels?

Costco’s stock has seen a significant surge over the past few years, driven by a material shift in consumer spending habits. This is making it quite pricey at current levels.

But I believe there’s more to the story.

Costco’s business model is uniquely positioned to thrive in the current economic climate. The shift in consumer spending habits has been remarkable, and it will likely be permanent.

More shoppers are turning to bulk buying and value-focused retailers. Costco stands out in this space with what I view as the best business flywheel on the planet.

The company continues to open new stores and enter new markets. This growth strategy could fuel long-term gains for investors.

That said, I’d approach buying Costco stock with caution at these levels. If you’re buying right now, you’d better have a long-term view. It’s not a bargain, but its long-term prospects remain strong.