Couche-Tard Stock: Is The Stocks Struggles a Huge Warning?

Couche-Tard is a blue-chip name that’s caught my eye lately. This convenience store giant has been making waves in the stock market, primarily due to its drawdown in 2024, and I figured I should take a look.

The company’s recent moves have been bold. Some would say even too bold. The recent dip might make some investors nervous, but I see it as a potential opportunity.

Lets dig into why.

Key Takeaways

- Couche-Tard’s recent acquisition attempts show an aggressive growth strategy, but one that could spell disaster

- The company’s stock price dip may present a buying opportunity for investors

- Couche-Tard’s global presence positions it well for future expansion

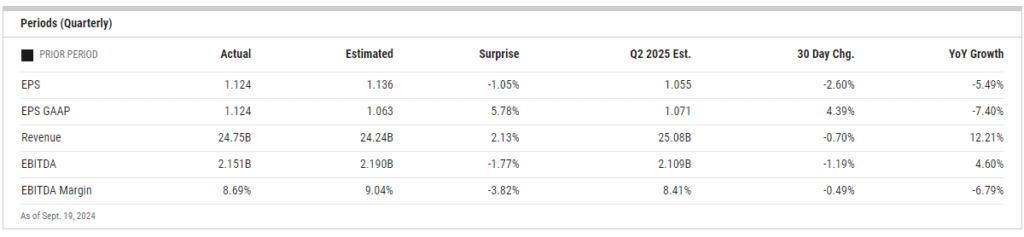

Q1 Earnings – How did the company do?

I think Couche-Tard’s Q1 performance was a bit of a mixed bag. They fell short of analyst expectations, which isn’t great news for investors. But on the flip side, it was very small misses on both the top and bottom line.

Net earnings came in at $790.8 million or $0.83 per share. That’s down from $834.1 million or $0.85 per share last year. Not a huge drop, but still heading in the wrong direction.

On the bright side, total merchandise and service revenues grew by 5.1% to $4.5 billion. But here’s where it gets tricky:

Same-store sales declined across the board:

- US: -1.1%

- Europe: -2.1%

- Canada: -3.9%

I’m a bit concerned about these numbers. They suggest consumers are tightening their belts, especially in Canada.

Fuel margins were a bright spot. In the US, they hit 48.13¢ per gallon. That’s down slightly from last year, but still healthy. Europe saw a small increase, while Canada dipped a tad.

One positive note: Couche-Tard is expanding with a deal to buy 270 GetGo stores. These smaller, tuck-in acquisitions are what has fueled the company’s success.

Overall, I’d say it wasn’t Couche-Tard’s best quarter. But they’re still profitable and making strategic moves. The real question is whether they can turn those same-store sales numbers around in the coming quarters as rates begin to drop.

Couche-Tard’s aggressive attempt at acquiring 7/11

I believe Couche-Tard’s bid for Seven & i Holdings is a bit of a stretch. While it’s ambitious, I’m not convinced it’s the best move for the company or its shareholders.

The sheer size of this deal is staggering. Seven & i operates nearly 86,000 stores worldwide – that’s a massive operation to absorb. I worry Couche-Tard might be biting off more than it can chew.

There are some serious hurdles to overcome:

• Regulatory scrutiny – especially in the US

• Large amounts of debt and equity needing to be issued

• Complex operating model of Seven & i

Combining these two giants would create a behemoth controlling about 20% of the US convenience store market. That’s bound to raise eyebrows with regulators.

I’m also concerned about the potential debt load. This would be an even bigger deal than Couche-Tard’s abandoned Carrefour bid. Taking on that much debt could hamper future growth and flexibility.

Sure, the economies of scale could be beneficial. But at what cost? The price tag and integration challenges might outweigh the potential gains.

Piling on a massive 7-Eleven deal seems risky to me.

In my view, Couche-Tard might be better off focusing on smaller, strategic acquisitions rather than this potential megadeal.

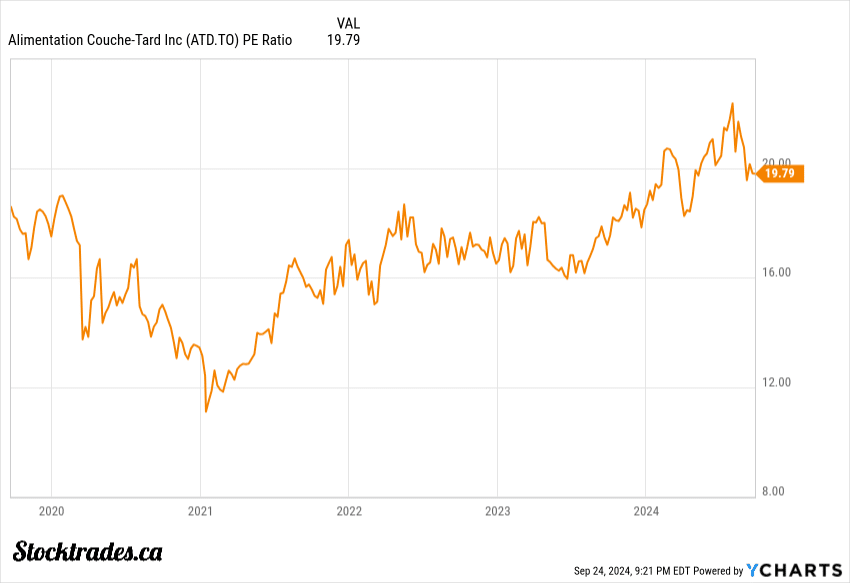

Is the company’s valuation more attractive now that it’s dipped?

Couche-Tard’s stock has dipped over 12% from its all-time high, which might catch the eye of bargain hunters. But I’m not convinced this dip makes it a screaming buy just yet.

Let’s look at the numbers:

- Forward P/E ratio: 18.94

- Price-to-Sales ratio: 0.75

- Price-to-Book ratio: 3.84

These valuation metrics aren’t exactly in bargain basement territory. There are plenty of top Canadian stocks that care cheaper.

The forward P/E of nearly 19 suggests investors are still pricing in solid growth expectations.

I’d argue that Couche-Tard’s current valuation is fair, but not particularly cheap when compared to its historical averages.

The company’s steady growth and strong market position justify a premium, but we’re not seeing a massive discount here.

One positive sign is the company’s solid profit margins relative to peers:

- Profit margin: 3.73%

- Operating margin: 6.02%

The valuation is more attractive than a few months ago, but it’s not a steal.

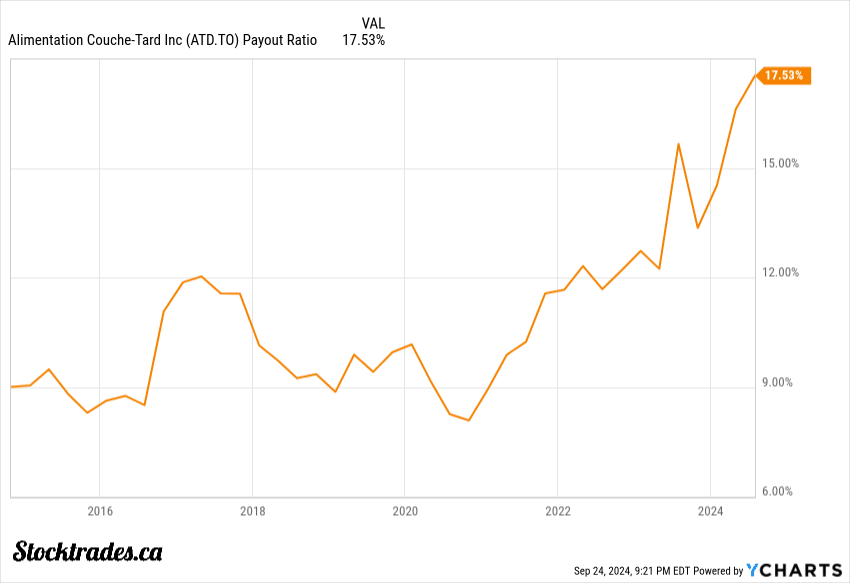

Will dividend growth be sustained despite struggles

Alimentation Couche-Tard’s dividend growth story is far from over, despite its struggles. This company has been a real star when it comes to boosting payouts for shareholders.

The company has consistently raised the dividend by double digits, and with payout ratios in the low teens, even if the environment gets worse for Couche-Tard, it has created a large buffer to continue that growth.

Even with some bumps in the road, like a dip in Q2 net sales, I’m not too worried. Couche-Tard’s got a knack for weathering storms.

So, do I think Couche-Tard is a buy right now?

Couche-Tard went on a tear in 2023, only to post an abysmal 2024 thus far. However, cyclical stocks will be, well, cyclical.

Here’s the thing: Couche-Tard isn’t exactly trading at a bargain right now. Its valuation has become a bit steep after such a strong run in 2023.

I also expect the company to face some challenges in the near term. The convenience store industry is competitive, and economic uncertainties could impact consumer spending.

Despite these concerns, I still believe Couche-Tard is a solid long-term buy.

Why? The company has a proven track record of growth through smart acquisitions and operational improvements.

Couche-Tard’s recent bid for the owner of 7-Eleven shows its ambitious expansion plans. If successful, this move could create a global convenience store powerhouse. Although I don’t like the deal, there is certainly the chance they work things out and it goes through.

The company’s focus on innovation and adapting to changing consumer needs is another plus. They’re not resting on their laurels.

In my view, patient investors who can weather some short-term volatility could be rewarded in the long run with Couche-Tard