Did You Miss The Boat on This Top Canadian Stock?

Canadian stocks often get a bad reputation. The American markets simply crush the TSX Index, and as a result investors think there is no growth in the Canadian market.

At Stocktrades Premium we are living proof that there is plenty of opportunities for growth among Canadian stocks. Over at Stocktrades Premium we’re simply crushing the broader index with small to mid cap growth stock opportunities.

One of those opportunities we relayed to members in the low $30 range was Goeasy Ltd (TSE:GSY). As I write this today, Goeasy Ltd is currently trading at $180 not even 3 years after we highlighted it.

So, one of the main questions we get asked is…

“has the ship sailed? Or is Goeasy Ltd stock still a strong buy today?”

I am going to attempt to answer just that in this article. And by the way, seasoned veteran investor, or just learning how to buy stocks, if you’re interested in getting started with Stocktrades Premium for free, just click here.

What exactly does Goeasy Ltd (TSE:GSY) do?

Goeasy Limited is a financial services provider, often deemed an “alternative lender.”

Why alternative?

The company is often seen as an option to Canadian borrowers that get refused by the major financial institutions such as TD Bank, Scotiabank, RBC, etc. Alternative lenders don’t have the strict lending rules placed upon them like major institutions have, and they can get away with taking a bit more “risk” in their loan portfolio.

However, as I’ll speak about later, the risk aspect of Goeasy’s loan portfolio is often used as a bear statement, and it is overblown.

The company provides financing options to purchase furniture, electronics, appliances, and also provides unsecured loans to customers who just need cash. It has two primary segments, easyhome and easyfinancial, with easyfinancial making up the lion’s share of revenue.

Why a lot of investors overstate the risk of Goeasy’s loan portfolio

As an alternative lender, Goeasy is often loaning people money who’ve been refused at a major institution. It’s likely the consumer either has poor credit, or simply not enough borrowing history to qualify for a loan.

The assumption is made that the company’s borrowing profile is high risk, and on the verge of collapse. But this really couldn’t be further from the truth.

Goeasy Ltd posted outstanding delinquency rates over the course of the pandemic, putting to bed any delusion that at the first sign of adversity its loan portfolio would crumble.

The company also reports that the majority of Goeasy Ltd customers actually leave the company with an improved credit rating. Which for the most part means the bills are getting paid on time.

A final key concept about the company, is the fact that the large majority of its borrowers do not hold a mortgage, making their debt burdens less than a customer of a major financial institution.

Your mortgage is tied to your home, and is one of the first things you’ll pay, as you’d like to keep the roof over your head.

Why the company is still a strong option today

The alternative lending industry here in Canada is not going to be getting any smaller. Goeasy Ltd is already a leader in a rapidly expanding industry.

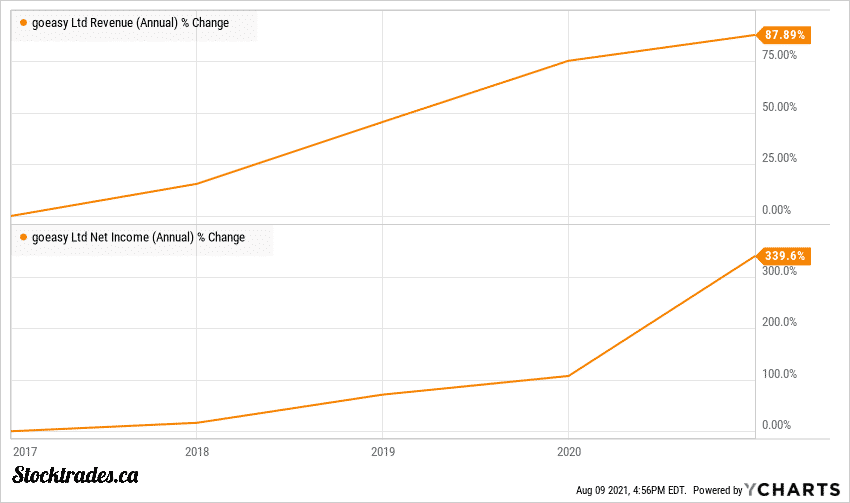

If we go back over a 20 year period, Goeasy Ltd has a 12.8% compound annual growth rate on earnings and a 31% CAGR on net income. More often than not with situations like this you’ll see the rapid growth being earlier in the company’s life cycle.

However, the most explosive period of growth for Goeasy Ltd has been over the last 6 years, in which revenue has nearly doubled and net income has gone up by 339%.

Although the Big Banks here in Canada still hold a commanding lead in terms of market share when it comes to lending, it is clear that smaller lenders like Goeasy Ltd are becoming disruptors in the sector.

Goeasy’s consumer loans have nearly tripled since 2016, a trend that is likely to continue. In fact, analysts are estimating that the company will post revenue of $830M in 2021, before breaching the $1B mark in 2022 and $1.1B by 2023.

With the trajectory Goeasy has been on over the last couple years, the only way I see these estimates heading is upwards.

Some investors view Goeasy’s business model as predatory. Others highlight a positive aspect of the business in allowing people an opportunity to increase their credit score when they had no opportunity to do so with a major bank. Opinions aside, the company’s business model seems to be working. It will likely continue to work in the future as more and more Canadians are looking to borrow in an ultra-low interest rate environment.

Overall, the valuation gap has closed, but there is still a ton of room to grow for Goeasy

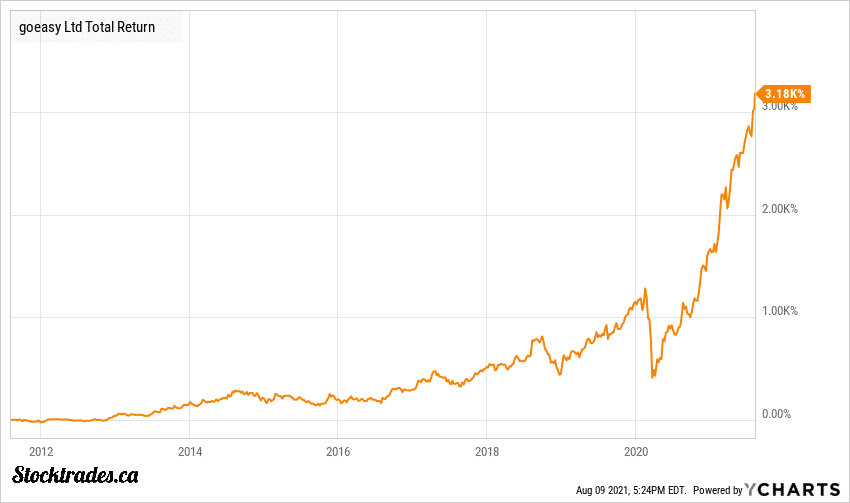

Goeasy Ltd was a stock that was chronically overlooked by the market for quite some time. As with any other strong company, the valuation gap will eventually close and the market will reward the stock with increased multiples.

This has happened with Goeasy Ltd, and the company is now more expensive on a price to sales, book, and earnings ratio when looking at its 3, 5, and 10 year median averages.

However, that doesn’t necessarily mean it’s expensive. In fact, it’s still trading at a respectable 14.75 times forward earnings. Many investors fear buying a stock that has run up considerably.

However, you have to understand that although Goeasy’s share price has gone up at a rapid clip, it was undervalued previous to it doing so, and the underlying business is also growing at a fast pace.

Both of these situations can lead to a rise in stock price, often one that is here to stay.

Speaking of growth stocks, should Nuvei Corporation (TSE:NVEI) be part of the conversation?