Does Equitable Bank (TSE:EQB) Have the Best Dividend in Canada?

As we continue to see the rise in popularity of alternative lenders in Canada among consumers, we are seeing the increase in attraction to the company stocks in the sector. People are buying stocks in Canada that are in the alternative lending sector today because not only are they some of the best Canadian dividend stocks, but they provide some potential on the growth front as well.

Among one of the leading alternative lenders in the country is Equitable Group (TSE:EQB).

So what makes Equitable Bank so promising, and how does it stack up to a similar alternative lender like Goeasy Ltd (TSE:GSY)? Lets have a look.

What does Equitable Bank (TSE:EQB) do?

A lot of investors call the company behind the EQB ticker Equitable Bank, however Equitable Bank is actually the subsidiary of the Equitable Group. Equitable Bank is the ninth largest schedule 1 bank in the country.

The company owns several business lines, including single-family lending services, commercial lending services, and securitization financing and deposit services.

One of the primary differences between a company like Equitable Group and Goeasy Ltd is the fact that Equitable offers mortgages, whereas Goeasy is strictly consumer based lending.

Although the company does have operations country wide, the bulk of its mortgages come from Ontario, Alberta, and Quebec.

One primary advantage for the company is the fact it isn’t required to adhere to strict lending regulations placed on major financial institutions in Canada, and this has allowed it to grow its customer base by being able to approve Canadians for mortgages who would otherwise be rejected at major institutions.

So, with the surge in customers and the expansion of the company’s products and reach, how safe is the dividend, and how much does the company have left in the tank in terms of growth? Lets review these things, starting with the dividend.

Equitable Bank dividend analysis

Prior to the pandemic, I actually would have voted Equitable Bank as one of my top dividend growth stocks in the country.

Although my attitude hasn’t changed much, it has moved to a little more of a bearish sentiment towards financials, and as a result I think Equitable Bank may slow on current dividend growth. However, this is still a dividend that is growing at an excellent pace.

Equitable Bank currently has a 9 year dividend growth streak, making it a Canadian Dividend Aristocrat, and it has a yield in the 1.8% range.

Over the last 5 years, the company has raised dividends at an annual rate of around 13.66%, but the company’s most recent increase was well above this at $0.22.

The one astonishing thing the company had achieved prior to the pandemic was 6 straight quarters of dividend growth. Yes, you read that right. Not six straight years, quarters.

From the second quarter of 2018 to the first quarter of 2020, Equitable Bank raised its dividend in every single quarter. The pandemic will no doubt slow down this growth, but I have complete faith that if this unprecedented situation had not happened, it would have continued this streak well into 2021. Why? Well, it’s payout ratios indicate there is a lot more room for growth.

Charts provided by StockRover. Check out Stockrover Here!

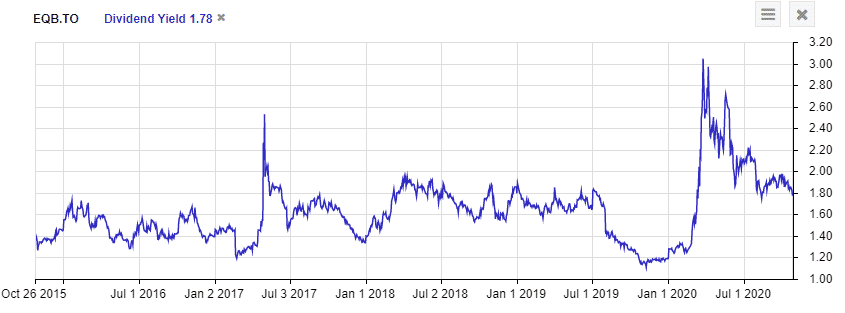

As of right now, the company is paying out around 12% of earnings towards the dividend. We can see that over the last 5 years, this is actually above its historical averages. This is primarily due to the fact that COVID-19 has had an impact on the company’s top and bottom lines, as we can see by the spike in March and subsequent drop in further quarters, but it still remains higher than usual.

If we look at the company’s yield, it’s nothing too spectacular. The company has a dividend yield of around 1.78% at the time of writing and the yield, besides a surge due to the market crash in March, has been quite steady.

If you’ve read any of my previous articles, you’ll know I get excited when I see a stock with this type of dividend growth keep it’s dividend steady.

And that’s because in order for its yield to be maintained while it’s raising its stock price, one thing needs to happen. It’s price needs to go up. And, Equitable Bank has been providing very solid returns for Canadian investors since 2004.

Overall, the dividend is not only safe, but I think it’s primed to continue growing. Just be patient with the company, and understand the fact that most financial companies are trying to preserve liquidity right now. Once things get back to normal, Equitable will likely continue its torrent pace of dividend growth.

Equitable Bank valuation and performance

Market Cap: $1.39 billion

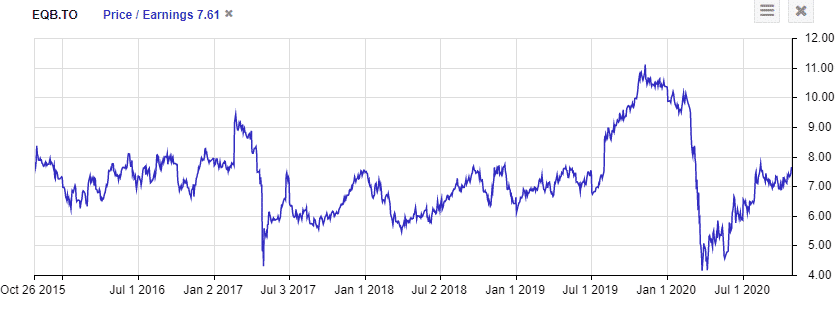

Forward P/E: 7.83

Yield: 1.78%

Dividend Growth Streak: 9 years

Payout Ratio (Earnings): 13.50%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 19.44%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

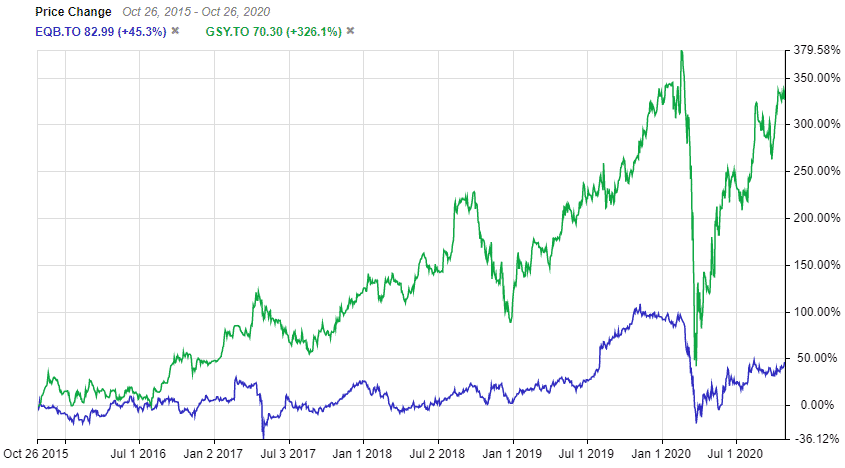

If we look at the chart above, it’s clear that Goeasy has outperformed Equitable Bank by a significant margin over the last 5 years. However, Equitable Bank has been no slouch.

The only major financial institution in terms of banks to have outperformed Equitable Bank over the last 5 years is National Bank, and even then it is a fairly close race. All of the Big 5 Banks have underperformed when looking at the alternative lender, and we can clearly see it was beginning to see a surge in popularity in mid 2019 prior to the pandemic wreaking havoc.

While a company like Goeasy Ltd has surged back to near 2020 highs, Equitable continues to struggle, and I’d attribute most of that to its exposure to the Canadian housing market and a drop in earnings.

During the height of the pandemic, the bank posted a double digit EPS drop on a year over year basis and PCL’s (Provisions for Credit Losses), although lower than quarters prior, still remain higher than historical numbers.

But, I do like the growth in its digital segment, as it has seen a 46% increase in year over year deposits and a 52% increase on its overall customer base when looking at EQ Bank, it’s digital platform.

If you’re looking to take a position in the bank, this is the cheapest it has traded at on a price to earnings basis since mid 2019. Although never impossible, I can’t see the company cutting the dividend at any point. Once we get back to normal market conditions, prices today will seem like a bargain. Equitable Bank is a contrarian play, and one that I feel is relatively low risk.

Although it’s important to note that an investment in the company will require extensive patience, as we will more than likely continue down the path of ultra-low interest rates for a couple years at minimum. Some investors look towards other industries due to the low-interest environment for financials at the time of writing, our well known operators such as Canadian National Railway (TSE:CNR).

Is Equitable Bank the best play in terms of alternative lenders? I’d say no, it would be difficult to take that title away from Goeasy considering it’s past performance. But this is still a company you don’t want to be overlooking moving forward.