Is Dollarama Stock Still a Buy After It’s Massive Runup?

Dollarama has been making waves in the Canadian market lately.

The company’s share price is up 44% YTD, and many investors who believed the company had soaked up a lot of the spending shift in Canadian consumers were no doubt wrong. At least thus far.

I’m always on the lookout for companies with strong growth potential, and I can tell you right now it’s rare to see this from a defensive retailer.

However, people tend to flock to discount stores when budgets are tight, and Dollarama seems to be capitalizing on this trend.

But is Dollarama stock a good buy right now? That’s the million-dollar question.

We need to look at the company’s fundamentals, growth prospects, and how it stacks up against competitors.

Key Takeaways

- Dollarama’s stock has shown impressive growth, outperforming many North American stocks

- The company’s success is tied to the growing trend of discount shopping in Canada

- It crushes its competition in nearly every financial metric

Q2 Earnings – Stellar results yet again

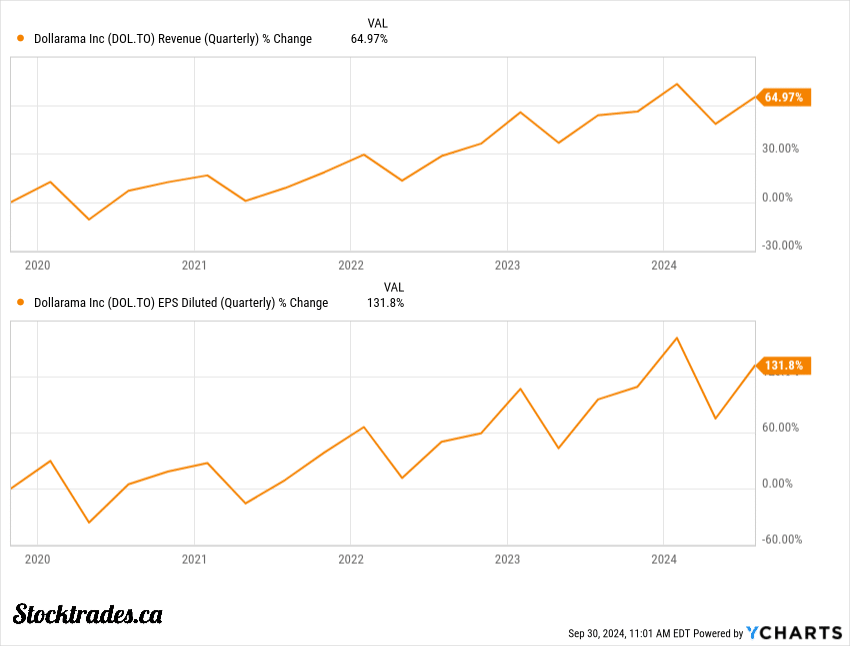

Dollarama’s sales increased by 7.4% to $1,563.4 million. This growth is noteworthy, especially considering the company’s huge growth last year.

This is highlighted even more in its same store sales, which grew by 4.7%. I find this particularly encouraging as it builds upon strong 15.5% growth in the same period last year. This suggests Dollarama’s value proposition is catching on with a ton of Canadians.

EBITDA saw a significant jump at 14.7% to $524.3 million. The company’s EBITDA margins improved to 33.5% from 31.4%

Diluted earnings per share rose 18.6% to $1.02.

The 7.0% increase in transaction numbers despite a slight 2.2% decrease in average transaction size tells me one thing: more customers are visiting the stores, but likely spending less on discretionary items and more so essentials.

There wasn’t much to dislike about the quarter, to be honest.

The shift to discount stores is a permanent trend in my opinion

I believe the move towards discount stores isn’t just a passing fad. It’s here to stay.

As Canadians, we’ve faced tough economic times lately. High interest rates, inflation, and an unsustainable rise in housing costs have caused many people to be on the brink in terms of financial health.

This squeeze has changed how we shop. We’re not splurging like we used to. Instead, we’re hunting for bargains.

Lets look at the retail picture for Canada. You’ll notice the numbers are poor, despite Dollarama’s numbers being outstanding:

- Retail spending fell 0.8% in May 2024. I’m mentioning May because it was the most notable drop recently

- It’s dropped 1.2% since the start of the year

- When adjusted for inflation, it’s down 11% since early 2022

I think this trend will stick around. Even if the economy improves, we’ve learned to be thrifty. We have to to survive in what I would certainly call a cost of living crisis.

In my view, discount stores like Dollarama and Loblaw are well-positioned for the future. They offer the value we now crave.

As long as budgets are tight, these stores will likely keep thriving.

The best out of its competitors, by a landslide

I believe Dollarama stands out as the most efficient dollar store compared to Dollar Tree and Dollar General. Its business model is simply brilliant.

Dollarama focuses on fewer products, keeping less inventory. This strategy allows for significantly higher margins than its competitors. I’m talking barely break even operating margins for Dollar Tree and Dollar General to 26%+ operating margins for Dollarama.

Let’s look at some key advantages Dollarama has over Dollar Tree:

- Higher price points (up to $5)

- Better store layout and product organization

- Stronger presence in smaller urban areas

- More diverse product mix

The numbers don’t lie. While Dollar Tree and Dollar General post poor results amidst an environment where consumers are desperate to save money, Dollarama continues to excel.

Valuations are expensive, no doubt

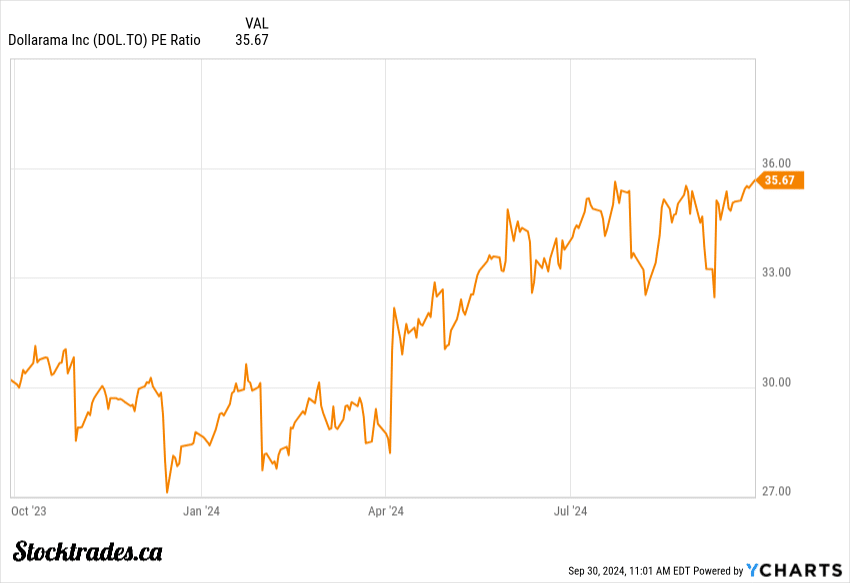

The company’s trailing P/E ratio sits at a lofty 35.45, which is well above what I’d typically consider reasonable for a defensive retail stock.

Even looking forward, the picture doesn’t change much. The forward P/E of 29.85 suggests that the market expects continued strong growth from Dollarama. But can they deliver on these high expectations?

Dollarama’s stock has outperformed the S&P 500 over the past year, with a 46.83% increase compared to the index’s 33.81% gain. This impressive performance has likely contributed to the current high valuations. Investors tend to chase gains.

Despite these rich valuations, I believe there’s a case to be made for Dollarama’s continued success. If the shift in consumer behavior towards value shopping is indeed permanent, Dollarama could very well grow into its current valuation.

Increased foot traffic from cost-conscious Canadians could drive sustained revenue growth and justify these premium multiples.

In my view, Dollarama needs to keep executing flawlessly to maintain its current valuation.

Would I buy the stock today?

Dollarama stock is a bit pricey right now. But, it does get promising to a degree if you look at the future.

Shopping habits have changed a lot lately. More folks are hunting for bargains, and Dollarama is right there to meet that need.

If you think long-term like me, this stock could be a smart buy. Dollarama plans to grow to 2,000 stores, and I have little doubt they’ll execute on that.

But keep in mind, the stock might be a bumpy ride. High valuations can lead to more ups and downs in the short term.

I’d say if you can stomach some volatility and have patience, Dollarama could be a solid addition to your portfolio.

Just remember, it’s crucial to do your own research and consider your personal financial goals before investing.