Has Dollarama Stock Run Up Too Much, or Is It Still a Buy?

Key takeaways

Dollarama’s stock shows strong growth but potential overvaluation risk

Expansion strategy boosts revenue but market saturation concerns loom

Investors must weigh premium pricing against Dollarama competitors

3 stocks I like better than DollaramaDollarama has carved out a unique niche in Canada’s retail landscape, offering bargain-hunting shoppers a treasure trove of affordable goods.

As a leading dollar store chain, Dollarama’s stock has caught the eye of many investors looking for growth in the discount retail sector. But is this retail giant still one of the best Canadian stocks to buy today?

Dollarama’s recent financial performance suggests the company is firing on all cylinders, with net sales rising 5.7% to $1.56 billion in the latest quarter. This growth, coupled with an impressive 6.5% increase in earnings per share, paints a picture of a company that’s not just surviving but thriving in a competitive market.

Yet, as with any investment, the devil’s in the details. We need to look beyond the shiny surface to truly gauge whether Dollarama’s stock is worth its current price tag, as valuation is ultimately key to higher returns.

Dollarama’s Earnings Signal Potential Overvaluation

Dollarama’s recent financial performance has been impressive, but I believe it may be signaling potential overvaluation. Let’s dive into the numbers.

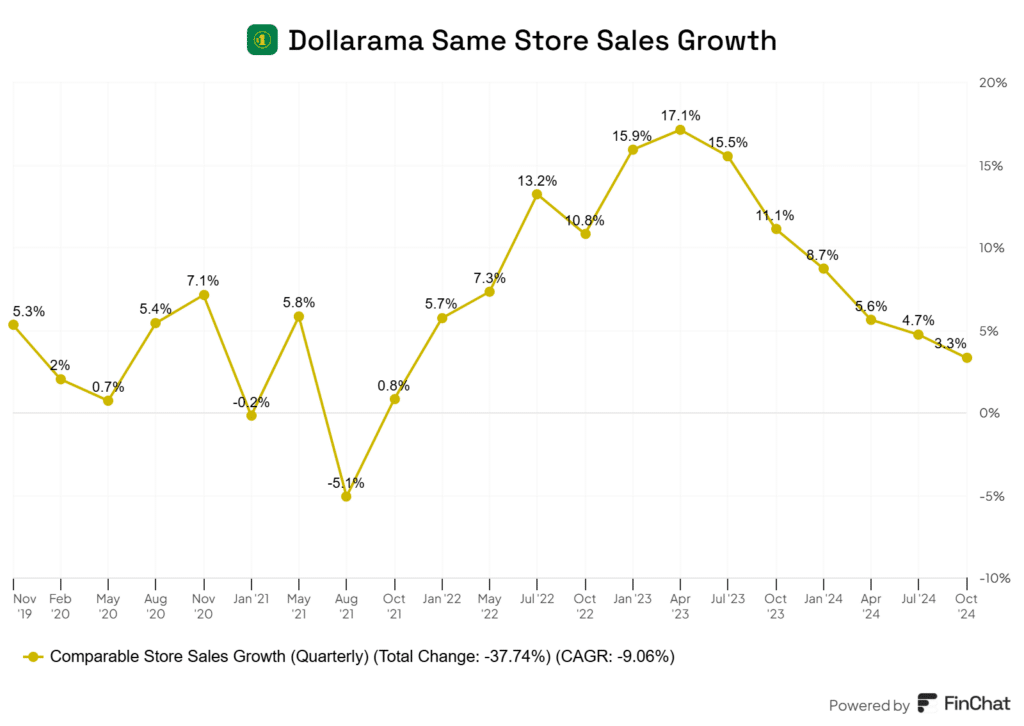

The company’s net sales increased by 5.6% year-over-year in Q3 2025. This growth is solid, but not extraordinary given the company’s current valuation. When we look to same store sales growth, they grew by 3.3%, which is notably lower than the double digit growth it was reporting last year.

Although we can’t expect the company to keep up with 2023 levels of growth, the consistent slide in same store sales growth right now is certainly concerning.

Earnings per share came in at C$0.98, beating analyst estimates of C$0.97. While this is positive, it is one of the lower beats on earnings it has had in a while.

Consumer demand for discounted products remains strong, which is good news for Dollarama. However, I worry this might already be priced into the stock.

Logistics and freight costs are a wild card, especially with volatile energy prices. If they increase significantly, it could eat into Dollarama’s bottom line.

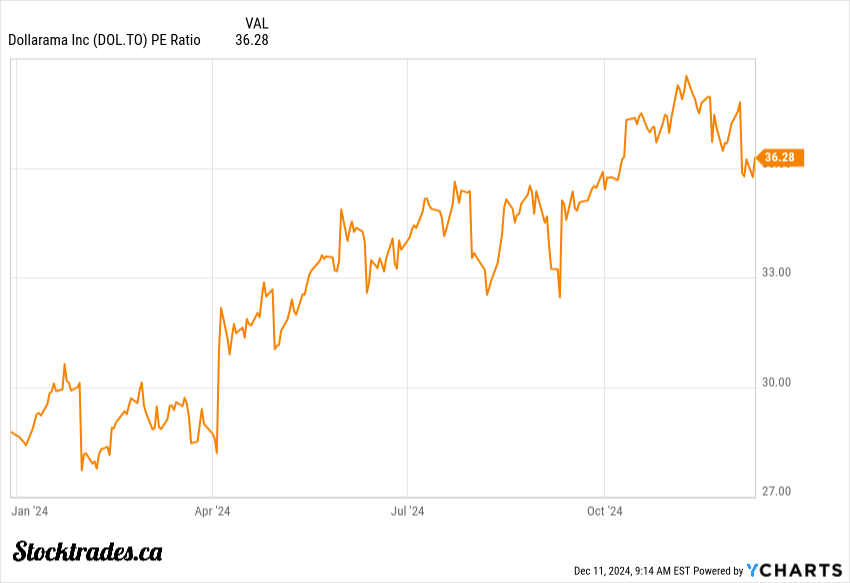

The company’s price-to-earnings ratio of 34.9 gives me pause. This premium valuation suggests investors might be too optimistic about future growth.

I believe Dollarama is a well-run company, but at current prices, I’m not convinced it offers good value for investors. The stock’s upside potential over the next few years may have been absorbed at this point in time.

Will Potential Trump Tariffs Impact Revenue?

I believe the proposed Trump tariffs could significantly impact Dollarama’s revenue. Trump’s suggested tariffs of 10-25% on all imports and tariffs on Chinese goods would likely hit Dollarama hard.

Dollarama sources many products from China. Higher import costs would force tough choices:

• Absorb costs, reducing profit margins

• Raise prices, risking sales declines

• Find new suppliers, disrupting the supply chain

I reckon consumer prices would rise, potentially driving customers to competitors. The National Retail Federation estimates Trump’s tariffs could cost Americans $78 billion in spending power. This definitely creates a headwind for discount retailers like Dollarama.

Supply chain impacts could be severe as well. Finding new low-cost suppliers to replace Chinese manufacturers would be challenging and time-consuming. Mexico and Canada might offer alternatives, but likely at higher prices.

I’m concerned about Dollarama’s ability to maintain its low price points. Even small price increases could deter budget-conscious shoppers, leading to reduced foot traffic and sales.

Profit margins would almost certainly take a hit. Dollarama might need to renegotiate deals with suppliers or find efficiencies elsewhere to offset higher costs.

While some argue tariffs could boost domestic manufacturing, I don’t see this benefiting Dollarama in the short term. The company relies heavily on imported goods to stock its shelves.

In my view, Trump’s proposed tariffs pose a serious threat to Dollarama’s revenue growth and profitability. The company may need to rethink its business model to adapt to this potential new reality.

Despite Higher Valuations, Dollarama is the Premier Dollar Store Operator

I know I’ve been critical of the company’s valuation through the article, but Dollarama stands out as the top player in North America’s dollar store market, and it’s not even close. Its market share continues to grow, even as the company expands its store network across the country.

I’m impressed by Dollarama’s competitive edge. The company’s efficient operations and smart product offerings have built strong consumer loyalty. This translates into higher same-store sales compared to competitors and much higher margins.

While Dollarama’s stock may seem pricey, I believe the premium is somewhat justified.

Dollarama’s success comes from its unique approach. Unlike Dollar Tree, which sticks to a strict price point, Dollarama offers products at various price levels. This flexibility allows for a wider range of items and higher profit margins.

The company’s operational efficiency is noteworthy. Dollarama maintains tight control over costs, resulting in better operating margins than many peers. This efficiency supports its ability to offer competitive prices while maintaining profitability.

In my view, Dollarama’s current valuation reflects its position as a market leader. While the stock trades at a premium, I believe the company’s growth prospects and strong fundamentals make it a compelling investment in the dollar store sector.

Am I Looking to Pay a Premium to Add to the Company Today?

Dollarama’s forward price-to-earnings ratio of 31 suggests a hefty valuation. Trailing price to earnings is even higher at 36x.

This P/E ratio is notably higher than many retail peers. It indicates investors expect strong future growth from Dollarama. Its margin profile is also much better than its peers which ultimately leads to higher free cash flow generation. As a result, it’s going to trade at a premium. But is the premium too much? I think so at this point in time relative to its growth.

The price-to-sales ratio of 6.39 also points to a premium valuation. This means you’d be paying over $6 for every dollar of sales the company generates.

Dollarama’s stock has performed well, with a 52-week range of $89.93 to $152.97. The current price sits near the upper end of this range.

There are risks to consider:

- High valuation leaves little room for disappointment

- Economic downturns could impact consumer spending

- Increased competition in the discount retail space

Potential rewards include:

- Continued expansion of store count

- Strong brand recognition in Canada

- Resilient business model during economic uncertainty

Dollarama’s beta of 0.54 suggests lower volatility compared to the overall market. This could be appealing for more conservative investors, especially paired with relatively consistent growth.

In my view, while Dollarama is a quality company, the current valuation gives me pause. I’d prefer to wait for a more attractive entry point before adding to my position.