Enbridge or Pembina Pipeline? Which Canadian Stock is Best

If there is one thing that many Canadian stocks are known for, it’s providing rock solid income. What industries in particular are deserving of this reputation? A fairly sure bet among Canadian dividend stocks over the last few decades has been the pipeline companies.

There are many pipeline stocks here in Canada, but the debate is often between a select few on the TSX Index. In this article, we’re going to narrow down the focus on two of the most popular pipelines in Canada, Enbridge (TSE:ENB) and Pembina Pipeline (TSE:PPL) and figure out which stock is best today.

What do Pembina (TSE:PPL) and Enbridge (TSE:ENB) do?

Pembina Pipeline and Enbridge are both mid-stream pipeline companies here in Canada.

With a market cap of just over $103B, Enbridge is much larger than Pembina Pipeline which sports a market cap of just over $22B.

The sheer size of Enbridge is amplified even further when we realize the company transports over 25% of North America’s crude oil and over 20% of the natural gas consumed in the United States.

Enbridge might be the blue-chip option, but Pembina is no slouch either. The company has over 3.1M barrels per day of hydrocarbon pipelines and 6.1B cubic feet per day of gas processing capacity.

Both companies are well established, and have the economic moats needed to be considered strong income plays in todays environment.

Pembine Pipeline vs Enbridge dividend, which stock is best?

What do they yield?

Important to note (especially those learning how to buy stocks), even though this should be one of the last things you look at in terms of the dividend, it is the question many ask first.

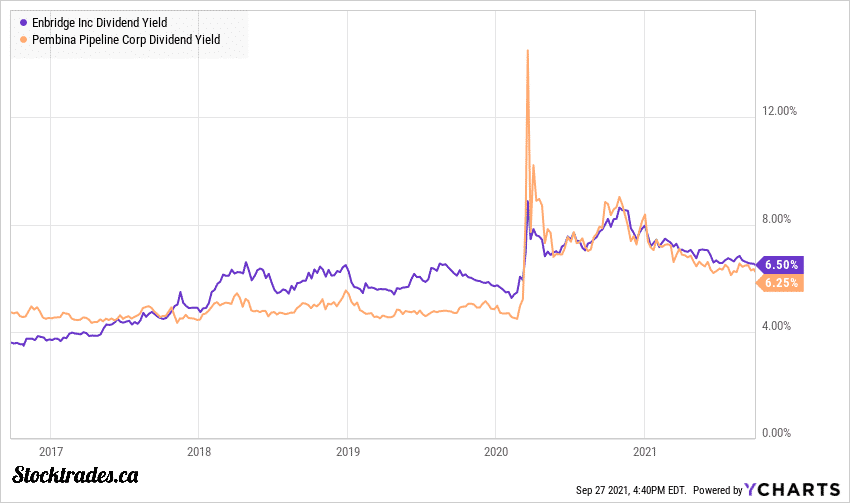

With a dividend yield of 6.25%, Pembina Pipeline yields around the same as Enbridge, give or take 0.25%.

This wasn’t always the case however, as pre-COVID Pembina typically trailed Enbridge by a reasonable margin as you can tell in the chart.

When we look to dividend growth, at least over the last half decade or so, Pembina has also trailed in this regard. Enbridge is the king of dividend growth in Canada when it comes to pipelines, with a dividend growth streak of 25 years and a 5 year dividend growth rate of 11.74% annually.

Although Pembina Pipeline is a Canadian Dividend Aristocrat, its 9 year dividend growth streak and 6.96% 5 year annual dividend growth rate pales in comparison.

When we look to payout ratios, it’s important we ignore all traditional ratios and instead head to the company’s reports and determine their payout ratio in terms of distributable cash flow.

To close out 2021, Enbridge expects distributable cash flow to be in the $4.70 to $5 range. With a $3.34 dividend, this puts the company’s payout ratio at 66.8%. For Pembina, it plans to pay out just over 72% of distributable cash flows towards its dividend.

All in all, both of these dividends are excellent options, well covered by DCFs. I have to give the slight edge to Enbridge considering its longevity in terms of growth, faster growth rates, and a higher buffer in terms of payouts.

Which one is best for forward outlook and valuation?

No matter how solid the dividend, we do need to consider the current valuation of the company as well.

Let it be known, both of these companies are cheap, and I’d be happy owning either at these price levels, at the time of writing. Pipeline companies along with oil and gas producers are still trading at discounts due to negative sentiment, and might continue to do so in the future. But we have to remember we’re buying an underlying business here, one that is pretty sound.

Pembina is trading at 17.3 times forward earnings and at a 5% discount to its historical averages. Enbridge is trading at around 18.3 times earnings, but often commands a premium due to its reliability, and is trading at a 17% discount to historical averages.

Overall, I find Enbridge the more attractive option right now from a valuation standpoint, especially considering you’re paying nearly the same earnings multiple for a much longer history, larger economic moat, and more attractive dividend.

Although we stress that high yields don’t tell the whole picture, Enbridge does tend to make the lists of high yielding Canadian dividend stocks.

In terms of forward outlook, I think the future is bright for both these companies, as they have both been able to deploy capital wisely to expand infrastructure and continue to drive cash flow growth.

Enbridge’s growing renewable profile is starting to look attractive, while Pembina has been notorious for completing capital projects on time, and on budget.

Pembina currently has $1.690B in capital projects underway and has the potential to add over $4B to the pipeline in the future. Enbridge on the other hand is looking to enhance returns from its existing businesses.

Overall, both of these Canadian dividend stocks are outstanding options

I think the growth prospects and current income are attractive enough that it makes sense to own either of these Canadian pipeline companies at current prices. And, I do feel that total returns for both of these companies will be similar in the future.

Enbridge brings with it a large and growing renewable profile along with one of the biggest economic moats in the country. However, Pembina Pipeline is well known for completing expansion projects on time and on budget, and could drive stronger cash flow growth moving forward.

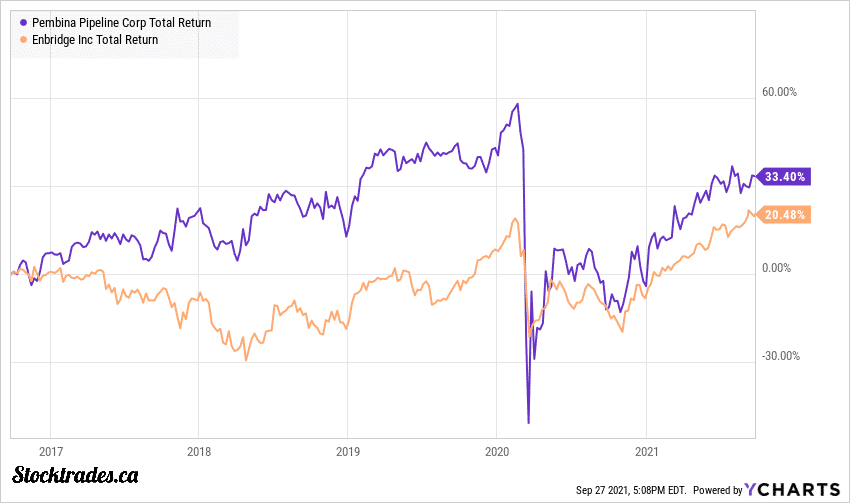

Both of these companies provide extremely reliable cash flow due to take or pay contracts, and trade at relatively the same multiples valuation wise. Pembina has been known to outperform Enbridge by a wide margin in terms of overall growth, but Enbridge provides that blue-chip like cushion.

The choice of what you want to expose yourself to is ultimately up to you. What I’m here to tell you is that both of these companies make sound investments, and likely will moving forward.