Enbridge Stock – Is This Passive Income Giant a Buy Now?

Enbridge stock has caught many investors eyes recently as it approaches 2022 highs, and I’ve been digging into the company’s financials and growth prospects.

As a major player in North America’s energy infrastructure, Enbridge has a lot to offer investors, primarily those who are focused on income.

The company’s stock price currently sits at attractive valuations despite rising share prices. It also offers a juicy dividend yield that’s hard to ignore.

I’m particularly impressed by Enbridge’s strong position in the energy sector. With its vast network of pipelines and renewable energy assets, the company is well-positioned to benefit from the ongoing energy transition.

But what really excites me is Enbridge’s focus on growth and its commitment to maintaining a solid balance sheet, a concept many high debt Canadian stocks have struggled to do (looking at you, BCE).

While some investors might worry about the volatility in energy markets, I think Enbridge’s diversified business model helps protect it from major shocks. The company’s steady cash flows and history of dividend growth make it an appealing option for income-seeking investors.

Lets dive a little deeper.

Key Takeaways

- Enbridge offers a high dividend yield and blue-chip style growth potential

- The company’s take or pay contract structure shelters it from volatile oil prices

- Enbridge’s focus on sustainability aligns with long-term industry trends, including shift to renewables

Q2 Results – Promising amidst volatile commodity markets

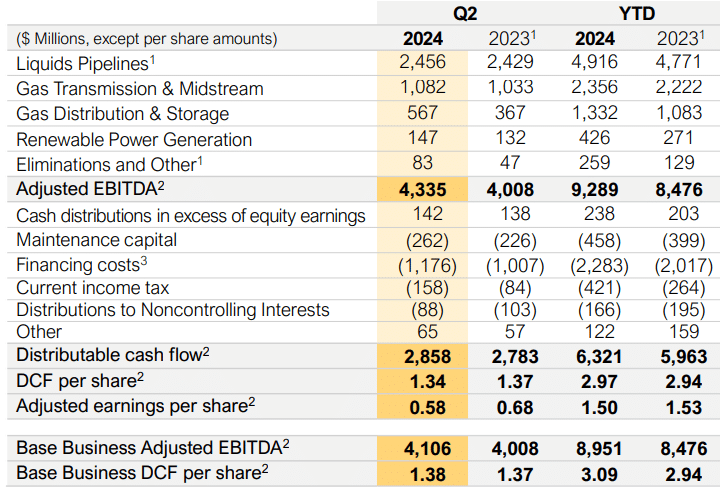

Enbridge’s Q2 2024 results are quite impressive, given the turbulent commodity markets. The company reported earnings of 58 cents per share, right in line with analysts’ expectations.

Distributable cash flows showed a solid increase compared to the same quarter last year, which is arguably the most important metric for the company overall. They came in at $2.85B, ahead of the $2.78B it reported in 2023.

Through the first 6 months of 2024, distributable cash flows grew by just under $400M to sit at $6.3B.

Why am I speaking so much on distributable cash flows? I’ll get to that in the dividend section.

Overall, every segment of the business is realizing year over year growth, but also 1st half growth relative to 2023.

The company continues to aim to grow distributable cash flows at a 3-5% range, all while providing that level of dividend growth moving forward. This is nothing flashy, more so the “blue chip” style growth we’ve seen from Enbridge for decades. Slow, but steady.

Enbridge’s commanding position

Enbridge holds a dominant place in North America’s energy infrastructure. As the fourth largest company in Canada by market cap, it’s a true heavyweight in the energy sector and the country overall.

Enbridge’s pipeline network is truly impressive. It spans across the continent, connecting key oil and gas production regions to major markets. This vast network gives Enbridge a huge advantage over its competitors.

Not to mention entry in the space is nearly impossible considering the cash outlays a newer company must make to develop the infrastructure.

Here’s why I think Enbridge’s position is so strong:

• Extensive reach: Pipelines cover thousands of kilometres

• Best-in-class locations: Access to crucial energy hubs

• Diverse assets: Oil, natural gas, and renewable energy infrastructure

Is the dividend safe?

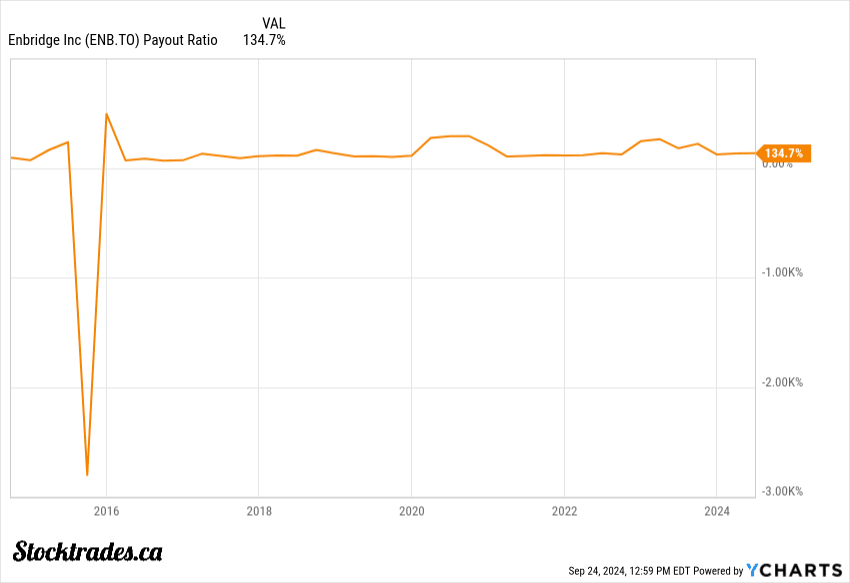

Enbridge’s dividend is on solid ground, despite some concerns. The payout ratio might seem a tad high at first glance, coming in at 134% of earnings, but that’s not the whole story.

In fact, if you’re avoiding this company solely based on a high earnings payout ratio, you’re making a huge mistake.

When it comes to pipeline companies like Enbridge, I prefer looking at the payout ratio relative to distributable cash flow (DCF). This gives a clearer picture of the company’s ability to keep those dividends flowing.

DCF is different for every company, but often accounts for things like maintenance CAPEX, non cash items, distributions made to non-controlling interests, and more.

Enbridge typically aims for a DCF payout ratio between 60% and 70%, and right now it is well within that target, generating $2.97 in DCF through the first 6 months of the year and paying out $1.83 in dividends.

Currently, Enbridge’s dividend yield sits at a juicy 6.6%. While high yields can sometimes be a red flag to someone who hasn’t dug all that deep, this isn’t the case here.

How will the company fuel growth moving forward?

As a blue-chip company, it’s unlikely to see massive growth spurts. This is something you have to come to expect with Enbridge.

That said, I believe Enbridge has some solid strategies up its sleeve:

- Expanding renewable energy projects

- Upgrading existing infrastructure

- Exploring new market opportunities

I’m particularly keen on their push into renewable power generation. It’s a smart move in today’s climate-conscious world.

I think investors should temper their expectations. We’re looking at modest but consistent growth here. It’s more tortoise than hare, but that’s not necessarily a bad thing, especially for those who simply want the income.

Is the company a buy today?

I think Enbridge is a solid choice for income-focused investors. The company offers a reliable cash stream that’s hard to ignore.

One of the biggest draws is Enbridge’s dividend safety. The company’s take-or-pay structure allows for consistent cash flows. This is music to the ears of dividend investors, as there is generally no surprises.

In a falling rate environment, I believe Enbridge should be able to provide steady growth. This is particularly appealing for those looking for stability in their portfolio.

That said, I personally prefer faster-growing smaller pipelines like Pembina Pipeline. I’m drawn to their potential for quicker expansion and possibly higher returns on capital.

However, this is me, and I am not you.

For those focused on income and stability, Enbridge is hard to beat. Its current valuation also makes it an attractive buy.

But if you’re after more growth and can stomach some extra risk, you might want to look at smaller players in the pipeline space.