Enbridge or Pembina Stock – Which Pipeline is Best in 2025

Key takeaways

- Enbridge’s larger size and broader diversification offer stability in volatile commodity markets

- Pembina’s smaller size may provide more room for growth and potential upside

- Both stocks offer attractive dividends, but investors should consider total return potential

Pipelines are a stable in an income investors portfolio. For many Canadians, the question is often Enbridge or Pembina Pipeline. Both companies have weathered their fair share of storms in the energy sector over the years, especially during the pandemic.

Enbridge, with its massive network spanning North America, is one of the blue-chip darlings on the TSX. Meanwhile, Pembina, though smaller, has carved out a strong niche in Western Canada’s oil and gas industry.

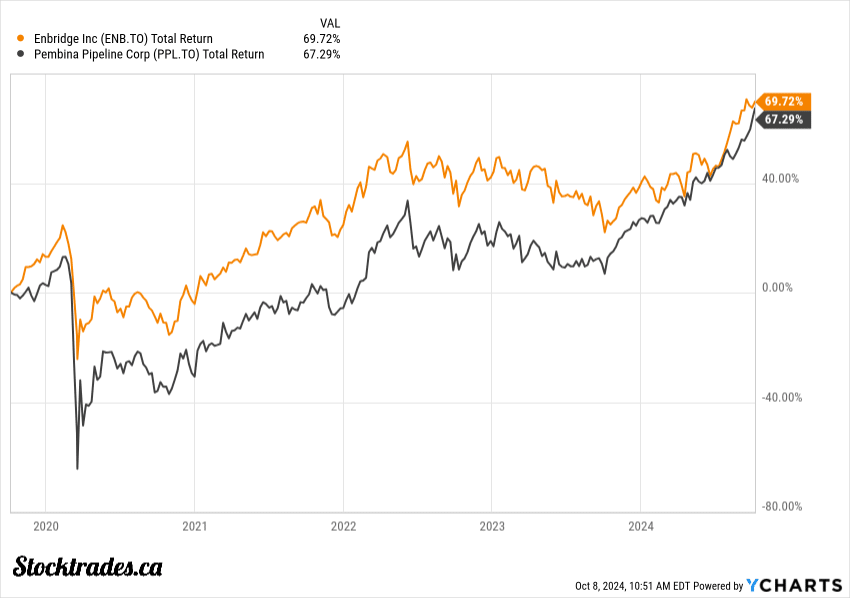

Enbridge stock has outperformed Pembina over the past five years, delivering higher total returns to investors. However, as you can see, the margin is razor thin.

Both companies are adapting to the changing energy landscape. Enbridge is increasing its focus on natural gas and renewable energy, while Pembina is diversifying its revenue streams beyond traditional pipeline operations.

Are these strategies paying off for shareholders?

Let’s take a deeper look at which stock might be the better buy today.

Comparing valuations: Which company offers better value?

Enbridge, with its massive $121B market cap, dwarfs Pembina’s $34B. This doesn’t necessarily make Enbridge automatically better, but there is no doubt it has a wider reach.

Lets look at some key valuation ratios when it comes to pipelines to get a birds eye view of which stock looks cheaper on the surface.

| Metric | Enbridge | Pembina |

|---|---|---|

| P/E Ratio | 21.29 | 17.85 |

| Forward P/E | 18.68 | 18.42 |

| P/B Ratio | 2.01 | 2.24 |

| EV/EBITDA | 13.61 | 14.52 |

Pembina’s lower P/E ratio suggests it might be slightly undervalued compared to Enbridge. However, their forward P/E ratios are nearly identical, indicating similar growth expectations.

Debt levels are another important factor. Enbridge’s debt-to-equity ratio of 1.31 is higher than Pembina’s 0.78, which might concern some investors. Pipelines are already heavily indebted. So, a lower debt to equity can highlight which pipeline is more efficient at driving shareholder value without having to utilize excess debt.

In my view, Pembina seems slightly cheaper and offers a more attractive debt profile than Enbridge. Although size here is a factor, I really don’t think it makes all that much of a difference. Pembina is still a dominant large-cap in the industry.

Market sentiment on each stock

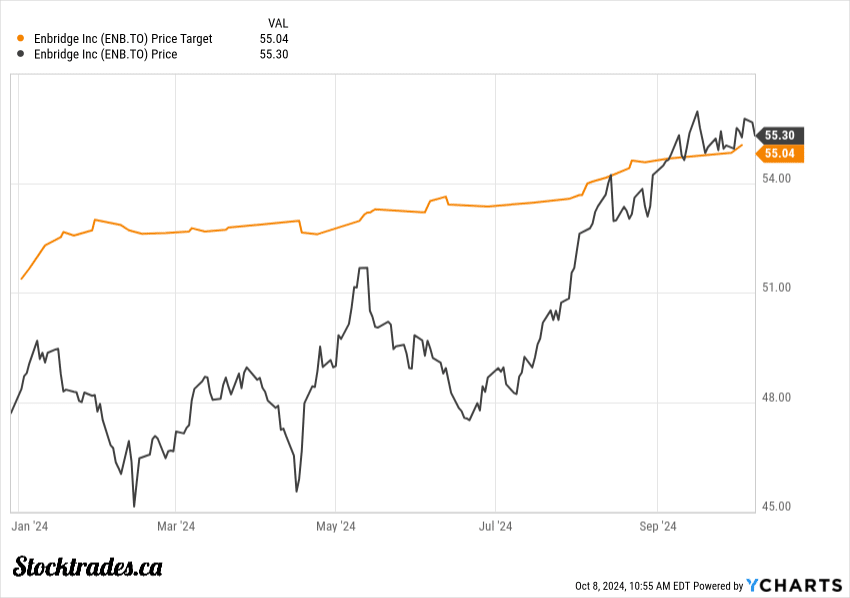

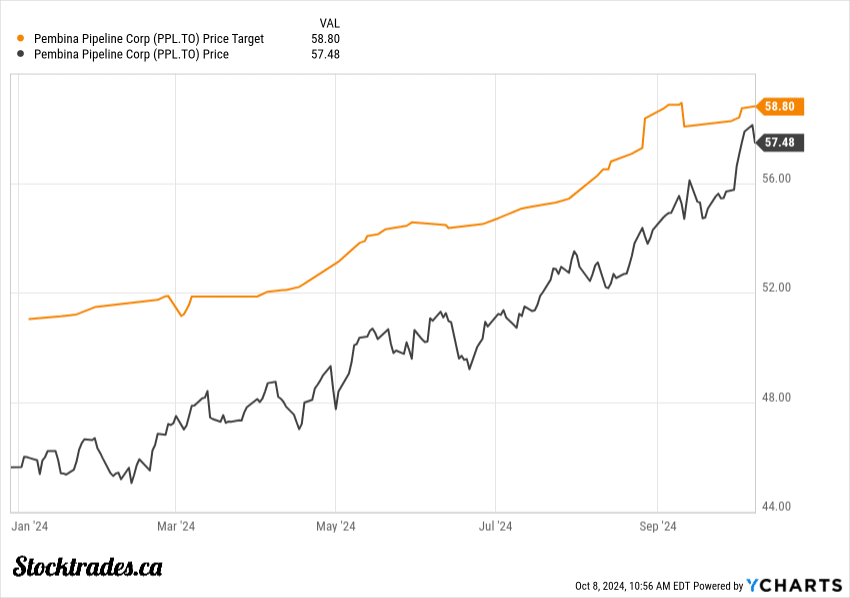

Analyst views paint an interesting picture of market sentiment. Both stocks have an average Outperform rating with median consensus price targets implying the stocks are currently fairly valued (upside potential <1%)

For Enbridge, many analysts seem cautiously optimistic. The stock has a “Buy” rating from several firms. Bulls point to Enbridge’s steady dividend growth and diverse energy assets. Bears worry about the company’s debt levels and regulatory hurdles for new projects.

Pembina Pipeline also has its share of fans among analysts. Some see it as undervalued compared to Enbridge.

Bulls like Pembina’s exposure to commodity prices, which could boost profits if energy markets stay strong. Critics argue this same factor makes Pembina riskier.

That said, both stocks have their merits. Pembina’s smaller size could mean more room to grow in a changing energy landscape. Meanwhile, Enbridge’s scale offers stability that some investors prefer.

Sentiment wise, it seems the market is a bit more bullish on Pembina.

Dividend strength: History, growth, yield, and sustainability

I find Enbridge’s dividend profile more compelling for income-focused investors.

Enbridge offers a higher dividend yield of 6.58%, which is notably attractive as interest rates start to fall.

Enbridge’s dividend growth streak is impressive, with 28 consecutive years of increases. The company has raised its payout by an average of 4.72% annually over the past 5 years. Although this isn’t world-beating dividend growth, this is also a very mature company, and we can’t really expect much more than this.

Pembina Pipeline, while solid, doesn’t quite match up. Its yield of 4.75% is good but not as enticing as Enbridge’s.

Pembina’s 5-year dividend growth rate of 3.11% is also lower than Enbridge’s, and the company lost its dividend growth streak during the pandemic. It has only started to raise the dividend again last year.

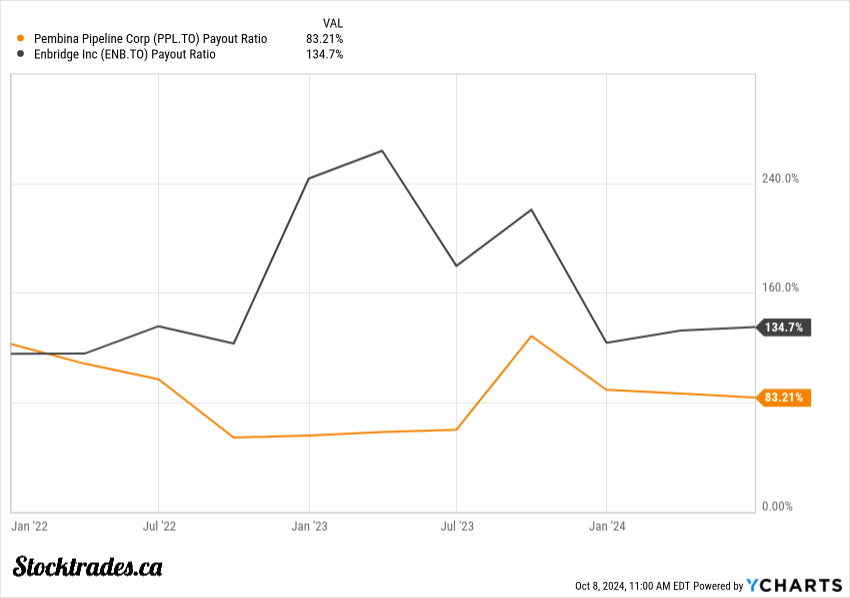

One area where Pembina shines is its payout ratio. At 60.51%, it’s much more conservative than Enbridge’s 134%. Keep in mind, most of these pipelines will use distributable cash flows to judge the safety of the dividend, and Enbridge’s is no doubt safe despite these payout ratios. However, if a company can cover the dividend on a GAAP earnings basis without any adjustments, that’s always a good sign.

For retirees seeking steady income, both stocks have merit. But from a pure income perspective, its hard to argue with Enbridge.

Pembina or Enbridge – Which stock wins in today’s market?

After weighing the pros and cons, I believe Enbridge stock has a slight edge over Pembina Pipeline in today’s market. But keep in mind, the edge is razor thin.

Here’s why:

- Enbridge offers a higher dividend yield, which is appealing for income-focused investors

- The company’s long history of dividend growth adds to its attractiveness

- Enbridge’s larger size and more diverse operations give it an advantage in terms of stability

- Its expansion into renewable energy projects also positions it well for the ongoing energy transition

That said, Pembina Pipeline shouldn’t be overlooked:

- The company’s expected capital investments of $730 million next year shows its commitment to growth

- Its smaller size could also make it a potential takeover target, which might benefit shareholders

For growth-oriented investors, Pembina might offer more upside potential. However, this comes with higher risk compared to Enbridge.

Considering current market conditions and economic uncertainties, I lean towards Enbridge for its defensive qualities and income potential. But both stocks have merit depending on individual investment goals. I wouldn’t blame investors for buying either option.