Index Funds Vs ETFs – What’s The Difference?

In a world where there is hundreds of investment strategies and thousands of investment products, it’s easy to get overwhelmed.

Often, investors will first try to learn how to buy stocks. After that becomes too cumbersome, they’ll shift to a more passive strategy like investing in index funds.

However, they’ll often hear that ETFs may be the way to go, as they provide lower fees and single click diversification. So, an investor might be left wondering what is the difference between index funds vs ETFs.

For the most part they are the same. But, there are some differences between particular types of index funds, which I’ll explain in this article.

Index funds vs ETFs – What’s the difference?

First, lets go over an index fund. An index fund is a mutual fund or ETF that tracks a particular exchange, with the ultimate goal of providing an investor with similar (but not identical due to costs) returns of the underlying index. If a stock market index gains 10% in a single year, it’s likely an index fund tracking that stock market index may post returns of 9.90%, or even better.

An ETF however, is a basket of stocks, commodities, bonds, or any other type of investment that is passively managed. The passive management of these ETFs results in less transactions and less portfolio turnover. As a result, the management expense ratios they charge to the investor can be significantly less than that of a mutual fund, for example.

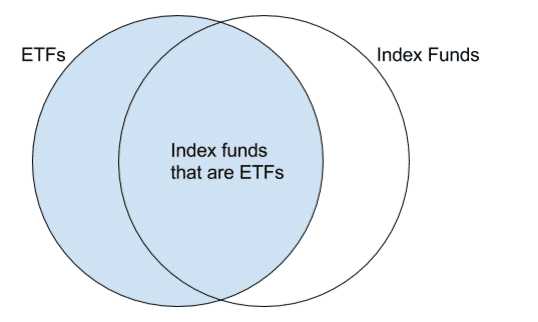

An index fund can be an ETF or a mutual fund. Now, this may sound super confusing at first. But, the easiest way to highlight this is to use this Venn diagram.

I mentioned that an ETF can be a basket of stocks. Well, that basket of stocks can represent an underlying index.

And as a result, there are many index funds that are ETFs. But, not all index funds are ETFs. In fact, some index funds are mutual funds.

An index fund is a strategy, an ETF is a legal structure

This is a particularly important point to take away from this article, and one that investors often confuse.

An ETF that tracks a particular index, by all means, is still an ETF. Its overall strategy is to replicate a particular index, and as such it is often deemed an index fund.

But in terms of structure and the ability for investors to trade ETFs, there is no difference between say the iShares S&P/TSX 60 Index ETF (TSE:XIU), which tracks the performance of the S&P/TSX 60 Index, and an ETF that simply contains a random grouping of stocks, holds commodities, or uses leverage.

The same can be said about an index fund that operates as a mutual fund. The strategy of the mutual fund is to track a particular index, while the overall structure of the mutual fund varies significantly from an ETF.

For example, you may have both a mutual fund and an ETF that track the S&P/TSX 60 Index. The ETF index fund will trade much like a stock. As long as their is significant liquidity, you’ll be able to buy and sell whenever the markets are open.

However, with an index mutual fund, due to the structure of the fund itself, if you decided to sell a fund at 10 AM, the fund would wait until the end of the day, figure out its net asset value per unit, and then proceed with the transaction.

You can see how two different “index funds”, tracking the exact same thing, are in fact two different products.

Which is better, index fund or ETF?

This is a question I get asked way too often. And again to come up with an answer is, somewhat awkward until a person learns what exactly an ETF is.

Now, if you were to ask me what is better, an ETF index fund or a mutual fund index fund, then I’d have an answer for you.

And in my eyes, there is almost no reason to be purchasing a mutual fund over an ETF in this day and age.

Why I prefer ETF index funds over mutual fund index funds

We’ve figured out that an index fund is simply a strategy, and it can be both a mutual fund or an ETF. Now we need to decide what is the better option.

Moving forward, I can’t see any logical reason to choose a mutual fund over an ETF if you’re looking to take an indexing strategy. Here’s a few reasons why…

ETF index funds are significantly cheaper

There are some ETFs that track underlying indexes that can be purchased for a 0.10% annual fee. Most mutual funds that take an indexing strategy are, although coming down recently, still in excess of 1%. There is absolutely no reason why you should be paying this much money for a fund to track a broader index.

Mutual fund sellers have often touted the fact that their fees are worth it, due to the fact they are actively managed, and can earn more. With an index fund however, the only time a transaction takes place, is when the structure of the index changes.

ETF index funds trade like stocks

This has to do with the overall legal structure of either an ETF or mutual fund. An ETF trades much like a stock. It has a total number of units outstanding, can have an IPO, and can even purchase back units.

A mutual fund is a type of open-ended fund that is seemingly in a never-ending state of IPO. New shares can constantly be purchased from the fund, and the fund can redeem shares from those looking to cash out as well.

The unfortunate thing about this is when you’re looking to sell your index fund, if it is a mutual fund style index fund, you’ll need to wait until the end of the day to do so. This is because a mutual fund’s net asset value is calculated at days end. So while an ETF has a consistently changing price throughout the day, a mutual fund does not.

ETF index funds are more tax efficient

I’m not going to go into how exactly a mutual fund and an ETF are structured, as that is an entirely different article in and of itself.

However, what you need to understand is when you want to sell an index ETF, you simply sell it on the open market to another investor. You pay a capital gain or have a capital loss, if its in a taxable investment account that is.

With a mutual index fund, when you want to redeem your units, the fund doesn’t sell them to another investor. Instead, they sell the stocks or whatever other investment the fund owns to pay back the person asking for redemption of their units. When this happens, a taxable event is triggered inside of the fund and is passed on to all unitholders.

Overall, the difference between index funds vs ETFs is a comparison that has no answer

I’ve had enough investors come to me and ask:

“I’m a passive investor, should I be buying index funds, or should I instead go with ETFs?”

To the point where I felt I needed to make this article, because they would benefit immensely by knowing that they are, in a lot of cases, one and the same.

The most important thing you can take away from this article is that index funds are an investment strategy while things like an ETF or a mutual fund are a legal structure.

When debating whether or not to choose from a mutual fund or ETF that deploys an indexing strategy however, in my eyes it is a no-brainer for investors to choose the lower cost, more tax efficient and significantly more liquid exchange-traded-fund.

They’ve been taking the investment world by storm as of late, and will continue to do so for the foreseeable future.