Facedrive (TSEV:FD) – Will Shareholders Recover Staggering Losses?

The rise and fall of speculative Canadian stocks during the COVID-19 lockdown will likely be documented for decades. Whether it be speculative Canadian renewable plays, electric vehicle companies, or simply just good old fashioned pump and dumps.

One that Canadians in particular will remember for many years to come, especially those who bought it at its peaks, is Facedrive (TSEV:FD).

For those who are still holding, there are many questions about the future potential of this company and whether or not it can rebound to euphoric highs witnessed in 2020.

In this piece, I’ll try to answer that question as best I can, and if you’re a current shareholder, you likely won’t be happy.

What exactly does Facedrive (TSEV:FD) do?

Generally, this area of the post is reserved for explaining the business model of the company in a few sentences. Unfortunately with Facedrive, it would require much more than that.

The company was founded in 2016 and started out as a ride sharing business in late 2018. During that period, it made around $14,000 in revenue.

The company has a mix match of business models, ranging from the aforementioned ride sharing platform, food delivery services, contract tracing, Facedrive Marketplace, Facedrive Health, and even dabbling into the EV space.

It’s difficult to tell where this company really excels, and a cloudy business model that seems to be tossed together with COVID-19 related momentum industries like contact tracing, food delivery, and EV should worry some investors.

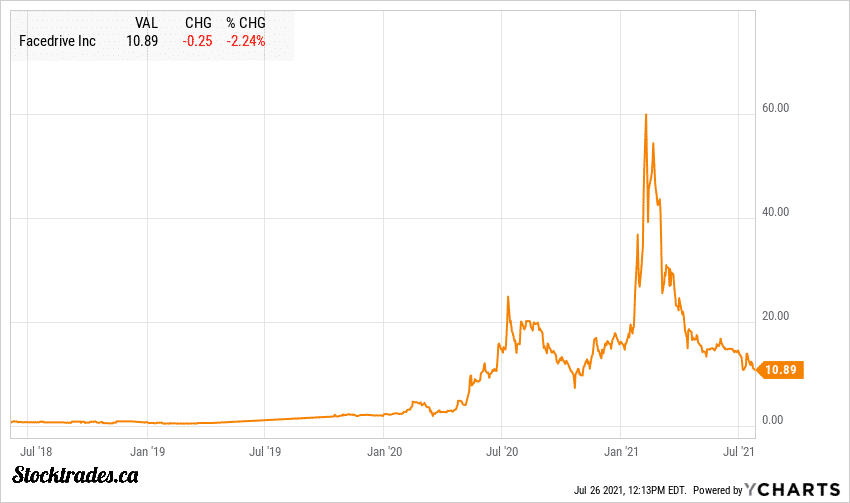

Parabolic share price growth, despite little underlying value

At its peak, Facedrive was trading at an absolutely astonishing 2600 times EV/Revenue ratio, as the company had a near $4.5B valuation in early February despite posting less than $3.7M in revenue over the previous 12 months.

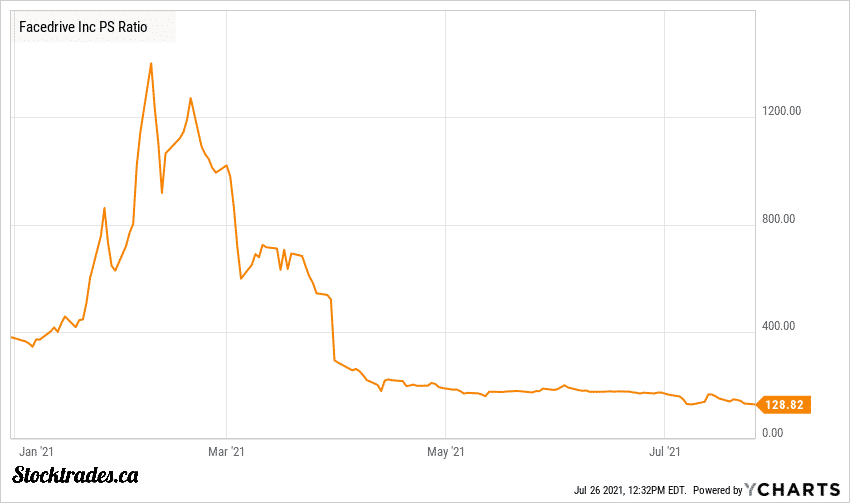

This put the company’s price to sales ratio at a yet again staggering 1250~ times, which is simply unfathomable to me how any investor would pay that price.

In order for Facedrive to justify its valuation, it would have likely needed to be one of the fastest growing companies in North America. And, it isn’t even remotely close. As we can see from the chart above, the company is still trading at 128 times trailing sales.

This is more than double the valuations of a company like Shopify at its peak. The major difference? Shopify has a clear business model, and a business that has been growing at a triple digit pace over the last half decade.

The company provides next to no competitive advantage

When looking for growth companies, I look to those who have the chance to disrupt the market with innovative technologies.

It’s ride sharing service along with its offering of electric vehicles is inferior to a company like Uber and its Facedrive Foods segment doesn’t fill me with any sort of confidence it will take market share from something like Skip the Dishes.

Overall, on the surface this looks to be a mix-match of business models, none of which are providing any sort of “wow” factor that justifies the valuation of the company even at today’s levels, which are 82% off highs.

Aggressive promotions and momentum sent this stock soaring

As I had mentioned earlier in the article, it seems like Facedrive was targeting popular COVID and environmental business models, ones that have a “futuresque” ring to them.

In return, unknowing investors bought in to this company of the “future” with almost no idea of what they were truly paying for, or how much this company was actually making.

Whether it be paid articles on high traffic websites with pump-and-dump like disclaimers or Youtube promotions, the company took a highly aggressive approach to promoting not its products, but simply its stock.

Overall, it’s highly unlikely we see Facedrive get even remotely close to peak valuations

Not only is this company’s business model cloudy, but it brings with it the uneasiness of what looks to be an early 2021 pump and dump.

Although nothing has been confirmed, there are numerous conversations about the potential fraud inside of this stock. For that reason alone I believe valuations will remain somewhat depressed moving forward.

I still view Facedrive in the low $10 range as an egregiously expensive growth stock, and as such in my opinion I don’t believe the company will ever get anywhere near its peak $60~ we witnessed in early 2021.

The company is increasing revenues, but not at a pace that even justifies its valuation right now, let alone at its peaks. And operating expenses are ballooning just as fast as revenue, which makes me hesitant to think this company will ever turn the corner.

Overall, it seems to have its set of die hard believers, but I am far from one of them. This is a shining example of how asset allocation is the most important factor to consider with investing. If an investment in Facedrive was the proper 0.5-1% of your portfolio we advocate to Stocktrades Premium members, this loss is completely manageable.

However, the euphoria of early 2021 had investors making some significant, and potentially life changing decisions, an investment of Facedrive at its peaks being one of them. This is an investment I feel investors will likely never recover.