Fortis (TSE:FTS) Dividend & Stock Analysis

If we’re looking for strong Canadian dividend stocks, there are a few industries that come to mind in Canada that provide enough of an economic moat to have consistent dividends and dividend growth.

Telecoms (companies like Telus) are some, pipeline companies being others as well…

The third group and probably the most important is utilities companies. In fact, if we look over some of the longest dividend growth streaks in the country, they’re all utilities. In particular, Fortis (TSE:FTS), carries the second longest streak in the country.

So, what makes Fortis such a strong option as a dividend play? Why is the company’s dividend so safe, and how will the company do despite poor economic outlook?

Let’s take a look.

Fortis (TSE:FTS) dividend and stock analysis

Fortis is a top 15 utility company in North America and has operations in Canada, the United States, and the Caribbean.

The company currently has over 3.3 million electricity and gas customers and has over 16,000 miles of high-voltage transmission lines in operation south of the border.

It’s one of the more well known utilities here in Canada, and operates in an industry that is highly regulated, leading to extensive barriers to entry and stable revenue.

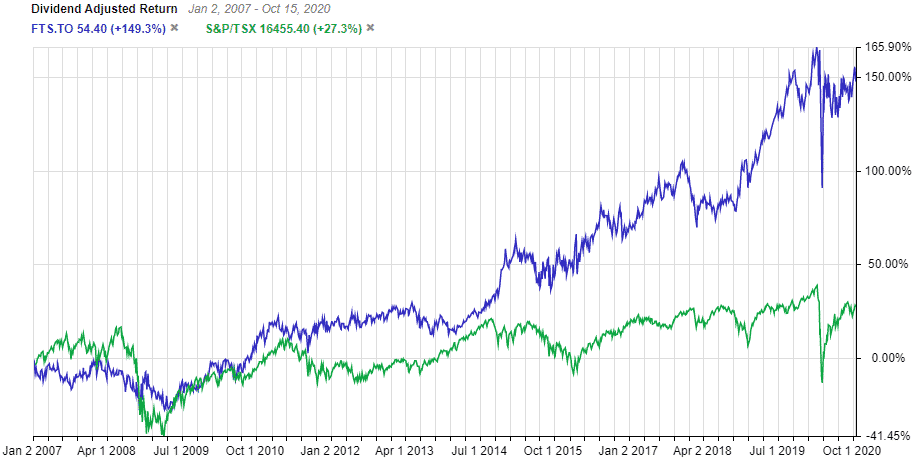

Charts provided by StockRover. Check out Stockrover Here!

Over the last 20 years, the company has provided annualized returns of 14% to shareholders, making it one of the best utilities to own in the country. As you can see by the chart, the company has significantly outperformed the TSX Index over the last 13 years.

Lets have a look at Fortis’s dividend

Fortis holds the second longest dividend growth streak in the country at 47 years. In fact, the company is only 3 years away from achieving Dividend King status, which in the United States is 50 consecutive years of dividend growth. A similar company in Canadian utilities owns the longest streak, and I’d expect both of them to achieve Dividend King status with relative ease.

Fortis currently yields around 3.6% at the time of writing and has grown its dividend by 7.38% annually over the last 5 years. Its most recent increase was a little shy of this, coming in at 5.34%, but we’re willing to forgive the company due to the current economic circumstances.

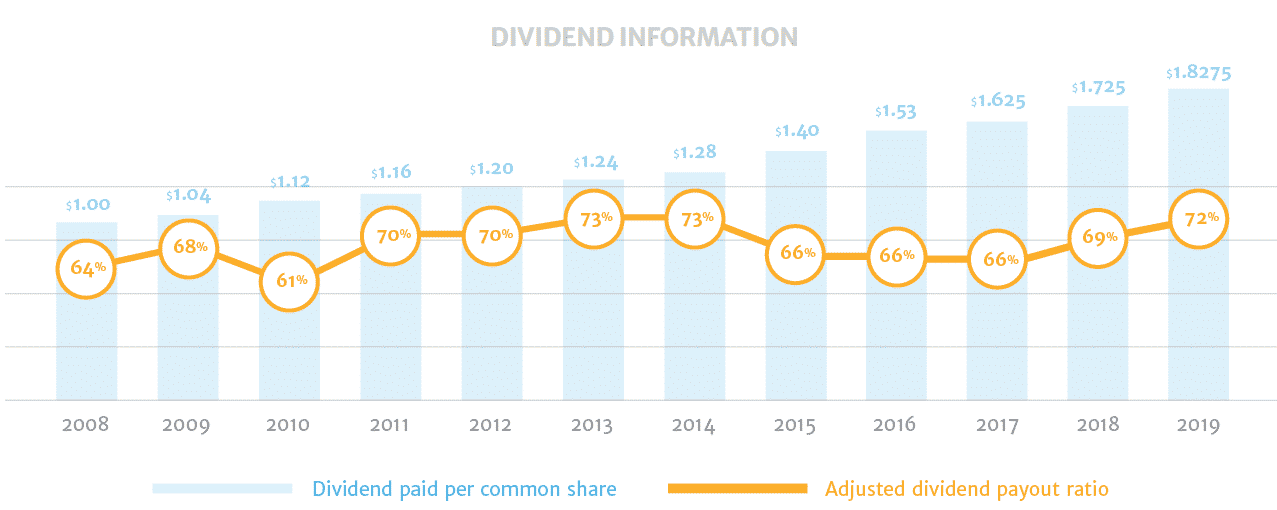

A lot of investors look to Fortis for its dividend, and as a result the company keeps meticulous track of growth estimates and payout ratios. In fact, the company has an excellent image on its investor relations page tracking its payout history over the last 12 years.

As we can see, Fortis has historically kept its dividend payout ratio in the 65-73% range with a few outliers. As the company sits right now, its payout ratio is 75% of earnings. This is a 3% increase from 2019 numbers, but is hardly anything to get concerned about.

When we look to something like operating cash flows, the dividend looks even safer, making up only 33.47% of OCFs.

When we look at a company’s dividend, we often analyze how safe the dividend is and whether or not it will be cut.

With a company like Fortis however, we’re not concerned about a dividend cut at all. In fact, we’re more so looking into what the company is going to be able to do to continue consistent dividend growth.

How Fortis will continue to drive dividend growth further

In order to understand how a company like Fortis has grown its dividend for that long and at such a consistent pace, we need to understand how the company generates such consistent cash flow.

Fortis operates in what I like to call a “regulated monopoly”. The company generates 99% of earnings through regulated utilities.

And before you think “woah, isn’t 99% of earnings from a single source a bad thing?” Well, not necessarily.

A regulated utility company is a company that owns the means of generation, the poles, wires, meter boxes, and whatever else is needed to supply power to the consumer.

From there, the company discusses an appropriate electricity rate with the municipality, which does one of two things.

For one, it creates a price point where the consumers aren’t being gouged for electricity.

But most importantly, it is a rate that essentially guarantees a profit for the utility company.

This is exactly why Fortis is going to be able to continue driving long standing growth via its share price and its dividend. Of note, another company that generates a significant amount of revenue via regulated utilities is Altagas (TSE:ALA).

Fortis expects to grow its dividend at an annual pace of 6% through 2025. The company’s increase of 5.8% nearly hits this mark in 2020, and I imagine they’ll make up the 0.2% somewhere down the line.

Fortis valuation and forward outlook

Market Cap: $25.52 billion

Forward P/E: 20.99

Yield: 3.68%

Dividend Growth Streak: 46 years

Payout Ratio (Earnings): 75.79%

Payout Ratio (Free Cash Flows): Premium Members Only

Payout Ratio (Operating Cash Flows): Premium Members Only

1 Yr Div Growth Rate: 5.94%

5 Yr Div Growth Rate: Premium Members Only

Stocktrades Growth Score: Premium Members Only

Stocktrades Dividend Safety Score: Premium Members Only

In its final quarter of 2020, Fortis stated that it would be bumping its Capital Plan from $18.8 billion to $19.6 billion over the next 5 years. The boost was likely a result of the low interest rate environment we’ve quickly transitioned to due to COVID-19.

Utility companies like Fortis take on significant amounts of debt to service and upgrade infrastructure. The lower the interest rates, the less interest they pay on most debt. As a result, its likely we see the company expand at a more rapid pace and increase its bottom line along with it.

Out of the company’s near $20 billion capital plan, 55% of that is in the United States, 41% in Canada, and 4% in the Caribbean. The bulk of these projects are small in nature, reducing the likelihood of them being over budget or overdue.

Fortis is not a company that is going to blow you away with growth. But they are likely to provide you with longstanding, reliable returns like they have over the last 2 decades.

And as a result of it being one of the most stable companies in the country, you’re going to end up paying a premium. Which leads us to valuation.

On a price to sales basis, the company hasn’t been this expensive for a long time, save a brief moment in early 2020. At that time, Fortis was trading in the high $50 range, all time highs. Right now in the low to mid $50 range, the company is trading at a 22% premium to its 5 year historical price to sales and a 11% premium to its historical price to earnings.

However, considering the current environment we’re in economically and interest rates hitting rock bottom, don’t expect the company to get any cheaper. Instead, just grab this blue-chip dividend stock, throw it in your portfolio and let it collect income and consistent returns for you on auto pilot.

I’m a current shareholder of Fortis. In fact, when I was just learning how to buy stocks in Canada, this was one of the first stocks I ever bought. And I still own it today. That should tell you a lot about the company and my overall confidence in it.