Fronsac REIT (TSE:FRO.UN) – Under the Radar in a Great Niche

Fronsac REIT (TSE:FRO.UN) is probably the most impressive Canadian REITs that nobody knows about.

It is concentrated in one of the strongest areas of the country: Ottawa, Montreal, Quebec City, and the corridor between the cities

The cities have strong fundamentals from people wanting to move there and good job markets, and the areas between the cities are well traveled.

Quebec had one of the lowest unemployment rates before the pandemic, well below the Canadian average

Montreal has the highest proportion of tech jobs in Canada, 70% higher than the national average.

Quebec City has been ranked second in Canada for both economic potential and business friendliness. And Ottawa of course has the government to support its economy and drive population inflows.

The properties are attractive, and in good locations. And the Fronsac business model is a great one for unitholders.

Fronsac REIT (TSE:FRO.UN) is concentrated on a few kinds of properties

The most unique of which is gas and service stations, but Fronsac also owns a lot of quick service restaurants (often on the same property as a service station) and single tenant retail properties.

These properties are much more desirable than those that the typical retail REIT holds. The best way to show how great the properties are is the 100% occupancy rate. No other REIT in Canada has 100% occupancy, but Fronsac has had 100% occupancy for 8 years now.

The final thing that makes Fronsac’s assets so great are the terms of its leases.

Fronsac uses triple net leases, which means the tenant is responsible for property expenses (taxes, insurance, and maintenance). A triple net lease leads to much higher margins for the landlord, and protects the landlord from large, unexpected expenses.

To see how triple net leases lead to higher margins, compare Riocan to Fronsac. This year, Riocan’s net operating income margin is 59.3% of its rental revenues. By comparison, Fronsac’s NOI margin is 76.7%.

Fronsac also has long leases with its tenants. The average lease has a remaining term of 8.1 years, a lengthy lease term for the retail sector.

Fronsac REIT Financials

Fronsac REIT has quietly put up fantastic financial numbers for a long time on the back of its strong assets and business.

Since paying its first distribution in 2012, Fronsac has increased its distribution by 10.4% annually, including a 17% increase this year. Not many REITs have raised their payout this year, some even made cuts such as Riocan REIT (TSE:TEI.UN), and none have raised theirs by as much as Fronsac did.

The distribution growth has been great, but the safety of the payout is also impressive. The AFFO (a REIT’s free cash flow) payout ratio in 2020 has been less than 58%. That is one of the lowest payout ratios of any REIT, and it means that Fronsac could grow its distribution quite a bit even if its cash flow doesn’t grow.

Fronsac’s yield is a little on the low side at 4.2%, but the growth makes up for it in being the highest you’ll find from a REIT.

Fronsac’s growth is likely to continue as well

The niche that Fronsac focuses on is unique, so the REIT doesn’t face competition from large institutions or asset managers for acquisitions. When Fronsac is bidding on a property, it doesn’t have to outbid Blackstone or Brookfield.

This means that there are lots of properties to go around for Fronsac and the other bidders in the niche, and also that it can buy properties at a good price, usually paying around a 7% cap rate.

In 2020, Fronsac is the strongest acquirer given the pandemic and so far has been able to buy 12 new properties.

The same factors that are going to help Fronsac grow in the future have caused the high growth in the past.

Since 2012, Fronsac has grown FFO per unit by 18% per year. Someone who invested $10,000 in Fronsac in 2011 would now have more than $53,000, a compound annual growth rate of 19%. There is no reason to think that great growth and the great returns are going to stop.

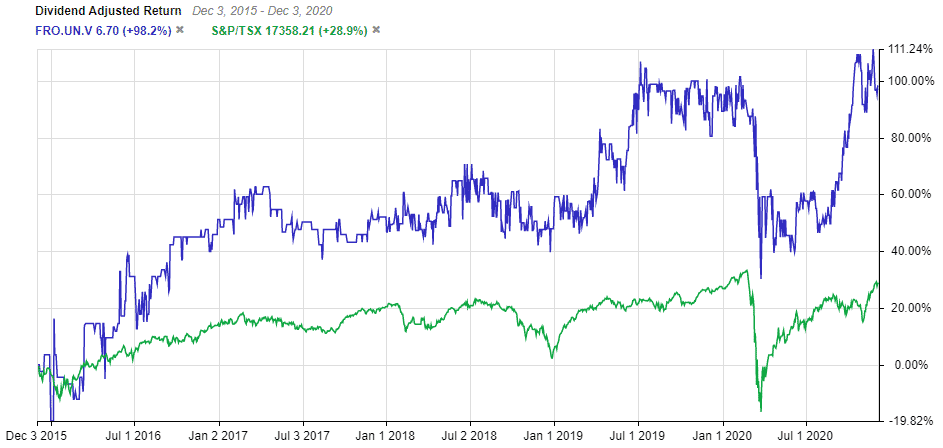

5 year dividend adjusted return for Fronsac vs S&P/TSX

Charts provided by StockRover. Check out Stockrover Here!

Considering Fronsac REIT has so much going for it, and its growth, the valuation is reasonable

Fronsac is trading at less than 15x AFFO. If you think of Fronsac as a retail REIT, 15x is a high multiple. But the REIT doesn’t fit well in the retail category. It doesn’t fit well in any category really, but the long triple net leases and the great properties mean the cash flows are safe and it deserves a high multiple.

Despite not being well known, Fronsac REIT is one of the strongest REITs in Canada.

It has made investors happy for years now, and will continue to do so in the future.