Goeasy Stock – Important KPI for the Company Creeping Upward

Key Takeaways

Goeasy’s loan portfolio is expanding rapidly, reflecting strong demand in the subprime market due to a weaker economy

The company’s increasing charge-off rates will need to be closely monitored

Harsh economic conditions could bring on extensive volatility in Goeasy’s stock price

As a Canadian subprime lender, Goeasy has found itself in a unique position. It is witnessing massive demand for its services. This growth is happening largely due to economic weakness and a cost of living crisis. However, it is a very thin line when it comes to the economy and Goeasy’s success.

A weak economy encourages sub-prime lending, but it must not get weak enough where charge off rates accelerate.

I’ve had many people ask me if Goeasy is still a top Canadian stock to buy after a large scale runup over the last year or so. I’m going to try and explain the sub-prime landscape and how I believe over the long run this company will do well, but there could be extensive short-term volatility.

The sub-prime market is growing at an astonishing pace

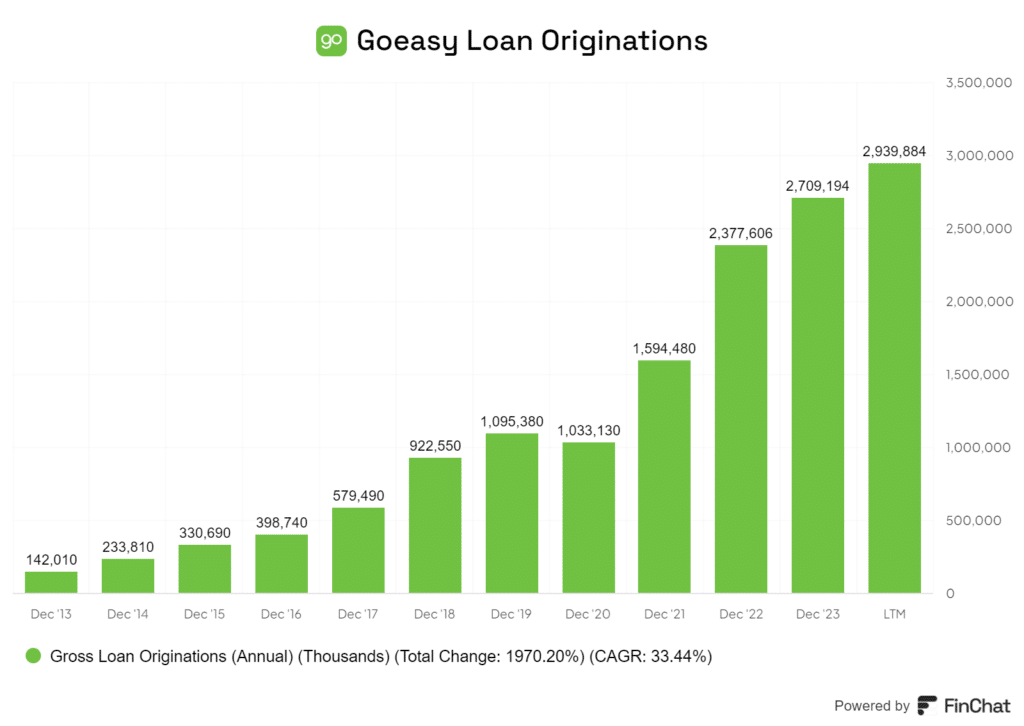

The sub-prime market is expanding rapidly, and it’s reshaping the financial sector. Look to the chart below to see Goeasy’s loan originations. Then consider the fact that Goeasy currently owns a fraction of the sub-prime market.

Subprime borrowers have become the fastest-growing credit segment, with a 9% increase in just one year. This growth outpaces other credit tiers by a wide margin.

What’s driving this surge? I believe it’s a mix of factors:

- Rising costs of living

- Higher interest rates

- Stagnant wages

These elements are pushing more Canadians into the subprime category.

Goeasy Ltd. is well-positioned to capitalize on this trend. The company has only tapped into 2% of the $218 billion Canadian subprime market. This leaves plenty of room for growth.

I think Goeasy’s diverse product portfolio gives it an edge, arguably the largest edge in the space. Their omnichannel approach allows them to reach a broader customer base.

During weaker economic periods, goeasy should thrive

When times get tough, traditional banks often tighten their lending criteria. This creates an opportunity for alternative lenders like Goeasy.

As economic conditions worsen, more people may find themselves turned away by major banks. These individuals still need access to credit, which is where Goeasy steps in. The company’s non-prime lending services fill this gap.

Many believe this to be predatory and refuse to invest in companies like this. Ultimately, that depends on your overall views on the industry. Some believe it’s also giving people access to credit they couldn’t have gotten anywhere else.

There’s a flip side to this coin, though. While demand for Goeasy’s loans may increase, so does the risk. Economic downturns can lead to job losses and financial strain for borrowers. This could potentially result in higher default rates.

Goeasy’s success hinges on its ability to balance these factors:

- Increased demand for loans

- Higher credit risk

- Effective underwriting practices

I think Goeasy’s experience in the sub-prime market gives it an edge. It has survived numerous economic downturns. The company has refined its risk assessment methods over time. This should help it navigate the challenges of lending in a tougher economic climate.

That said, it’s crucial to keep an eye on Goeasy’s loan performance metrics. Any significant uptick in defaults could signal trouble ahead.

The company’s charge-off rates should be closely monitored

Charge-off rates are a key metric I keep a close eye on when evaluating lending companies like Goeasy. These rates show the percentage of loans a lender expects won’t be repaid, which directly impacts profitability.

Goeasy has historically targeted a net charge-off rate between 8% and 10%. In recent quarters, I’ve noticed their rates creeping towards the upper end of this range. The company reported a 9.3% annualized net charge-off rate in their latest results.

This trend worries me a bit. As rates approach 10%, it could signal growing risk in Goeasy’s loan portfolio. Higher charge-offs mean more losses, which can eat into earnings.

I think it’s crucial to compare Goeasy’s performance to other non-prime lenders. While their rates aren’t alarming yet, any further increases could be a red flag.

The company’s loan loss provisions are another area I’m watching closely. These reserves directly affect the bottom line. If provisions start rising faster than revenue growth, it may indicate trouble ahead.

In my view, investors need to monitor these metrics vigilantly. Economic uncertainty could lead to more borrowers struggling to repay loans. Any sustained uptick in charge-offs or delinquencies might signal bigger problems for Goeasy’s business model.

Is the company a buy at this point in time?

I believe goeasy Ltd. stock presents an intriguing opportunity for investors with a higher risk tolerance.

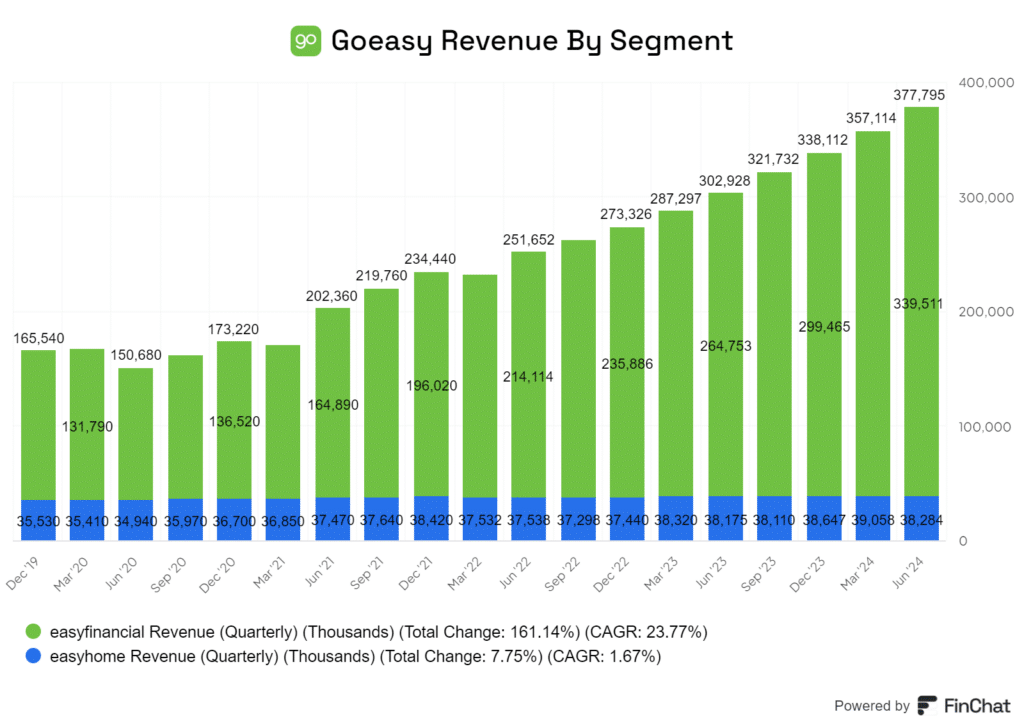

goeasy’s growth in the subprime lending market has been remarkable. Its loan portfolio has expanded to $3.65 billion, up 30% from the previous year. This growth showcases the company’s ability to capitalize on a niche market. Although it does have its easyhome segment, which finances things like electronics and furniture to consumers, its main business is zero doubt its lending department.

Despite market volatility, the company has maintained strong performance. However, it’s crucial to monitor charge-off rates closely. They’ve been ticking up, and are hitting the top end of guidance.

The stock’s valuation is another point in its favour after its recent drawdown. At just 11X trailing earnings, it is trading at a single digit discount to historical averages.

Nevertheless, I must caution that goeasy’s business model carries inherent risks. The subprime lending market can be volatile, especially during economic downturns. Investors should carefully consider their risk tolerance before diving in.

In my opinion, goeasy stock is a cautious buy for those comfortable with potential volatility.

Its growth trajectory and market position are compelling, just keep a close eye on economic indicators and the company’s charge-off rates.