Gold is Shining Right Now – Here’s Some Ways to Get Exposure

**This piece is brought to you by BMO Exchange Traded Funds.**

Gold has always had this allure, right?

It’s precious, it’s limited, and it’s always seemed to be something people turn to during unpredictable times. Now more than ever, gold is grabbing headlines and catching the eye of investors.

But why is that, and why should we even consider adding gold to our portfolios, especially right now? Let’s dig into what’s making gold such an attractive option and explore how gold ETFs can be an accessible and smart way to get involved without, you know, actually going to Costco and buying gold bars to store under your mattress.

Why Gold? The “Safe Haven” Appeal

Gold has earned the title of a “safe haven” asset.

Simply put, when markets feel shaky, people tend to flock to gold because it has demonstrated itself to be a stable, reliable store of value. In times of uncertainty, which can range from economic downturns and high inflation to political upheaval, gold often performs well. Its price tends to rise when everything else feels unpredictable.

Think of it like this: if stocks are the roller coasters in our financial world—thrilling and fun, but sometimes a little stomach-churning—gold is like the sturdy bench in the shade. It’s there when you need a break from the chaos.

This idea of stability becomes even more valuable during times of high inflation, which we’ve been seeing a lot lately.

Gold’s Unique Inflation Hedge

Inflation—when prices for everything from gas to groceries are rising—is one of those financial realities that can make us feel like our money is slipping away.

Since inflation erodes the purchasing power of cash, holding onto cash during these times can feel like a loss. This is where gold shines because, historically, it has maintained its value during inflationary periods.

If you look back through history, gold has often acted as a buffer, holding onto its value even as paper currency fluctuates. This characteristic makes it especially appealing now when inflation remains sticky.

Diversification and Portfolio Stability

Let’s get real for a second—diversification can sound like one of those fancy finance terms, but it’s actually super important for anyone who wants a stable investment portfolio.

When we talk about diversification, we’re really just talking about not putting all your eggs in one basket. It means spreading out your investments so that if one type of asset isn’t doing so hot, another type might balance things out.

Enter BMO Gold ETFs: A Practical Way to Access Gold

Okay, so maybe by now you’re on board with the idea of adding a bit of gold to your investments.

But if the thought of storing gold bars doesn’t sound practical, don’t worry—there’s a better way to get exposure to gold without actually having to buy and store physical gold. This is where BMO Gold ETFs come in.

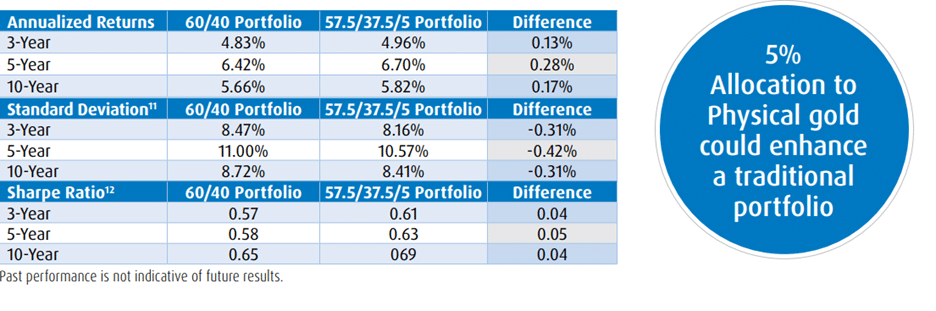

Portfolio Construction Use Case10

Historically just a 5% allocation to gold has provided better risk adjusted returns than a traditional 60/40 portfolio. A 57.50% Equity, 37.50% Fixed Income 5% Gold portfolio has produced greater returns, lower levels of volatility and higher Sharpe ratios over 3, 5 and 10-year periods!

Which BMO Gold ETF is Right for You?

BMO offers a few different gold ETFs, so you can choose one based on your investment goals.

BMO Gold Bullion ETF (ZGLD)

If you want exposure to the price of gold itself, ZGLD is a straightforward option. It aims to closely track the price of gold, providing you exposure to physical gold stored in a vault by the Bank of Montreal.

You can learn more about the fund here

BMO Equal Weight Global Gold Index ETF (ZGD)

This one is great if you want exposure to gold-related companies rather than the commodity itself. It holds a mix of global gold mining companies, so you’re investing in the gold industry without directly buying gold.

You can learn more about the fund here

BMO Junior Gold Index ETF (ZJG)

This ETF will provide exposure to smaller sized gold companies typically involved in development projects, providing you greater potential upside, but also carrying a higher level of risk for investors.

You can learn more about the fund here

Let’s look at a few of the benefits of choosing a Gold ETF From BMO

Easy to Buy and Sell

Just like buying a stock, you can buy BMO’s Gold ETFs on the exchange. This is way simpler than dealing with gold dealers or storage.

Cost-Effective

Owning physical gold can come with storage costs and security concerns. With a gold ETF, you avoid those expenses. Plus, you can buy in smaller amounts, so you don’t need to have a huge chunk of cash to start.

Transparent and Liquid

ETFs are regulated investments, so you always know what you’re getting, and they’re super liquid—you can sell whenever the market’s open. It’s a flexible and transparent way to hold gold as part of your portfolio.

Ideal for Diversification

As we talked about earlier, adding a little bit of gold to your mix can help protect you from wild market swings. BMO’s Gold ETFs are a simple way to bring this element of balance to your investments.

Is Gold Right for You?

So, should you dive into gold?

The answer really depends on your goals and risk tolerance. Gold isn’t typically a high-growth asset—it’s more about protection and balance. If you’re looking for a way to add stability to your investments, hedge against inflation, or diversify with something outside the usual stocks and bonds, then a bit of gold could be a smart addition to your portfolio.

So, if you’re considering a little golden insurance policy for your investments, now might be the perfect time to shine up your portfolio with BMO’s gold ETFs.

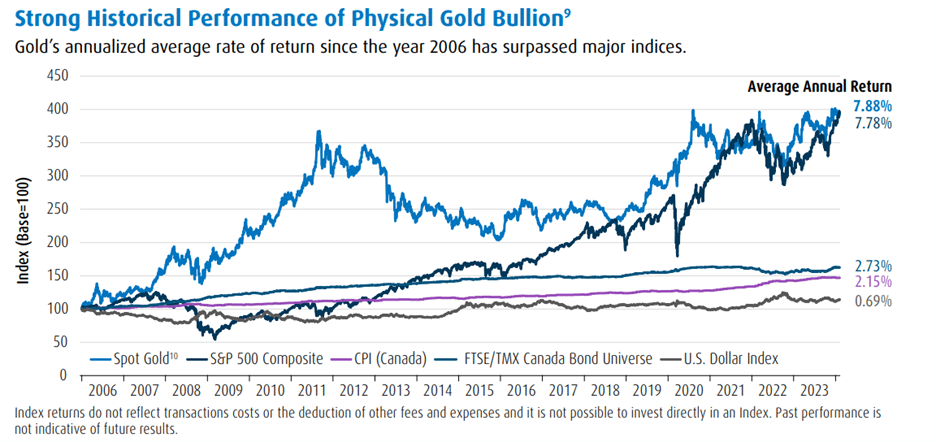

9 Source: BMO Global Asset Management, Bloomberg As of February 6, 2024. Average annual percentages are calculated in local currencies. Past performance is no guaranteed of future results.

10 Source: BMO Global Asset Management, Bloomberg,(60/40 portfolio – is composed of 60% S&P/TSX Composite Index and 40% FTSE/TMX Canada Bond Universe Index , 57.5/37.5/35 portfolio is composed of 57.50% S&P/TSX Composite Index, 37.50% FTSE/TMX Canada Bond Universe index and 5% Spot Gold Index), All components are in Canadian dollar terms. Time period used for calculations are daily from January 2, 2006–January 31,2024.

Disclaimer

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. An investor that purchases Units of a Structured Outcome ETF other than on the first day of a Target Outcome Period and/or sells Units of a Structured Outcome ETF prior to the end of a Target Outcome Period may experience results that are very different from the target outcomes sought by the Structured Outcome ETF for that Target Outcome Period. Both the cap and, where applicable, the buffer are fixed levels that are calculated in relation to the market price of the applicable Reference ETF and a Structured Outcome ETF’s NAV (as Structured herein) at the start of each Target Outcome Period. As the market price of the applicable Reference ETF and the Structured Outcome ETF’s NAV will change over the Target Outcome Period, an investor acquiring Units of a Structured Outcome ETF after the start of a Target Outcome Period will likely have a different return potential than an investor who purchased Units of a Structured Outcome ETF at the start of the Target Outcome Period. This is because while the cap and, as applicable, the buffer for the Target Outcome Period are fixed levels that remain constant throughout the Target Outcome Period, an investor purchasing Units of a Structured Outcome ETF at market value during the Target Outcome Period likely purchase Units of a Structured Outcome ETF at a market price that is different from the Structured Outcome ETF’s NAV at the start of the Target Outcome Period (i.e., the NAV that the cap and, as applicable, the buffer reference). In addition, the market price of the applicable Reference ETF is likely to be different from the price of that Reference ETF at the start of the Target Outcome Period. To achieve the intended target outcomes sought by a Structured Outcome ETF for a Target Outcome Period, an investor must hold Units of the Structured Outcome ETF for that entire Target Outcome Period. BMO Buffer ETFs seeks to provide income and appreciation that match the return of a Reference Index up to a cap (before fees, expenses and taxes), while providing a buffer against the first 15% (before fees, expenses and taxes) of a decrease in the Reference Index over a period of approximately one year, starting from the first business day of the stated outcome period. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.